The era of “growth at all costs” has been dead for two years, but 2026 is the year the funeral is finally being held. As renewal cycles from the frenetic 2023-2024 AI boom hit a wall of unwavering financial scrutiny, SaaS leaders are facing a stark reality: generic demand generation is failing, “shelfware” is being aggressively purged, and the only metric that matters is proven, indisputable Return on Investment (ROI).

Contextual Background: The Road to the Great Correction

To understand the severity of the 2026 landscape, we must analyze the trajectory of the last five years. The “Zero Interest Rate Policy” (ZIRP) era fueled a “buy now, figure it out later” mentality that peaked in 2021. This was immediately followed by the Generative AI explosion of 2023-2024. During this period, enterprises scrambled to acquire any tool promising automation, leading to massive tech stack bloat.

By late 2025, the “AI Hangover” set in. Companies realized that owning 50 disparate SaaS tools often created data silos rather than efficiency. Now, in early 2026, we have entered the “Accountability Crisis.” The market has shifted from FOMO (Fear Of Missing Out) to FOGS (Fear Of Getting Stuck)—fear of getting stuck with expensive, unproven software. CFOs have effectively become the ultimate gatekeepers, armed with automated spend management tools that ruthlessly identify underutilized software.

1. The CFO as the New CMO: The Financial Firewall

The most significant shift in 2026 demand generation isn’t in marketing tactics—it is in financial governance. The Chief Financial Officer (CFO) is no longer just signing checks; they are dictating the buying criteria.

In 2024, a marketing leader could argue for a tool based on “potential efficiency gains” or “innovation.” In 2026, that argument is dead on arrival. Finance teams have transformed into “Revenue Operations Engines.” They use sophisticated “FinOps” platforms (like G2 Track or Zylo 2.0) to audit SaaS usage in real-time. If a tool shows low login rates or lack of feature adoption, it is flagged for cancellation automatically.

The “Proof of Work” Requirement:

Vendors are now required to provide “CFO-ready” business cases before the contract is signed. This includes ROI calculators validated by third-party data, not just marketing claims. The buying cycle has lengthened because finance committees are demanding a “Pilot-to-Proof” phase before committing to multi-year contracts.

Table 1: The CFO’s Buying Criteria Evolution (2023 vs. 2026)

| Evaluation Metric | 2023 Criteria (The AI Boom) | 2026 Criteria (The Accountability Era) |

| Primary Driver | Innovation & Fear of Missing Out (FOMO) | Cost Consolidation & Proven Efficiency |

| Budget Source | Experimental / R&D Budgets | Operational Expenditure (OpEx) / Strict Allocation |

| Implementation | “We’ll figure it out post-purchase” | “Show me the implementation roadmap before signing” |

| ROI Horizon | 12-18 Months | < 90 Days (Time-to-Value) |

| Tech Stack View | Best-of-Breed (Buying separate tools) | All-in-One (Platform Consolidation) |

| Churn Risk | Low (Contracts auto-renewed) | High (Auto-renewals disabled by default) |

2. The Death of the MQL: Revenue-First Attribution

For a decade, the Marketing Qualified Lead (MQL) was the north star of B2B marketing. In 2026, the MQL is a relic. The traditional “Lead Gen” model—gating content to capture emails and handing them to sales—has collapsed under the weight of AI-generated noise and privacy regulations.

The Conversion Crisis:

Data from late 2025 indicates that over 92% of MQLs never convert to paying customers. In an efficiency-first market, this waste is unacceptable to the C-Suite. Marketing teams are no longer judged on the volume of leads, but on Pipeline Velocity and Revenue Influence.

The Rise of “Dark Social”:

Buyers now conduct 80% of their research in “Dark Social” channels—peer groups, Slack communities, private Discords, and offline events—where traditional attribution software is blind. Demand generation in 2026 is less about capturing contact info and more about Demand Creation: influencing the market narrative so that when the buyer is ready, they come to you (Inbound) rather than you chasing them (Outbound).

Table 2: Metric Migration – From Vanity to Value

| Traditional Metric | Why It Failed | 2026 Replacement Metric | Why It Matters Now |

| MQL Volume | Easy to game; low correlation to revenue. | Pipeline Velocity | Measures how fast deals move; highlights friction. |

| Cost Per Lead (CPL) | Encourages cheap, low-quality leads. | Cost Per Opportunity (CPO) | Focuses budget on leads that actually enter the sales cycle. |

| Website Traffic | Bot traffic and “click-bait” skews data. | Account Engagement Score | Measures depth of interaction across multiple stakeholders in an account. |

| Form Fills | Friction causes drop-off; fake data common. | Ungated Content Consumption | Tracks consumption time/depth to gauge genuine intent. |

3. AI: The Efficiency Trap vs. The Trust Deficit

Artificial Intelligence has saturated the B2B landscape, creating a paradoxical “Trust Deficit.” While AI tools have made it easier to create content and send emails, they have made it harder to build relationships.

The Spam Tsunami & The Flight to Relevance:

With AI agents capable of sending thousands of personalized emails an hour, executive inboxes are unusable. This has devalued “cold outreach” to near zero. Because generic AI outreach is everywhere, human connection and hyper-relevance have become premium assets. Buyers are skeptical of anything that smells like a bot.

Agentic AI as a Filter, Not a Sender:

The winners in 2026 are using AI not to replace human interaction, but to inform it. They use “Agentic AI” to analyze buying signals (hiring sprees, tech installs, funding news) and intent data. This allows human sellers to reach out with surgical precision only when a buyer is actually in-market, a methodology known as “Signal-Based Selling.”

Table 3: The AI Implementation Spectrum

| Feature | The “Lazy” Approach (Losers) | The “Strategic” Approach (Winners) |

| Content Creation | Mass-producing generic SEO blog posts. | Using AI to summarize proprietary data/research. |

| Outreach | Automated sequences sending 1000s of emails. | AI monitors signals; Human sends 1:1 hyper-personalized video/note. |

| Customer Support | Frustrating chatbots that loop answers. | AI Agents that resolve tier-1 issues instantly + seamless human handoff. |

| Data Usage | Spray and pray (Quantity). | Predictive Intent Modeling (Quality). |

4. Retention is the New Acquisition

In a capital-constrained environment, acquiring a new customer is 5x to 10x more expensive than retaining an existing one. The “Leaky Bucket” growth model—where you churn customers but add new ones faster—is mathematically impossible in 2026.

NRR is the “God Metric”:

Investors and boards are scrutinizing Net Revenue Retention (NRR) above all else. A company with 120% NRR (meaning they grow even if they don’t add a single new logo) commands a premium valuation. Conversely, a company with 90% NRR is viewed as a distressed asset.

Customer Success as a Revenue Center:

Customer Success (CS) has evolved from a support function (“fixing problems”) to a core revenue driver (“unlocking value”). CS teams in 2026 carry quotas for cross-sells and up-sells. They are responsible for “Quarterly Value Reviews” (QVRs) rather than just business reviews, focusing strictly on ROI delivered.

Table 4: The Retention Matrix – Identifying Churn Risks

| Risk Indicator | The Old Response | The 2026 Strategy |

| Low Usage | Send a generic “login reminder” email. | Intervention: CSM conducts workflow audit to reintegrate tool. |

| Stakeholder Departure | Hope the replacement likes the tool. | Multi-Threading: Ensure 3+ “Champions” exist in the account at all times. |

| Support Ticket Spike | Fix the bugs as they come. | Root Cause Analysis: Engineering sprint dedicated to UX friction removal. |

| Silent Customer | Assume “No news is good news.” | Red Flag: Silence = Disengagement. Initiate executive-to-executive outreach. |

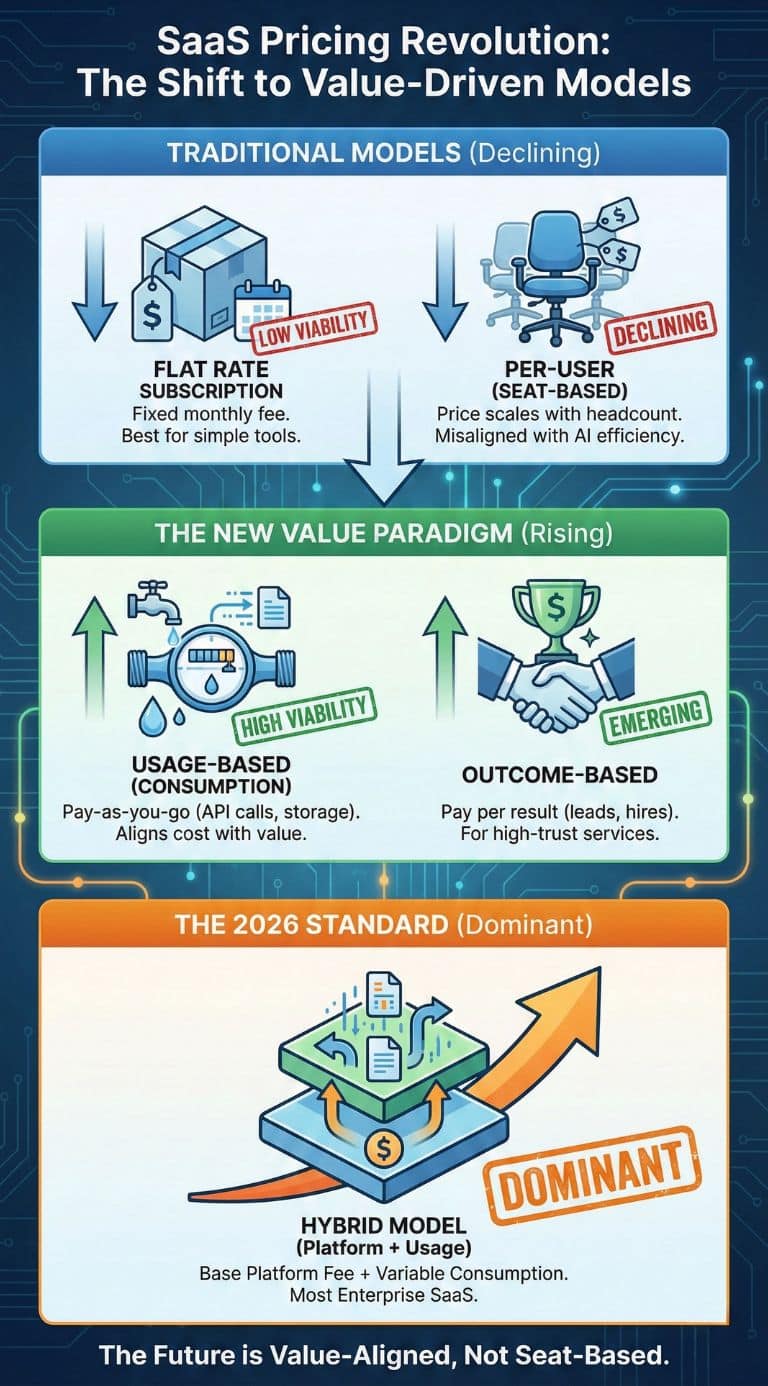

5. The Pricing Revolution: Usage-Based & Outcome-Based

The rigid “per seat” subscription model is dying, a victim of the AI era where “agents” do the work of humans.

The Seat Dilemma:

If an AI tool makes one employee as productive as five, the company hires fewer people. If the software vendor charges “per seat,” they are penalized for their own efficiency. This misalignment has forced a massive pivot.

Consumption Models & Hybrid Pricing:

We are seeing a shift to Usage-Based Pricing (UBP). Companies like Snowflake normalized this, and now vertical SaaS is following suit. Buyers prefer it because it aligns cost with value—they only pay when the tool is working. The standard for 2026 is a Hybrid Model: a platform fee (to cover R&D/Support) + consumption charges (e.g., per API call, per report generated, per transaction processed).

Table 5: Pricing Models Deconstructed

| Model | Description | 2026 Viability | Best Use Case |

| Flat Rate Subscription | Fixed monthly fee regardless of usage. | Low | Simple, low-touch productivity tools. |

| Per-User (Seat Based) | Price scales with employee count. | Declining | Collaboration tools (Slack/Zoom) where humans must interact. |

| Usage-Based (Consumption) | Pay-as-you-go (credits, tokens, storage). | High | Infrastructure, Data, API-heavy tools. |

| Outcome-Based | Pay per result (e.g., per lead, per hire). | Emerging | High-trust services (Recruiting, Lead Gen agencies). |

| Hybrid (Platform + Usage) | Base fee + variable costs. | Dominant | Most Enterprise SaaS platforms. |

Expert Perspectives: The Industry Consensus

The shift isn’t just anecdotal; it’s backed by industry heavyweights.

“The classic SaaS playbook of ‘grow fast, raise big, exit’ is clearly under pressure. In 2026, we are seeing the convergence of operational excellence with AI-enabled decision-making. Finance is no longer a back-office function; it is the strategic pilot of the organization.”

— Dave Leaver, CFO, Mention Me (via Younium Report)

“Marketing in 2026 is about ‘Account-Based Everything’. You cannot spam your way to success anymore. The ‘Sandwich Model’—where AI handles data/segmentation and humans handle strategy/engagement—is the only way to cut through the noise.”

— Demand Gen Analysts, Dealfront

“Buyers want answers quickly, and static PDFs are no longer sufficient. We are shifting toward dynamic knowledge hubs where procurement teams can interact with modular content. If your ROI isn’t visible in the first 30 days, you are churned.”

— Sagefrog B2B Trends Analysis

Future Outlook: What Happens Next?

As we look toward the second half of 2026 and into 2027, several trends will crystallize:

-

AI Agents Negotiating with AI Agents: We are approaching a future where a buyer’s “Procurement Agent” will automatically negotiate terms with a vendor’s “Sales Agent” based on pre-set parameters (price floors, compliance needs). Human involvement will be limited to final strategic approval.

-

The “Zero-Click” Search Reality: As AI search engines (like SearchGPT and Perplexity) dominate, traditional SEO traffic to B2B websites will plummet further. Brands must optimize for “Answer Engine Optimization” (AEO)—ensuring their value prop is cited by the AI models themselves, rather than fighting for Google clicks.

-

Consolidation of the Tech Stack: The average enterprise used ~130 SaaS applications in 2024. We predict this will contract by 20% by 2027 as “Super-Apps” and platform consolidation swallow up point solutions.

Final Thoughts:

The “Accountability Crisis” is painful, but necessary. It is purging the market of vaporware and forcing vendors to align their success strictly with their customers’ success. For the demand generation marketer, the mandate is clear: Stop counting leads, start proving value.