Cryptocurrency as an investment vehicle thrives on public opinion. As much as there is a need for a favorable macroeconomic outlook for it to thrive, the overwhelming need for favorable public bias cannot be overlooked. One thing that has kept many invested in cryptocurrencies is that there will be a new wave of capital inflow into the space in a short while; majorly from retail traders, but institutions will be a huge role too.

Well, while we could argue this would happen soon, no one knows how soon it would be, and if data is anything to go by, the opposite is what is happening for almost a year, and for the foreseeable future both in normal cryptocurrencies and even the best proof of stake coins.

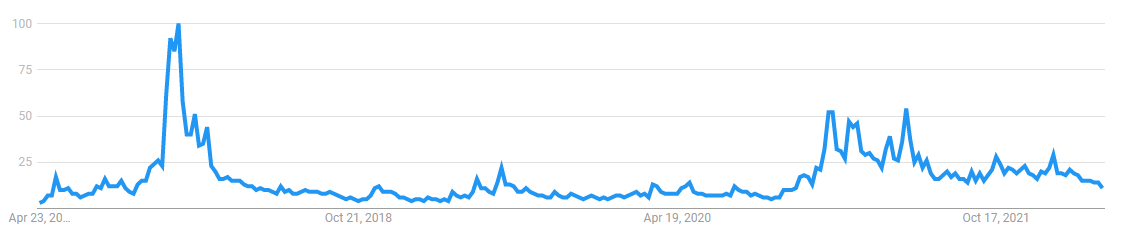

First, the number of global searches for the word ‘Bitcoin’ has been reducing for almost a year.

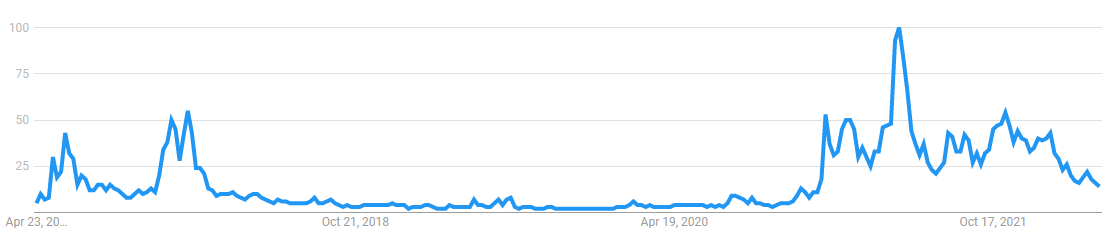

We could argue that since 2021, Ethereum has been the most used protocol due to its smart contract capabilities, but looking at Ethereum’s search volume on Google, the trend does not change. Searches for the word “Ethereum” peaked in May last year, and it has not reached near that height ever since. In fact, the search for Ethereum has not reached this dept since December 2020, prior to the crypto rave the next year.

From this data, perhaps, it would do us some service to check the possible options for where the next bull run will come from which will propel retail investors to take the bold move. There are two major signals that signal we might be nearer to a bull run than many expect and seeing the level of pessimism in the market recently, it is important to share these.

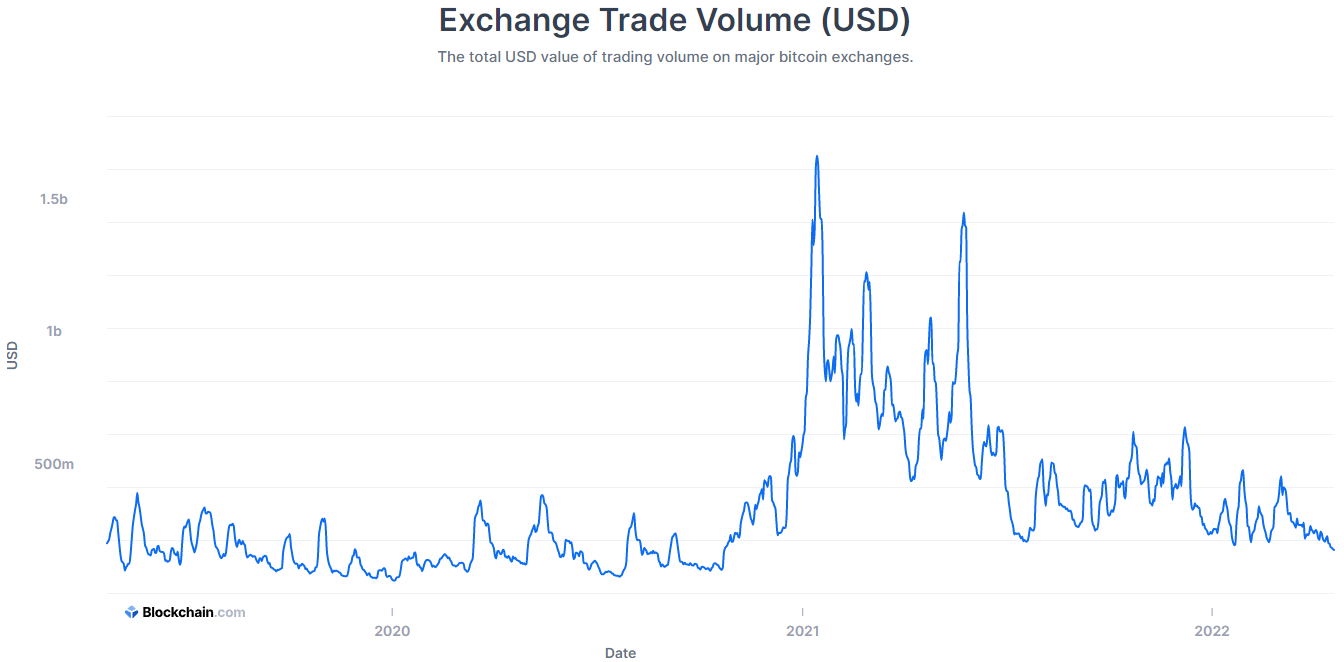

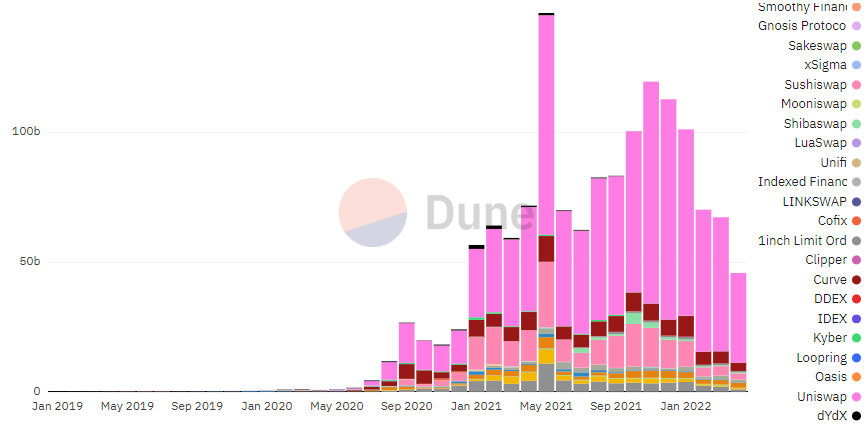

Low Volumes on all types of Exchanges

One major proof to show that global interests in cryptocurrencies are declining can be seen in the volume on most large exchanges. A blockchain.com data revealed that the volume was around $165billion in the middle of April. To put in perspective, the last time volume on crypto exchanges was this low was in October 2020.

Not only does cryptocurrency volume on exchanges show growing disinterest from people, but Defi and Decentralized Exchanges also are not exempted from this trend. As seen on Dune Analytics, Decentralized exchanges are also reeling from very low trading volume. The trend, as seen below, shows that the last time decentralized exchanges had volumes this low was in January 2021, remember that was when the last crypto rally began.

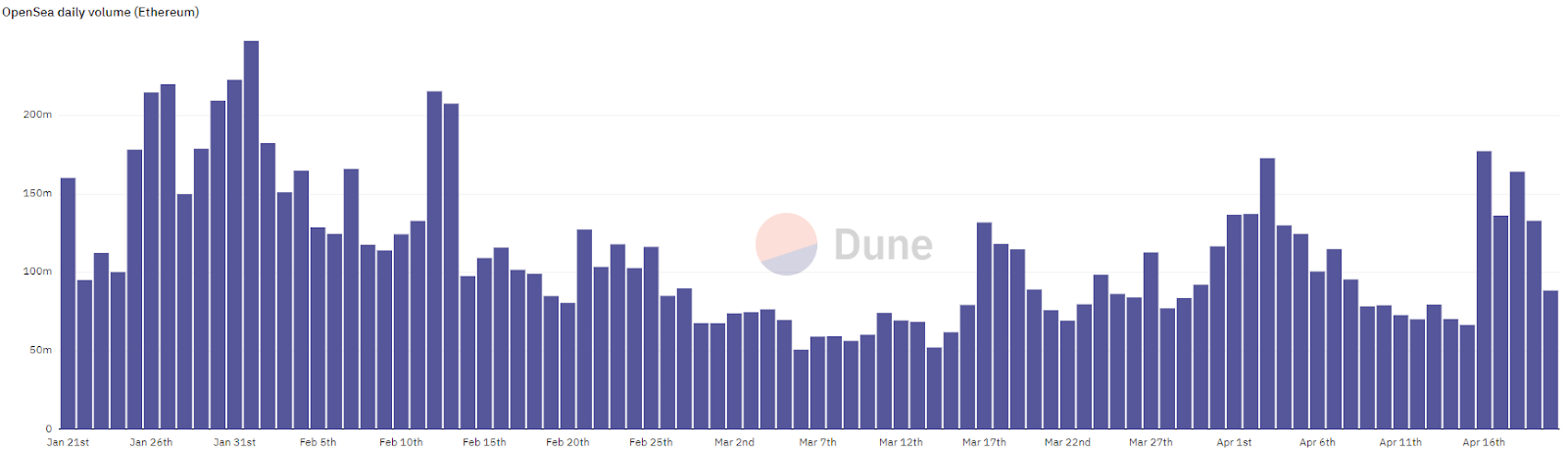

Increased capital inflow into the NFT space

The Non-fungible Token space, which has been the beloved of many investors since the downturn of the crypto market, has begun to come up in its trading volume. Ethereum-based NFT marketplace, which doubles as the biggest NFT marketplace; OpenSea, has begun to see a rise in its average daily transactions. The volume took a drastic dip in March but has since started picking up.

The increase in the daily volume of NFTs will influence the floor price of many projects and the momentum is just picking up.

Another major proof of the increased rave can be seen in Coinbase’s announcement to launch their own NFT marketplace. The company announced it would open it up for anyone above 18 years old, and the waitlist quickly garnered almost 9 million people in the first few days. The NFT marketplace was so loved because its released Beta version removed the need for trading fees, and there is an option to connect a decentralized wallet to it. This makes it different from many other centralized marketplaces which only accept the address of their native wallets.

There might be fears that this volume rise is caused by the BAYC and their plan to launch their metaverse called the other side. In line with this move, they have released ApeCoin (the token to be employed in the metaverse).

While we hold our hands akimbo, it is still unclear if this increase in volume can be sustained, or if we are moving slowly to the end of the NFT rave, seeing parallels between its growth and that of the ICO boom in 2017.

Either way, the next capital inflow into the market will be caused by one or a number of factors, and some investors have taken it upon themselves to find the next wave early.

Conclusion

With the macroeconomy in shambles, this seems like the best time to plan for the next Bull Run. It would be great to take the quote “be greedy when others are fearful” to the next level. Either way, our attention is on the Eth blockchain explorer and major crypto analytics platforms to monitor the transactions and guess the market’s next direction.