Most people find Decentralized Finance (DeFi) confusing and hard to use. It’s easy to get lost with so many crypto assets, new platforms, and endless rules. Maybe you wonder why some countries move fast while others fall behind.

Here is a fact that might surprise you: South Korea has more than 33 million citizens owning cryptocurrency. This country is now famous for its tech-savvy population and advanced digital systems.

If you’re curious about how the economy of South Korea grew into a global DeFi leader, this post will break it down step by step. Stick around to see six simple reasons behind their rise in decentralized finance!

Strategic Government Support

The South Korean government supports cryptocurrency and blockchain. They create rules that help businesses grow in this area.

Pro-crypto regulations

A 2020 law made crypto exchanges legal in South Korea. Strict rules cover anti-money laundering and know-your-customer checks, so people cannot hide their identity. Privacy coins get heavy restrictions, stopping anyone from using them for secret deals.

Initial coin offerings are still banned, but Bitcoin works as a legal way to send money across borders. Crypto assets act like stock investments; they face capital gains taxes up to 22 percent for big traders.

As one local finance official put it,.

Transparent rules help keep the market safe while letting innovation grow.

These smart moves help boost economic growth and trust in the fast-growing crypto market.

Investment in blockchain research and development

Smart rules alone do not fuel South Korea’s blockchain boom. Big money and bold ideas light the way, too. In 2018, the government injected $2 billion into artificial intelligence research, a move that gave technology development a huge push.

By August 2023, Yoon Suk Yeol’s team rolled out the New Growth Strategy 4.0 to fund new areas like AI semiconductors and clean hydrogen production. It supports both high-speed advances and job creation.

Government funding goes beyond talk. Almost $9 million, or about 10 billion won, is set aside for blockchain pilot projects in public services such as voting systems and real estate tracking.

The Korean New Deal poured $144 billion into digital tools to boost private consumption and improve gross domestic product. Blockchain startups get extra help through these funds; fintech companies now test safer peer-to-peer lending under strict guidelines from the Financial Supervisory Service.

This steady flow of investment makes South Korea one of Asia’s strongest players in public blockchain innovation today—rain or shine!

Establishing blockchain-friendly policies

South Korea rolled out blockchain-friendly rules with the speed of a winter wind in Seoul. The government built strong guardrails to protect people and grow new ideas. In 2019, the National Health Insurance Service started using Aergo to store health records on-chain—this is not your granddad’s filing cabinet.

K-BTF was launched as a toolkit for all groups, aiming to make blockchain use clear and fair across sectors.

Clear paths matter for both startups and giants in South Korea’s economy, from Hallyu stars to keiretsus shifting toward technology development. Lawmakers pushed policies that support token sales but keep a close eye on safety through anti-money laundering efforts.

Policymakers aim for transparency, so no one feels left out or lost at sea during times of economic crisis or downturns. New rules seek public trust and help foreign investors feel safe entering the growing crypto market—a big deal after battles with high fiscal deficit rates and lessons learned since the Asian Financial Crisis rocked these shores years ago.

Advanced Digital Infrastructure

South Korea boasts a strong digital network. With fast internet speeds and widespread 5G coverage, people can easily access online services and platforms. This strong setup helps spark creativity in tech and finance.

South Koreans quickly embrace new tools, making them key players in the DeFi space.

High internet penetration rates

South Korea enjoys a 100% household internet access rate. This means every home is online. With 47 million active internet users, about 93% of the total population uses it daily. Such high numbers create a strong base for digital growth.

These rates help drive innovation in finance and technology. Many South Koreans are quick to adopt new tools like cryptocurrencies and decentralized finance (DeFi). High-speed connections allow easy access to these platforms, supporting a booming crypto market and blockchain infrastructure.

The internet connects everyone, opening doors to limitless possibilities.

Nationwide 5G network deployment

High internet use sets the stage for South Korea’s 5G network. In April 2019, it became the first country to launch a nationwide 5G system. This new technology supports fast connections and improves digital services across the nation.

With 5G, users can enjoy smoother streaming and gaming experiences. Businesses also benefit from quick data transfer speeds. It helps them innovate and offer better products. The deployment of this network boosts South Korea’s economy by supporting blockchain startups and enhancing its crypto market growth.

Support for digital innovation hubs

The strong digital infrastructure leads to support for digital innovation hubs. These hubs are spaces where new ideas can grow. They help entrepreneurs develop blockchain technology and decentralized finance (DeFi) solutions.

In 2021, South Korea saw a big rise in venture capital investments. Startups got over 7.7 trillion won, which is about $6.4 billion. People are excited about these innovations because they create jobs and boost the economy.

Many believe that these hubs will help South Korea improve its crypto market and lead in tech development globally.

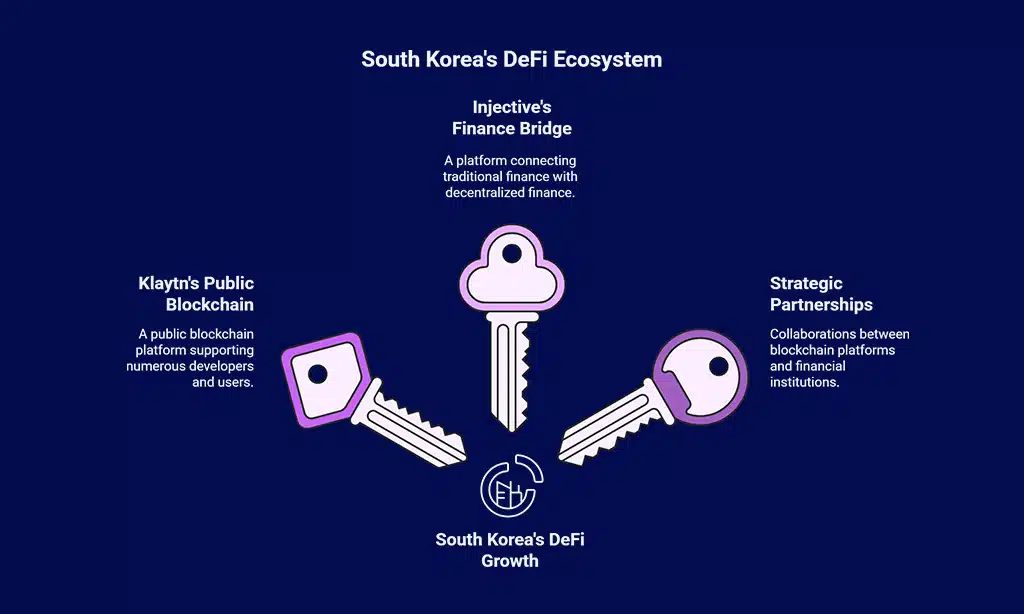

Major Blockchain Platforms Driving DeFi Growth

South Korea is home to powerful blockchain platforms that drive growth in decentralized finance. Klaytn stands out as a leader, offering a public blockchain for many developers and users.

Injective helps bridge the gap between traditional finance and this new world of digital money. These platforms work closely with banks and financial firms, creating strong partnerships that push DeFi forward.

Curious about how these changes shape the economy? Keep reading!

Klaytn: Korea’s leading public blockchain

Klaytn is Korea’s top public blockchain. Kakao developed it and launched it in June 2019. It quickly became popular, processing over 3.5 million transactions every day. The Klip wallet, linked to Klaytn, has more than 2 million users.

This platform supports many applications for decentralized finance (DeFi). Klaytn aims to make blockchain technology accessible and easy to use. Its growth is vital for the crypto market in South Korea and beyond.

Injective: Bridging TradFi and DeFi

Injective connects traditional finance (TradFi) with decentralized finance (DeFi). It supports advanced use cases like decentralized derivatives, prediction markets, and synthetic assets.

This makes trading more flexible for users.

The platform’s decentralized exchange (DEX) boasts daily trading volumes over $100 million. With these figures, Injective stands as a strong player in the crypto market. Its partnerships with financial institutions further boost its reach and credibility in South Korea’s growing DeFi scene.

Partnerships between blockchain platforms and financial institutions

Klaytn and Injective are paving the way for DeFi in South Korea. Klaytn has teamed up with giants like Samsung, LG, and Binance to push further into decentralized finance. These partnerships help blend traditional finance with blockchain technology.

They open doors to new services and opportunities.

This collaboration can unlock billions in value for users and businesses alike. It makes financial transactions faster, safer, and more efficient. The future looks bright as these platforms work together to boost the crypto market in South Korea.

Next comes a look at how people are using DeFi in real life across the nation.

Strong Culture of Technological Adoption

South Korea loves technology. People here quickly adopt new tools like mobile payments and digital wallets. Apps for everyday tasks are common. Citizens embrace change, making it easy to use decentralized apps in their lives.

This tech-friendly mindset fuels growth in DeFi. It’s exciting to see how fast they adapt!

High adoption rates of digital payment systems

Digital payment systems have taken off in South Korea. People are moving away from cash and cards to mobile payments. Nearly everyone has a smartphone, which makes it easy to use apps for paying bills or shopping.

This shift helps the economy of the Republic of Korea grow faster. With more users engaging in these digital transactions, it’s clear that technology development plays a big role here.

The culture is tech-savvy, and people welcome new ways to manage their money securely and quickly.

Tech-savvy population

High adoption rates of digital payment systems show the tech-savvy nature of South Korea’s population. Most people use smartphones and computers daily. This makes them quick to accept new technology.

Apps for payments and services are popular in cities and rural areas alike.

South Koreans love innovation. They embrace new ideas with open arms, whether it’s shopping or banking online. Young people lead this change, but older folks join in too. The country’s shift to a strong industrial economy over the past 50 years helps fuel this trend.

With a tech-friendly environment, South Korea stands ready to shape its future in DeFi and beyond.

Early adoption of decentralized applications (dApps)

South Korea is a leader in using decentralized applications, known as dApps. About 33 million South Koreans own cryptocurrency. This strong interest helps support the growth of dApps.

Major platforms like Klaytn and Injective push this trend further. Klaytn processes over 5 million transactions daily and aims to bridge traditional finance with DeFi.

The South Korean government has also helped by lifting the ban on initial coin offerings (ICOs). This move fosters more innovation in the dApp space. With big companies showing more interest, we can expect greater adoption soon.

As we look at regulatory compliance and security next, it’s clear that trust will play a key role in these developments.

Regulatory Compliance and Security

Regulatory compliance helps keep the DeFi space safe. Clear rules guide businesses on how to operate without risks like fraud.

Clear guidelines for crypto and DeFi operations

Clear rules guide crypto and DeFi operations in South Korea. The government plans comprehensive reforms for this sector by 2025. New regulations will punish unfair practices in the crypto market.

South Korea aims to make trading cheaper too, lowering fees on exchanges from 0.05% to 0.015%. These steps help create a safer environment for users and investors alike.

Crypto enthusiasts can feel more secure with these guidelines in place. A focus on anti-money laundering (AML) measures also boosts trust among users. Transparency is key; it builds confidence in the growing crypto market of South Korea, especially as blockchain infrastructure develops rapidly.

Focus on anti-money laundering (AML) and fraud prevention

Clear guidelines for crypto and DeFi operations lead to a strong focus on anti-money laundering (AML) and fraud prevention. South Korea takes these issues seriously. They have set up a solid AML strategy to boost credibility in their financial system.

The Korea Financial Intelligence Unit, known as KoFIU, plays a key role here. This unit looks at data from banks and other financial bodies.

KoFIU helps law enforcement catch money launderers too. South Korea is also part of the Financial Action Task Force (FATF). This shows they are committed to fighting financial crimes effectively.

With these measures in place, trust grows among users of crypto markets and blockchain startups alike within the nation’s economy.

Building trust through transparency and accountability

Strict AML and KYC rules help cryptocurrency exchanges stay accountable. This builds trust in DeFi for users. Lifting the ICO ban sparks innovation and boosts development. These steps make people feel safer about investing.

The Financial Innovation Bureau plays a key role here. It promotes clear guidelines for crypto operations, ensuring transparency. Major exchanges connecting with Klaytn also enhance liquidity.

This further increases user confidence in the system. With dApps classified as financial institutions, trust grows stronger across the ecosystem. Next, we will explore real-world use cases for DeFi in South Korea.

Real-World Use Cases for DeFi in South Korea

South Korea shows us many real-life uses for DeFi. People can lend money directly to others through online platforms. They can send money across borders quickly and easily. Even the gaming industry is getting involved, with DeFi changes that mix fun and finance.

Want to learn more? Keep reading!

Peer-to-peer lending platforms

Peer-to-peer lending platforms grew quickly in South Korea. In 2020, these platforms offered over $50 billion in loans. This type of lending connects borrowers directly with lenders, cutting out the bank middleman.

People can often find better rates this way.

These platforms support many individuals and small businesses. They make it easier for people to get funds without complicated processes. Users enjoy quick approvals and more flexible terms than traditional banks offer.

Peer-to-peer lending is helping shape the future of finance in South Korea’s economy.

Cross-border payment solutions

Cross-border payment solutions are changing the way money moves. Traditional banks in South Korea often take a long time for payments. They also have high fees, which can be a problem.

DeFi helps fix these issues with fast transactions and lower costs.

This shift makes it easier for people to send money internationally. For example, businesses can quickly pay suppliers abroad without delays or extra charges. These improvements help enhance trade with other countries and boost the South Korean economy.

Integration of DeFi in gaming and entertainment industries

DeFi is changing gaming and entertainment in South Korea. Tokenized in-game assets are one big shift. Players can own, trade, and sell virtual items as real assets. This adds value to gameplay.

The Korean gaming industry made $15 billion in 2020 alone. This growth opens doors for more DeFi projects like Injective, which connects traditional finance with digital games. Gamers can earn money while playing, making the experience even more exciting.

Expanding Access to DeFi

Expanding access to DeFi helps more people join in. Simple and friendly platforms make it easier for everyone, even those who often miss out.

Simplified and user-focused platforms

Platforms like Klaytn and Injective make DeFi easy for users. Klaytn focuses on user-friendliness, making it simple to join the DeFi world. Injective provides advanced trading features for quick peer-to-peer transactions.

These platforms aim to boost access for over 50 million South Koreans.

Major exchanges like Upbit and Bithumb are partnering with Klaytn too. This helps improve liquidity and keeps users engaged in DeFi activities. High rates of cryptocurrency ownership in South Korea push for more streamlined platforms that fit user needs perfectly.

With clear support from the government, these advancements will keep growing strong!

Expanding access to underserved populations

Klaytn and Injective work together to make DeFi easier for more people. They focus on those who don’t always have access to financial services. This partnership aims to reach over 50 million South Koreans.

It opens doors for many, including low-income families.

Platforms are becoming simpler and user-friendly. This helps people join the crypto market more easily. With better access, liquidity rises and there is more availability of assets too.

People can now explore peer-to-peer lending or cross-border payments without hurdles. Next up, we will look at how public and private sectors team up in this area.

Increasing liquidity and asset availability

Expanding access to underserved populations helps boost liquidity and asset availability in South Korea. More people can use decentralized finance (DeFi) platforms now. This growth leads to a wider range of financial services.

South Korea’s asset tokenization market is set to hit US$287 billion by 2030. With this growth, more assets become available for trade and investment. Increased liquidity means users can buy or sell easily without major price changes.

Blockchain startups play a vital role in making this happen, driving innovation and improving the crypto market in the country. As DeFi expands, it opens doors for even more opportunities in various sectors like gaming and cross-border payments.

Collaboration Between Public and Private Sectors

South Korea’s success in DeFi comes from teamwork. The government and tech firms join forces to boost blockchain projects. They offer funds and support, making it easier for startups to grow.

This strong bond helps South Korea stay ahead in the crypto world.

Government partnerships with tech companies

The government partners with tech companies to boost innovation. This cooperation leads to more research and development in blockchain technology. With public-private partnerships, South Korea enhances its blockchain infrastructure and supports startups.

These alliances make it easier for businesses to grow.

Tech firms gain from this support too. They get incentives that help them thrive in the crypto market. Working together, they build a stronger foundation for decentralized finance (DeFi).

Next, we’ll explore how advanced digital infrastructure plays a role in South Korea’s DeFi growth.

Incentives for blockchain startups

South Korea offers numerous incentives for blockchain startups. The country has clear rules that help these businesses grow. Startups can easily maneuver through the crypto market because of friendly regulations.

Moreover, public funds support technology development in fintech and insurtech sectors.

Partnerships with global DeFi leaders also enhance innovation. These collaborations address financial challenges and create new opportunities for growth. Blockchain startups find a supportive environment in South Korea’s strong culture of technological adoption.

This combination drives their success, making South Korea a key player in blockchain technology.

Joint ventures with global DeFi leaders

Joint ventures boost the DeFi landscape in South Korea. Klaytn, the leading public blockchain, partners with global DeFi firms. This helps bring new services to over 50 million people in the country.

Injective also plays a big role here. Their decentralized exchange makes trading simpler and safer.

Major South Korean companies join forces with these leaders too. They work together on real blockchain applications. These alliances promote consumer protection and ensure legal operations for crypto exchanges.

With these partnerships, advancements in DeFi adoption increase every day, making financial technology more accessible for everyone involved.

Future of DeFi in South Korea

The future of DeFi in South Korea looks bright. There is a chance for the country to lead in blockchain innovation. With tech companies and the government working together, possibilities are endless.

More partnerships could open doors for new ideas. Imagine what that means for everyday folks! If you’re curious about how this will unfold, stay tuned and keep exploring!

Potential for global leadership in blockchain innovation

South Korea has huge potential to lead in blockchain innovation. The country already makes up over 20% of global cryptocurrency trading activity. This strong presence shows that South Korea is a key player in the crypto market.

The government invests heavily, putting more than $880 million into blockchain and AI projects. These investments support new ideas and technologies. They also create jobs and help startups grow.

With smart policies and a tech-savvy population, South Korea could become a global leader in DeFi and other blockchain applications.

Opportunities for expanding international collaboration

International collaboration can grow in many ways. South Korea is ready to team up with other countries in blockchain. Events like the STO Summit Korea and Korea Blockchain Week will attract global attention in 2024.

These events are perfect for sharing ideas and building connections.

Partnerships with foreign tech companies can bring fresh ideas to South Korea’s crypto market. Working together helps both sides learn more about decentralized finance (DeFi). It also paves the way for new projects that can benefit everyone involved.

With a strong focus on security, these collaborations can build trust across borders, making it easier for people to join this new financial world.

Vision for a fully decentralized financial ecosystem

The future of DeFi in South Korea looks bright. A fully decentralized financial ecosystem will allow everyone to benefit from digital assets equally. With clear guidelines for crypto and DeFi operations, this system can grow safely.

The goal is to connect services without banks as middlemen. This change means lower fees and faster transactions.

Koreans already saw a 60% rise in their digital asset value in 2022, showing strong interest. As the blockchain and DeFi markets are set to grow by 30% each year for five years, many opportunities lie ahead.

Innovation will drive progress. South Korea is poised to lead this change on a global scale, bringing new ideas and partnerships along the way.

Takeaways

South Korea stands strong as a leader in DeFi. Its government supports crypto in many ways. The country has fast internet and a big 5G network, which aids growth. Klaytn and Injective are major players that help users easily access DeFi services.

By teaming up with tech firms, South Korea makes it simple to join this financial revolution.

For anyone curious about the future of finance, South Korea offers great examples to follow. Dive deeper into blockchain projects and see how they can benefit you too! Keep an eye on this exciting shift; who knows what amazing things are next? Embrace change, because every step counts!