Struggling to understand your credit score and why it matters? A good credit score can affect major life moves, like buying a house or getting approved for loans. This guide about Gomyfinance.com Credit Score will show you how to check, manage, and improve your credit with ease.

Keep reading—your financial health depends on it!

Key Takeaways

- Gomyfinance.com provides free credit score checks using data from TransUnion, Experian, and Equifax. It uses soft inquiries that don’t affect your score.

- The service offers real-time alerts for any changes to your credit report, helping detect fraud or errors quickly.

- Personalized tips include lowering credit utilization below 30%, automating payments, and disputing inaccuracies to improve scores.

- Its tools are beginner-friendly but lack advanced features like a mobile app or more in-depth analysis for experienced users.

- Regular use of Gomyfinance.com can help track progress and manage financial decisions effectively for better long-term outcomes.

What Are Credit Scores and Why Do They Matter?

Credit scores show how reliable you are with money. They range from 300 to 850. A higher score means lenders trust you more. It can help you get loans or credit cards with lower interest rates, saving thousands of dollars over time.

Scores are based on factors like payment history, credit utilization (how much credit you use versus what’s available), length of your credit history, types of accounts, and new inquiries.

A low score makes it hard to borrow money for things like cars or homes. For example, most mortgage lenders require a minimum credit score around 620 for approval. Good credit keeps interest rates down and opens doors to better financial options in life—like buying a house or getting lower insurance premiums!

Features of Gomyfinance. com Credit Score Services

Gomyfinance.com offers tools to track and manage your credit health with ease. It helps you stay informed so you can make smarter financial choices.

Free Credit Score Checks

Checking your credit score is quick, easy, and free with this service. Users can view their credit scores without paying anything or worrying about hidden fees. Many other platforms sneak in charges later, but this one keeps it simple—no surprises.

Your score comes from all three major credit bureaus: TransUnion, Experian, and Equifax. Knowing where you stand helps you manage credit better. Whether you need to buy a house or improve your current credit status, free checks keep you on track without any hassle.

Credit Monitoring and Alerts

Free tools only go so far; staying informed matters even more. Gomyfinance.com sends real-time alerts if changes hit your credit report. It watches for new accounts, hard inquiries, or missed payments like a hawk.

For example, if someone tries to open a line of credit in your name, you’ll know immediately.

This service helps protect against fraud and keeps you mindful of anything that might hurt your credit score. Spot errors fast and tackle them before they affect your profile. Monitoring ensures smooth management while boosting your credit score over time.

Personalized Recommendations for Improvement

Paying down high credit card balances can boost your score. Gomyfinance.com uses your credit profile to give clear action steps. Automating payments is another tip they suggest, helping avoid missed due dates.

These tools let you take control of your personal finances with ease.

Lowering your credit utilization ratio also plays a key role. Keeping it under 30% improves how lenders view you as a debtor. Their advice covers areas like managing new credit applications and balancing different types of loans effectively.

Each step is simple but impactful for improving poor or fair credit profiles over time.

How to Use Gomyfinance. com to Improve Your Credit Score

Taking control of your credit score is simpler with tools like Gomyfinance.com. Follow these steps to start improving your credit profile today:

- Sign up on www.gomyfinance.com using basic personal details. It’s quick and only takes a few minutes.

- Verify your identity by either answering security questions or uploading required identification documents. This step helps protect your data from unauthorized access.

- Access your credit score directly on the dashboard. Review the key factors affecting it, such as your payment history and credit usage levels, to identify improvement areas.

- Set up notifications to stay informed about any changes in your credit report, such as new inquiries or potential fraud warnings.

- Explore customized recommendations provided by Gomyfinance.com. These tips may include steps like reducing credit card balances or disputing inaccuracies on your report, based on your current situation.

- Use the available tools to actively monitor and improve your credit score. For instance, see how paying off specific debts or lowering your overall debt-to-income ratio could raise your score over time.

- Carry out practical changes suggested by the platform, like keeping credit utilization below 30% or avoiding multiple hard inquiries within a short period when applying for loans or cards.

- Check the dashboard regularly to track progress and stay updated with any fluctuations in your score due to reported changes on your account. A clear view of your credit can help you make better financial decisions moving forward.

Next, discover more about the advantages and disadvantages of Gomyfinance.com Credit Score Services to see if it fits your needs perfectly!

Pros and Cons of Gomyfinance. com Credit Score Services

Gomyfinance.com offers credit score services with helpful features, but it’s not without its quirks. Below is a breakdown of its strengths and weaknesses.

| Pros | Cons |

|---|---|

|

|

Ready to explore how Gomyfinance.com can improve your credit score? Keep reading!

Tips for Maintaining a Healthy Credit Score

Keeping your credit score strong can open doors to better loans and lower interest rates. Simple habits make a big difference over time.

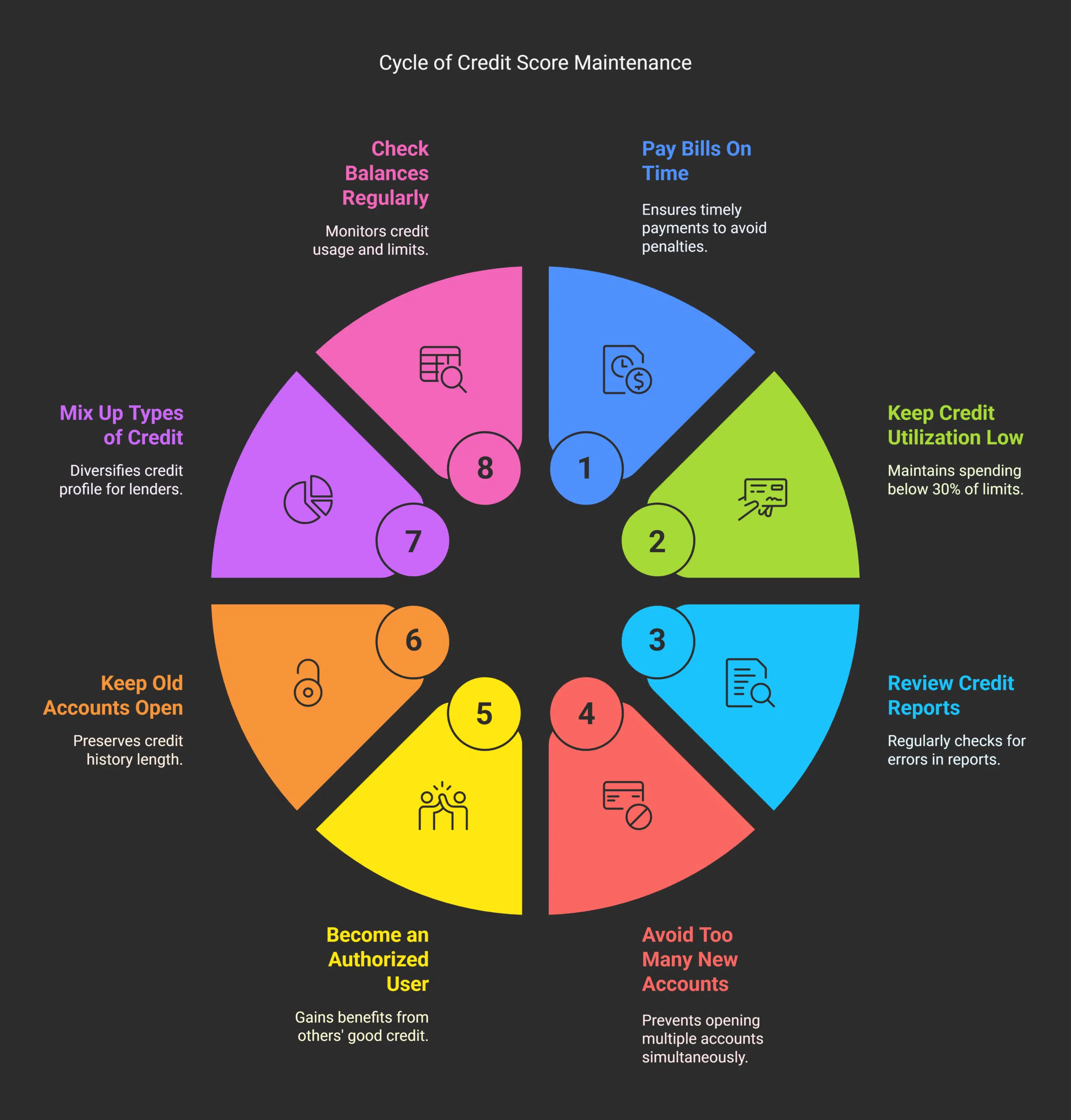

- Pay bills on time: Late payments hurt your credit score badly. Automate payments to avoid missing due dates. This step is one of the easiest ways to protect your score.

- Keep credit utilization low: Use less than 30% of your credit limit at all times. For example, spend no more than $300 if your card’s limit is $1,000. High balances signal financial stress to lenders.

- Review credit reports often: Mistakes happen in reports, and they can damage scores unfairly. Check for errors using free annual credit reports and dispute inaccuracies quickly.

- Avoid too many new accounts: Opening multiple accounts at once shortens the average length of your credit history. Lenders might see this as risky behavior because it increases credit inquiries.

- Become an authorized user: Ask a trusted friend or family member with excellent credit to add you as an authorized user on their account. You’ll benefit from their good payment history without spending extra money.

- Keep old accounts open: Closing older accounts lowers the length of your credit history, which impacts scores negatively over time. Even unused cards boost total available credit, helping with utilization rates.

- Mix up types of credit: Different kinds of debt, like car loans, mortgages, or secured credit cards, build diversity in your profile—a “credit mix” that lenders look for positively.

- Check balances regularly: Stay aware of how much available credit remains versus what you’ve used already each month before statements close.

Takeaways

Improving your credit score doesn’t have to feel like rocket science. With tools like Gomyfinance.com, you can track, learn, and take control of your financial health. Its simple layout and helpful tips make the process smoother than you’d think.

A better score opens doors—whether for a car loan or a new home. Start small today; your future self will thank you!

FAQs on Gomyfinance.com Credit Score

1. What is a credit score, and why does it matter?

A credit score is a number that shows your credit risk based on your credit report. It affects your ability to get loans, like car finance or mortgages, and can impact interest rates and terms.

2. How can Gomyfinance.com help with my credit score?

Gomyfinance.com provides tools to monitor your credit reports for inaccuracies, keep track of total credit available, and offer tips to maintain low credit utilization.

3. What factors affect your credit score the most?

Your length of credit history, payment habits, total debt, and how much of your available credit you use all play big roles in determining scores like FICO or VantageScore.

4. Why should I review my free annual credit report?

Reviewing helps spot errors that could lower your score unfairly. It also gives you a clear view of what lenders use when deciding if you’re eligible for things like fixed-rate mortgages or deposit accounts.

5. What’s considered a poor or good range for scores in the United States?

Scores range from 300 to 850. A higher score—like above 700—is good for loans such as conforming ones backed by Fannie Mae or Freddie Mac; below 620 may be seen as poor by creditors.

6. Can keeping my balances low improve my chances with lenders?

Yes! Low balances show responsible behavior to lenders like banks or mortgage companies using reports from agencies such as Equifax or Experian when assessing applications for jumbo loans or other financing options.