Hey there, are those credit card statements starting to feel a little heavy? You aren’t the only one feeling the pinch. With average credit card interest rates hitting nearly 25% in early 2026, paying down that balance can feel like running on a treadmill that’s moving too fast. But there is a way to catch your breath. Balance transfers are still one of the most effective tools for taking control of your debt.

In this guide, I’m going to walk you through exactly how they work and how you can use them to save thousands of dollars in interest. We will cover the specific cards that offer 0% APR for up to 21 months and the insider tricks you need to avoid hidden fees. This option can cut high-interest costs and help with Debt Consolidation Strategies. Paying off debts faster means less stress at bedtime!

Let’s get your plan sorted out. There’s more on how everyday people are winning against debt headaches coming next!

What Are Balance Transfers?

At its core, a balance transfer is a simple financial move where you shift debt from one credit card to another. Usually, you move it from a card with a high interest rate to a new card with a much lower rate.

“Think of a balance transfer like moving your high-interest debt into a ‘time-out’ corner. It stops the interest from growing so you can finally attack the actual balance.”

Definition and purpose

A balance transfer means moving what you owe from one credit card to another. People use this tool to put all their debts in one spot, often chasing lower interest rates or better terms.

The main goal is to save money on high-interest debt and make payments simpler. Instead of fighting a 25% interest rate that eats up your payment, every dollar you pay goes toward the principal. This leads folks closer to financial independence with less hassle each month.

Many see a balance transfer as the first step in smart debt management and personal finance planning.

How balance transfers work

After seeing why people use balance transfers, it helps to see how the process works step by step. Credit card users move their high-interest debt from one card to another that offers a lower or even zero introductory APR.

Here is the standard process for 2026:

- Find a Card: You look for a card like the Citi Simplicity or Wells Fargo Reflect, which are known for long introductory periods.

- Apply and Approve: You apply for the new card.

- Initiate the Transfer: Once approved, you tell the new lender which debts you want to move.

- Wait for the Switch: It usually takes 5 to 7 days for the new bank to pay off your old card.

Once confirmed, your account shows the transferred amount as new debt, but at the intro rate promised in the 2026 offers. This is sometimes even 0 percent for up to 21 months. During this period, your payments chip away at the main balance instead of just covering interest fees. This makes it easier to manage multiple payments and focus on financial strategies such as debt reduction and better budgeting.

Benefits of Balance Transfers for Debt Consolidation

Balance transfers can ease the stress of too many payments, putting you back in the driver’s seat. With a simple move, you may find your debt feels lighter and easier to manage.

Lower interest rates

Paying high interest on credit card debt can feel like trying to fill a bucket with holes. A balance transfer often gives you a lower interest rate, sometimes as low as 0 percent for the first year or more.

Let’s look at the real math on a $5,000 balance to see why this matters:

| Feature | Standard Credit Card | Balance Transfer Card |

|---|---|---|

| Interest Rate (APR) | 25% (Average in 2026) | 0% (Intro Period) |

| Monthly Interest Cost | ~$105 | $0 |

| Principal Paid (of $200 pmt) | $95 | $200 |

| Time to Pay Off | 34 Months | 25 Months |

| Total Interest Paid | ~$1,900 | $0 (if paid in terms) |

For example, in 2026, many banks plan to offer introductory APR deals that last up to 21 months. Less money going to interest means more cash goes toward reducing your actual debt. Shifting your high-interest balances helps shrink what you owe faster.

Simplified payments

After you cut your interest with a balance transfer, things get much easier to handle. All those credit card bills can pile up and make life messy fast. With debt consolidation, most people move their high-interest debt onto one card.

Instead of tracking five different payments, you just pay once each month. Money stress drops since there is only one due date and no more guessing which bill got paid already.

Many folks say this simple switch makes them feel less worried about missing a payment or getting hit by late fees. Keeping tabs on your repayment plan feels more manageable as well. It is almost like turning down the noise in a busy room so you can finally think straight about your next steps for financial health.

Potential for faster debt repayment

Balance transfers can speed up debt repayment. Lower interest rates mean more of your payment goes straight to the balance, not just to interest charges. For example, paying off $5,000 in credit card debt at 25 percent interest might take years and piles of extra money in fees.

A balance transfer with a zero percent introductory APR for eighteen months lets you make bigger dents in that stack of debt every month. Tackling high-interest debt with smart financial strategies often brings relief faster than old habits ever could.

Pay close attention to the terms and stay active with your plan. Those monthly bills may shrink before you know it. Now we’ll look at how to use these tools wisely and get even better results from your consolidation strategy in 2026.

Effective Debt Consolidation Strategies in 2026

Fresh ideas keep popping up every year, and 2026 is no different. These tips can help you grab the bull by the horns and turn a mountain of bills into a small hill.

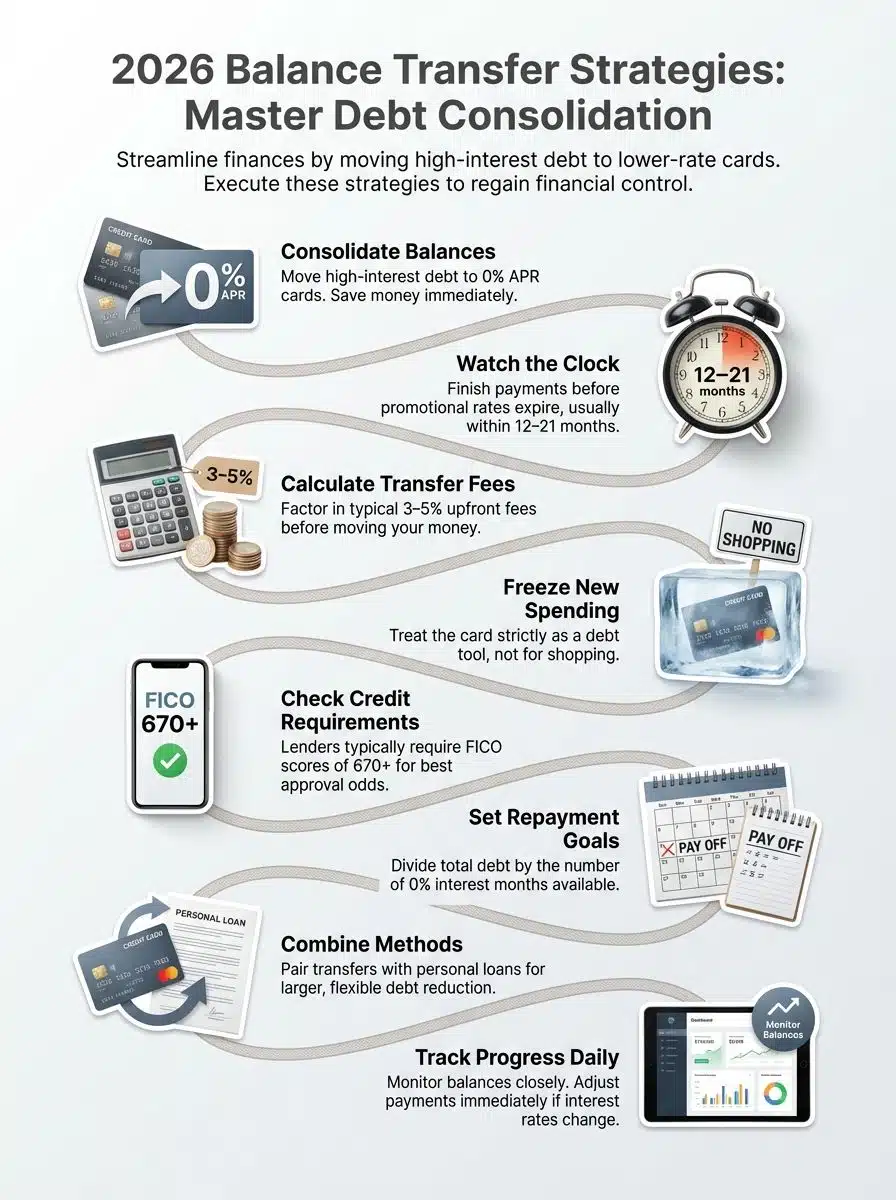

Using balance transfers strategically

Using balance transfers as a financial strategy can help lower credit card debt. Smart moves lead to real savings and better debt management.

- Follow the “60-Day Rule”: Most issuers require you to complete the transfer within the first 60 days to get the 0% rate. Don’t wait.

- Transfer high-interest credit card balances onto a card with a lower introductory APR, such as 0 percent for 12 to 18 months, giving yourself time to pay off more of the principal.

- Pay attention to the clock. Promotional interest rates usually expire after a set period. This makes it key to plan quick repayments before higher rates kick in.

- Focus new payments on the transferred debt while avoiding extra purchases on your balance transfer card. Treat it like a tool, not a shopping spree pass.

- Check how much of your total debt you can move. Some cards let you transfer up to your available credit limit, but watch out for restrictions.

- Calculate transfer fees before acting. Typical fees range from 3 percent to 5 percent of each amount moved, so add those costs when weighing your options.

- Use online calculators or budgeting tools like YNAB or Rocket Money to forecast savings and track how much faster consolidation could help reach financial independence.

- Keep old accounts open after you shift balances if possible. This can boost your credit score by improving your overall credit utilization rate.

- Set clear deadlines for paying off transferred amounts. Stick these dates on the fridge, or anywhere you glance often, to make repayment goals top-of-mind every day.

- Avoid applying for too many balance transfer cards at once, since too many checks on your report may harm your score or slow approval processes.

Combining balance transfers with other methods

Debt consolidation works best when you mix balance transfers with other smart steps. Doing so can help you pay off your high-interest debt faster.

- Pairing a balance transfer card with a personal loan gives you more flexible ways to pay down debt. Many people use a 0 percent introductory APR offer for smaller balances and take a personal loan for larger ones.

- Lower monthly payments from consolidation loans can free up cash for extra credit card payments, speeding up the debt reduction process.

- Some use home equity loans or lines of credit to wipe out big portions of credit card debt, then move any leftover balances onto low-interest transfer cards.

- A debt management program from a nonprofit group may combine several credit accounts into one payment, while also letting you shift part of your debt onto a balance transfer card.

- Tracking your progress with simple budgeting tools keeps spending in check and improves your chances of meeting your repayment goal.

Understanding these combined strategies helps set clear repayment goals. Now, let’s look at what matters before choosing a balance transfer in 2026.

Setting clear repayment goals

Pick a target date for clearing your credit card debt. Use simple math to break the total amount into monthly payments. Focus on high-interest debt first, like cards with rates over 25 percent.

Set reminders so you never miss a due date. Pay more than the minimum if possible. Paying just the basics drags out debt and adds extra interest.

Write this goal on paper or in your phone so you see it daily. Share it with someone close if that helps you stick to it. Track every payment using a basic spreadsheet or app, celebrating small wins after each paid-off balance transfer. Sticking to clear goals feels tough at first, but leads to lighter financial burdens faster than guesswork ever could.

Key Considerations Before Opting for a Balance Transfer

Think carefully before starting a balance transfer. The details can change your whole plan, so keep reading to find out what really matters.

Understanding balance transfer fees

Balance transfer fees sneak up on many people. Most banks charge 3% to 5% of each amount moved. So if you move $5,000, the fee might cost between $150 and $250 right from the start. This fee comes out even before you pay down any debt. It is added to your balance immediately.

Some credit cards waive these fees in special offers for new customers in 2026, but such deals are rare. Always read the fine print before moving your high-interest debt. That way, your financial strategies work in your favor instead of backfiring on your budget plans or debt reduction goals.

Evaluating promotional interest periods

Some balance transfer credit cards offer a 0% introductory APR. This period can last from 6 to 21 months, so keep an eagle eye on these numbers. Shorter time frames mean less breathing room to pay off debt without interest.

Longer promotional periods may sound great, but you must finish your payments before the regular rate kicks in. The average competitive card in 2026 offers about a 15 to 18-month promo period, according to national lending reports.

Plan each payment with that timer ticking away. If possible, split your total transferred amount by the number of zero-interest months. Aim for even payments so nothing gets left behind once higher rates return. Miss this window, and standard interest rates might land between 18% and 28%. This puts pressure back on your wallet fast.

Assessing your credit score requirements

Introductory rates sound great, but your credit score opens the door. Most banks look for a good credit score before allowing balance transfers in 2026.

A FICO score of at least 670 puts you in a stronger position for approval. You can check your score for free using services like AnnualCreditReport.com or your banking app.

Not all cards use the same rules, so lenders may set different cut-offs. For example, some cards will work with fair scores, while others require excellent credit only. Pay close attention to your current debt-to-credit ratio and past payment history.

High balances or missed payments can drop your chances fast. Some companies also review how many recent applications you have made. Too many can raise red flags. Lenders check if you manage credit well before handing out their best offers on debt consolidation tools like balance transfers or consolidation loans.

Alternatives to Balance Transfers for Debt Consolidation

You have more than one path to crush your debt. Some folks use other options that might fit their situation better, so explore what works for you.

Personal loans

Personal loans give borrowers a fixed amount of money with set monthly payments, usually lasting two to five years. Many people use these loans for debt consolidation since rates can be lower than most credit card interest rates.

Companies like SoFi, Marcus, or LightStream are popular choices for these types of loans in 2026. Lenders check income, job history, and total debts before giving loan funds.

Some folks use personal loans to pay off high-interest debt fast. This way, they trade several bills for one simple payment each month. There is no juggling due dates or missing small print on intro offers.

Interest stays the same through the whole term, so budgeting gets easier too. For 2026, many banks and online lenders offer instant decisions. Some even send funds by the next business day after approval.

Home equity loans or lines of credit

Some choose personal loans, while others tap into their home’s value with a home equity loan or a line of credit (HELOC). These options let you borrow money using your house as collateral.

With a home equity loan, you get all the cash at once and pay it back in fixed monthly payments. This is usually over five to thirty years.

A home equity line of credit works like a credit card, letting you borrow only what you need up to a set limit. Interest rates can be lower than those on most high-interest debt or credit cards. However, you must be careful about closing costs, which can sometimes add $500 to $2,000 to the cost of the loan.

Using this approach for debt consolidation may save money, but it puts your house at risk if payments are missed. For some people looking for bigger amounts or longer repayment terms, these methods offer both flexibility and lower interest rates compared to many other types of borrowing.

Debt management programs

Home equity loans or lines of credit use your home as collateral. That can feel risky for many folks. Debt management programs, on the other hand, do not require you to put up your house or car at all.

Credit counselors work with people to build a repayment plan. Organizations like the National Foundation for Credit Counseling (NFCC) are reputable places to start. They speak with lenders and try to lower interest rates or get fees dropped.

Clients pay one monthly amount, and the counselor sends those payments out. These plans usually last three to five years but give structure and support while tackling high-interest debt from credit cards. Enrollment may affect your credit score in the short run. However, many find peace of mind knowing someone has their back.

Tips for Successful Debt Consolidation

Small changes in how you handle debt can make a big difference. Simple steps help keep your plan on track and bring peace of mind.

Create a realistic repayment plan

Write down your debts and due dates. List out how much you owe on each credit card, the interest rates, and the required payments. Make a simple budget with your monthly income and basic expenses like groceries or rent.

Many experts recommend the “Avalanche Method” for this step. This means you focus all your extra money on the debt with the highest interest rate first while paying minimums on the others.

Use balance transfers to lower high-interest rates if you qualify for an introductory APR offer. Focus on paying as much as possible every month without missing other bills. Set reminders to make payments on time so you avoid fees that chip away at progress. Sticking to this plan helps you reach debt relief sooner and boosts your financial health in 2026.

Avoid accumulating new debt

Cutting up extra credit cards can help you avoid new spending temptations. Stick to a set budget and use cash for most purchases. New debt on top of transfers can pile up fast. The goal is to pay off what you owe, not add more weight to your financial backpack.

Track every dollar, so surprise charges do not sneak in at the end of the month. Hold off on big buys or store cards with flashy offers until you are back in control. Think twice before taking out payday loans. Interest rates there can soar above 400 percent APR, according to CFPB reports.

Track progress and adjust strategies

Staying away from new debt is only part of smart financial planning. Set reminders to check your balance transfer cards each month. Watch those interest rates and pay close attention if a promotional offer ends.

Maybe the card’s introductory APR jumps up after 18 months, leaving you with higher fees than before. Study your payments and see if they help chip away at high-interest debt faster.

Make quick changes if something is not working. If you miss payments or see your credit score drop, change your repayment plan right away. For example, shift extra money toward the highest-interest loan first or try using a personal loan for better debt relief options.

Final Thought

Balance transfers offer a smart path to debt relief, lower interest rates, and easier payments. By acting now, you can lock in 0% rates for nearly two years and stop the bleeding from high-interest charges.

These debt consolidation strategies are easy to put into action. They give you clear steps toward being free from high-interest credit card debt.

Making these moves now could mean big changes for your financial health and peace of mind in 2026. For more tips and support, reach out to trusted money guides or visit online personal finance resources. If I can do it, so can you. Real change begins with one bold step today!