Many e-commerce shops watch payments drop when banks label them high risk. They face constant chargebacks, high processing fees, and lost sales. They need a solid payment processing solution and a reliable merchant account.

It can feel like climbing a steep hill.

In under 24 hours, High Risk Pay approves 99% of high-risk merchants. This post shows you how to apply for a High Risk Merchant Account At Highriskpay.com, gather the right documents, and use ACH setup, chargeback management, and fraud prevention tools for fast funding.

Read on.

Key Takeaways

- HighRiskPay.com approves 99% of high-risk merchants in under 24 hours, even businesses denied by PayPal, Stripe, or Square.

- It offers chargeback management, AVS and CVV checks, device fingerprinting, and ACH transfers to lower fraud and cut processing fees.

- It serves online gambling, e-commerce, dropshipping, subscription services, nutraceuticals, firearms, and debt collection with clear rates from 1.79% and no setup fees.

- It links your site via API to payment gateways and EMV readers, sets reserve funds up to 10% of monthly volume, and delivers next-day funding.

- It assigns a dedicated account manager, guides you through KYC, underwriting, and PCI compliance, and shows all fees in real time.

What Is a High-Risk Merchant Account?

High Risk Merchant Account At Highriskpay.com offers a high-risk merchant account built for businesses with frequent chargebacks and fraud alerts. It runs like a normal payment processor, but adds extra fraud prevention tools, holds reserve funds, and taps into a payment gateway or automated clearing house for clear audits.

A vendor in online gambling, pharmaceuticals, debt collection, firearms sales, or tech support faces tougher underwriting rules and higher fees. The provider charges monthly fees, levy chargeback costs, and may impose early termination penalties.

Underwriting teams review credit history, license copies, and company data, then assign a risk profile that sets reserve levels. They link your point of sale or virtual terminal to EMV readers and digital wallets.

This service suits a high-risk merchant account at highriskpay.com, for businesses that need fast approvals, strong risk management, and a steady merchant services partner.

Key Features of HighRiskPay. com

HighRiskPay arms you with smart shields and dispute trackers to beat credit card fraud. It feels like a Swiss Army knife, with electronic funds transfer and a handy card swiper ready at checkout.

Chargeback management

Chargeback management monitors every dispute, it logs transaction patterns and chargeback ratios like a hawk. The merchant account provider flags high-risk trends fast. Clear return policies join fraud prevention tools like AVS and CVV checks to cut back clashes.

Electronic funds transfer reports feed real-time alerts. The system warns of fund holds or termination when disputes exceed set limits.

Specialists in chargeback management services handle retrievals and file representments for you. They craft defense letters, guide on identity document checks, and tighten refund rules.

Merchants see lower dispute rates, and bad credit businesses win higher approval rates. High-risk merchant account provider support keeps your service running, so you can apply for a high-risk merchant account with confidence.

Fraud prevention tools

High Risk Merchant Account At Highriskpay.com adds strict fraud prevention tools to protect your high-risk merchant account. It scans each payment with AVS and CVV checks, catching odd transactions at the gate.

The system marks strange IP locations and shuts down cards from known scammers. A risk score tells you why payments fail, and you see blocks in real time. These measures guard account stability and cut chargeback spikes for e-commerce payment systems.

The platform uses encryption, tokenization, and device fingerprinting to foil fraudsters. Each tool ties into chargeback management and clear pricing, so you pay only for use. High-risk merchants face more fraud attempts, so these checks act like guard dogs on your sales.

HighRiskPay.com’s proactive approach drives down losses and keeps your payment terminal safe.

ACH payment processing

Business owners can accept electronic checks through the Automated Clearing House network. This direct debit service cuts the risk of chargebacks compared to card payments. Clients tap payment solutions for high-risk companies, offering a safe ACH payment processing option.

ACH transfers fit businesses with recurring billing, like subscriptions or memberships.

Merchants use a secure API to link bank accounts and initiate transfers via the Federal Reserve system. This online payment method suits high-risk business owners, even with a bad credit merchant account.

It avoids high fees tied to card processors and reduces disputes. Banks process each transaction on a central processing unit that logs settlement data.

Industries Served by HighRiskPay. com

HighRiskPay.com powers payments for riskier ventures, from specialty shops to streaming plans, using card processing, direct debit, digital tokens, and Shopify storefronts—keep reading!

E-commerce and dropshipping

Online sellers in e-commerce and dropshipping face big hurdles, like fraud spikes, heavy chargebacks, and tough underwriting. They need a merchant account solution that keeps them afloat, with chargeback management, fraud prevention tools, ACH payment processing, credit card and debit card support, plus digital wallet and cryptocurrency options.

Reserve requirements may apply, and strict setup fees often loom, but this high-risk account service handles those curves. The service from High Risk Merchant Account At Highriskpay.com also supports store builder platforms, and grants fast approvals for businesses considered high-risk.

These plans often carry higher fees than low-risk accounts, and strict reserve rules protect payment processor risk. A dedicated account manager arrives with every signup, and transparent pricing clears up hidden costs.

Other options include smooth ACH payment processing, and flexible digital wallet or cryptocurrency trades, letting merchants accept credit and debit card payments swiftly.

Online gambling and casinos

Casinos run on fast payouts, but fraud and chargebacks hit hard. Businesses in high-risk industries like online gambling want to reduce risk. You can choose a high-risk merchant account or payment processor that meets reserve requirements and factors in higher fees.

They need strict fraud prevention tools and clear merchant account services.

HighRiskPay.com provides specialized payment processing solutions, with charge dispute handling, ACH payment processing, and real-time fraud alerts. Its merchant account approvals team works with Visa Inc., Mastercard Inc., and major payment card networks.

You can get your merchant account in days with a high approval rate.

Subscription services with recurring billing

Subscription services that charge customers every month carry high risk. They often face chargeback rates near 1.5 percent, twice the level of standard retail. Fraud attempts hit some accounts daily, so merchants need strict fraud prevention and a robust payment gateway.

HighRiskPay.com, a high-risk merchant account service provider, matches each client with a solid merchant account, and applies reserve requirements up to 10 percent of monthly volume.

It acts like a bouncer at a club, blocking suspicious transactions with advanced fraud tools and a built-in chargeback management system. The platform links to a bank debit network and digital wallet for seamless processing.

Merchants get swift approvals, transparent fees with no hidden costs, and 24/7 customer support to keep recurring payments on track.

Benefits of Choosing HighRiskPay. com

High Risk Merchant Account At Highriskpay.com fast-tracks approvals and slashes costs, so you handle chargebacks with ease. You plug in the payment API and reporting dashboard, and your platform hums with smoother transactions and rock-solid cash flow.

Fast approvals for high-risk businesses

Business owners in sectors like adult entertainment or nutraceuticals face steep hurdles. They get approved within 24 to 48 hours at a 99% rate. The approval process uses a payment gateway and API powered risk monitor.

This high-risk payment processor handles big sales. Clients with poor credit or denied by PayPal, Stripe, or Square still get green lights. Next day funding follows every cleared transaction.

The platform skips long-term contracts, charges clear fees, and plugs into any business bank account.

Medical clinics and online gambling sites file one digital form with email and basic info. They avoid annual fees and hidden rates. The screen shows pricing per transaction in dollars and percentage.

The fraud monitor and chargeback management tools slash disputes. This merchant accounts and payment processing service keeps the flow tight. Clients choose HighRiskPay.com for its speed in high-risk merchant account solutions.

Competitive rates and transparent pricing

The merchant account at highriskpay.com offers starting rates of 1.79% for high risk business owners. The platform charges no application or setup fees. It lists every price in a clear table on its web dashboard.

Merchants can accept credit card payments and cheque deposits without hidden costs. Companies in credit repair or the sex industry rely on open fee structures to cut business risk.

The site serves US clients and matches each quoted price with upfront terms.

A rate calculator and reporting tools let users track fees in real time. Merchants with bad credit get the same transparent policy as those with strong credit scores. HighRiskPay.com ranks among reliable merchant account service providers, thanks to straight price plans and flexible debit and card acceptance.

The firm has powered accounts and payment processing services since 1997 and handles industries with high sales volume.

Dedicated account management

High Risk Merchant Account At Highriskpay.com offers high-risk merchant accounts with a dedicated support agent. This expert guides businesses with bad credit or those considered high risk. They coach you on chargeback management and fraud prevention tools.

Agents share clear information and honest guidance in every chat. You may text or call within the United States for fast assistance.

Your support agent draws on experience in the credit card industry since 1997. They know high-risk merchant services like HighRiskPay.com. Their customer service blends smart fraud tips with proactive risk management solutions.

You can start accepting credit card payments without stress. This personalized assistance tames high rates and eases concerns about chargebacks.

How to Apply for a High Risk Merchant Account at HighRiskPay.com

Grab your ID, company papers, and a recent bank report, then stroll over to High Risk Merchant Account At Highriskpay.com and breeze through the KYC section. Link your site to their payments API, pass the PCI compliance scan, land a risk score in 48 hours, and boom—you can hit the ground running with cards and e-checks.

Required documents

Truth can surprise you, but it feels like laying all your cards on a table. It takes a name, email, phone number, and website to start. Underwriters may want a copy of your ID and a bank statement.

Detailed financial documents may be required. Businesses may also need proof of funds.

Apps often demand a clear business model explanation and risk mitigation steps. HighRiskPay.com can offer merchant accounts to high-risk accounts at any risk level. Some merchant accounts often ask for past processing history and evidence of financial stability.

Getting merchant approval means you gather every essential document. A merchant account high limit may need more proof of cash flow. Reliable services in the industry hinge on a complete file.

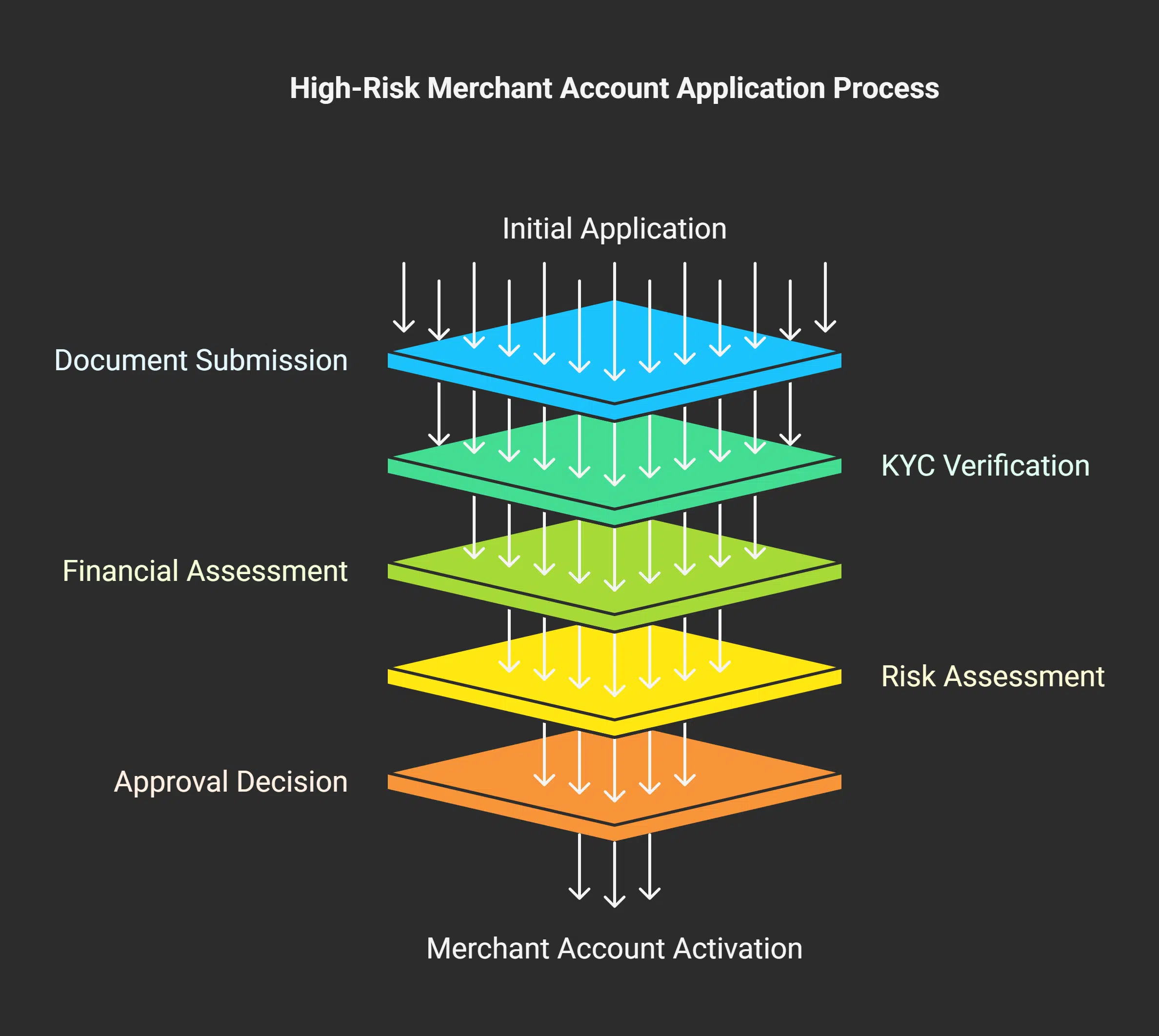

Step-by-step application process

High Risk Merchant Account At Highriskpay.com has an offer high risk businesses need. Applicants go through four main steps to open a merchant highriskpay.com account.

- Complete the online intake form on the payment portal, supply your business name, address, and industry details.

- Send scans of a driver’s license or passport, plus three months of checking account records to run KYC checks.

- Underwriting experts inspect your financial stability, conduct a risk assessment based on industry type, and use fraud prevention models.

- Get a conditional approval, follow up with extra paperwork, then receive final approval or a denial.

Takeaways

At High Risk Merchant Account At Highriskpay.com, your approvals land in just one day. The fraud prevention tool guards your cash. Chargeback management cuts your risk on disputes. Next day funding keeps your funds flowing.

You can grow your brand with peace of mind.

FAQs on High Risk Merchant Account At Highriskpay.com

1. What is a high risk merchant account?

A high risk merchant account is a payment service for firms in fields banks avoid. It lets you take online funds without extra worry.

2. Why choose HighRiskPay.com for a high risk merchant account?

At HighRiskPay.com, we talk to you, fast and fair. We smooth rough spots in payments, like a road crew at dawn. We guard your cash and cut chargebacks.

3. How does a high risk merchant account secure my business?

It spots fraud, holds tight to your money, and keeps bad charges away. It acts like a guard dog for your cash.

4. How do I start with HighRiskPay.com?

First, you fill a simple form. Next, we call you and ask for basic papers. Then, you go live and start taking payments.