When it comes to growing wealth through mutual funds, numbers matter. Not just how much you invest, but also how your investments could perform over time. That’s why many investors turn to tools like SIP and lumpsum calculators. These simple yet effective tools help you get a clearer picture of your potential returns, based on your style of investing—whether you’re adding money monthly or putting in a lump sum.

But which of these tools truly fits your financial behaviour? That’s what we’ll explore here. Whether you’re just starting out or trying to make better sense of your options, this guide will walk you through both calculators and help you decide which suits your goals better.

SIP Calculator: What It Does and Who It’s For

A SIP (Systematic Investment Plan) calculator is designed for those who invest a fixed sum regularly—usually every month. It works well if you have a consistent income and prefer a gradual approach to wealth creation.

Let’s say you start investing ₹5,000 every month in an equity mutual fund, aiming for an average annual return of 12%. You plan to continue this for 10 years. A SIP calculator takes these numbers, runs them through the compounding formula, and shows you the estimated future value—roughly ₹11.6 lakh. It also tells you how much of that is your invested amount and how much is the return on it.

This tool can be especially helpful if you’re saving for long-term goals like your child’s education or a home down payment. It encourages disciplined investing by showing how regular, modest contributions can grow over time. For instance, Rohan, a salaried professional, uses a SIP calculator each year to adjust his contributions and stay on track with his financial goals.

Besides forecasting growth, SIP calculators also indirectly showcase the benefit of rupee cost averaging—where you buy more units when prices are low and fewer when they’re high. This reduces the average cost per unit and helps manage the risk of market volatility over time.

Lumpsum Calculator: What It Tells You and When It’s Useful

Unlike SIPs, a lumpsum investment involves putting in a large amount at once. A lumpsum calculator helps you understand what that one-time investment might grow into over a certain period, assuming a fixed return rate.

Let’s take an example. Say you have ₹3 lakh from a work bonus or fixed deposit maturity, and you want to invest it in a mutual fund for 7 years. You expect an annual return of 11%. A lumpsum calculator would show you a projected corpus of around ₹6.25 lakh by the end of that term.

This kind of tool is especially useful when you’ve received a windfall—be it a bonus, a gift, or even sale proceeds from a property. It’s also handy for investors who don’t want the hassle of monthly payments or want their money to work for them from day one.

Take the case of Meera, a freelance consultant. Her income is irregular, but when she wraps up a big project, she often receives lump sum payments. Instead of parking that money in a savings account, she uses a lumpsum calculator to check where and how to invest it efficiently for long-term gains.

However, lumpsum investing also carries a higher entry risk. Since the entire amount is exposed to the market upfront, a sudden downturn could impact the returns in the short term. That’s why this strategy often suits investors with a higher risk appetite or those who are timing the market after doing thorough research.

Comparing SIP and Lumpsum Calculators

Now that we’ve seen what each calculator does, it’s worth comparing them side by side—not to pick a winner, but to understand where each one fits best.

| Feature | SIP Calculator | Lumpsum Calculator |

| Investment Approach | Monthly or periodic contributions | One-time investment |

| Ideal For | Salaried individuals, habitual savers | Investors with surplus capital |

| Market Timing Risk | Reduced due to averaging | Higher, as money enters the market all at once |

| Flexibility | High—easy to start, stop, or increase | Low—decision made at the outset |

| Best Use Case | Planning for goals like education, retirement, travel | Deploying bonuses, inheritance, or fixed deposit exits |

| Return Build-up | Gradual and steady | Potentially higher if timed well |

Which One Aligns with Your Style of Investing?

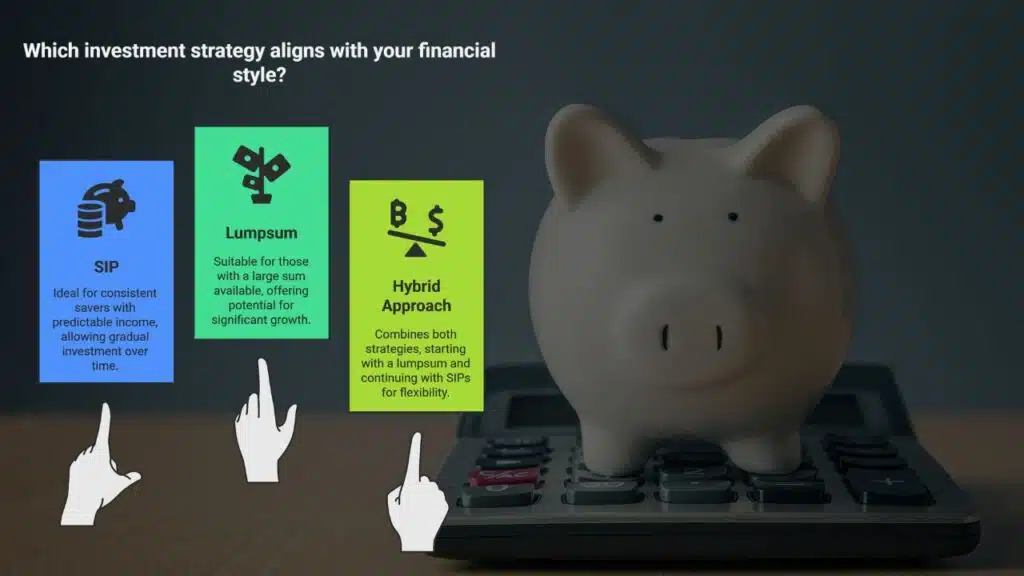

Choosing between SIP and lumpsum isn’t about which gives better returns on paper. It’s more about how you earn, save, and feel about risk.

If your income is predictable and you’re more comfortable saving bit by bit, then a SIP calculator is probably more useful for you. It’s a tool that reflects the benefit of consistency—perfect for people who don’t have large amounts to invest at once but are willing to stay patient.

However, if you’ve received a large sum—whether from a bonus, sale of an asset, or an inheritance—a lumpsum calculator helps you weigh your options. It shows you what your money could grow into and allows you to adjust the investment horizon or return expectations before locking anything in.

It’s also not uncommon for investors to start with a lumpsum and later continue with SIPs. The point is: your approach can evolve. The tools are here to support that evolution, not force you into a single mould.

Is There Merit in Using Both Together?

In reality, many people use both methods—and for good reason. For instance, you might invest a lumpsum amount after a fixed deposit matures and then start a SIP alongside it to keep your investments growing steadily.

Using both calculators can give you a more realistic picture of what your financial future might look like. Let’s say you invest ₹1.5 lakh upfront and continue with ₹3,000 per month in SIPs. Checking both projections side by side not only motivates you to stay the course, but also helps you make informed adjustments along the way.

In this blended approach, the lumpsum gives your portfolio an early boost, while the SIP keeps you connected with the market consistently, reducing emotional investing and timing errors.

Final Thoughts

There’s no one-size-fits-all when it comes to investing, and the same holds true for the calculators you use. Whether it’s the SIP calculator or the lumpsum one, each tool is designed to mirror a specific investing style.

The key is to match the tool with your situation. Are you someone who prefers structure and long-term planning? A SIP calculator might be your guide. Do you have a significant amount to deploy and want to see how it can grow? Then the lumpsum calculator is worth exploring.

Ultimately, these tools are not just about numbers—they’re about clarity. And when you have clarity, making smart, confident decisions becomes a lot easier.