Buying a home in Florida is an exciting yet challenging process. With a booming real estate market and unique environmental factors to consider, it’s essential to be well-prepared. Whether you’re a first-time homebuyer or a seasoned investor, understanding the ins and outs of purchasing property in the Sunshine State can make all the difference. In this guide, we’ll explore the most important factors Florida residents should keep in mind when buying a house in 2025.

1. Understanding Florida’s Housing Market

The Florida real estate market will remain competitive in 2025. Home prices have seen steady increases due to high demand, a growing population, and a limited housing supply in popular areas. Mortgage rates have fluctuated over the past year, influencing affordability for many buyers.

With rising home values, it’s important to act strategically. Research market trends, compare home prices in different regions, and keep an eye on interest rates. Staying informed will help you determine the right time to buy.

2. Choosing the Right Location

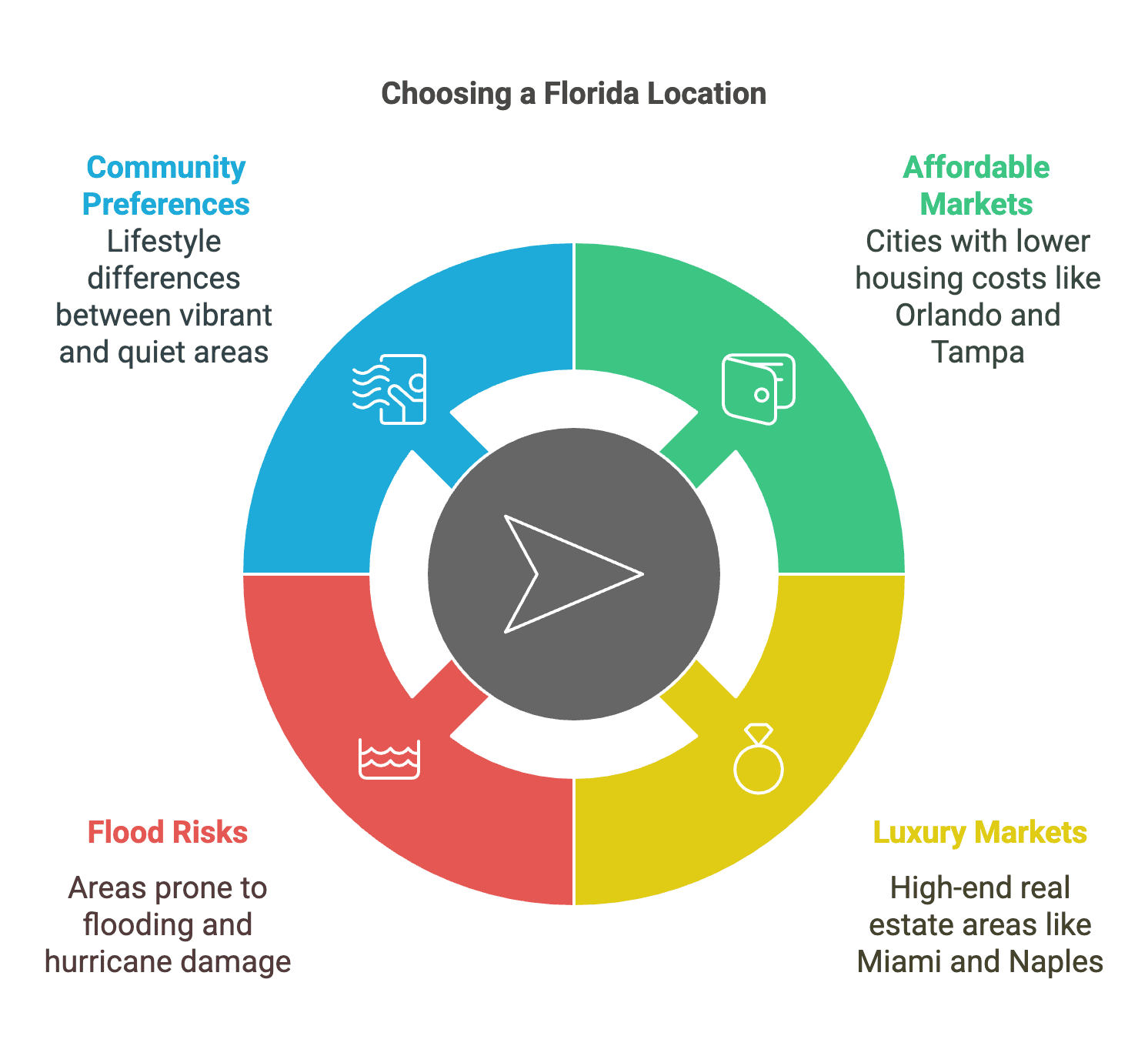

Florida is known for its diverse cities and coastal communities. Choosing where to buy depends on factors like lifestyle, work opportunities, and long-term investment potential.

- Affordable vs. Luxury Markets: Cities like Orlando, Tampa, and Jacksonville offer more affordable options, while Miami, Naples, and Sarasota tend to have higher price tags.

- Flood Zones and Hurricane Risks: Coastal areas are vulnerable to flooding and hurricanes. Check FEMA flood zone maps and consider the costs of flood insurance before committing to a location.

- Community and Amenities: Whether you prefer the excitement of Miami or the quiet of Ocala, make sure the area aligns with your needs.

3. Florida-Specific Financial Considerations

Florida has unique financial factors that affect homeowners. Property taxes, insurance costs, and state incentives should all be factored into your budget.

- Property Taxes: While Florida has no state income tax, property taxes vary by county. Some areas have higher rates, so research this beforehand. Additionally, the Florida real estate transfer tax applies when ownership of a property is transferred, and all parties involved in the transaction are liable for this tax.

- Homestead Exemption: Florida residents may qualify for a homestead exemption, which reduces taxable value and saves money annually.

- Insurance Costs: Due to hurricanes, homeowners insurance can be expensive. Windstorm and flood insurance may be necessary, depending on your location.

4. Financing Your Home in Florida

Getting financing in order before house hunting is crucial. Lenders will consider your credit score, income, and debt-to-income ratio to determine loan eligibility.

- Mortgage Options: Florida offers a variety of mortgage options, including conventional, FHA, VA, and USDA loans. Research which one suits your situation best.

- First-Time Homebuyer Programs: Florida has programs that offer down payment assistance and lower interest rates for first-time buyers.

- Pre-Approval Process: Before making an offer, get pre-approved. This shows sellers you’re serious and gives you a clear idea of what you can afford.

When evaluating Florida mortgage rates, compare offers from different lenders to secure the best deal. Even a small difference in interest rates can save you thousands over the life of your loan.

5. Working with a Local Real Estate Agent

A knowledgeable real estate agent can make the home-buying process smoother. Florida’s market is unique, and having someone who understands the local trends, regulations, and negotiation strategies is invaluable.

- Why a Local Agent Matters: A Florida-based agent knows which areas are growing, which neighborhoods fit your needs, and how to navigate the state’s specific market challenges.

- Red Flags to Watch For: Be cautious of agents who pressure you into decisions or seem unfamiliar with local regulations. A good agent should prioritize your needs over a quick sale.

6. Understanding Homeowner’s Associations (HOAs)

Many Florida communities are governed by homeowner’s associations (HOAs), which enforce rules and maintain neighborhood standards.

- Pros of HOAs: They can provide community amenities, enforce property upkeep, and enhance home values.

- Cons of HOAs: Monthly fees can be costly, and strict regulations may limit your home modifications.

- Check HOA Rules Before Buying: If you’re considering a property in an HOA community, review the rules and fees before making an offer.

7. Home Inspections and Insurance Considerations

Skipping a home inspection in Florida can be a costly mistake. The state’s climate, high humidity, and hurricane risks mean homes may have hidden issues.

- Essential Inspections: A general home inspection is necessary, but also consider specialized inspections for termites, mold, and seawall stability if applicable.

- Windstorm and Flood Insurance: Many standard homeowner policies don’t cover flood damage. If you’re in a flood zone, you’ll need additional coverage.

- Roof Condition: Florida insurers often require roofs to be under a certain age to qualify for coverage. Older roofs may increase insurance premiums or require replacement before closing.

8. Closing Process and Final Steps

Once you find the right home, the closing process begins. Understanding what to expect can prevent delays and surprises.

- Closing Costs: These typically include lender fees, title insurance, and other administrative expenses. In Florida, closing costs range from 2% to 5% of the home’s purchase price.

- Title and Escrow Services: A title company will verify the legal status of the property, ensuring there are no outstanding claims or liens.

- Final Walkthrough: Before closing, conduct a final walkthrough to ensure everything is in order and any agreed-upon repairs have been completed.

Conclusion

Buying a home in Florida requires careful planning and a thorough understanding of the market. From financing to location selection, every step matters. By staying informed, working with experienced professionals, and considering Florida-specific factors like flood risks and insurance costs, you can navigate the home-buying process with confidence.

If you’re ready to start your journey, research mortgage options, connect with a local agent, and begin exploring the best areas to find your dream home in Florida.