The global cryptocurrency market saw a sharp turnaround on Wednesday, bouncing back after several days of volatility that rattled both retail and institutional investors. Bitcoin (BTC) once again surpassed the $115,000 mark, while Ethereum (ETH) rebounded to nearly $3,600. This rebound comes amid renewed optimism in the digital asset space, despite recent liquidations and ETF outflows.

Bitcoin Reclaims $115,000: A Strong Psychological and Technical Level

Bitcoin’s move back above $115,000 marks a significant moment for traders and analysts alike. Over the past 24 hours, BTC posted a 1.3% gain, stabilizing after falling to as low as $113,000 earlier in the week. This recovery suggests growing confidence in the asset’s long-term trend, despite heightened short-term volatility.

Historically, Bitcoin has faced multiple corrections even during bull runs. Analysts point out that recovering above strong psychological levels like $115K can trigger bullish momentum in the broader crypto market, influencing other digital assets to follow suit.

Ethereum Bounces to $3,600 After ETF Reversal

Ethereum, the second-largest cryptocurrency by market capitalization, saw an even stronger recovery, jumping 2.8% in a 24-hour span to trade above $3,600. The turnaround was significantly influenced by a major shift in ETF fund flows.

According to data from Farside Investors, Ethereum ETFs saw positive net inflows of over $73 million on Tuesday, breaking a two-day streak of outflows. This signaled renewed interest among institutional investors and helped push ETH prices higher.

This contrasts with the Ethereum ETF market’s recent behavior, where a mix of macroeconomic factors and regulatory uncertainty caused consistent withdrawals. The latest inflow may mark the beginning of a more stable phase for Ethereum-based investment vehicles.

Bitcoin ETFs Still See Outflows — But It’s Slowing Down

While Ethereum’s ETF situation showed signs of improvement, Bitcoin ETFs remained in the red. On Tuesday, Bitcoin ETFs recorded $196 million in net outflows, down from $333 million on Monday and a whopping $819 million on Friday.

Despite these outflows, the decline in magnitude over three consecutive days suggests that the worst of the selling pressure might be over. Analysts believe some of these movements are technical in nature, involving institutional rebalancing rather than outright bearish sentiment.

ETF data from BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity Wise Origin Bitcoin Fund (FBTC) show declining volumes this week, indicating a pause in investor sell-off behavior.

What Caused the Market Dip Last Week? Overleveraging and Liquidations

The sudden downturn last week was driven primarily by excessive leverage in the derivatives market, leading to mass liquidations. According to Coinglass, total crypto liquidations topped $890 million on Friday alone. This was one of the highest single-day wipeouts in the current market cycle.

Bitcoin plummeted to around $113,000, while Ethereum touched $3,500, and XRP, a popular altcoin tied to Ripple Labs, dropped to $2.92.

The liquidations were largely driven by long positions — traders betting on higher prices — who were forced to close positions as prices fell sharply. When markets become too over-leveraged, even small drops can trigger a cascade of forced selling, amplifying the decline.

Analysts: Volatility Is Normal in Bull Markets

Despite the turbulence, crypto market experts are not worried. In fact, they see these movements as part of a healthy market cycle.

Ryan Rasmussen, Head of Research at Bitwise Asset Management, explained that volatility is a natural feature of any bullish market trend. In an interview with Decrypt, he said:

“In past bull runs, it was never just a straight path up. There were corrections, liquidations, and rebounds. Traders often over-leverage during highs and are forced to sell or liquidate during small corrections. That’s what causes sudden drops followed by quick recoveries.”

This view is widely shared across the industry. Volatility, while unsettling in the short term, provides entry points for long-term investors who are looking to build positions in quality crypto assets.

Weekly Losses: Minimal Damage Despite the Drama

Despite the steep dip late last week, Bitcoin, Ethereum, and XRP have all managed to post only modest weekly losses, ranging from 1% to 3%. This suggests that the broader market is resilient, with buyers stepping in quickly to absorb the panic selling.

Data from CoinGecko and CoinMarketCap also show that market capitalization for the entire crypto sector has remained relatively stable, hovering just below its recent multi-year highs.

This is an important metric to watch, as a stable total market cap often reflects long-term investor confidence — even amid temporary price fluctuations.

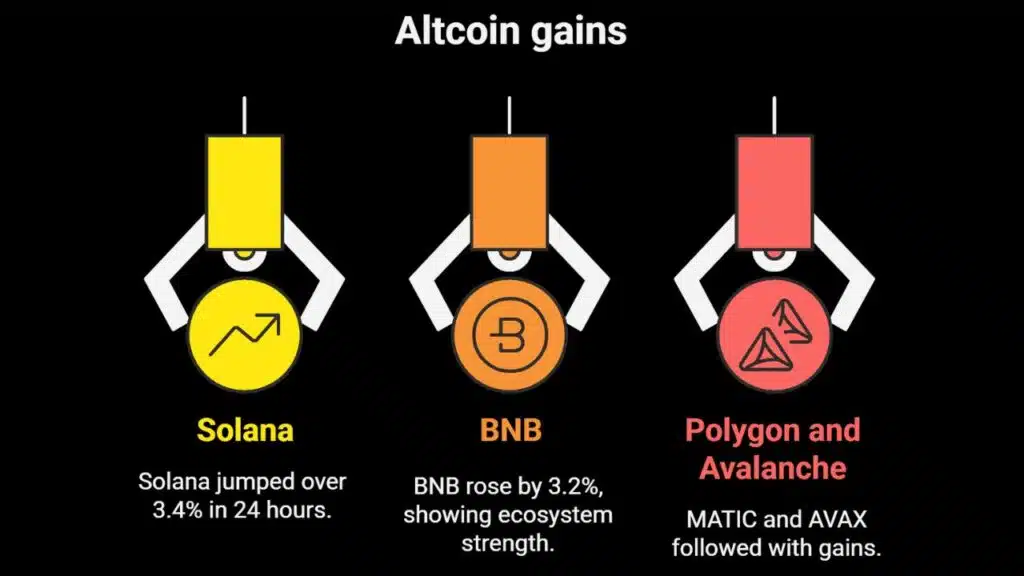

Altcoins Join the Rally: Solana, BNB Lead the Way

It wasn’t just Bitcoin and Ethereum that rebounded. Altcoins — smaller but still significant crypto assets — also made strong gains:

- Solana (SOL) jumped over 3.4% in the past 24 hours

- BNB (Binance Coin) rose by 3.2%, reflecting strength in ecosystem tokens

- Polygon (MATIC) and Avalanche (AVAX) followed closely with gains of 2.5% and 2.9%, respectively

Overall, the total crypto market cap rose by 1.8% in 24 hours, according to CoinGecko. This indicates broad-based participation in the rally, rather than isolated recoveries by just Bitcoin or Ethereum.

Bitwise: This Is a Multi-Year Bull Market

While some short-term traders might be cautious due to volatility, institutional firms like Bitwise Asset Management are focusing on long-term growth. Rasmussen emphasized that the current trend is part of a multi-year bull market cycle in digital assets.

“We expect short-term volatility to continue, but we view it as an opportunity to build strong, diversified positions in crypto,” he added.

Analysts at Bloomberg Intelligence and ARK Invest have also supported this long-term thesis, projecting that Bitcoin could potentially surpass $150,000 to $180,000 within the next 6–12 months if ETF inflows stabilize and macroeconomic conditions remain favorable.

Key Metrics at a Glance

| Metric | Value (as of Wednesday) |

| Bitcoin Price | $115,000+ |

| Ethereum Price | $3,600+ |

| Ethereum ETF Inflow | $73 million (Tuesday) |

| Bitcoin ETF Outflow | $196 million (Tuesday) |

| Friday Liquidations | ~$890 million |

| XRP Price (low) | $2.92 |

| Solana 24h Gain | 3.4% |

| BNB 24h Gain | 3.2% |

| Overall Market 24h Gain | 1.8% |

What to Watch Next

As the crypto market regains stability, several key factors will determine the path forward:

- ETF Net Flows — Continued inflows into Ethereum and slowing outflows from Bitcoin ETFs could signal bullish momentum.

- Leverage Levels — Monitoring open interest and funding rates on major exchanges will help assess future liquidation risks.

- Macroeconomic Factors — US inflation data, interest rate decisions, and global liquidity trends will also influence crypto price action.

- Adoption Trends — Institutional interest in crypto assets, such as BlackRock and Fidelity’s continued support, remains a bullish signal.

The rebound in Bitcoin, Ethereum, and other major cryptocurrencies shows that the crypto market remains strong despite short-term volatility. While ETF outflows and massive liquidations last week caused brief panic, the quick recovery across top coins highlights resilient investor sentiment.

For long-term investors, these moments offer opportunities to reassess and strategically build their portfolios. As more traditional financial institutions adopt digital assets and crypto products mature, the long-term outlook for the market continues to brighten.

The Information is Collected from Decrypt and Yahoo Finance.