Navigating the ever-changing landscape of financial markets can be daunting. However, sector rotation—strategically shifting investments between various sectors based on market trends—offers a dynamic way to stay ahead.

This strategy leverages the economic cycle, allowing investors to capitalize on sectors poised for growth while minimizing exposure to underperforming areas.

In this article, we’ll explore 8 proven sector rotation strategies, offering detailed insights into how they work, their advantages, and how to implement them effectively.

Whether you’re a seasoned investor or just starting, these strategies can help you optimize your portfolio for changing market conditions.

Understanding Sector Rotation

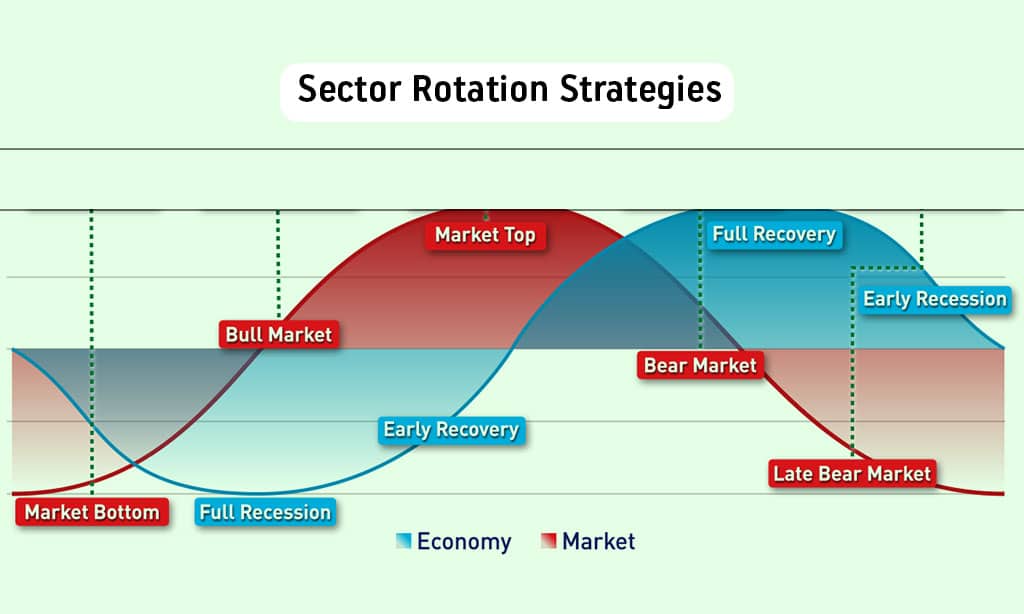

Before diving into strategies, let’s define sector rotation. In essence, it’s an investment strategy that reallocates funds among sectors based on where they are in the economic cycle. For example, during a recession, defensive sectors like utilities and healthcare often outperform, while cyclical sectors like consumer discretionary may lead during economic expansions.

Sector rotation capitalizes on these cyclical patterns, enabling investors to maximize returns while managing risk.

Key Benefits of Sector Rotation

- Optimized Returns: By investing in sectors likely to outperform, investors can enhance portfolio performance.

- Risk Management: Reduces exposure to underperforming sectors.

- Diversification: Promotes a balanced portfolio by shifting across various industries.

Now, let’s explore the 8 sector rotation strategies in detail.

1. Economic Cycle-Based Rotation

One of the most common sector rotation strategies aligns investments with the different phases of the economic cycle: expansion, peak, contraction, and trough.

How It Works

- Expansion Phase: Invest in growth-oriented sectors like technology, industrials, and consumer discretionary.

- Peak Phase: Shift to energy and materials as inflation rises.

- Contraction Phase: Move funds to defensive sectors like utilities, healthcare, and consumer staples.

- Trough Phase: Focus on financials and cyclical sectors anticipating recovery.

Why It’s Effective

This strategy leverages predictable economic patterns, allowing investors to align their portfolios with macroeconomic conditions.

2. Momentum-Based Rotation

Momentum-based rotation involves investing in sectors showing the strongest recent performance.

How It Works

- Analyze historical sector performance over a defined period, such as three or six months.

- Identify top-performing sectors and allocate capital accordingly.

- Regularly review and adjust the portfolio to maintain exposure to high-momentum sectors.

Benefits

- Data-Driven Decisions: Relies on clear, measurable performance indicators.

- Adaptability: Adjusts quickly to market trends.

Risks

Momentum strategies can lead to chasing overheated markets, so investors should combine them with risk management techniques.

3. Seasonal Sector Rotation

Certain sectors historically perform better during specific times of the year, making seasonal rotation a valuable strategy.

Examples of Seasonal Trends

- Retail: Strong performance during the holiday season.

- Energy: Peaks in the winter as demand for heating increases.

- Technology: Often rallies during earnings seasons and product launches.

Implementation

- Analyze historical performance trends for each sector.

- Allocate investments to sectors with strong seasonal track records.

This strategy is particularly effective for short-term traders seeking to capitalize on predictable patterns.

4. Interest Rate Sensitivity Rotation

Interest rate changes significantly impact sector performance, making rate-sensitive rotation an essential strategy.

How It Works

- Rising Rates: Favor financials, energy, and industrials, as these sectors typically benefit from a robust economy.

- Falling Rates: Shift to utilities, real estate, and technology, which perform better in low-interest environments.

Key Considerations

Monitoring central bank policies, inflation data, and bond yields is crucial for this strategy.

5. Inflation-Based Sector Allocation

Inflation levels can dictate sector performance, offering opportunities for strategic rotation.

Sectors to Focus On

- High Inflation: Energy, materials, and consumer staples tend to outperform.

- Low Inflation: Technology and discretionary sectors thrive due to lower input costs.

Implementation Tips

- Keep an eye on inflation indicators like the Consumer Price Index (CPI).

- Diversify within inflation-resistant sectors to reduce risk.

6. Defensive vs. Cyclical Rotation

This strategy involves toggling between defensive and cyclical sectors based on market conditions.

Defensive Sectors

- Utilities

- Healthcare

- Consumer Staples

Cyclical Sectors

- Industrials

- Technology

- Financials

During economic uncertainty, defensive sectors provide stability, while cyclical sectors offer growth during recoveries.

7. ETF-Based Sector Rotation

Exchange-Traded Funds (ETFs) simplify sector rotation by offering diversified exposure to specific industries.

Advantages

- Low-cost access to sector-specific investments.

- Easy portfolio adjustments without needing to buy individual stocks.

Popular Sector ETFs

- Technology: XLK (Technology Select Sector SPDR Fund)

- Healthcare: XLV (Health Care Select Sector SPDR Fund)

- Financials: XLF (Financial Select Sector SPDR Fund)

ETFs make sector rotation accessible to investors of all experience levels.

8. News-Driven Rotation

Market news, such as government policies, geopolitical events, or technological breakthroughs, can create sector-specific opportunities.

Examples

- Renewable Energy: Increased focus on green initiatives drives growth.

- Defense: Military conflicts boost defense sector stocks.

- Healthcare: Regulatory changes or medical breakthroughs create new opportunities.

How to Stay Informed

- Follow financial news platforms.

- Subscribe to sector-specific updates from credible sources.

This strategy requires a proactive approach but offers substantial rewards during pivotal market events.

Tips for Successful Sector Rotation

1. Stay Diversified

Even with sector rotation, maintain a diversified portfolio to spread risk.

2. Monitor Indicators

Track key economic and market indicators, such as GDP growth, unemployment rates, and corporate earnings.

3. Use Technology

Leverage tools like Bloomberg Terminal, Morningstar, or sector-specific ETFs to streamline decision-making.

4. Set Clear Goals

Determine your investment objectives—whether it’s growth, income, or risk management—and align your sector rotation strategy accordingly.

Takeaways

Sector rotation strategies empower investors to adapt to market changes, optimize returns, and mitigate risks. From leveraging the economic cycle to using ETFs and monitoring interest rates, these strategies offer a roadmap for staying ahead of market trends.

By understanding the unique characteristics of each sector and applying these strategies thoughtfully, investors can make informed decisions that align with their financial goals.

Start implementing sector rotation strategies today and position your portfolio for success in any market environment.