Starting a business is an exciting journey, but it also comes with its challenges—one of the most significant being managing taxes.

For startups in Canada, tax planning strategies for startups in Canada aren’t just about compliance; they are strategic tools to save money, reinvest in growth, and set your business on a path to success.

In this comprehensive guide, we’ll dive into 7 tax planning strategies for startups in Canada, equipping you with actionable insights to optimize your financial strategy and navigate Canada’s tax landscape effectively.

What is Tax Planning for Startups?

Tax planning strategies for startups in Canada involve structuring your financial operations to minimize tax liabilities while remaining compliant with Canadian tax laws.

It’s a proactive process that helps businesses save money, reduce risks, and take advantage of available tax benefits.

In Canada, startups face unique opportunities and challenges when it comes to tax planning.

By understanding the tax system and implementing effective strategies, you can free up capital to reinvest in your business and fuel growth.

Key Terms to Know

Before diving into the strategies, here are a few essential terms every startup owner should know:

- Corporate taxes: Taxes levied on a corporation’s income.

- Income splitting: A strategy to distribute income among family members to reduce overall tax liabilities.

- Tax credits and incentives: Financial benefits offered by the government to encourage specific activities or investments.

7 Tax Planning Strategies for Startups in Canada

1. Leverage Startup-Specific Tax Credits

One of the most effective tax planning strategies for startups in Canada is to take full advantage of tax credits designed for early-stage businesses.

These tax credits can significantly reduce your tax burden, allowing you to reinvest the savings into scaling your operations.

Scientific Research and Experimental Development (SR&ED) Tax Incentive Program

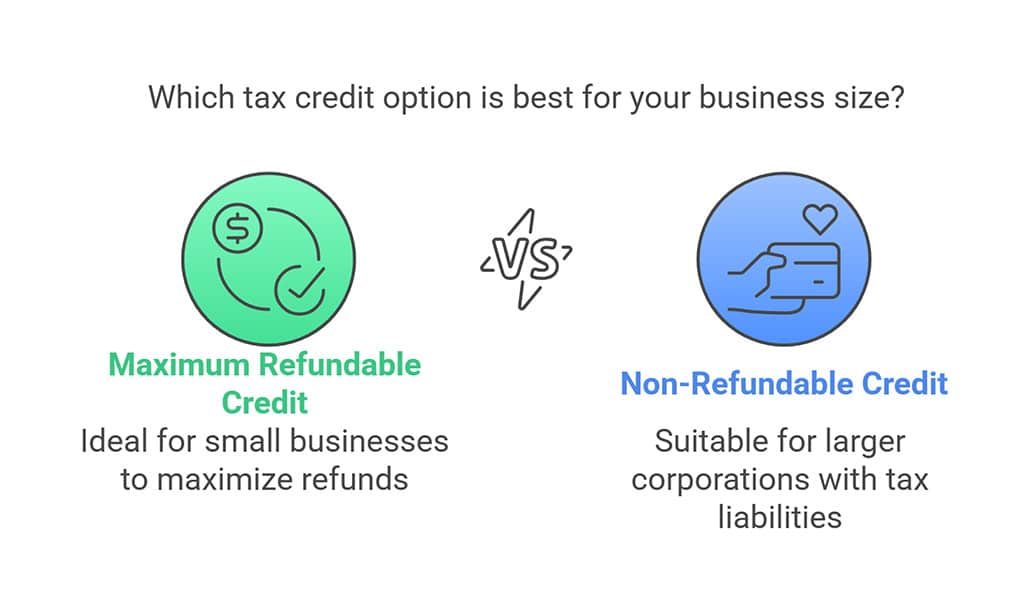

The SR&ED program is one of the most generous tax credit programs available to startups in Canada.

It encourages businesses to invest in research and development (R&D) by offering tax incentives.

- Overview: Provides refundable and non-refundable tax credits for eligible R&D activities, often covering up to 35% of qualifying expenses.

- Eligibility: Includes wages, materials, and overhead costs related to R&D projects that aim to improve technology or processes.

- How to Apply: File Form T661 along with your corporate tax return, ensuring all documentation and technical descriptions are accurate.

| Feature | Details |

| Maximum Refundable Credit | 35% for small Canadian businesses |

| Non-Refundable Credit | 15% for larger corporations |

| Eligibility Costs | Salaries, equipment, and materials |

| Turnaround Time | 120 days for processing claims |

Pro Tip: Many startups hire specialized consultants to prepare SR&ED claims, which can increase the likelihood of approval.

Provincial Tax Credits

In addition to federal programs, many provinces offer their own tax credits to support startups. For example:

- Ontario Innovation Tax Credit: Provides a refundable tax credit of 8% for eligible R&D expenses, offering significant relief for innovative businesses.

- BC Interactive Digital Media Tax Credit: Aimed at companies developing video games or educational software, providing a credit of up to 17.5% of eligible expenses.

| Province | Tax Credit | Percentage |

| Ontario | Innovation Tax Credit | 8% |

| British Columbia | Interactive Digital Media Tax Credit | 17.5% |

| Quebec | R&D Wage Credit | 14% |

| Alberta | Innovation Employment Grant | 20% |

2. Choose the Right Business Structure

Your business structure has a significant impact on your tax liabilities. Choosing the right one is a cornerstone of effective tax planning strategies for startups in Canada.

Incorporation Benefits

Incorporating your startup can provide several tax advantages:

- Lower tax rates: Corporate tax rates are generally lower than personal income tax rates. For example, small businesses in Canada can benefit from a federal tax rate as low as 9% on the first $500,000 of active business income.

- Income splitting: Allows you to pay dividends to shareholders, which can include family members in lower tax brackets, reducing the overall tax burden.

- Limited liability: Protects your personal assets from business debts, a critical consideration for startups with higher risks.

| Structure Type | Pros | Cons |

| Sole Proprietorship | Simple setup, full control | Unlimited personal liability |

| Partnership | Shared financial burden | Joint liability for debts |

| Corporation | Tax advantages, limited liability | More regulatory requirements |

| Cooperative | Democratic decision-making | Profit-sharing requirements |

When to Incorporate

Incorporating too early can lead to unnecessary costs. Consider these factors:

- Revenue thresholds: Incorporation is often beneficial once your business generates significant income (e.g., $30,000+ annually).

- Growth plans: If you plan to seek investors, incorporation is typically necessary to issue shares and attract funding.

3. Optimize Deductions and Write-Offs

Properly claiming deductions and write-offs can substantially reduce your taxable income, leaving more funds available for growth.

Eligible Expenses

Startups can claim various business-related expenses as deductions. These include:

- Office supplies: Computers, printers, desks, and chairs used for business purposes.

- Marketing and advertising: Expenses for digital advertising, website development, and promotional events.

- Travel: Costs related to transportation, meals, and accommodation for business trips.

- Professional fees: Legal, accounting, and consulting services.

| Expense Type | Examples | Tax Deduction |

| Office Supplies | Laptops, desks, printers | 100% |

| Marketing Costs | Google Ads, social media campaigns | 100% |

| Travel | Flights, hotels, meals | 50%-100% |

| Professional Fees | Lawyer or CPA consultation | 100% |

Maximizing Depreciation

Leverage the Capital Cost Allowance (CCA) to claim depreciation on assets. This ensures you get maximum value from your investments over time.

| Asset Type | CCA Rate (%) | Example |

| Machinery | 20 | Manufacturing equipment |

| Computer Equipment | 55 | Laptops, servers |

| Buildings | 4 | Office buildings or warehouses |

4. Take Advantage of Income Splitting

Income splitting is a powerful tax planning strategy for startups in Canada that can help reduce overall tax burdens, especially for family-run businesses.

Definition and Benefits

Income splitting involves allocating income to family members in lower tax brackets. Benefits include:

- Tax savings: Reduces the overall effective tax rate by utilizing lower tax brackets.

- Wealth distribution: Shares income among family members, fostering financial security.

Rules and Compliance

The CRA has strict guidelines to prevent misuse. Key points include:

- Payments must be reasonable for the work performed, such as salaries or dividends.

- Proper documentation and contracts are essential to ensure compliance and avoid audits.

- Consider using a family trust to simplify income distribution.

| Income Splitting Tool | Use Case | Key Benefit |

| Dividends | Distributing profits | Lower tax rates for family |

| Salaries | Paying family employees | Justifiable tax deductions |

| Family Trusts | Asset management | Simplified income allocation |

5. Understand and Plan for GST/HST Obligations

Startups need to be mindful of Goods and Services Tax (GST) and Harmonized Sales Tax (HST) obligations, as failing to comply can lead to penalties.

Registering for GST/HST

- Mandatory registration: Required if your revenue exceeds $30,000 in a calendar quarter.

- Voluntary registration: Beneficial even below the threshold to claim Input Tax Credits (ITCs).

Input Tax Credits (ITCs)

ITCs allow you to recover GST/HST paid on business expenses. Tips for maximizing ITCs:

- Maintain accurate records of all purchases.

- File returns promptly to avoid penalties.

| Scenario | Obligation |

| Revenue <$30,000 | Optional registration |

| Revenue >$30,000 | Mandatory registration within 29 days |

| Exporters | ITC claims on export inputs |

6. Utilize Tax-Deferred Investment Accounts

Tax-deferred accounts like RRSPs and TFSAs can be invaluable for startup owners looking to manage personal and business finances efficiently.

RRSPs and TFSAs for Business Owners

- RRSPs: Contributions are tax-deductible, and growth is tax-deferred until withdrawal, making it an excellent retirement planning tool.

- TFSAs: Investment growth is tax-free, offering flexibility for short-term and long-term savings.

Tax-Deferred Growth Opportunities

Aligning investments with your startup’s financial goals can yield significant tax advantages. For example, using a TFSA to save for a future office space avoids taxes on investment gains.

| Account Type | Key Benefit | Best Use |

| RRSP | Tax-deferred growth | Retirement savings |

| TFSA | Tax-free investment income | Short-term business goals |

7. Plan for Losses and Carryovers

Startups often experience losses in their early stages. Effective planning can turn these losses into future tax savings.

Understanding Tax Losses

- Non-capital losses: Can offset income in future years, reducing taxable income.

- Capital losses: Can be applied against capital gains to minimize taxes owed.

Carryover Strategies

- Carry-forward: Use losses to reduce taxes in future profitable years.

- Carry-back: Apply losses to past tax returns to claim refunds.

| Type of Loss | Use Case | Time Frame |

| Non-Capital Losses | Offset business income | 20 years forward, 3 years back |

| Capital Losses | Apply to previous/future gains | Unlimited carry-forward |

Takeaways

Proactive tax planning strategies for startups in Canada can significantly impact your business’s success.

By leveraging credits, optimizing deductions, and planning for losses, you can save money and focus on growth.

Don’t hesitate to consult with a tax professional to tailor strategies to your unique needs and maximize your financial potential.