Home insurance is one of the most essential yet often overlooked aspects of homeownership, particularly in a country like India, which is prone to a variety of risks—natural disasters, fire hazards, theft, and more.

While owning a home is a significant achievement, protecting that home should always be a priority. Home insurance not only safeguards your property and belongings but also provides peace of mind for you and your family.

In India, where natural disasters like floods, earthquakes, and storms are increasingly becoming common, understanding the benefits of having home insurance in India is crucial. Home insurance ensures that you don’t have to bear the financial burden of such catastrophes on your own.

It helps restore your home and life after an unfortunate event, ensuring that your finances and lifestyle remain protected.

What is Home Insurance?

Home insurance is a policy that provides coverage against damages or losses to your property and belongings due to unforeseen events such as fire, theft, natural disasters, or vandalism. Typically, home insurance in India includes two primary types of coverage:

- Building Coverage: This protects the structure of your home, including the walls, roof, and foundation.

- Content Coverage: This protects personal belongings within your home, such as furniture, electronics, appliances, and other valuable items.

With home insurance, homeowners in India can rest assured that their investment is well protected against various risks.

Importance of Home Insurance in India

The importance of home insurance cannot be overstated. With an ever-growing population, rapid urbanization, and frequent natural disasters, the risks of owning a property have never been higher.

In India, a large percentage of the population still does not fully grasp the benefits of having home insurance in India. Many believe that it’s an unnecessary expense. However, considering the rising cost of property repairs, medical bills due to injuries from accidents, or even the loss of irreplaceable items, home insurance can offer vital financial support when needed the most.

Common Misconceptions About Home Insurance

While home insurance provides essential coverage, there are several misconceptions that may prevent homeowners from purchasing it. Common myths include:

- Home insurance is expensive: While some premium policies might come at a higher cost, there are many affordable home insurance plans available in India. Additionally, comparing different providers can help you find a policy that fits your budget.

- Home insurance only covers natural disasters: In fact, home insurance policies in India provide coverage for a variety of situations, including theft, fire, vandalism, and accidental damage.

- Home insurance is unnecessary if I live in a safe area: Regardless of your location, risks such as fire, theft, or accidents are always possible. Home insurance helps cover these unforeseen events.

Top 10 Benefits of Having Home Insurance in India

Let’s take a look.

Benefit 1: Financial Protection Against Natural Disasters

India is prone to various natural disasters like floods, earthquakes, cyclones, and landslides. In such situations, the benefits of having home insurance in India are immense. Natural disasters can cause severe damage to both the structure and content of your home, leading to exorbitant repair and rebuilding costs.

With home insurance, you are protected financially from such events. Insurance companies typically offer policies that cover damage due to natural calamities. Whether your home is affected by an earthquake in Gujarat, floods in Kerala, or cyclones in Odisha, your insurance policy will help you recover.

Coverage for Earthquakes, Floods, and More

Many home insurance policies in India offer protection against specific natural disasters, including:

| Disaster Type | Coverage Details |

| Earthquakes | Covers damage to the structure and content of the house caused by seismic activity. |

| Floods | Coverage varies, but many policies offer protection for flood-induced damage, especially in flood-prone areas. |

| Landslides | Covers damage from landslides, particularly in hill stations or mountainous regions. |

| Cyclones | Protection against damage from high winds, heavy rainfall, and floods caused by cyclones. |

Why India Needs Natural Disaster Protection

Given the frequency of natural disasters, especially in states like Kerala, Assam, and Maharashtra, having comprehensive coverage becomes not just an option but a necessity for homeowners.

Benefit 2: Protection Against Theft and Burglary

In India, property theft and burglary are significant concerns for homeowners. With rapid urbanization, the crime rate in certain areas has risen. If your home is burglarized or vandalized, the loss can be devastating—both emotionally and financially.

The benefits of having home insurance in India extend to offering protection for stolen or damaged property due to burglary. Insurance policies usually cover the replacement of stolen valuables such as electronics, furniture, jewelry, and personal items.

What Home Insurance Covers for Theft

| Coverage Type | Details |

| Stolen Personal Property | Covers stolen household items, including electronics, furniture, and appliances. |

| Vandalism | Protection for damages caused by burglars during the break-in process. |

| Cash and Valuables | Coverage for lost or stolen cash, jewelry, and valuable personal items. |

How to Safeguard Your Home from Theft with Insurance

To enhance the benefits of your home insurance policy, consider adding extra security measures to your home—like installing surveillance cameras or using smart locks. These actions may also help reduce your insurance premium.

Benefit 3: Protection Against Fire Damage

Fires are a serious risk in every country, including India. Whether it’s a kitchen fire or a short circuit, fire can spread rapidly, causing severe damage to property and belongings.

Most home insurance policies in India offer fire coverage, which helps cover the costs of damage caused by fires. Fire-related damage can include structural damage to the home and destruction of personal belongings, such as clothes, electronics, and furniture.

Fire Coverage in Home Insurance Policies

| Coverage Type | Details |

| Structural Fire Damage | Rebuilding or repairing the structure of the house after fire damage. |

| Content Damage | Protection for personal belongings, including electronics, clothing, and furniture destroyed by fire. |

Impact of Fire Damage in Indian Households

Fire accidents can lead to extensive property loss, resulting in financial hardships. Having fire coverage in your home insurance policy can significantly reduce the economic burden after such incidents.

Benefit 4: Coverage for Personal Belongings

One of the most significant benefits of having home insurance in India is the protection it offers to your personal belongings. Your household items, such as furniture, electronics, clothes, and even expensive jewelry, can be insured under a comprehensive home insurance policy.

Insuring Household Items and Valuables

Most home insurance policies cover personal items damaged by fire, theft, or natural disasters. Homeowners can also add valuable items like jewelry or expensive art to their policy to ensure complete coverage.

| Item Type | Coverage Details |

| Household Items | Includes furniture, appliances, clothing, and electronics. |

| High-Value Items | Jewelry, artwork, antiques, and expensive electronics can be added as valuable items under the policy. |

How Personal Property Coverage Works in India

- Replacement Cost vs. Actual Cash Value: Depending on the policy, insurers may pay for the full replacement cost or the actual cash value of lost or damaged items.

- High-Value Items: You can list high-value items separately to ensure they are adequately covered.

Benefit 5: Home Insurance Provides Liability Coverage

In India, homeowners may be legally responsible if someone is injured on their property or if there is damage caused to another person’s property. Liability coverage within home insurance policies ensures that the homeowner is protected against such risks.

What Is Personal Liability Coverage?

Liability coverage typically covers medical expenses and legal fees if someone gets injured while visiting your property or if you accidentally damage someone else’s property.

| Liability Type | Coverage Details |

| Medical Expenses | Covers hospital bills if someone is injured on your property. |

| Legal Fees | Legal fees in case a third party sues for damages or injury caused on your property. |

How Liability Coverage Can Protect Homeowners in India

In an unfortunate event, such as a visitor falling in your home or a neighbor’s property getting damaged, liability insurance helps cover the legal costs and compensation claims. This protection is crucial, especially in densely populated areas where accidents are more likely to occur.

Benefit 6: Peace of Mind and Security

The emotional peace of mind that comes with knowing your home and belongings are protected is priceless. Owning home insurance gives homeowners a sense of security, knowing that they are covered in case of unexpected losses or damage.

Emotional and Psychological Benefits of Home Insurance

Having home insurance helps reduce anxiety about potential disasters, allowing homeowners to focus on their daily lives and long-term goals without constant worry about their property.

Creating a Secure Environment for Your Family

When your home is protected, it’s easier to create a secure and stable environment for your family to thrive in. Home insurance not only safeguards your property but also protects the well-being of your loved ones.

Benefit 7: Cost-Effective Financial Planning

Home insurance can often be more affordable than homeowners think. In India, there are various policies to fit different budgets. Furthermore, taking out home insurance is a smart financial decision that helps you avoid unexpected repair costs that can deplete your savings.

How Affordable Home Insurance Can Be in India

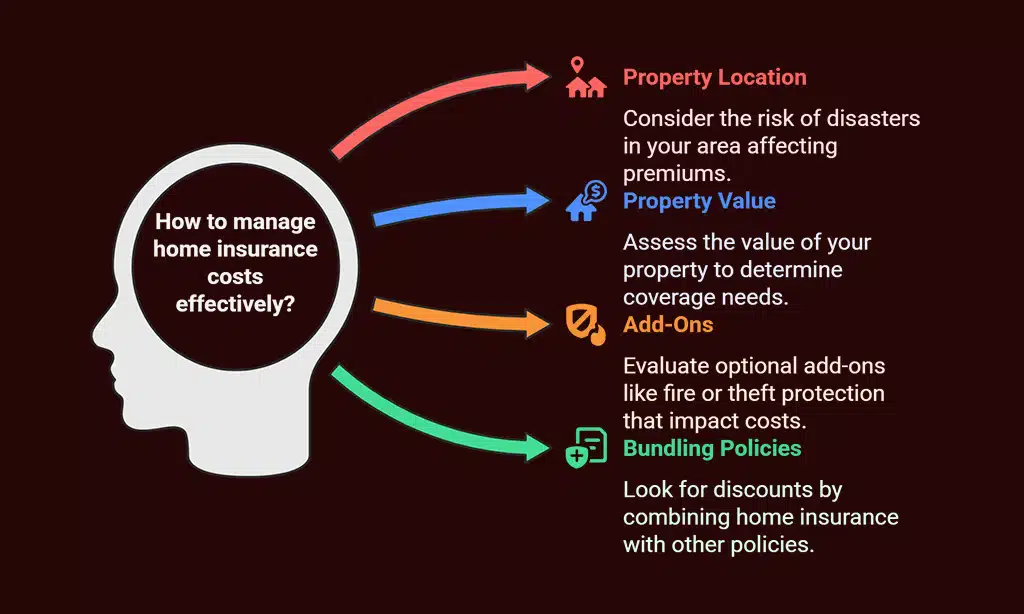

Several factors affect the cost of home insurance, including:

| Factor | Impact on Premium |

| Property Location | Areas prone to disasters may have higher premiums. |

| Property Value | Higher-value properties require higher coverage, increasing premiums. |

| Add-Ons | Optional add-ons, such as fire or theft protection, will affect premium costs. |

Managing Insurance Costs with Discounts and Policies

- Bundling Policies: Many insurers offer discounts for bundling home insurance with other policies, like car insurance.

- Risk Mitigation: Installing fire alarms, security systems, or reinforcing the structure of your home can lead to lower premiums.

Benefit 8: Coverage for Additional Living Expenses

If your home becomes uninhabitable due to a covered event, such as a fire or natural disaster, your home insurance policy can help with additional living expenses. These costs may include temporary housing, meals, and other essential living expenses during repairs.

What Happens If Your Home Is Uninhabitable?

If your home is damaged severely, home insurance can provide financial support to help you and your family stay elsewhere until repairs are completed.

| Coverage Type | Details |

| Temporary Housing Coverage | Helps pay for lodging while your home is under repair. |

| Meal Expenses | Coverage for meals if you are unable to cook during repairs. |

Temporary Housing and Living Costs Coverage

This benefit is crucial in emergencies when you need to vacate your home while repairs take place. Coverage ensures that you can maintain your standard of living while your home is being repaired.

Benefit 9: Protecting Against Structural Damage

Over time, wear and tear can take a toll on the structural integrity of a home. Structural damage can arise from several causes, including weather conditions, faulty construction, or accidents.

Common Causes of Structural Damage in India

| Cause | Details |

| Natural Disasters | Earthquakes, floods, and cyclones can cause severe structural damage. |

| Poor Construction | Structural damage due to low-quality materials or faulty designs. |

| Termites or Pests | Damage from termite infestations, which are common in humid areas. |

How Insurance Can Save You from Major Repairs

Home insurance covers the cost of repairing or rebuilding your home in case of structural damage. Without this protection, the financial burden of these repairs can be overwhelming.

Benefit 10: Customizable Policies to Fit Your Needs

In India, insurance companies offer flexible and customizable policies. This means that you can tailor your home insurance to cover specific risks relevant to your location and home type.

Flexible Home Insurance Plans in India

| Policy Type | Coverage Details |

| Standard Coverage | Covers basic risks like fire, theft, and natural disasters. |

| Customized Add-Ons | Options for adding specific coverage, such as for high-value items or additional risks. |

Tailoring Your Coverage Based on Your Property Type

Homeowners with apartments, for example, may only need content coverage, while those with independent houses may need both building and content coverage.

How to Choose the Right Home Insurance Policy in India

Choosing the right home insurance policy is a critical decision for homeowners in India. Here are some factors to consider:

Factors to Consider When Selecting a Policy

- Coverage Types: Ensure the policy covers both the structure and content of your home.

- Premiums: Compare premiums across different insurers to find an affordable plan.

- Exclusions: Understand what the policy does not cover before purchasing.

- Claim Process: Opt for an insurer with a simple and transparent claim process.

Common Home Insurance Terms You Should Know

- Deductible: The amount you need to pay out of pocket before the insurer covers the rest.

- Premium: The amount paid periodically for the insurance policy.

- Sum Insured: The maximum amount the insurer will pay for a claim.

Comparing Home Insurance Providers in India

To make an informed decision, it’s essential to compare home insurance providers and read customer reviews to gauge their reliability and customer service.

Wrap Up: Why Home Insurance is a Must-Have for Homeowners in India

As we’ve seen, the benefits of having home insurance in India are undeniable. It provides financial protection against natural disasters, theft, fire, and other risks, while also offering peace of mind for homeowners.

Whether you are buying a new home, or already own one, investing in home insurance is a wise decision to safeguard your property, belongings, and family’s future.

By carefully choosing the right policy, understanding the available benefits, and customizing your coverage, you ensure that your home remains protected from life’s unforeseen challenges. Don’t wait until it’s too late—protect your home and your future today.