In today’s fast-evolving financial landscape, neobanks are redefining banking by providing seamless, digital-first services that cater to underserved communities, particularly women and entrepreneurs.

Traditional banking systems often come with barriers—high fees, lengthy approval processes, and limited financial accessibility—that make it difficult for women and small business owners to access essential banking services.

However, the emergence of neobanks is transforming financial inclusion worldwide, offering innovative solutions that promote financial empowerment.

This article explores how neobanks are empowering women and entrepreneurs, breaking down their benefits, real-world examples, and the challenges they face in revolutionizing global finance.

What Are Neobanks and How Do They Work?

Neobanks are digital-only financial institutions that provide banking services without physical branches.

Unlike traditional banks, neobanks operate entirely online, leveraging technology, AI, and automation to offer seamless, user-friendly banking experiences.

These digital banks provide services such as:

- Online checking and savings accounts – Open accounts instantly with no physical paperwork.

- Instant fund transfers – Fast and secure transactions with real-time processing.

- Business loans and credit solutions – AI-driven approval processes tailored to small businesses.

- AI-driven financial management tools – Smart tracking of expenses, savings, and investment opportunities.

- Multi-currency support for global transactions – Simplified currency exchange and international payments.

- Fraud protection and advanced security – AI-powered fraud detection and encryption ensure safer transactions.

- Financial education resources – Many neobanks provide learning tools to help users develop money management skills.

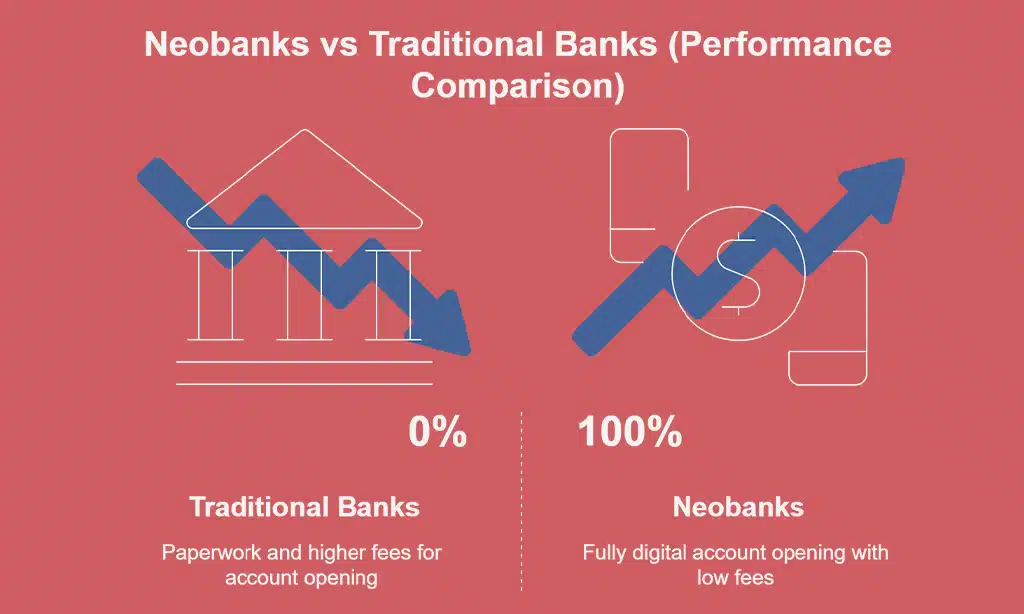

How Neobanks Differ from Traditional Banks

| Feature | Neobanks | Traditional Banks |

| Physical Branches | No | Yes |

| Account Opening | 100% Digital | Paperwork & In-person visits |

| Fees | Low/No fees | Higher fees & hidden charges |

| Loan Approval | AI-based & fast | Lengthy & document-heavy |

| Customer Support | Chatbots & digital | In-person & call centers |

| Global Transactions | Yes | Limited |

| Financial Education | Frequently provided | Limited |

By eliminating the need for brick-and-mortar operations, neobanks significantly reduce overhead costs, allowing them to offer lower fees and improved financial access, particularly for women and entrepreneurs who often struggle with traditional banking barriers.

The Growing Need for Financial Inclusion Among Women and Entrepreneurs

Despite growing global awareness of gender equality, women continue to face financial discrimination and limited access to banking services. Some major challenges include:

- Higher Loan Rejection Rates: Traditional banks often consider women-owned businesses as high-risk ventures due to lower collateral availability.

- Limited Credit History: Many women lack formal credit records due to systemic financial exclusion, making it difficult to secure loans.

- High Banking Fees: Costly account maintenance, high-interest rates, and additional service fees limit financial autonomy.

- Societal Barriers: In many developing nations, cultural restrictions hinder women from accessing independent financial services.

- Lack of Financial Education: Many women are not exposed to financial literacy programs, limiting their ability to manage funds efficiently.

- Limited Business Support: Fewer mentorship and networking opportunities hinder female entrepreneurs from scaling their ventures.

Barriers to Entrepreneurs in Traditional Banking

Entrepreneurs, especially small business owners and startups, face similar hurdles:

- Strict Collateral Requirements: Many entrepreneurs lack assets to secure loans, limiting access to capital.

- Slow Loan Processing: Lengthy approval periods and bureaucratic red tape delay business expansion.

- Complex Paperwork: Excessive documentation discourages small business owners from applying for financial aid.

- Limited Financial Literacy: Many entrepreneurs lack knowledge of traditional banking products, leading to poor financial decision-making.

- Restricted Access to Global Markets: Traditional banks may not support seamless international transactions for small businesses.

- Inconsistent Cash Flow Support: Traditional banks offer limited financial tools to help businesses manage irregular revenue streams.

Neobanks addresses these challenges by offering simplified banking solutions that prioritize financial inclusion.

How Neobanks Are Empowering Women and Entrepreneurs

One of the biggest ways how neobanks are empowering women and entrepreneurs is by removing bureaucratic hurdles and simplifying financial access. Digital banks enable instant online account opening, eliminating the need for in-person visits and extensive paperwork.

By leveraging AI-driven identity verification and biometric authentication, neobanks ensure a secure and seamless onboarding process.

This is particularly beneficial for individuals in remote areas or those facing socio-economic restrictions that limit their ability to visit physical bank branches.

Additionally, many neobanks integrate multilingual customer support and easy-to-use mobile interfaces, making digital banking accessible to a diverse global audience.

Benefits of Digital Account Opening

| Feature | Traditional Banks | Neobanks |

| Account Opening Time | Days to weeks | Minutes to hours |

| Documentation Required | Multiple forms | Minimal digital verification |

| Accessibility | Limited hours | 24/7 availability |

| Loan Approval Speed | Weeks to months | Instant to few days |

| Financial Tools | Basic | Advanced AI-powered tools |

Affordable and Transparent Banking Solutions

- No Monthly Maintenance Fees: Unlike traditional banks, neobanks often have zero or minimal account maintenance fees.

- Lower Transaction Costs: Competitive exchange rates and reduced transaction charges benefit small businesses.

- Transparent Pricing Models: No hidden fees, making banking more predictable.

- Personalized Financial Insights: AI-driven analytics help users track expenses and improve financial habits.

- Subscription-Based Business Models: Many neobanks offer premium banking features via subscription rather than high transaction fees.

Access to Business Loans and Credit for Entrepreneurs

Many neobanks leverage AI-powered credit scoring to assess loan eligibility, making it easier for women and entrepreneurs to access capital. They offer:

- Microloans & Instant Credit: Ideal for small businesses and startups.

- Flexible Repayment Plans: Custom loan repayment structures.

- Fast Approval Process: AI-driven decisions reduce approval time.

- Revenue-Based Financing: Alternative lending solutions based on business performance rather than collateral.

- Peer-to-Peer Lending Integration: Some neobanks partner with lending networks to connect entrepreneurs with investors.

Digital Tools for Financial Management and Growth

Neobanks provide smart financial tools tailored to entrepreneurs, including:

- AI-powered expense tracking

- Automated budgeting and savings features

- Real-time business performance analytics

- Smart invoicing and payment tracking

- Integrated accounting software

These tools help women and entrepreneurs manage cash flow, reduce expenses, and optimize business strategies.

Global Reach and Cross-Border Transactions

For female entrepreneurs and small business owners expanding internationally, neobanks offer:

- Multi-currency accounts

- Seamless cross-border payments

- Low international transaction fees

- Integrated payment gateways for e-commerce businesses

- Virtual business cards for easy international payments

Takeaways

Neobanks are transforming the banking landscape, offering accessible, affordable, and technology-driven solutions for women and entrepreneurs worldwide.

As fintech advances, neobanks will continue bridging financial gaps and empowering more people to achieve economic independence.

Through innovative financial solutions, AI-powered tools, and inclusive banking models, neobanks are not just a trend—they are the future of financial empowerment, leveling the playing field for millions worldwide.