Picking health insurance in Japan can feel hard. You see public plans like kokumin kenko hoken. You also find private health insurance options. You may not know which plan fits your budget or visa.

You worry about high costs, co-pay, and paperwork.

Japan has two main public plans: company health insurance and the national health insurance scheme. All residents must join one or the other. They must carry a health insurance card or an eligibility confirmation certificate.

In this post, we list ten top providers, from AXA to Sompo Japan. We compare cost, coverage, digital tools, and support. Keep reading.

Key Takeaways

- By Dec. 2, 2024, all Japan residents must join either company health insurance (shakai hoken) or national health insurance (kokumin kenko hoken) and carry a health card.

- The top 10 private insurers—AXA, Bupa Global, Allianz Care, Cigna, William Russell, VUMI, IMG, DavidShield, GeoBlue, and Sompo Japan—offer tiered plans to fill coverage gaps.

- Annual benefit limits span from $160,000 (AXA Foundation) up to $8,000,000 (AXA Prestige Plus, IMG Platinum) and include options from $500,000 (Cigna Silver) to unlimited (Cigna Platinum).

- Monthly premiums range roughly $150–$400 based on age, visa status, and plan tier, and most policies add dental, preventive care, long-term care, and emergency evacuation.

- Insurers provide digital health cards, online claim portals, telehealth apps, and English-speaking support to help track costs, file claims, and handle residence-card paperwork.

Overview: Health Insurance Options for Residents and Expats

Public health insurance cuts medical fees for illness or injury. All residents must join a plan. Company staff join Kenko Hoken, known as shakai hoken. Freelancers, students, and job seekers pick Kokumin Kenko Hoken, or national health insurance.

The city hall issues a health insurance card, a National Health Insurance Certificate, and a Notice of Eligibility Information. Officials will stop issuing new certificates after December 2, 2024.

Many expats opt for private insurance to fill coverage gaps. These international plans cover dental care, long-term care insurance, and preventive care. Policies include emergency treatment and co-payments at top medical facilities.

You pay premiums based on age, medical history, and salary bracket. Expats must show a residence card and the Notice of Eligibility Information to enroll.

Top 10 Health Insurance Providers in Japan (with brief descriptions)

You can peek under the hood of ten standout insurers to see how they handle clinical visits, prescription costs, and dental care. Each plan taps into Japan’s universal healthcare system, adds a global coverage option, and keeps your health insurance card within reach.

AXA

AXA ranks among the top international health insurance companies in Japan. It offers five plans: Foundation, Standard, Comprehensive, Prestige, and Prestige Plus. Plans suit various budgets and health needs.

Foundation covers $160,000 per year, while Prestige Plus pays up to $8,000,000. Many expats use AXA for medical coverage, dental care, and emergency evacuation. A policyholder can walk into a clinic with a health insurance card, avoid high medical expenses, and get private health insurance perks on top of universal healthcare.

Plans ask for monthly contributions. Some holders mix public health insurance, like kokumin kenko hoken, with AXA to fill gaps. Coverage spans preventive care, long-term care, and major surgery.

AXA jumps in when bills hit the roof, and friends say it feels like a safety net. The network links top medical facilities in Japan. Helpful staff guide you through visa applications and identification documents, they smooth out the red tape.

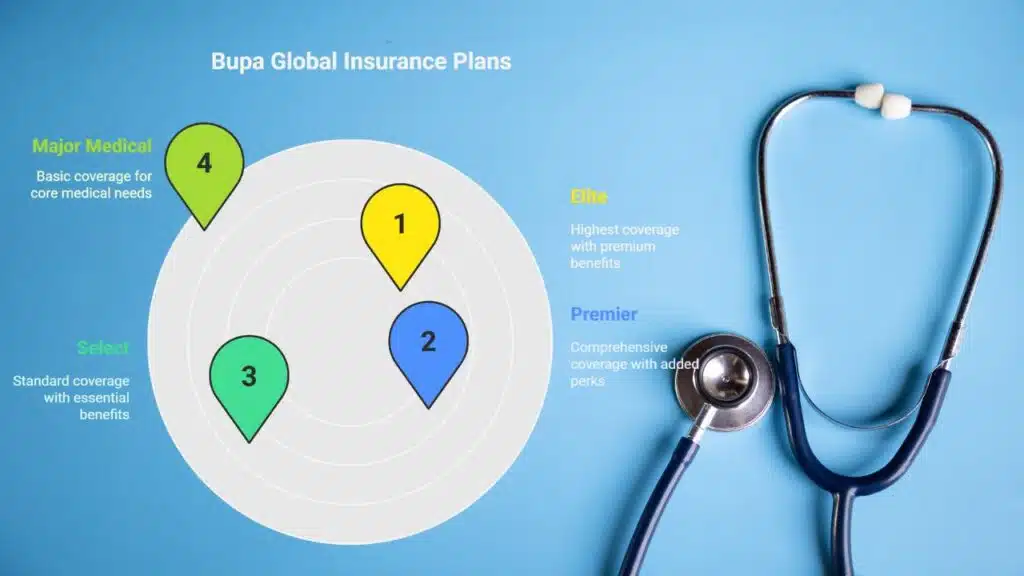

Bupa Global

Its plans span four tiers: Major Medical, Select, Premier, and Elite. These tiers help members choose the right health insurance coverage. They set annual limits from $1,587,100 to $4,761,300.

Expats access private healthcare coverage and travel insurance benefits. The global network cuts healthcare costs and connects to top medical facilities.

Members get a digital insurance card and online premium calculator. The insurer handles monthly contributions for each plan. It covers dental care, long-term care insurance, and mental health services.

This option works alongside national health insurance and employer schemes. It suits those with a residence card in Japan.

Allianz Care

Allianz Care offers three plans: CARE, CARE PLUS, CARE PRO. Each plan caps annual benefits at $2,500,000 or $5,000,000. This coverage handles costly medical expenses and prescription medications at top medical facilities in Japan.

The insurer provides a digital health insurance card and an online claims portal. Expats and residents can tap into international health insurance and private health insurance.

Members pay monthly premiums based on age and coverage level. Coverage includes preventive care, dental care, and emergency evacuation. You can submit medical bills and get refunds through the mobile app.

Allianz Care guides you on handling medical coverage and using Japan’s healthcare services. The insurer issues documents you need for residence card and national health insurance registration.

Cigna

Cigna brings four major tiers to expats in Japan: SILVER, GOLD, PLATINUM and CLOSE CARE. SILVER covers up to $500,000 in annual medical expenses. GOLD raises that to $750,000. PLATINUM offers unlimited coverage.

CLOSE CARE pairs a tight local network with extra perks.

The insurer adds mental health care, dental care, and preventive care to each option. It links to top medical facilities across Japan. You register with a residence card or health insurance card and see clear monthly contributions.

The Cigna Telehealth App lets you book virtual visits in minutes. The Online Claim Portal cuts red tape like a sushi chef slicing tuna.

William Russell

William Russell serves expats and locals with private medical insurance on Japanese soil. It sets annual limits from $1,500,000 to $5,000,000. Clients choose from Bronze, SilverLite, Silver, or Gold tiers.

Each tier covers inpatient care, outpatient visits, dental care, and preventive services. It cuts healthcare costs in japan by capping out-of-pocket expenses. Policyholders get a digital health insurance card for easy doctor visits.

Monthly contributions match plan levels. Bronze has lower premiums and basic medical coverage. Gold asks a higher fee but covers more treatments and prescription drugs. The firm accepts credit card payments and bank transfers.

It offers long-term care insurance as an add-on. Expats show a residence card to enroll. This provider stands among top global insurers in the Japanese market.

VUMI

VUMI serves expats and locals with flexible coverage. It offers BASIC, STANDARD, SUPERIOR, ULTRA, and TOTAL plans. These plans carry annual limits from $3,000,000 to $5,000,000. VUMI covers medical services like hospital visits, prescription medications, dental care, and preventive care in Japan.

Clients choose VUMI as an international health insurance partner to top up kokumin kenko hoken or private health insurance. The insurer works with top medical facilities in Japan. It sets monthly contributions based on age and plan tier.

VUMI issues a health insurance card and guides on residence card submission.

IMG

IMG offers four tiered international health plans for expats in Japan, labeled Bronze, Silver, Gold, and Platinum. You pick a plan that fits your budget, with annual limits from $1,000,000 to $8,000,000.

It covers care center stays, outpatient visits, dental care, and checkups. IMG also pays for prescription medicine and preventive screenings.

Policyholders can enjoy direct billing at care centers and clinics across Tokyo, Osaka, and other regions. IMG’s online portal tracks claims fast, so you see costs clear and skip long waits.

You pay monthly contributions based on your income and visa status, and you need to show a residence card to enroll. This private health insurance covers gaps beyond Japan’s public system for nonresidents.

DavidShield

DavidShield ranks among top international health insurance companies in Japan. It issues plans like Passport Card Global and Relocation Worldwide. Annual limits range from around $4,100,000 to $5,000,000.

Coverage spans preventive care, dental visits and emergency evacuation. Claim forms reach your inbox fast, so you skip long waits.

Friendly reps speak clear English, helping expats feel at home. You pair these plans with Japan’s national health insurance to cut medical expenses. A health insurance card makes visits at clinics or hospitals smooth.

DavidShield takes some sting out of healthcare costs, leaving you free to enjoy ramen shops or cherry blossoms.

GeoBlue

GeoBlue offers private health insurance for expats in Japan. It packs two tiers, XPLORER ESSENTIAL and XPLORER PREMIER, with annual limits from $1,000,000 to unlimited. You tap into global medical centers and enjoy direct billing at partner clinics.

The plans cover preventive care, dental treatment, and air ambulance in emergencies.

Members pay monthly contributions and track health insurance premiums online. This health insurance company issues a digital health insurance card for Japan healthcare compliance. Coverage starts on the policy date, cutting out-of-pocket costs for medical exams and prescription drugs.

That design feels like a safety net across oceans, easing worries about healthcare costs in Japan.

Sompo Japan

Sompo Japan leads private health insurance in Japan for locals and expats. The provider makes its service clear on pricing and coverage. It links with experienced brokers who know your needs.

You can choose a plan with dental care or long-term care insurance. The company stands beside AXA Global and Aflac Japan on top lists.

Residents and visa holders can add universal coverage to national health insurance plans. Sompo Japan offers international medical coverage that fits a foreigner’s budget. You receive a health insurance card soon after enrollment.

Brokers guide you through claims and renewal. This mix helps cut healthcare costs in Japan.

Key Factors to Consider When Selecting a Provider

Pick a plan that fits your budget. Use a premium comparison chart to line up costs from $150 to $400 per month for expats. Check each provider’s deductible, coverage levels, and copays.

Note if COVID-19 treatment sits in the policy document. Ask if they list treatment details for AXA, Cigna, and GeoBlue. Look at care groups, too. Larger care groups often cut wait times.

Measure claim process speed with a risk assessment tool. Test language support in English if you speak little Japanese. Weigh public health plan eligibility based on your job status.

Hold a residence card or work visa? See if you qualify for national health insurance or need private coverage. Mix private health insurance with national plans to cover long-term care insurance and dental care.

Use a coverage calculator to spot gaps fast. Compare monthly totals, out-of-pocket caps, and claim deadlines. Ring customer reps in English to judge their help level. Glance at feedback from patients, peers, and local forums.

A small slip in translation can cost you stress or a stray bill. Find a provider that speaks your tongue. This step guards you from future headaches.

Takeaways

Choosing the right plan can act as your compass in a storm. Keep a clear insurance card and proof of coverage in your wallet and bag. Tap a mobile platform or log into an online service to track costs, claims, and visits.

Dial the support line when questions pop up, you will get help fast. Scan your monthly contributions, check medical coverage, then tweak your policy as life changes.

FAQs

1. What types of health insurance can I choose in Japan?

You can join public health insurance or private health insurance, or buy international health insurance if you travel a lot. The public care system, called Japan’s national health insurance, covers all residents under universal healthcare. Private plans add extra medical coverage. International plans help expats who need broad medical care.

2. How do I sign up and get a health insurance card?

Go to city hall with your residence card or resident ID card, and fill out the forms. If you work, your employers will enroll you in the public plan. You pay monthly contributions based on your gross income and tax bracket, and then they mail you a health insurance card. Keep that card safe for all medical facilities in Japan.

3. What does Japan’s national health insurance cover?

It pays for visits at medical facilities in Japan, from doctor’s fees to hospital stays. It also covers preventive care, dental care, and the cost of prescription medications. If you need long-term care, it helps with long-term care insurance for nursing homes or assisted living facilities.

4. Can I use private and international plans too?

Yes, private health insurances fill gaps in public healthcare, like private rooms or extra therapies. International health insurance covers you if you move or travel a lot. Always read your policy for medical coverage limits, risks, and how it works with public health insurance.

5. Do I need life insurance in Japan?

Life insurance is not required, but many people buy it for extra help. Term life insurance gives you set protection for a few years at lower cost. Whole life insurance lasts for your lifetime and builds cash value, like a small savings fund. Universal life insurance lets you change your premium and coverage as you go.

6. How can I handle costs for chronic conditions?

Get regular medical examinations and use preventive measures like screenings and checkups. Public health insurance will cover most medical expenses, but you can add private plans or aid programs if needed. You can also look into old age fund support or public assistance to ease your financial risks.