Car insurance is a vital part of owning and operating a vehicle in the United States. Whether you’re a seasoned driver or a first-time car owner, understanding the nuances of car insurance can save you money, ensure adequate protection, and keep you compliant with state laws.

This article will uncover 10 Essential Facts About Car Insurance, offering insights that every American should know.

From understanding coverage types to tips on lowering premiums, this comprehensive guide is your roadmap to making informed decisions about car insurance.

1. Car Insurance is Legally Required in Most States

Car insurance isn’t just a financial safety net—it’s a legal necessity in most U.S. states. Driving without adequate coverage can lead to hefty fines, license suspension, or even jail time. Understanding the specific requirements in your state ensures you avoid penalties and maintain compliance.

What Are the Minimum Requirements by State?

Each state has its own minimum coverage requirements, typically focused on liability insurance. Liability insurance covers damages to others if you’re at fault in an accident. Here’s a snapshot:

| State | Bodily Injury Liability (per person/per accident) | Property Damage Liability |

| California | $15,000 / $30,000 | $5,000 |

| Texas | $30,000 / $60,000 | $25,000 |

| Florida | $10,000 / $20,000 | $10,000 |

Exceptions to the Rule

While most states mandate car insurance, places like New Hampshire and Virginia offer alternatives. For example, New Hampshire drivers can forgo insurance but must prove financial responsibility in the event of an accident. However, this alternative often requires significant financial resources, making traditional insurance a more practical choice for most drivers.

Real-Life Example: State Variances

For instance, a driver in Florida with only minimum coverage might face significant out-of-pocket costs in a severe accident, as medical and property damage expenses often exceed the state’s low limits. Knowing your state’s requirements can help you decide if additional coverage is necessary.

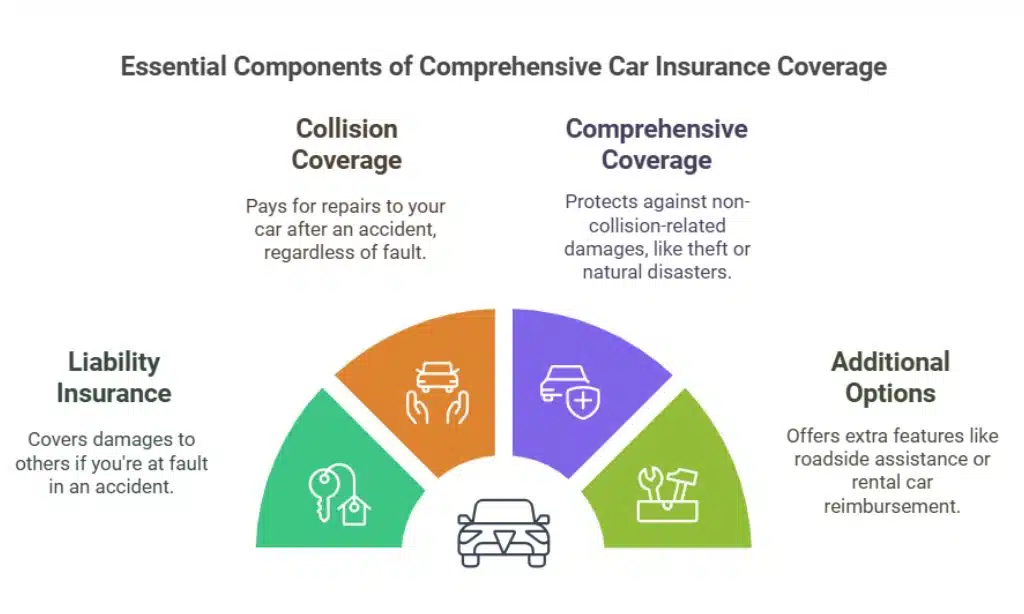

2. Different Types of Car Insurance Coverage

Understanding the various types of car insurance coverage is essential for crafting a policy that meets your needs. Here are the main types:

Liability Insurance

Liability insurance is the foundation of most policies. It covers:

- Bodily injury: Medical costs and lost wages for other parties.

- Property damage: Repairs to another person’s vehicle or property.

Collision and Comprehensive Coverage

- Collision Coverage: Pays for damages to your vehicle in an accident, regardless of fault.

- Comprehensive Coverage: Covers non-collision events like theft, vandalism, or natural disasters. This is especially useful in areas prone to extreme weather or high crime rates.

Additional Options

Many insurers offer add-ons to enhance coverage:

- Personal Injury Protection (PIP): Covers medical expenses for you and your passengers.

- Uninsured/Underinsured Motorist Coverage: Protects you if the at-fault driver lacks sufficient insurance.

- Roadside Assistance: Provides towing, jump-starts, and other emergency services. Ideal for frequent travelers or those driving older vehicles.

| Coverage Type | Key Benefits | Best For |

| Liability Insurance | Covers third-party damages | All drivers |

| Collision Coverage | Pays for your vehicle repairs | Drivers with new vehicles |

| Comprehensive Coverage | Protects against theft or natural events | Urban and high-risk areas |

| Personal Injury Protection (PIP) | Medical expense coverage | Families and commuters |

Tip: Coverage Customization

For maximum protection, combine liability with collision and comprehensive coverage. Add-ons like PIP and roadside assistance can further tailor your policy to suit your driving habits.

3. Your Driving Record Significantly Affects Premiums

Insurance companies assess your driving record to determine how much of a risk you pose. A clean record can result in substantial savings, while accidents and traffic violations can lead to higher premiums.

How Accidents and Violations Impact Rates

For example:

- A minor speeding ticket can increase premiums by 20-30%.

- An at-fault accident can result in a 40-50% hike in rates. Insurers view these incidents as indicators of future claims risk.

Discounts for Safe Drivers

Many insurers reward safe drivers with discounts:

- Defensive Driving Courses: Completing a course can reduce premiums by up to 10%.

- Telematics Programs: Devices like Progressive’s Snapshot track driving behavior and offer discounts for safe habits, including smooth braking and low mileage.

Case Study: Clean Record vs. At-Fault Accident

| Scenario | Average Annual Premium (USD) |

| Clean Driving Record | $1,200 |

| At-Fault Accident | $1,800 |

Practical Insight: Tracking Progress

Some insurers offer apps that monitor driving behavior and provide regular feedback, helping you adopt safer practices over time and qualify for discounts.

4. Credit Score Can Influence Your Car Insurance Rates

Your credit score isn’t just for loans—it can impact your car insurance premiums as well. Insurers use credit-based insurance scores to predict the likelihood of filing a claim.

Why Insurers Use Credit Scores

Studies show that drivers with poor credit are more likely to file claims. As a result, insurers often charge higher premiums to those with low credit scores. For example, a driver with excellent credit may pay $1,200 annually, while one with poor credit could pay $2,000 for the same coverage.

States Where Credit Score Cannot Be Used

In some states, like California, Hawaii, and Massachusetts, using credit scores to calculate premiums is prohibited. These states emphasize driving history and other factors over financial metrics.

Tips to Improve Your Score and Save Money

- Pay bills on time to avoid late fees.

- Keep credit utilization below 30%.

- Regularly check and dispute errors on your credit report using free tools like AnnualCreditReport.com.

| Credit Tier | Average Annual Premium (USD) |

| Excellent (750+) | $1,200 |

| Good (700-749) | $1,400 |

| Fair (650-699) | $1,800 |

| Poor (<650) | $2,000 |

Example: Building Credit

A driver who improved their credit score from 650 to 750 over three years saved $800 annually on car insurance premiums.

5. Bundling Policies Can Save You Money

Combining multiple insurance policies with the same provider can lead to significant savings. Bundling simplifies billing and often unlocks loyalty discounts.

What is Policy Bundling?

Bundling involves purchasing multiple policies—such as auto and home insurance—from one provider. This often results in discounts ranging from 10-25%, depending on the insurer and policies combined.

How Much Can You Save?

| Policy Bundle | Average Discount (%) | Estimated Annual Savings (USD) |

| Auto + Home Insurance | 15 | $200-500 |

| Auto + Renters Insurance | 10 | $100-200 |

Is Bundling Always the Best Option?

While bundling offers convenience and savings, it’s important to compare standalone policies to ensure you’re getting the best deal. If your auto insurance provider doesn’t offer competitive rates for homeowners, separate policies might be more cost-effective.

Insight: Loyalty Perks

Some providers offer loyalty bonuses for customers who bundle and stay with them for several years, increasing the long-term value of the discount.

6. Car Insurance Rates Vary by Location

Where you live plays a major role in determining your car insurance rates. Urban areas tend to have higher premiums due to increased traffic density and crime rates, while rural areas generally see lower costs.

How ZIP Codes Influence Premiums

Insurers consider factors like:

- Crime rates (e.g., vehicle theft, vandalism).

- Traffic congestion and accident statistics.

- Availability of repair shops and local weather conditions.

Urban vs. Rural Rates

| Location Type | Average Annual Premium (USD) |

| Urban | $1,800 |

| Suburban | $1,500 |

| Rural | $1,200 |

Example: Moving for Savings

A family relocating from downtown Chicago to a suburban area saved over $600 annually on their car insurance policy due to reduced traffic risks and lower crime rates.

7. Age and Gender Impact Insurance Costs

Insurers analyze demographic data to predict risk levels, which often results in variations in premiums based on age and gender. While these practices can seem controversial, they are rooted in statistical trends.

Why Younger Drivers Pay More

Young drivers (16-25 years old) face higher premiums due to their higher likelihood of accidents. For instance, a teen driver could pay $3,000 annually, while a driver in their 40s might pay just $1,200.

Gender-Based Pricing Trends

- Men typically pay more than women due to statistically riskier driving behavior.

- Some states, like California, prohibit gender-based pricing.

Senior Discounts

Drivers aged 55+ may qualify for discounts through senior-specific programs or AARP memberships, often saving 10-20% annually.

Example: Senior Savings

A retired couple in Florida reduced their premiums by bundling auto insurance with an AARP-endorsed provider, saving $400 annually.

8. Vehicle Type and Usage Matter

The car you drive and how you use it can impact your insurance rates.

High-Risk vs. Low-Risk Vehicles

- Sports cars and luxury vehicles often come with higher premiums.

- Sedans and family-friendly SUVs are usually cheaper to insure due to their safety ratings and repair costs.

Mileage-Based Insurance Options

Programs like Metromile offer pay-per-mile insurance, ideal for low-mileage drivers. This option can reduce costs significantly for those who drive less than 10,000 miles annually.

Safety Features That Reduce Premiums

| Safety Feature | Average Premium Reduction (%) |

| Anti-theft System | 5-10 |

| Adaptive Cruise Control | 7-12 |

| Lane Departure Warning | 5-8 |

Practical Tip: Feature Incentives

Vehicles with factory-installed safety features may qualify for additional discounts compared to aftermarket installations.

9. You Can Shop Around for Better Rates Anytime

Many drivers stick with the same insurer for years, but shopping around can lead to significant savings.

When to Compare Quotes

- Policy renewal time.

- After major life changes like marriage or moving.

- If you purchase a new vehicle or experience a significant rate increase.

Tips for Finding the Best Policy

- Use online comparison tools like Insurify or Policygenius.

- Consult with independent insurance agents to explore multiple options.

Avoiding Coverage Gaps

Continuous coverage prevents penalties and ensures uninterrupted protection. Always secure a new policy before canceling your current one.

Insight: Annual Reviews

Set a reminder to review your policy annually to ensure it aligns with your current needs and offers competitive rates.

10. Claims Process and Filing Tips

Filing a claim can be daunting, but knowing the process makes it smoother.

Steps to File a Claim

- Report the incident to your insurer immediately.

- Document damages with photos and a detailed report.

- Work with an adjuster to assess the claim.

- Receive payment or repairs.

Common Reasons for Claim Denials

- Policy exclusions.

- Late reporting.

- Insufficient documentation.

How to Avoid Common Pitfalls

- Regularly review your policy’s terms.

- Keep all records related to the incident.

Example: Quick Response Benefits

A driver who promptly reported a minor fender bender and provided complete documentation received a claim payout within 72 hours.

Takeaway

Car insurance is more than a legal requirement; it’s a critical tool for financial protection and peace of mind. By understanding these Essential Facts About Car Insurance, you can make informed decisions that save money and provide the best coverage for your needs.

Review your policy today, compare options, and stay informed to drive confidently on America’s roads.