Are you a small business owner who feels overwhelmed when thinking about bookkeeping? Don’t worry, you’re not alone. It can be tricky, but keeping your finances in order is essential. In this post, we’ll go over the basics of bookkeeping and teach you how to keep your business’ books in good shape.

1. Keep Track of Your Business Expenses and Income

As a small business, owner, keeping track of your expenses and income is among the most important things you need to do, especially if you’re starting a tax business. It will help you budget and make informed decisions about where to allocate your resources.

There are many ways to track expenses, ranging from simple excel sheets to complex accounting software. Find a system that works for you, and update it regularly. In addition to tracking expenses, it is crucial to monitor your income. This will give you a better understanding of your overall financial health.

Again, there are many different ways to do this, so find a method that suits your needs. Finally, remember to review your records regularly. This way, you will always be aware of your financial situation and able to make necessary changes.

2. Organize Your Financial Records in a Consistent Manner

Having organized financial records is essential for any business, large or small. It can help you track expenses, income, and profits over time and provide documentation if you ever need to file taxes or apply for loans.

One way to do this is to use small business bookkeeping services, which can help you track income and expenses and manage invoices and bills. This can be a great way to stay organized and ensure that all financial records are up-to-date.

Additionally, they can also help you with tax preparation and compliance. As a result, you will save time and money and avoid costly mistakes.

3. Reconcile Your Bank Statements and Credit Card Statements

It’s important to reconcile your bank and credit card statements each month. This process involves matching the transactions listed on your statement with the transactions in your records.

This way, you will ensure that all of your transactions are accounted for and that there are no discrepancies. If you find any, you’ll need to investigate and resolve them. Reconciling your statements can be time-consuming, but it’s integral to maintaining your financial records.

4. Make a Budget and Stick to It

Any small business owner will tell you that having a budget is critical to their success. Not only does it help you to track your spending and keep your finances in order, but it also forces you to be mindful of where your money is going.

There are a few different ways to approach creating a budget. First, you can start by looking at your monthly expenses and income. Then, you can allocate a certain amount of money toward each payment. Another approach is creating a more detailed budget that includes weekly or daily costs.

Whichever method you choose, the important thing is to stick to your budget as closely as possible. It can be difficult, but it’s essential for keeping your small business afloat.

5. Set Aside Money for Taxes

When it comes to financial planning, one of the most important things to remember is to set aside money for taxes. This may not seem very easy, but it can be pretty straightforward.

First, you need to calculate your tax liability. You can do this using a tax calculator or speaking with a tax professional. Once you know how much you owe in taxes, you can start setting aside money each month to ensure that you have the funds available when it comes time to file your return.

By taking this proactive approach, you can avoid the stress and hassle of generating a large sum of money all at once.

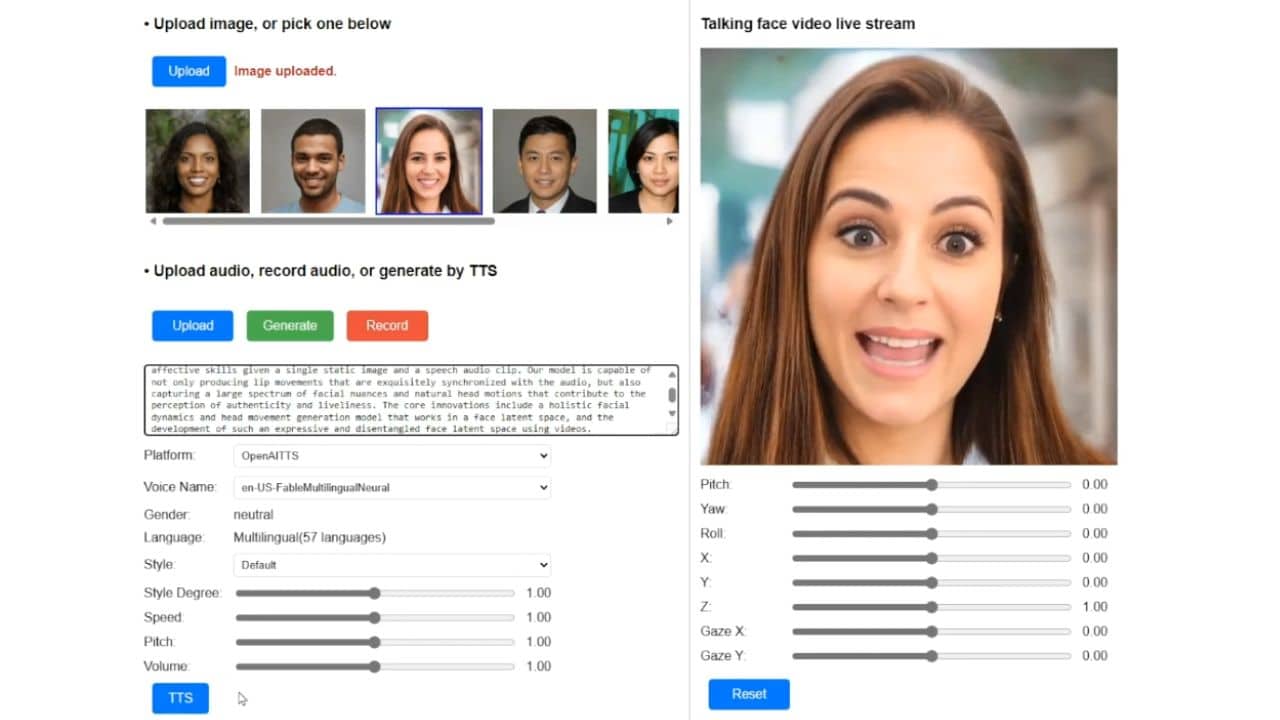

6. Invest in Accounting Software to Make Bookkeeping Easier

For any business, keeping on top of your finances is key. This is where accounting software can come in handy.

Accounting software can save you considerable time and effort by automating tasks such as invoicing, tracking expenses, and preparing financial reports. In addition, most accounting software packages offer a variety of features and integrations that can further streamline your bookkeeping workflow.

For example, some programs can automatically generate or integrate tax forms with payroll systems. With so much to gain, it’s no wonder that more and more businesses are investing in accounting software. Whether you’re a startup or an established enterprise, there’s a package out there that can suit your needs.

Congratulations! You have reached the end of this bookkeeping guide for small business owners. By now, you should be able to understand the basics of bookkeeping and how to keep track of your finances. Follow these tips, and you will streamline the process and make it less daunting!