Car insurance is a necessity for every driver, but misconceptions about how it works can lead to costly mistakes. Many people believe myths that can result in overspending, being underinsured, or making poor policy choices.

These myths often come from outdated assumptions, misinformation, or misunderstandings of policy terms.

In this detailed guide, we will uncover the common myths about car insurance debunked, providing you with accurate information to help you make informed decisions.

Understanding these myths and facts will not only help you save money but also ensure that you are adequately covered in case of an accident or unexpected event

Understanding Car Insurance Myths and Facts

Misconceptions about car insurance often stem from:

- Misinterpretation of policy terms – Many insurance policies contain complex wording, leading to misunderstandings.

- Outdated information – Insurance policies change over time, and old assumptions may no longer be valid.

- Word-of-mouth misinformation – Friends or family members may unknowingly spread inaccurate information.

- Marketing tactics – Some myths are perpetuated by misleading advertisements from insurers or third parties.

- Lack of transparency – Some consumers struggle to understand how insurers calculate premiums and apply coverage.

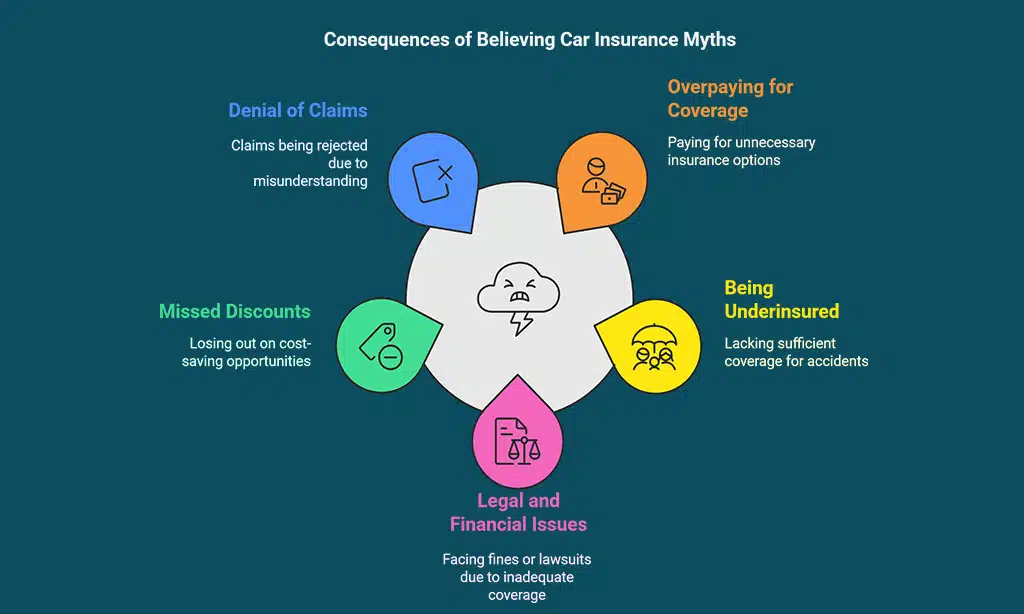

How These Myths Can Cost You More

Believing car insurance myths can have serious consequences, including:

- Overpaying for unnecessary coverage – Thinking you need coverage you don’t actually require.

- Being underinsured – Not having enough protection in case of accidents.

- Legal and financial consequences – Facing fines or lawsuits due to lack of proper coverage.

- Missed discounts – Falling for myths may prevent you from taking advantage of valuable discounts and cost-saving opportunities.

- Denial of claims – Misunderstanding policy terms can lead to rejected claims when coverage is assumed but not actually included.

10 Common Myths About Car Insurance Debunked

Car insurance can be confusing, and many people believe myths that can affect their decisions. These misconceptions can lead to unnecessary expenses, inadequate coverage, or even difficulty in choosing the right policy.

Whether you’re a new driver or someone looking to renew your policy, it’s essential to separate fact from fiction.

Understanding how car insurance really works can help you make informed decisions and potentially save money.

Let’s get into the details of what’s fact and what’s fiction when it comes to car insurance.

Myth 1 – Red Cars Cost More to Insure

Truth: Insurance rates are based on make, model, and history, not color.

Contrary to popular belief, red cars do not inherently have higher insurance premiums. Insurers determine rates based on factors such as:

- The car’s make and model

- Engine size and repair costs

- Driver’s age, driving record, and location

- Past claims history

Factors Affecting Insurance Premiums

| Factor | Impact on Premium |

| Car Make & Model | Higher-end models have higher premiums |

| Driving Record | More violations lead to increased rates |

| Location | Urban areas often have higher rates due to more accidents |

| Credit Score | Lower scores may lead to higher premiums |

Myth 2 – Comprehensive Insurance Covers Everything

Truth: Comprehensive insurance covers only theft and non-collision damage.

Comprehensive insurance does not mean you are covered for every possible scenario. It typically includes protection against:

- Theft

- Natural disasters (floods, hurricanes, etc.)

- Vandalism

- Falling objects

However, it does not cover mechanical breakdowns, normal wear and tear, or injuries from accidents.

What Comprehensive Insurance Covers

| Covered Incident | Not Covered Incident |

| Theft | Mechanical breakdowns |

| Fire | Wear and tear |

| Flood damage | Personal belongings inside the car |

| Hail damage | Regular maintenance issues |

Myth 3 – My Personal Belongings in the Car Are Covered

Truth: Car insurance does not cover personal items inside your vehicle.

If your laptop or phone is stolen from your car, your auto insurance policy won’t cover it. Instead, you may need to file a claim through your homeowners or renters insurance.

To protect personal belongings, consider adding additional coverage or securing valuables when leaving your car unattended.

Example: If your car is broken into while parked at a shopping mall and your backpack is stolen, your auto insurance will not reimburse you.

However, if you have renters’ or homeowners’ insurance, you may be able to file a claim for the stolen items.

Myth 4 – Minimum Liability Coverage Is Enough

Truth: It may not cover full damages in a major accident.

Many drivers assume that carrying the minimum required liability insurance is sufficient. However, this can leave you vulnerable to out-of-pocket expenses.

If damages exceed your policy limit, you will be responsible for the remaining costs.

Liability Coverage vs. Recommended Coverage

| Coverage Type | Minimum Requirement | Recommended Amount |

| Bodily Injury Liability | $25,000 per person | $100,000+ per person |

| Property Damage Liability | $10,000 per accident | $50,000+ per accident |

| Uninsured Motorist Coverage | Not Required in Some States | Highly Recommended |

Myth 5 – My Credit Score Doesn’t Affect My Insurance Premium

Truth: Many insurers use credit scores to determine rates.

In many states, insurance companies analyze your credit score when calculating premiums. A lower credit score can lead to higher rates, as insurers may view individuals with poor credit as higher-risk drivers.

Tip: Regularly check your credit report and improve your score to lower insurance costs. Pay off outstanding debts and maintain a low credit utilization ratio to positively impact your premium rates.

Myth 6 – Older Drivers Always Pay More for Insurance

Truth: Experienced older drivers may actually pay less.

While it’s true that very elderly drivers may see rate increases due to higher accident risk, drivers in their 50s and 60s often receive some of the best rates available.

This is because they have more driving experience and may qualify for senior discounts. Maintaining a clean driving record and taking defensive driving courses can also reduce premiums.

Age and Insurance Premiums

| Age Group | Average Premium Impact |

| Under 25 | High premiums due to inexperience |

| 25-50 | Lower premiums with a good driving record |

| 50-70 | Often the lowest rates available |

| 70+ | Potential increases due to higher accident risk |

Myth 7 – Your Insurance Covers Any Driver Using Your Car

Truth: Policies typically cover only drivers listed on the policy.

Many people believe that anyone borrowing their car is automatically covered under their policy, but this is not always true.

Most standard policies provide coverage only for named drivers or permissive users (people you explicitly allow to drive your car). If a non-listed driver gets into an accident, you could be personally responsible for damages.

Tip: Always check with your insurance provider before allowing someone else to drive your vehicle.

Myth 8 – If an Accident Isn’t Your Fault, Your Insurance Won’t Be Affected

Truth: Even if you’re not at fault, your premium may increase.

Although the at-fault driver’s insurance typically covers damages, your premium could still rise. Insurers calculate risk based on your claims history, and filing a claim—even for an accident that wasn’t your fault—could increase your rates.

How At-Fault vs. No-Fault Claims Impact Premiums

| Scenario | Potential Rate Impact |

| No accidents | No impact or possible discounts |

| Not-at-fault accident (first claim) | Small or no increase |

| Multiple not-at-fault claims | Possible premium increase |

| At-fault accident | Significant premium hike |

Myth 9 – Small Claims Are Not Worth Reporting

Truth: Failing to report small accidents can backfire.

Some drivers avoid reporting minor accidents to prevent premium increases. However, not reporting an incident can lead to complications later, especially if the other party files a claim against you.

Additionally, some insurers may drop your coverage if they find out about an unreported accident.

Example: If you hit a parked car and exchange information without reporting it, the other driver could later file a claim, and your insurer may refuse to cover you if they were unaware of the incident.

Myth 10 – Parking Tickets Affect Your Insurance Premiums

Truth: Parking violations do not directly impact insurance rates.

Parking tickets and other non-moving violations do not affect your insurance premiums because they are not considered risk indicators for insurers.

However, failing to pay parking tickets could lead to consequences such as license suspension, which might increase your rates due to lapses in coverage or legal issues.

How Different Violations Affect Insurance Rates

| Violation Type | Impact on Premium |

| Parking Ticket | No impact |

| Speeding Ticket | Moderate increase |

| DUI/DWI | Severe increase or policy cancellation |

| At-Fault Accident | Significant increase |

Takeaways

Car insurance myths can lead to costly mistakes, but by understanding the facts, you can make informed decisions that save money and provide proper protection.

Always verify information, read your policy thoroughly, and consult experts when in doubt. The next time you hear an insurance myth, you’ll know exactly how to separate fact from fiction.

Take a few minutes today to review your car insurance policy and ensure you have the right coverage in place. Need more tips? Contact your insurance provider for a free policy review!