Web3 tokens are reshaping the digital economy, offering decentralized solutions across industries. As blockchain technology evolves, many investors are seeking the next big opportunity. However, not every Web3 token is a smart investment. Some are groundbreaking, while others may be hype-driven projects with little real value.

So, how do you determine whether a Web3 token is worth investing in? By analyzing key factors that separate high-potential tokens from risky ones. This article explores seven essential signs a Web3 token is a smart investment, ensuring that you make informed and strategic decisions.

1. Strong Utility and Use Case

A token’s success depends on its real-world utility. Tokens that serve a practical purpose in an ecosystem tend to have long-term value. If a token solves a real problem, offers unique benefits, and is widely adopted, it is more likely to be a strong investment.

Additionally, tokens that integrate seamlessly with existing blockchain networks have higher chances of success. Interoperability allows them to function across multiple platforms, increasing their adoption rate. The more a token is utilized in different real-world applications, the stronger its value proposition becomes.

Key Factors to Evaluate Utility:

| Feature | Details |

| Real-World Use Case | Does the token solve a genuine problem? |

| Ecosystem Demand | Is there a market for this token’s service? |

| Adoption Rate | Are companies and users actively using it? |

| Unique Technology | Does it offer something innovative? |

Examples of Web3 Tokens with Strong Utility:

- Ethereum (ETH): Enables smart contracts and decentralized applications.

- Chainlink (LINK): Bridges real-world data with blockchain networks.

- Filecoin (FIL): Provides decentralized storage solutions.

Tokens without real use cases often rely on speculation and can crash when hype fades. Always check if a token has a clear purpose.

2. Robust Community and Developer Support

A strong community and active developers indicate long-term project sustainability. Web3 tokens with engaged users and dedicated developers are more likely to survive market fluctuations.

A thriving community ensures organic marketing and continuous project improvements. Developer engagement also suggests ongoing innovation and bug fixes, making the project more secure. Social media discussions and development updates reflect the trust and enthusiasm surrounding the project.

How to Assess Community Strength:

| Feature | Details |

| Social Media Engagement | Active discussions on platforms like Twitter and Reddit. |

| Developer Activity | Frequent updates on GitHub or blockchain explorers. |

| Token Holder Growth | Increasing number of unique wallet addresses. |

| Forum Discussions | Presence in Web3-focused communities like Discord. |

Example: The Polkadot (DOT) community is highly engaged, with continuous updates from developers, making it a promising investment.

3. Transparent and Experienced Team

The credibility of a Web3 project heavily depends on its founders and developers. Transparent teams with experience in blockchain and technology increase trust and reliability.

A project led by experts in cryptography, finance, and software development is more likely to succeed. Transparency in roadmaps, team communication, and governance structures further strengthens investor confidence. Investors should always verify whether the team has experience in delivering successful blockchain projects.

How to Evaluate a Project Team:

| Feature | Details |

| Public Identity | Are the founders and team members publicly known? |

| Past Experience | Do they have a track record in blockchain or finance? |

| LinkedIn & GitHub Profiles | Can you verify their professional history? |

| Past Successes | Have they worked on other successful projects? |

Be cautious of anonymous teams, as many scams and rug pulls come from unidentified developers.

4. Sustainable Tokenomics and Scarcity

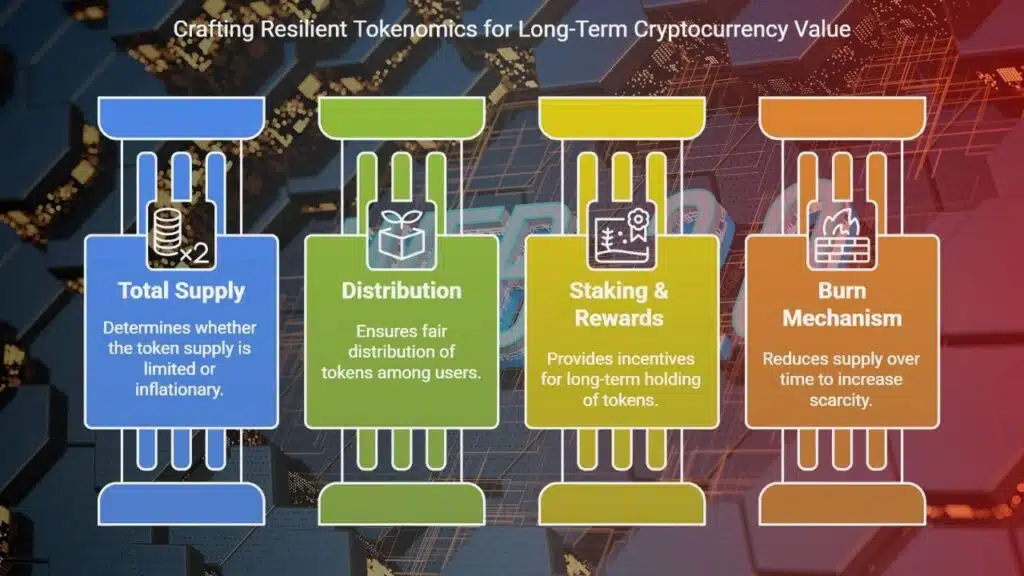

Tokenomics refers to the economic model of a cryptocurrency. A token with a well-planned supply, distribution, and incentives is more likely to maintain its value over time.

Proper tokenomics ensures fair value appreciation and prevents inflation or devaluation. Tokens with clear allocation plans, fair staking rewards, and burning mechanisms tend to retain demand. A sustainable distribution model encourages long-term holders instead of short-term speculators.

Important Aspects of Tokenomics:

| Feature | Details |

| Total Supply | Is the token supply limited or inflationary? |

| Distribution | Are tokens fairly distributed among users? |

| Staking & Rewards | Does it offer incentives for long-term holding? |

| Burn Mechanism | Does the project reduce supply over time? |

Example: BNB (Binance Coin) has a burning mechanism that reduces supply, increasing scarcity and potential value over time.

5. Real Partnerships and Ecosystem Growth

Legitimate partnerships with established companies or blockchain networks add credibility and utility to a Web3 token.

A project with real partnerships can attract institutional investors, increasing demand and trust. Collaborations with well-known brands indicate the project’s relevance and future expansion potential. Verified partnerships also create new use cases, strengthening the token’s value proposition.

How to Identify Real Partnerships:

| Feature | Details |

| Official Announcements | Verified press releases from both partners. |

| Integration in Ecosystem | Actual use of the token in partnerships. |

| Major Backers | Investments from reputable venture capital firms. |

| Blockchain Adoption | Usage within other blockchain platforms. |

Example: Polygon (MATIC) has partnerships with Meta (Facebook) and Stripe, demonstrating real-world adoption.

6. Regulatory Compliance and Security

With increasing regulatory scrutiny on cryptocurrencies, tokens that comply with financial laws have a better chance of long-term survival.

Regulatory approval ensures that a token operates within legal boundaries, reducing the risk of government bans. Security audits by reputable firms confirm that the project is free from vulnerabilities. A compliant and secure project is more attractive to institutional investors.

Key Compliance and Security Checks:

| Feature | Details |

| Regulatory Approvals | Does it comply with financial authorities? |

| Security Audits | Has the smart contract been audited by firms like CertiK? |

| KYC & AML Policies | Are there measures to prevent fraud and scams? |

| Hacking History | Has the project been exploited or suffered breaches? |

Projects with poor security can lead to investor losses through hacks and scams. Always verify the project’s security measures.

7. Consistent Market Performance and Liquidity

A token’s market performance and liquidity determine its ability to sustain price growth and avoid sudden crashes.

A token with high liquidity ensures smooth trading, reducing slippage issues. Historical price data can reveal patterns of growth or instability, helping investors make informed decisions. Analyzing past bull and bear market performances provides insights into a token’s resilience.

How to Analyze Market Performance:

| Feature | Details |

| Trading Volume | Is the daily trading volume high? |

| Exchange Listings | Available on major exchanges like Binance, Coinbase? |

| Price Stability | Avoids extreme volatility or price manipulation. |

| Liquidity Providers | Strong liquidity pools for easy trading. |

Example: Stable tokens like USDC maintain liquidity and are widely traded, reducing investment risks.

Takeaways

Investing in Web3 tokens requires thorough research and careful analysis. A good investment opportunity is characterized by utility, strong community support, transparency, sustainable tokenomics, real partnerships, security, and market liquidity.

By following these seven signs, you can reduce risks and increase your chances of success in the Web3 investment space.