Many startup founders feel stuck by loan payments. They grab capital loans with hope but no clear plan. They choke on hefty interest rates and hidden fees. A study finds that half of new ventures fail from poor cash flow management.

In this post we map eight money traps to dodge. We show weak spots in your business plan and your business model. We walk you through due diligence, scenario planning, and simple repayment steps.

Keep reading.

Key Takeaways

- A study finds half of new ventures fail from poor cash flow management. Plan a 24-month runway in Excel or Google Sheets. Map cash inflows, outflows, and debt service. Update forecasts each month.

- Watch hidden fees in rent, utilities, cloud servers, and inventory lags. Stash 3–6 months of cash to cover 60–120-day invoice delays. Log all income and expenses in QuickBooks or Xero.

- Borrow only what you need by tracking weekly burn rate and unit economics. Tie loan size to milestones like product-market fit or monthly revenue. Keep equity dilution under 30% in seed rounds.

- Compare funding options beyond loans: venture capital, revenue-based finance, grants, equity crowdfunding, or invoice financing. For example, Jobberman used a MasterCard Foundation grant and Lafmob Contractors tapped invoice financing.

- Manage post-loan cash flow by automating invoices on net 30 or net 60 terms. Keep a 3–6 month cash buffer and audit overhead costs monthly. Diversify revenue so no client drives more than 30% of sales.

How can I create a clear repayment plan before borrowing?

Entrepreneurs need a solid plan for repaying debts before they borrow. A clear road map protects your runway and eases stress.

- Sketch a 24-month runway in an Excel sheet, mapping cash inflows, outflows, overhead costs, and debt service.

- Test interest rates and term lengths with an online loan calculator to spot hidden costs.

- Build best-case, worst-case, and baseline forecasts in Google Sheets for solid scenario planning.

- Link loan amounts to growth milestones like monthly revenue or product-market fit targets, so you match borrowing to specific goals.

- Track daily income and expenses in QuickBooks or Xero for tight cash flow management and stress management.

- Update your financial forecast every month or quarter to reflect shifts in sales, stock levels, or investment from VCs and angel investment.

- Monitor a KPI dashboard for burn rate, runway, debt ratios, and equity dilution signals.

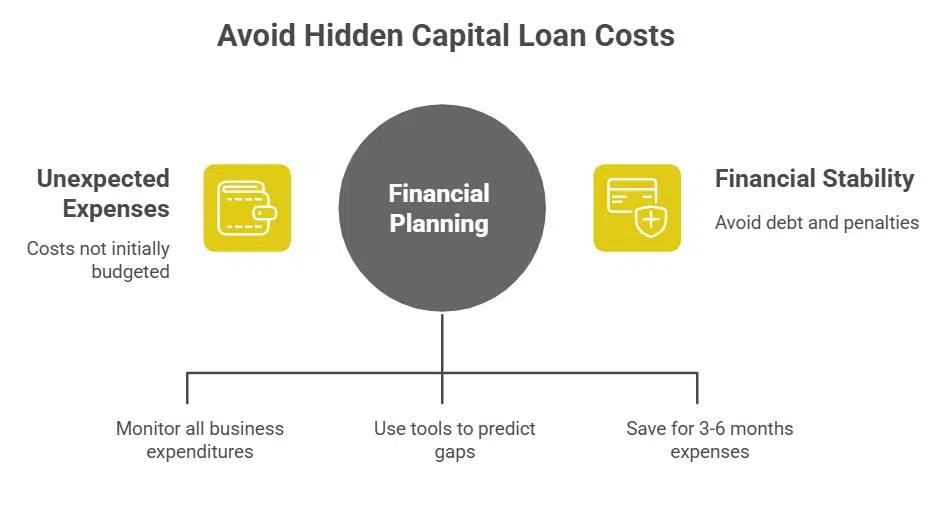

What are the hidden costs of a capital loan I should know?

Hidden fees often hide in lines like office rent, utilities, and subscriptions. Many startups paint a rosy budget but miss high overhead costs. Cloud server bills can spike without warning.

Inventory purchases for busy seasons can tie up cash months before you sell. Lenders rarely warn you about these lags. Cash flow management tools like QuickBooks or Excel spreadsheets can catch gaps early.

A solid business model on paper can still crack under these extra expenses.

Late invoice payments can stretch 60 to 120 days and starve your bank account. You should stash cash for at least three to six months of spending. Sudden growth may force you to buy servers or hire support staff before sales catch up.

Sloppy bookkeeping and wrong invoices can trigger bank fees or loan penalties. A weak tracking system will let these costs slip through. Lean into financial planning and cash flow management.

This strategy will help you dodge those sneaky debt traps.

How do I know if I’m borrowing more than my startup needs?

Track burn rate every week, using a spreadsheet for unit economics and cash flow management. Mix revenue forecasts with customer needs in your business plan. Set realistic milestones with basic financial planning.

Plan for a 24 month runway, as a longer runway signals extra capital. A quick bottom-up analysis can spot excess funding early.

Test product-market fit with minimum viable product data, case studies, and testimonials before you pitch to venture capital. Choose convertible notes or equity financing that matches unit economics, not hype on valuations or future growth rates.

Keep equity dilution near 10 to 20 percent in your seed funding round; never pass 30 percent without solid traction. This tactic curbs funding mistakes, shields your vision and mission, and eases stress management.

What other funding options are available besides loans?

Start-ups can tap fresh capital without loan interest. Founders can choose equity or grant money to cut financial risk.

- Venture capital can fuel rapid growth but costs you board seats and dividends; it demands product market fit and a clear business plan.

- Revenue based financing can ease stress management since you pay as you earn and avoid fixed interest; it improves mental health by cutting debt stress.

- Grant funding like a MasterCard Foundation award can train 5 million youths without equity dilution; Jobberman tapped one to boost skills and dodge investor pressure.

- Equity crowdfunding via platforms such as Thundafund can attract B2B and consumer investors; Aerosphere raised funds that way for key product launches.

- Invoice financing from providers like Capsa can improve cash flow management; Lafmob Contractors used it to fund supplier payments without adding debt.

- Bootstrapping and hybrid models let you use savings or early revenue for seed funding and sharpen your value proposition before courting venture capital.

How do I understand the terms and conditions of a loan?

Loan deals can feel tricky at first. You might skip the small print. Lawyers spot issues in term sheets, IP clauses, licensing rules, and securities law. You hire legal counsel to read every line.

They catch risky fees, hidden costs, and odd clauses. You store signed contracts, board minutes, and compliance documents in a secure data room. That habit pays off if you face an audit or need proof.

Open talks with lenders or venture capital firms support stress management. You check the AML and KYC status before signing. Your team reviews interest rates and repayment terms to aid cash flow, using a spreadsheet.

You add anti-dilution clauses to curb equity dilution, plus vesting schedules and board seat deals. You update your financials at each board meeting and record minutes. That tracks all changes and cuts funding mistakes.

When is it appropriate to use loan money for expenses?

Use borrowed funds only when they fuel clear goals in your strategic planning. Tie each expense to revenue generation goals and a growth milestone backed by a financial forecast. Base spending on real data from your financial plan to avoid cash flow management issues.

Track every dollar with accounting software or a spreadsheet program. Check key performance indicators and customer feedback to spot waste early. Leverage that insight to protect your value proposition and sidestep funding mistakes.

Why is building a strong credit history important before applying?

Poor records and invoicing errors scare banks and venture capital firms. Lenders and investors spot those gaps and doubt your credit score. Missing supplier payments or wrong invoices may stall seed funding or a Kickstarter campaign.

That kind of funding mistake can drain a startup’s cash fast.

Strong cash flow management and a savings schedule build a positive track record. QuickBooks or Xero logs each expense with clear verification. Hiring a part-time financial expert gives you ready reports for loan officers.

Routine reviews of expenses prove your discipline and boost your financial planning.

How do I choose the right lender for my startup?

Open your business plan and list your target market, check size, stage and location. Pick lenders who match your seed funding goals and vision, and those who back venture capital deals in your industry.

Scan their portfolio, spot past investments, note any conflicts. Call founders who took loans from them for real feedback. Do anti-money laundering checks and customer identity checks early.

This step cuts fraud, lowers financial risks, supports sound financial planning and cash flow management and fits your startup ecosystem.

Skip lenders who overpromise, rush deals, or hide documents behind paywalls. Drop any broker dealer who lacks a license, or asks for a finders fee. Dig into background checks, chase references.

This work shields your startup funding, limits equity dilution, and improves chances of healthy revenue generation.

What are the best practices for managing cash flow after getting a loan?

Cash flow management keeps your startup from hitting a wall. A solid plan guards you from slumps after seed funding, loans, or venture capital.

- Use accounting software to track burn rate, cash flow, and unit economics weekly; this keeps you ahead of a capital crash.

- Automate invoices, set net 30 or net 60 terms, and chase late accounts; long delays of 60 to 120 days can stall your runway.

- Keep three to six months of expenses in a cash reserve; that buffer helps you weather a slump or recession.

- Audit fixed overhead costs monthly and cut office rent, utilities, and subscription waste; shift to remote work to trim bills.

- Diversify revenue streams so no client supplies more than thirty percent of your sales; this shields you from a big hit if one client leaves.

- Align inventory and staffing with peak and slow seasons; this seasonal plan can save you from costly overstock or idle wage bills.

- Update revenue forecasts with data-driven methods and establish backup plans; dashboards or forecasting tools reveal blind spots.

- Throttle growth if funds feel tight and trim spend on new hires or tools; slowing down beats a sudden cash shock.

- Use a cash flow dashboard or spreadsheet for daily review; clear visibility helps you spot trouble before it starts.

- Offer small discounts or rewards programs to clients for early payment; that tactic can speed up revenue generation and ease stress.

Takeaways

Steer clear of capital loan traps to protect your runway. Plug your numbers into a quick Google Sheets amortization table. Track expenses with QuickBooks or Niki.ai to spot hidden costs.

Match your seed funding to real cash flow needs and avoid equity dilution. Let a smart venture capitalist back your value proposition, not bleed it dry. Keep your credit history strong, balance stress, and live your startup dream.

FAQs on Capital Loan Mistakes

1. What common funding mistakes kill a startup dream?

Many founders bite off more than they can chew with unsecured loans. They ignore post money valuation and equity dilution, classic startup mistakes. They skip cash flow management, scaring off venture capital and suppliers.

2. How do I manage equity dilution when I take seed funding?

Set clear incentives with each investor. Check your post money valuation before you sign. Keep control of your vision and mission. Avoid shy offers that cut your stake too much.

3. How can cash flow management support my financial planning?

Cash flow management tracks every business expense. It flags high expenditure in advertising or social media campaigns. Good numbers help you avoid liability, plan ahead, and aim for revenue generation.

4. How do I test product-market fit before seeking venture capital?

Talk to your target audience and learn their customer needs. Run a small social media campaign or ad. Use data from online courses or niki.ai tools. Pivot fast if your value proposition does not stick.

5. How do I balance stress management with startup pressure?

Your mental health is a key asset. Build time-management habits early. Take breaks, set clear work hours, ask for help, avoid negligence. Stress management keeps you sharp in the startup ecosystem.

6. How can I refine my business model and boost revenue generation?

Write a lean business plan. Pin down your value proposition and vision, mission. Map out a marketing strategy, test several business models, use fair incentives for both you and suppliers, watch your expenditure, then spark a growth boom.