The landscape for renewable energy funding has shifted dramatically this year. As 2026 begins, homeowners must navigate a complex transition following the expiration of traditional residential tax codes. Finding the best home solar incentives 2026 now requires a mix of federal programs, specialized state grants, and utility-level rebates.

Securing financial support for your solar project is more time-sensitive than ever before. This guide outlines the most effective ways to lower your installation costs despite the recent changes in federal law. Understanding these programs will ensure you maximize your savings while contributing to a cleaner energy grid.

How We Chose Our Top 5 List?

Our evaluation process is rigorous and relies on public data from the current year. We prioritize the long term safety of user investments and the reliability of funding sources. This ensures that the incentives we recommend are active and accessible for the 2026 calendar year.

We applied the following weightings to our research and comparison efforts to identify the top contenders.

| Criteria | Weighting | Focus Area |

| Financial Impact | 40% | Total percentage of system cost covered |

| Accessibility | 30% | Ease of application and income requirements |

| Reliability | 30% | Stability of the funding source throughout 2026 |

5 Essential Ways To Improve Best Home Solar Incentives 2026

The following programs represent the gold standard for reducing solar costs this year. We have evaluated these options based on their ability to provide significant upfront savings or long-term financial returns. Each selection offers a unique pathway to making renewable energy more affordable for your household.

1. State-Specific Solar Tax Credits

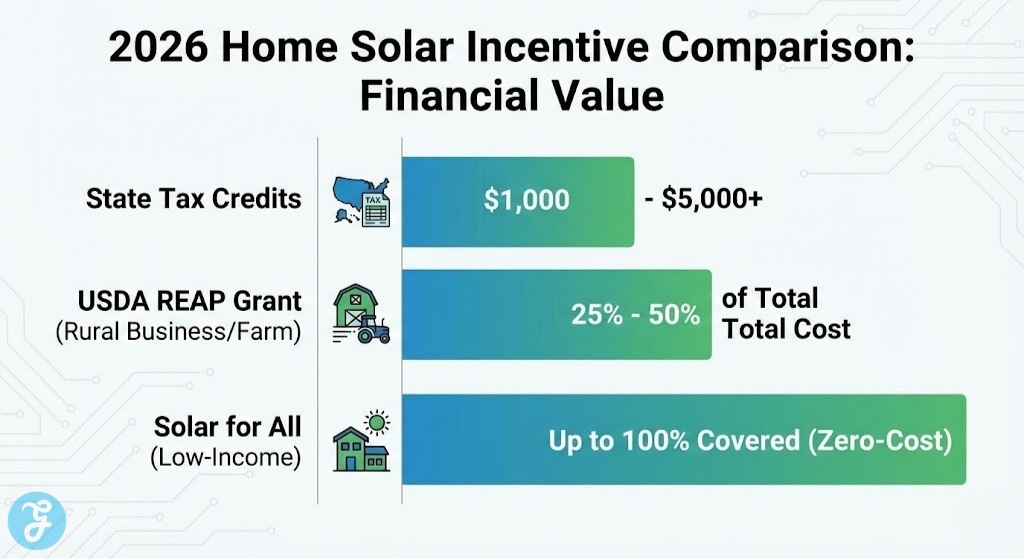

While the primary federal residential credit (Section 25D) has expired for new direct-owned systems in 2026, many states have maintained their own robust tax incentives. These programs allow you to deduct a significant portion of your installation costs directly from your state income tax. In many cases, these credits can be carried forward for several years if your liability is low.

The following details highlight the regional strengths and functional limits of state tax credits.

Special Features:

-

Dollar-for-dollar reduction in state tax liability

-

Typical caps ranging from $1,000 to $5,000

-

Often stackable with local utility rebates and grants

Things to Consider:

-

Eligibility varies strictly by your primary state of residence

-

Some states require a “placed in service” date within the current year

-

Non-refundable status means you must owe state taxes to benefit

Best for: Homeowners in high-incentive states like New York, Massachusetts, and Hawaii.

2. USDA Rural Energy For America Program (REAP)

The REAP program is one of the most powerful tools available in 2026 for homeowners who also operate a rural small business or farm. This federal grant can cover up to 50% of the total cost of a solar installation for qualifying projects. It is specifically designed to strengthen rural economies by reducing energy overhead for agricultural producers.

The platform provides the following advantages for rural residents and business owners.

Special Features:

-

Grant funding for 25% to 50% of eligible project costs

-

Guaranteed loan options covering up to 75% of financing

-

Quarterly application competitions throughout the 2026 fiscal year

Things to Consider:

-

Requires the property to be in a designated rural area

-

At least 50% of gross income must come from agricultural operations

-

Application process is highly technical and requires detailed narratives

Best for: Farmers and rural small business owners looking for massive cost reductions.

File Name: usda-reap-eligibility-map-2026.png

Alt Text: A 16:9 infographic map showing the eligible rural zones and grant percentages for the 2026 USDA REAP program.

3. Solar For All Grants

The “Solar for All” initiative is a massive federal program that has distributed billions to states and nonprofits to help low-income families go solar. In 2026, many of these state-level programs are reaching full implementation, offering no-cost or heavily subsidized installations. These grants are specifically targeted at reducing the energy burden on disadvantaged communities.

The service provides the following specific benefits for income-qualified households.

Special Features:

-

Potential for zero-cost solar installations for qualifying homes

-

Focus on both single-family and multi-family residential units

-

Includes funding for integrated battery storage in high-risk areas

Things to Consider:

-

Strict income limits apply based on area median income (AMI)

-

Availability depends on your state’s specific deployment timeline

-

Some programs may involve a “rebate swap” of existing energy subsidies

Best for: Low-to-moderate income households and those in disadvantaged communities.

4. Utility-Based Performance Rebates

Many local utility companies offer direct cash rebates to encourage the adoption of solar within their specific service territories. These rebates are often calculated based on the total wattage of your system or its expected annual performance. In 2026, some utilities are shifting these incentives toward “smart” systems that include battery storage.

The following list provides a framework for evaluating these utility-level incentives.

Special Features:

-

Immediate cash back following the final inspection of the system

-

Values ranging from $0.25 to $0.85 per watt installed

-

May include additional “adders” for low-income or equity areas

Things to Consider:

-

Funds are often limited and distributed on a first-come, first-served basis

-

Requires the use of a utility-approved contractor for the installation

-

Some rebates may reduce your eligible basis for other tax credits

Best for: Homeowners in utility territories with active renewable energy mandates.

5. SREC Market Participation

Solar Renewable Energy Certificates (SRECs) allow you to earn ongoing passive income from the electricity your system generates. For every megawatt-hour of solar power produced, you receive one SREC that can be sold on an open market to utilities. In 2026, states like New Jersey and Washington D.C. maintain some of the most lucrative markets for these credits.

The platform provides the following long-term financial advantages for system owners.

Special Features:

-

Ongoing income stream for up to 10-15 years after installation

-

Market prices that fluctuate based on state renewable targets

-

Managed through third-party brokers for easy monthly payouts

Things to Consider:

-

SREC prices are not guaranteed and can drop if the market is oversupplied

-

Only available in select states with “Renewable Portfolio Standards”

-

Requires a revenue-grade meter to track production accurately

Best for: Homeowners in high-value SREC states looking for a long-term return on investment.

Home Solar Incentive Overview

The 2026 market is defined by a shift away from direct consumer tax credits toward state-managed grants and third-party financing models. While some traditional paths have narrowed, new “Solar for All” initiatives have expanded options for specific demographics. The following table provides a high level look at the leading incentive types.

| Incentive Type | Typical Value | Primary Benefit | Availability |

| State Tax Credits | $1,000 – $5,000 | Direct tax liability reduction | Select States |

| USDA REAP Grants | 25% – 50% | Direct project funding | Rural / Agricultural |

| Solar For All | Varies | Low-income specific support | Federal / State |

| Performance Rebates | $0.20 – $0.85/W | Cash back based on system size | Utility Specific |

| SREC Markets | $20 – $400/MWh | Ongoing passive income | SREC States |

How Should You Choose The Best Option For You

Choosing the best solar incentive depends on your household income and your specific geographic location. You should prioritize state-level tax credits if you have a high tax liability and look toward grant programs if you meet income or rural requirements. The following table identifies which incentives perform best in different categories.

Still having trouble deciding?

| Category | Top Pick | Primary Reason |

| Upfront Savings | USDA REAP | Covers up to half of the total project cost |

| Long-term ROI | SREC Markets | Generates passive income for over a decade |

| Accessibility | Solar For All | Specifically designed to remove the cost barrier for many |

| Reliability | State Tax Credits | Stable legislative support in leading green states |

Wrap-Up

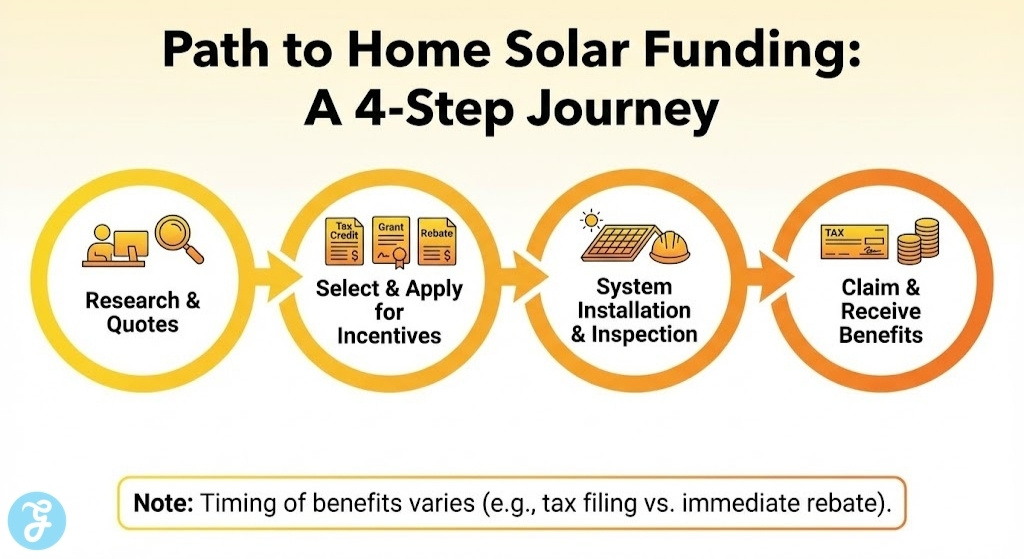

The search for the best home solar incentives 2026 highlights the importance of localized research and quick action. While the federal landscape has changed, the combination of state grants and utility rebates can still cover more than half of your installation costs. Always consult with a tax professional to ensure you are meeting all filing requirements for these programs.

Transitioning to solar is a strategic financial move that protects you from rising utility rates. By leveraging these five incentives, you can secure a sustainable future for your home while significantly reducing your carbon footprint. Start by checking your local utility website and your state’s energy office to see which programs are currently accepting applications.