Denmark is an attractive country for real estate investment due to its high standard of living, stable economy, and strong property market.

However, buying property in Denmark as a foreigner comes with specific regulations, financial considerations, and legal requirements. Whether you’re planning to purchase a home for personal use or as an investment, understanding the 10 Things to Know Before Buying Property in Denmark will ensure a smooth transaction.

Denmark’s property market is known for its transparency and stability, but navigating the process can be complex, especially for non-residents. This guide provides essential information, including legal restrictions, costs, taxes, financing options, and market trends, helping you make an informed decision.

By the end of this article, you’ll have a clear roadmap for buying property in Denmark, avoiding common pitfalls, and maximizing your investment potential.

Why Denmark is the Suitable Option to Buy Properties

Denmark presents a compelling opportunity for expatriates considering property investment, owing to its stable economy, robust housing market, and high quality of life. Here are key factors that make Denmark an attractive destination for expat property buyers:

1. Strong and Stable Economy

Denmark boasts a resilient economy characterized by low unemployment rates and high disposable income levels. This economic stability enhances the purchasing power of residents and fosters a secure environment for property investments.

2. Thriving Housing Market

The Danish housing market has demonstrated significant growth. In 2024, house prices increased by an average of 5.2%, reflecting a robust demand for residential properties.

3. Sustainable and Energy-Efficient Living

Denmark is at the forefront of sustainable living, with a strong emphasis on eco-friendly and energy-efficient properties. By 2025, it is anticipated that 90% of Danish homes will possess energy performance certificates, underscoring the country’s commitment to environmental sustainability.

4. Urban Development Initiatives

Innovative urban planning projects, such as Copenhagen’s “five-minute city” concept in the Nordhavn neighborhood, exemplify Denmark’s dedication to creating accessible and community-centric living spaces. These developments enhance the appeal of urban living for expatriates.

5. Favorable Market Projections

The residential real estate sector in Denmark is projected to grow by 3.95% between 2025 and 2029, reaching a market volume of approximately US$2.65 trillion by 2029. This positive outlook indicates a promising environment for property investment.

6. Increasing Foreign Investment

The Danish real estate market is experiencing a rise in foreign investment. By 2025, the number of foreign investors in the residential real estate market is expected to increase by 10%, highlighting Denmark’s growing appeal to international buyers.

7. High Quality of Life

Denmark consistently ranks high in global quality of life indices, offering excellent healthcare, education, and public services. The country’s safe environment and well-functioning infrastructure make it an attractive place for expatriates to settle.

8. Transparent Market Practices

Denmark’s real estate market is known for its transparency and well-regulated processes, providing a secure framework for property transactions. This clarity is particularly beneficial for expatriates navigating a foreign market.

9. Strategic Location

Situated in Northern Europe, Denmark offers strategic access to other major European markets, making it an ideal base for expatriates involved in international business.

10. Cultural Appeal

With its rich history, vibrant cultural scene, and emphasis on work-life balance, Denmark provides an enriching living experience that appeals to expatriates seeking both professional opportunities and personal fulfillment.

Here’s a comparative table highlighting the key benefits of buying property in Denmark compared to other major EU countries:

| Factor | Denmark | Germany | France | Spain | Netherlands |

| Market Stability | ✅ Highly stable with steady price growth (5.2% in 2024) | ✅ Stable but slow price appreciation | ❌ Fluctuates due to economic and political changes | ❌ Market bubbles, price drops in some regions | ✅ Stable but with periodic surges |

| Property Ownership for Expats | ✅ Expats can buy with approval | ✅ No restrictions, but taxes are high | ✅ Open to expats but complex tax rules | ✅ Open, especially for retirees | ✅ Open, but limited availability |

| Property Taxes & Fees | ✅ Low annual property tax (0.92%) | ❌ Higher tax burden (up to 2.1%) | ❌ Wealth tax for high-value properties | ✅ Low purchase costs but high annual tax | ❌ High land registry fees |

| Cost of Living & Affordability | ✅ Balanced cost vs. quality | ❌ High living costs in cities | ❌ Expensive in Paris & other major areas | ✅ Affordable in many regions | ❌ High costs in Amsterdam |

| Mortgage Availability | ✅ Expats can secure mortgages with 20%–30% down payment | ✅ Available, but stricter conditions for non-EU citizens | ✅ Available, but interest rates are higher for non-residents | ✅ Expats can get loans easily | ❌ Difficult for non-EU citizens |

| Economic Strength | ✅ Strong and stable economy | ✅ Europe’s largest economy | ✅ Strong but slow-growing | ❌ Economic challenges in some regions | ✅ Stable with strong GDP growth |

| Quality of Life | ✅ High (Ranked among top in happiness index) | ✅ High but work-life balance can be poor | ✅ High with great healthcare and culture | ✅ High, especially for retirees | ✅ High but work stress is a concern |

| Sustainability & Green Living | ✅ Leading in energy-efficient homes | ✅ Strong but still improving | ✅ Green initiatives but slow progress | ❌ Less emphasis on sustainability | ✅ Strong green policies |

| Public Transport & Infrastructure | ✅ Excellent public transport | ✅ Strong, but traffic congestion in cities | ✅ Good transport but expensive | ✅ Well-connected with affordable options | ✅ Efficient, but limited options outside major cities |

| Foreign Investment Growth | ✅ Increasing demand from foreign investors (+10% expected in 2025) | ✅ Growing interest but bureaucratic hurdles | ❌ Limited growth due to complex tax rules | ✅ Popular among retirees and digital nomads | ❌ Limited availability and competitive market |

In summary, Denmark’s combination of economic stability, progressive housing market, and exceptional quality of life makes it a highly suitable option for expatriates looking to invest in property.

Things to Know Before Buying Property in Denmark

Here are key factors and things to know before buying property in Denmark.

1. Can Foreigners Buy Property in Denmark?

Denmark has strict property ownership rules for non-residents. If you’re a foreigner looking to buy property, here’s what you need to know:

- EU/EEA Citizens: If you are from the European Union (EU) or European Economic Area (EEA), you can buy property in Denmark without restrictions, provided you intend to live in the country.

- Non-EU Citizens: If you are from a non-EU country, you must obtain permission from the Danish Ministry of Justice before purchasing property. The application requires proof of ties to Denmark, such as family, work, or long-term residency.

- Holiday Homes: Special restrictions apply to buying summer houses or holiday homes, especially for non-residents.

Checklist for Foreign Buyers:

| Criteria | EU/EEA Citizens | Non-EU Citizens |

| Permission Needed | No | Yes, from the Ministry of Justice |

| Residency Required | Preferable | Strongly recommended |

| Holiday Home Purchase | Restricted | Highly restricted |

Case Study:

A Canadian investor looking to purchase an apartment in Copenhagen had to submit an application to the Ministry of Justice, showing proof of his work contract with a Danish company. Approval took about three months, after which he successfully secured a mortgage and completed the purchase.

2. Understanding Denmark’s Property Laws

Denmark’s real estate market operates under a well-regulated legal system. Knowing the legal framework is one of the key Things to Know Before Buying Property in Denmark:

- Property Rights: Danish property laws protect buyers and ensure transparency in transactions.

- Real Estate Agents: Licensed agents handle most transactions, ensuring compliance with local laws.

- Legal Assistance: Hiring a Danish lawyer (advokat) is highly recommended to review contracts and verify property ownership.

Legal Steps for Buying Property in Denmark:

| Step | Description |

| 1 | Choose a property and negotiate the price. |

| 2 | Sign a purchase agreement. |

| 3 | Obtain legal approval if required. |

| 4 | Pay the deposit (usually 5-10%). |

| 5 | Register ownership with the Land Registry. |

3. Property Types and Best Locations

Denmark offers various types of properties that cater to different buyer needs. Whether you’re looking for an urban apartment or a countryside home, choosing the right location and property type is crucial.

Property Types

- Apartments: Common in cities like Copenhagen and Aarhus, ideal for urban professionals and investors.

- Detached Houses: Popular in suburban and rural areas, suitable for families seeking space and tranquility.

- Holiday Homes: Often located near beaches or countryside, but with strict ownership regulations.

Best Cities for Buying Property:

| City | Average Price per m² (DKK) | Key Features |

| Copenhagen | 50,000 – 75,000 | Urban lifestyle, strong rental market |

| Aarhus | 40,000 – 60,000 | Education hub, vibrant culture |

| Odense | 25,000 – 45,000 | Affordable, family-friendly |

| Aalborg | 20,000 – 35,000 | Growing economy, investment potential |

Location Selection Tips

- Consider future infrastructure developments.

- Research local amenities such as schools, hospitals, and transport options.

- Analyze property value trends over the past decade.

4. The Cost of Buying Property in Denmark

Understanding the financial aspects is crucial among the Things to Know Before Buying Property in Denmark. Apart from the purchase price, buyers should consider various fees and taxes associated with property transactions.

Breakdown of Expenses:

| Expense | Estimated Cost (DKK) |

| Property Price | Varies by location |

| Legal Fees | 10,000 – 30,000 |

| Registration Fee | 1,750 + 0.6% of purchase price |

| Real Estate Agent Fees | 1-3% of purchase price |

| Notary Fees | 5,000 – 15,000 |

Hidden Costs to Consider

- Renovation costs.

- Homeowners’ association fees.

- Annual property tax.

5. Financing and Mortgage Options

Buying property in Denmark often requires financing, and understanding mortgage options is crucial for a successful purchase. Whether you’re a resident or a foreigner, securing a mortgage depends on your residency status, creditworthiness, and financial stability.

Can Foreigners Get a Mortgage in Denmark?

Yes, foreigners can obtain a mortgage in Denmark, but eligibility varies based on nationality, residency status, and financial background. EU/EEA citizens have easier access to Danish banks, whereas non-EU residents may face stricter conditions.

Mortgage Options

| Type | Features |

| Danish Banks | Available to EU citizens, limited for non-EU residents |

| Interest Rates | Low, around 1-3% annually |

| Down Payment | Typically 5-10% for residents, higher for non-residents |

Key Considerations for Securing a Mortgage

- Income Stability: Banks assess your income and employment history.

- Credit History: A strong credit score improves loan approval chances.

- Loan Term: Danish banks offer flexible repayment terms, typically 20-30 years.

- Mortgage Guarantees: Some lenders require additional security or guarantees.

Case Study:

A German professional relocating to Denmark successfully secured a mortgage through Danske Bank with a 10% down payment and a 25-year term. The approval process took six weeks, and having an EU residency played a key role in eligibility.

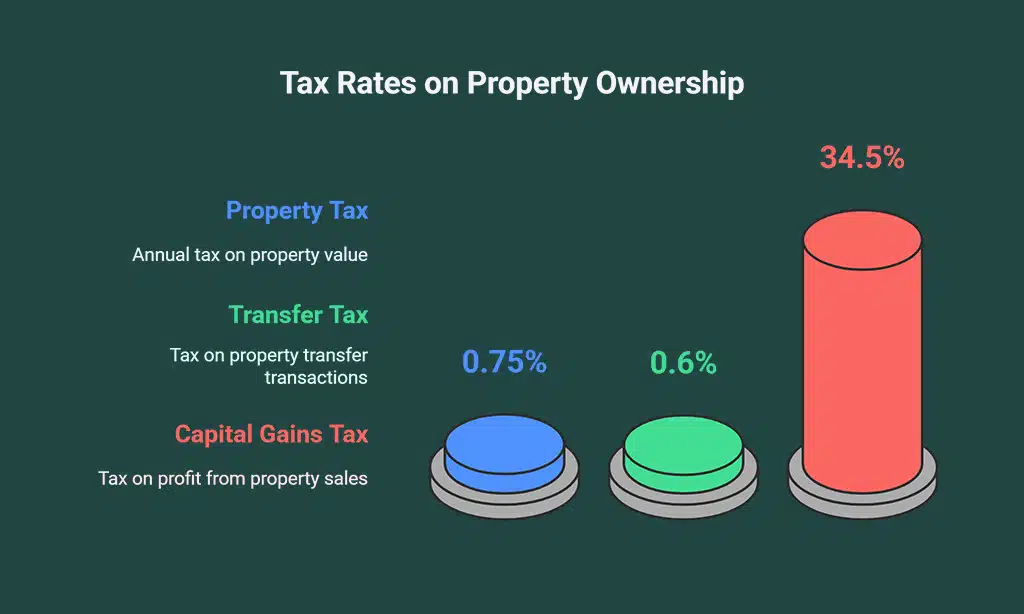

6. Taxes and Fees Associated with Property Ownership

Denmark has multiple taxes and fees that property owners must consider. These include property tax, transfer tax, and capital gains tax.

Tax Obligations for Property Owners

| Tax Type | Rate |

| Property Tax | 0.5% – 1% (varies by municipality) |

| Transfer Tax | 0.6% of the purchase price |

| Capital Gains Tax | 27%-42% (if selling at a profit) |

Additional Fees

- Municipal Charges: Local government fees for waste disposal and infrastructure.

- Annual Property Tax: Paid annually to maintain local services.

- Wealth Tax: Applies to high-value properties.

Tax Saving Tips

- Consult a tax expert to understand deductions and exemptions.

- If renting out the property, explore tax benefits for landlords.

- Monitor property value trends to plan future capital gains taxation.

7. Buying Process: Step-by-Step Guide

The property buying process in Denmark is structured and transparent, but it requires thorough research and legal compliance. Whether you’re a resident or a foreign buyer, following these steps ensures a smoother transaction.

Step 1: Research and Find Property

- Explore local real estate websites such as Boligsiden, DBA, and Home.dk.

- Engage with licensed real estate agents who have expertise in your preferred location.

- Visit multiple properties to compare features, pricing, and neighborhoods.

- Check zoning laws and property usage restrictions.

Step 2: Legal and Financial Preparation

- Assess your financial situation and determine your budget.

- Secure mortgage pre-approval from Danish banks (if applicable).

- Hire a legal expert to review property documentation and compliance.

- Obtain required permissions if you’re a non-EU citizen.

Step 3: Purchase Agreement and Payment

- Negotiate terms with the seller and sign a legally binding purchase agreement.

- Pay the deposit (usually 5-10% of the total property price).

- Ensure a cooling-off period exists in case of withdrawal.

- Conduct a final inspection before completing the transaction.

Step 4: Registration and Finalization

- Finalize all paperwork with legal representatives.

- Register the property ownership with the Danish Land Registry.

- Pay applicable taxes and fees.

- Obtain property insurance and arrange utilities.

Key Considerations in the Buying Process

| Step | Key Actions & Requirements |

| Research Property | Use real estate portals, visit properties, check zoning laws. |

| Secure Financing | Get mortgage pre-approval, assess affordability. |

| Legal Checks | Hire a lawyer, verify contracts, get necessary permissions. |

| Signing & Payment | Negotiate price, pay deposit, confirm agreement terms. |

| Registration | Complete legal paperwork, register ownership, pay fees. |

8. Living in Denmark: What to Expect

Living in Denmark provides an exceptional quality of life, with excellent healthcare, education, and social benefits. However, foreigners should be aware of cultural differences, taxation policies, and cost of living before relocating.

Key Aspects of Living in Denmark

| Aspect | Key Features |

| Healthcare | Universal healthcare system, public and private options. |

| Education | Free education for residents, high-ranking universities. |

| Work-Life Balance | Flexible working hours, strong employee protections. |

| Cost of Living | High compared to other EU countries, but balanced by higher wages. |

| Language & Culture | Danish is the official language; English is widely spoken. |

9. Common Challenges and How to Overcome Them

Although Denmark offers a welcoming environment for property buyers, there are challenges that foreigners may face. Below are common obstacles and strategies to navigate them.

Challenges & Solutions

| Challenge | Solution |

| Understanding the local market | Work with a real estate agent familiar with Danish regulations. |

| Language barriers | Use translation services, hire English-speaking advisors. |

| Bureaucracy & legal procedures | Consult a Danish lawyer specializing in real estate. |

| High property prices | Consider locations outside major cities for affordability. |

10. Expert Tips for a Successful Property Purchase

To ensure a smooth transaction and a profitable investment, follow these expert tips when purchasing property in Denmark.

Proven Strategies

| Tip | Benefit |

| Work with reputable real estate agents | Get access to verified listings and professional guidance. |

| Research financing options thoroughly | Secure favorable mortgage terms and avoid hidden fees. |

| Stay informed about market trends | Make informed investment decisions based on property values. |

| Consider long-term resale value | Choose properties in high-demand locations to ensure future profit. |

| Seek legal and tax advice early | Avoid legal pitfalls and ensure compliance with local laws. |

Takeaways

Buying property in Denmark is a significant investment that requires careful planning and legal understanding. By keeping these Things to Know Before Buying Property in Denmark in mind, you can navigate the market confidently and secure a home that suits your needs.

Whether you’re an investor, retiree, or family looking to relocate, staying informed and seeking professional advice will ensure a smooth and successful property purchase experience.