Buying property can feel out of reach. High prices, paperwork, and big down payments keep many people from joining real estate investments. Maybe you have wondered how to own a piece of real estate without lots of cash or hassle.

Now there is tokenized real estate. This new way lets you buy digital tokens that stand for shares in physical property, all done on the blockchain network with tools like smart contracts and digital assets.

Soon you will see how tokenization makes home investing easier, faster, and safer for regular folks anywhere. Want to learn how it works? Keep reading!

Key Takeaways

- Tokenized real estate lets people buy digital tokens that stand for parts of a property. These tokens are stored on blockchains like Ethereum, making it easy to own and sell small shares.

- Blockchain and smart contracts make trades fast and safe. They cut out banks, lower costs, and keep clear records of who owns what.

- Both NFTs (for whole properties) and fungible tokens (for smaller parts) can be used in these deals. Firms like Blocksquare use this method to let more people invest with less money up front.

- Deloitte predicts that $4 trillion worth of real estate could be tokenized by 2035, opening global markets to regular investors who once could not join.

- There are still hurdles. Investors face tough rules, tax issues from different places, cybersecurity risks with smart contracts, and trouble recovering wallets if they lose access.

Understanding Real Estate Tokenization

Real estate tokenization changes how we think about property. It turns physical assets into digital tokens using blockchain. This process makes buying and selling easier for everyone, not just big investors.

Each token can show ownership of a part of the property, making investments more accessible and affordable.

Definition of tokenization

Tokenization splits an asset, like property, into digital tokens. Each token stays on a blockchain network such as the Ethereum blockchain. These tokens may stand for ownership of the building or its cash flow.

For example, one office tower might be split into 1,000 digital tokens on a layer-1 blockchain. People can buy these pieces using cryptocurrencies or credit cards.

Big companies expect huge changes from this technology. Deloitte predicts $4 trillion worth of real estate will get tokenized by 2035. Investors then gain access to fractional ownership and liquidity in real estate markets that once locked out small buyers.

Smart contracts track who owns each piece and help transfer shares safely without piles of paperwork or visits to banks. The process works much faster than selling old-school mortgage-backed securities or REITs, making property investment more open for everyone—no matter where they live.

How blockchain facilitates tokenization

Blockchain technology breaks up property investments into digital tokens. It uses blockchain networks like Ethereum, which supports ERC-721 tokens and other non-fungible tokens (NFTs).

These tokens show real estate ownership in small parts, making fractional ownership easy. Tools from Chainlink help connect these crypto assets to the real asset’s data for more security.

Digital securities move fast on permissionless blockchains without middlemen like banks or title companies slowing things down. Smart contracts handle trust deeds, escrow steps, and even know your customer (KYC) checks using serverless functions or cloud services such as Amazon DynamoDB.

Each token directly links to a fair-value slice of the underlying asset, tracked on-chain for transparency in transactions. This makes buying and selling easier for individual and institutional investors worldwide through markets like an NFT marketplace or secondary market platforms.

Types of tokens used in real estate

Real estate is getting a digital upgrade through tokenization. This process uses blockchain technology to create digital tokens that represent ownership of real estate assets. Here are the main types:

- NFTs (Non-Fungible Tokens): These represent whole properties. Each one is different and can’t be replaced by another. Think of it like a painting; no two are exactly alike.

- Fungible tokens: They stand for parts of property ownership, making it possible for many people to own shares in real estate. This idea is similar to owning stock in a company.

Both types use blockchain, such as Ethereum, for security and ease of transfer. With NFTs and fungible tokens, buying into real estate becomes more accessible and simpler.

The Process of Tokenizing Real Estate Assets

Tokenizing real estate starts with valuing the property. Experts check its worth and do a thorough review to ensure everything is in order.

Next, digital tokens are created for ownership. Smart contracts help transfer these tokens easily while staying within legal guidelines.

Asset valuation and due diligence

Asset valuation is key in tokenized real estate. It helps figure out how much a property is worth. Data authentication and verification are critical for reliable valuation. Companies like Chainlink work with providers such as ProspectNow and SmartZip to make data available.

Due diligence checks all parts of the deal. It ensures that everything is correct before moving forward. This step looks at legal matters, ownership records, and market conditions, too.

Investors want to know they are making a smart choice in real estate investing, especially when using digital tokens for fractional ownership or asset-backed securities.

Token creation and issuance

Token creation begins with a digital representation of a property. Each token stands for a piece of that real estate asset. This process uses blockchain technology, which provides security and transparency.

Companies like Blocksquare in Slovenia fractionalize properties using the Ethereum blockchain. They break down assets into smaller pieces, making them easier to buy and sell.

Issuing these tokens involves letting investors purchase shares of the property through a token sale. Each investor gets ownership rights linked to their tokens. Automated systems like Chainlink help manage rental payments for token owners smoothly; they make sure payouts are automatic and timely.

This setup allows many people to invest in real estate without needing large amounts of cash upfront, creating opportunities for passive income and better liquidity in real estate investments.

Smart contract implementation for ownership transfers

Smart contracts make ownership transfers quick and easy. They automatically execute when certain conditions are met. For example, if you buy a tokenized real estate asset, the smart contract updates ownership without delays.

This means no need for long paperwork or waiting on banks.

These contracts also enhance security in transactions. They reduce fraud risks since all details are recorded on the blockchain. With smart contracts, buyers and sellers can trust that the transfer happens smoothly and fairly.

Navigating regulatory compliance

Regulatory compliance poses real challenges in tokenized real estate. Complex licensing is a big part of this. Companies must meet strict rules to sell tokens legally. These can change from state to state or country to country.

Token promoters also face issues with anti-money laundering (AML) laws. They need clear plans for how money comes in and goes out. Failing this can lead to hefty fines or worse, losing the right to operate.

Wallet recovery risks add another layer of stress; if you lose access, you may lose your tokenized property forever!

Key Benefits of Real Estate Tokenization

Key benefits of real estate tokenization shine bright. Investors can buy smaller shares, which makes owning property easier. This creates more chances for many people to join the market.

Plus, it cuts down costs and speeds up transactions, making things smoother. With clear records on a blockchain, trust grows in every deal. It’s a win-win for buyers and sellers alike!

Enhanced liquidity

Real estate tokenization brings enhanced liquidity to the market. With digital tokens, people can buy and sell parts of real estate easily. This is called fractional ownership. It allows more investors to join in without needing a lot of money upfront.

Liquidity means you can quickly turn assets into cash when needed. Tokenized real estate makes this possible. Investors can trade their shares anytime on various platforms, just like stocks or other securities.

This increased access opens doors for many who want to invest in property but couldn’t before due to high costs or barriers in traditional markets.

Increased global accessibility

Tokenized real estate allows anyone to invest in property, no matter where they live. Blockchain technology breaks down barriers. It makes buying and selling easier for people around the world.

Investors can purchase small parts of expensive properties through fractional ownership.

This new system opens doors for many investors, including those who might not have had access before. A person doesn’t need a fortune to enter the market anymore. With lower entry points, many more are able to engage with real estate investment easily.

According to reports from Deloitte and Ernst & Young (EY), this method boosts transparency while cutting costs like land transfer taxes too!

Reduced transaction costs

Transaction costs drop when real estate is tokenized. This process speeds up buying and selling. Time is money, right? Fewer steps mean less work for everyone involved. For example, Figure Technologies found that people can save $850 on every $100,000 mortgage through tokenization.

Smart contracts play a big role here. They help to make ownership transfers smooth and quick. With fewer people handling each deal, expenses shrink further. Lower transaction costs attract more investors too.

That boosts liquidity in real estate markets and opens doors for fresh opportunities in property investment.

Improved transparency in transactions

Blockchain technology boosts transparency in transactions. This technology records every step, making it hard for anyone to hide fraud. With tokenized real estate, all parties can see the same data at the same time.

Each transaction is visible and traceable.

Smart contracts help too. They automate tasks and reduce errors. For example, a smart contract handles ownership transfers securely. This clear process builds trust among buyers and sellers in the real estate market.

Better price discovery happens as a result of this clear view, simplifying deals for everyone involved.

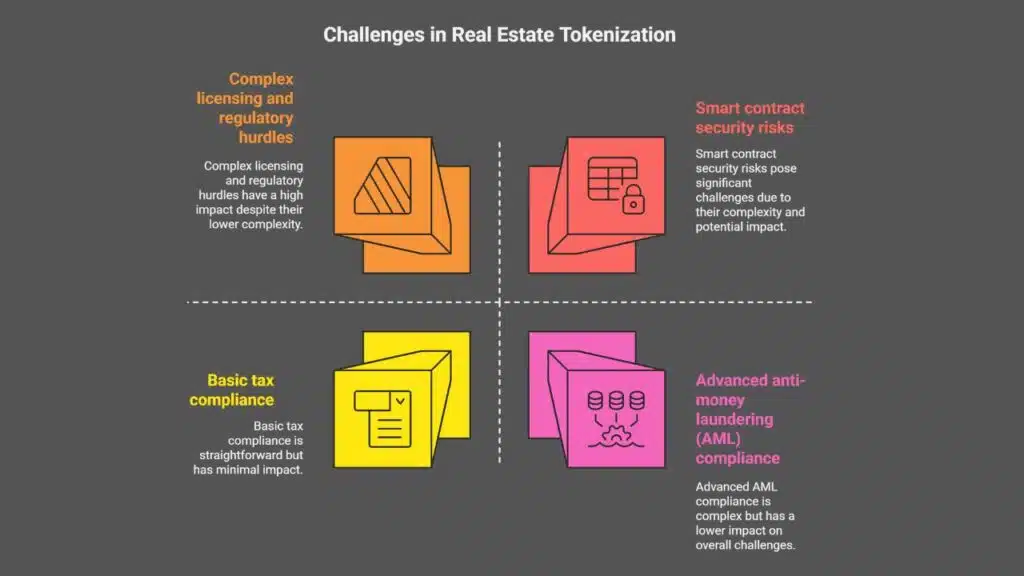

Challenges in Real Estate Tokenization

Real estate tokenization has its bumps. Smart contracts can have security issues. There are also tricky licensing rules to follow. Tax problems can pop up too, making things harder for investors.

If you want to know more about these challenges, read on!

Smart contract security risks

Smart contracts are beneficial in real estate tokenization. They assist with ownership transfers and make transactions quicker. Yet, they present risks. Cybersecurity threats can lead to breaches, putting your investment at stake.

Data authentication is essential for dependable asset valuation. If the data is not secure, it can create problems later on. Investors should be informed about these smart contract security risks before entering the realm of tokenized real estate.

Addressing cybersecurity is crucial in this new environment of digital assets and property ownership.

Complex licensing and regulatory hurdles

Licensing and regulatory hurdles can be tough in real estate tokenization. Many rules exist for digital assets. They vary by state and country. Each market has its own laws on ownership, securities, and taxes.

Compliance is vital for anyone interested in this area. It helps avoid legal troubles down the road. Firms need to understand anti-money laundering (AML) rules too. This complexity makes it hard for some investors to jump into tokenized assets like property investments or equity securities easily.

Taxation and compliance issues

Tax rules for digital assets can be tricky. Different places have different laws about taxes on tokenized real estate. This affects how profits are taxed from sales or rentals of tokens.

Compliance is another challenge. Real estate tokenization needs to follow many rules, like anti-money laundering (AML) laws. Many countries want to control how these assets move in the market, adding more steps for investors and companies alike.

These issues can slow down the process and make it harder for individuals looking into property investment through tokens.

The Future of Tokenized Real Estate

The future of tokenized real estate is bright. Investors are showing more interest every day. With tools like blockchain, buying and selling property could be easier than ever. Tokens can allow people to own a piece of buildings or land without needing a lot of money upfront.

This opens doors for many new investors around the globe, making real estate accessible to everyone. As technology improves, we may see even more changes in how we buy and sell properties in the market today!

Potential for market adoption

Tokenized real estate has a bright future. Deloitte predicts that by 2035, around $4 trillion of real estate will be tokenized. This shift aims to make property investment easier for everyone.

As technology improves and laws change, more people may invest in fractional ownership through digital tokens.

With the rise of blockchain technology and smart contracts, transactions could become quicker and cheaper. Access to global markets will widen too. Investors can buy shares in properties from anywhere in the world with just a click.

This new way of buying real estate is likely to reshape traditional models quickly.

Advancements in technological infrastructure

New tools and systems improve real estate tokenization. DeFi adoption speeds up transactions while cutting costs. Layer-2 solutions help clear blocks faster, which allows for quicker deals.

Interconnected blockchains make it easier to exchange tokens safely. They keep data private and meet compliance needs.

These advancements enhance the real estate market’s transparency in transactions. Increased efficiency attracts more investors, especially institutional ones seeking new opportunities.

Smart contracts streamline ownership transfers and reduce risks linked to paper-based processes. This shift signals a change in how we handle property investment today.

Impact on traditional real estate models

Tokenized real estate shakes up old ways of buying and selling property. It brings new markets to life. Traditional models often leave out small investors. With tokenization, more retail investors can join the game.

They can buy fractions of properties through digital tokens.

This change lowers transaction costs too. People no longer need big money to invest in real estate. Now, they can enter with smaller amounts. Transparency improves as well; everyone sees what is happening in transactions.

All these factors make the real estate market more open and efficient for all players involved.

Takeaways

Tokenized real estate changes how we think about property ownership. It makes investing easier for everyone, not just the wealthy. You can buy small parts of buildings with digital tokens.

Blockchain keeps everything safe and clear, showing who owns what. As technology grows, more people may join in this exciting way to invest in real estate.

FAQs

1. What is tokenized real estate and how does it work?

Tokenized real estate lets you own a piece of property using digital tokens on blockchain technology. Each token stands for fractional ownership in the underlying asset, like commercial buildings or homes. Smart contracts handle deals and make sure rules are followed.

2. How can I buy into tokenized assets?

You invest by buying digital tokens, often created as ERC-721 or fungible tokens on networks like Ethereum Blockchain or Binance Smart Chain. These tokens may represent shares in properties or mortgage-backed securities (MBS). Payment processors help move funds.

3. Why do people say tokenization brings liquidity to the real estate market?

Real estate is known as an illiquid asset; selling takes time and paperwork piles up fast. With asset tokenization, you can sell your fraction any day, just like trading stocks, which adds more liquidity in finance.

4. Are there risks with this decentralized structure?

Like any investment option, risks exist here too—market value changes quickly and legal framework shifts often confuse even institutional investors. Anti-money laundering (AML) checks try to keep things safe but always double-check who manages the securitized process.

5. Can anyone invest in these private equity investments through real estate tokenization platforms?

Yes, almost anyone can join depending on local laws about property ownership and banking regulations; some projects limit access to accredited investors only though due to rules from regulators such as Markets In Crypto-Assets authorities.

6. How secure are my title deeds if I use smart contracts for property investment?

Smart contracts use multi-factor authentication plus blockchain records for transparency in transactions; Deloitte & Touche LLP even reviews systems sometimes for extra trust—but remember no system has perfect security so stay alert when managing your home equity line of credit or other options!