Car Title Loans Can Be Convenient Options

Struggling with finances is something that almost every person will experience at some point in their lives. Unfortunately, unexpected events can cause chaos in our lives while costing lots of money. Maybe you’re behind on bill payments due to circumstances out of your control, or your car broke down, and you can’t afford to fix it.

Many situations can throw a wrench in our everyday lives, and handling them can be stress-inducing. When you don’t have enough money to pay for emergencies, you must start exploring your financial options.

Many people turn to traditional bank loans or credit cards when they need extra help, but this can be challenging for several reasons. If you have a bad credit history, you may not pass approval. The application and approval process for these financing options can be time-consuming and require in-person visits.

With a car title loan agreement, you may not need to worry about either of the factors mentioned. People with bad credit scores can inquire about funding, and you can begin the inquiry process without bringing your car in for an inspection!

Learn why title loans can be helpful solutions for people who need money quickly! Find out if you can get a fast cash title loan in no time

How Do Quick Title Loans Work?

Title loans work by allowing a person to borrow funding from the available equity in their vehicles. A lender will place a lien on the car title if you pass approval and then have it removed when you finish repayment. The vehicle title is insurance if the money is not paid back. Missed title loan payments can result in car repossession, so keep that in mind.

Applying for a streamlined car title loan can be simple! Below are the steps involved with inquiring about a title loan online:

1. Submit an Inquiry Online or Over the Phone

If you want to apply for a fast cash car title loan, you must fill out the pre-qualification form or call to speak directly with a title loan agent. The great thing about both options is that neither requires you to leave home! You can start inquiring about funds from the comfort of your home.

2. Collect and Submit the Correct Documents

After you fill out the pre-qualification form or call to speak with a title loan agent, they will review your information. Next, they will contact you about submitting the correct documents for a title loan inquiry. The documents required aren’t complicated, but you must find them beforehand so your process moves quickly!

You will need the following:

- Valid Government or State Issued Photo I.D.

- Proof of Residency

- Proof of a Qualifying Vehicle Title in Your Name

- Proof of a Steady or Alternative Income

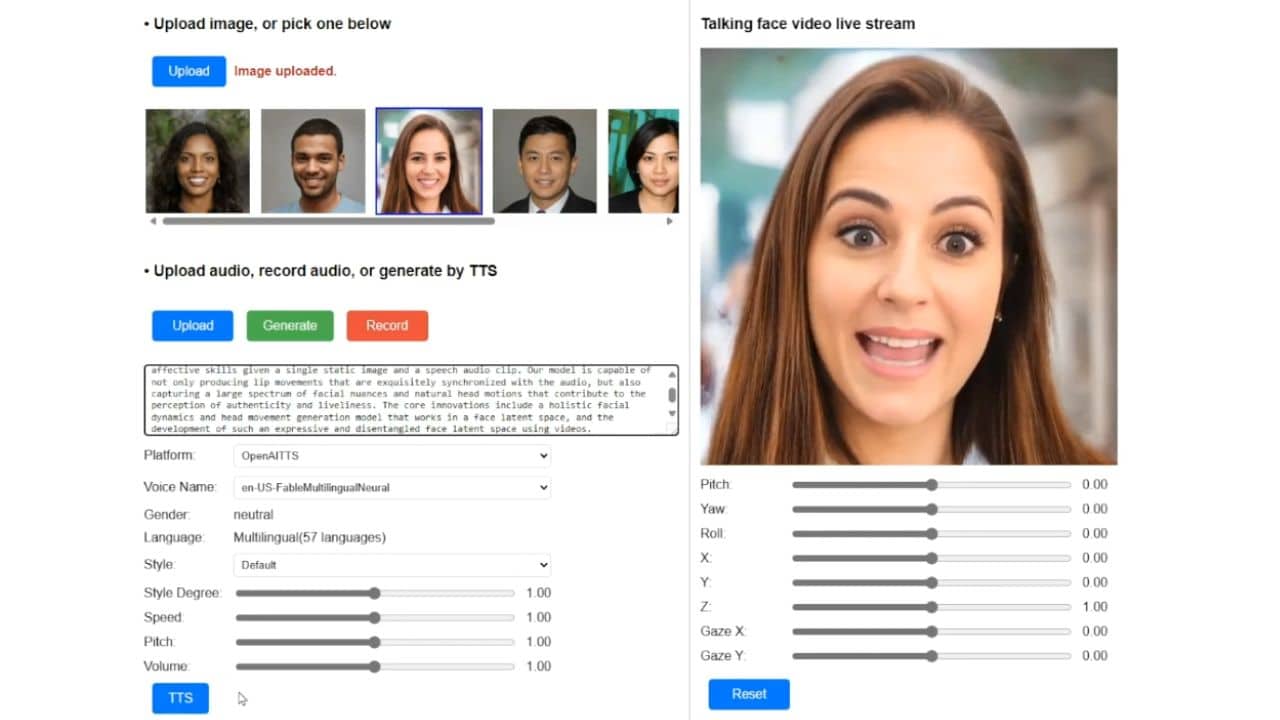

- Recent Photos of the Vehicle

Providing recent photos of the vehicle serves as the virtual car inspection! Instead of bringing your car in person, you can send pictures via email or fax. Ensure the photos are clear, direct, and taken from the correct angles! Blurry images may not pass approval and slow up your inquiry process.

3. Potential Approval and Receiving Money

The final step of a car title loan inquiry is awaiting your approval and receiving the money! Qualified borrowers may obtain access to cash within the same business day as inquiring, which can be super convenient during an emergency.

Apply for a Fast Cash Title Loan Today!

The most problematic aspect of a traditional bank loan is that it can take a long time to pass approval, and you may have to visit a physical location. With a car title loan, you can begin the inquiry process from the comfort of your home and don’t have to worry about bringing your car in for an inspection.

You can send the necessary documents via email or fax, making this an accessible option for people from many financial backgrounds.

Consider a car title loan if you need help with bill payments or an unexpected event! The inquiry and approval process can be fast and straightforward, which can be great for people who need help. Start today by filling out this pre-qualification form or calling to speak with a title loan agent.