Saving money on taxes while helping the planet? That sounds like a win-win, right? Many homeowners want to make their homes more energy-efficient but worry about the upfront costs.

Energy bills are rising, and older systems waste power. It feels overwhelming to find affordable ways to upgrade your home.

Here’s some good news: Green Energy Tax Credits For Homeowners In 2025 can help! The government offers tax breaks for making eco-friendly changes like installing solar panels or heat pumps.

These credits lower costs and reward you for using clean energy.

In this blog, you’ll discover seven top green energy tax credits available in 2025. Learn how they work, what upgrades qualify, and how much you can save. Ready to cut those energy bills while boosting savings? Keep reading!

What Are Green Energy Tax Credits?

Green energy tax credits help homeowners save money on taxes. They reward you for using renewable energy and making energy-efficient improvements to your home. These credits reduce the amount of income tax you owe, giving back a portion of what you spend on updates.

For example, installing solar panels or geothermal heat pumps can earn federal tax credits equal to 30% of your total costs. Under the Inflation Reduction Act, this applies to upgrades like heat pump water heaters or battery storage systems until 2032.

If you replace old windows with energy-efficient ones or add insulation, you may also qualify for savings up to $3,200 each year.

Federal Tax Credits for Energy Efficiency in 2025

The government offers tax breaks to help homeowners save on energy-efficient upgrades. These credits make green improvements more affordable and appealing.

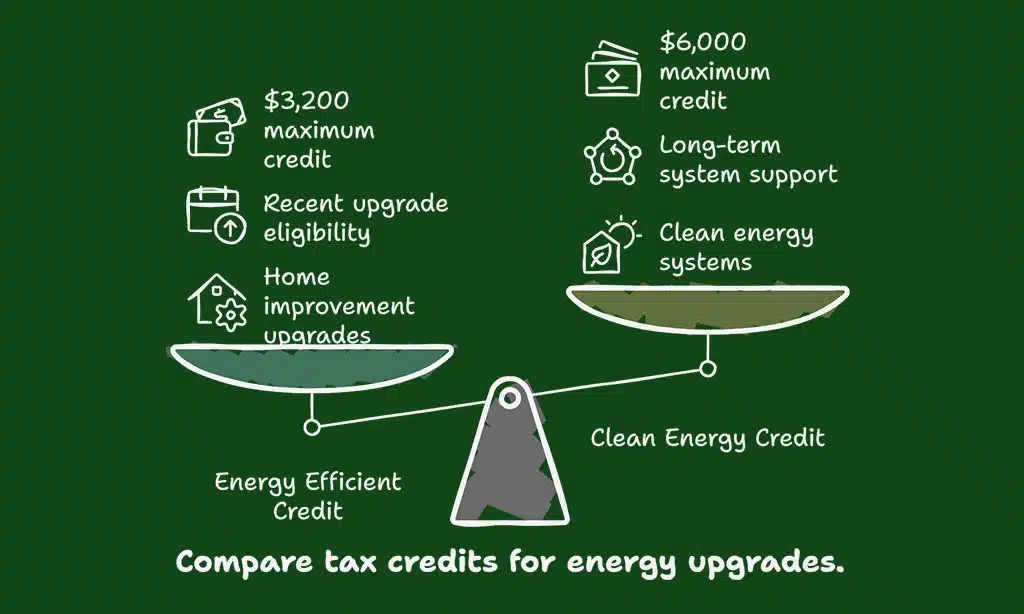

Energy Efficient Home Improvement Credit

Homeowners can get a 30% tax credit for energy-efficient upgrades. This includes projects like adding insulation, upgrading windows, and installing heat pumps. The maximum yearly credit is $3,200.

Of this amount, up to $2,000 can cover heat pump costs.

Electric panel upgrades may also qualify under this program. Improvements made after January 1, 2023, count for the credit in your tax return. These credits aim to cut electricity bills and support clean energy use at home.

Save money while saving energy—it’s a win-win!

Residential Clean Energy Credit

The Residential Clean Energy Credit offers 30% back on costs for clean energy upgrades. This includes installing solar panels, wind turbines, geothermal heat pumps, and battery storage technology.

The credit applies to systems put in place from 2022 through 2032.

For example, a $20,000 solar panel system could qualify for a $6,000 tax credit. Geothermal systems or hot water boilers may also be eligible if they meet energy efficiency standards.

These credits help cut your federal income tax while saving money on energy bills long term.

Top 7 Green Energy Tax Credits for Homeowners

Save money and help the planet with these energy-friendly tax perks. These credits can make upgrading your home more affordable while boosting efficiency.

Solar Panel Installation Credit

Installing solar panels can lower energy bills and your tax burden. The Residential Clean Energy Credit allows homeowners to claim 30% of the cost for new solar photovoltaic (PV) systems installed between 2022 and 2032.

This includes labor, equipment, and even battery storage technology connected to your system.

“Solar energy is a great choice for savings and sustainability.”

For example, if your installation costs $20,000, you could get a $6,000 credit back on your taxes. Pairing this with net metering can save even more by sending excess power to the grid.

Solar energy reduces property tax concerns while also cutting reliance on natural gas or other traditional sources.

Heat Pump Tax Credit

Homeowners can get a tax credit for heat pumps in 2025. The credit covers 30% of costs, up to $2,000 per year. Heat pump water heaters and other energy-saving models meet this rule if they follow Energy Star standards.

These systems help cut heating and cooling bills while reducing energy usage.

Switching to heat pumps also supports cleaner energy sources. The Inflation Reduction Act promotes these upgrades by making them affordable through federal tax credits. Installing a new system after January 1, 2023, qualifies homeowners for savings under the Energy Efficient Home Improvement Credit plan.

Energy-Efficient Windows and Doors Credit

Upgrading to energy-efficient exterior windows and doors can earn a tax credit of 30% of the cost. This applies to qualifying improvements made after January 1, 2023. The maximum annual credit for all eligible home upgrades is $3,200.

Exterior doors can qualify for up to $500 in credits, while exterior windows may provide up to $600.

These upgrades must meet strict energy efficiency standards set by Energy Star. Replacing old windows or drafty doors with newer models saves money through this federal tax credit and reduces heating and cooling costs throughout the year.

Better insulation lowers your energy bills while reducing carbon emissions as well!

Geothermal Systems Tax Credit

Homeowners installing geothermal heat pumps can claim a 30% tax credit through the Residential Clean Energy Credit. This applies to systems added between 2022 and 2032. These systems are great for heating, cooling, and even water-heating while saving energy.

A geothermal heat pump uses underground temperatures to keep homes comfortable year-round. If you spend $20,000 installing such a system, you could get a $6,000 tax credit. This helps cut project costs while boosting energy efficiency at home.

Energy-Efficient Roofing Credit

Installing energy-efficient roofing can save money and cut energy use. This credit offers 30% of the roof’s cost back, up to $3,200. Roofing materials like cool shingles or metal roofs that meet Energy Star standards qualify.

These products reflect sunlight and reduce heat inside your home.

Materials must meet U.S. Department of Energy guidelines for certification. For more savings, pair it with insulation materials or air sealing improvements. Proper upgrades lower heating and cooling costs while reducing your carbon footprint.

Home Energy Audits Credit

A home energy audit can save you money. The Home Energy Audits Credit covers 30% of the cost, up to $150. This credit applies if a professional checks your home’s energy use and suggests ways to improve it.

Air sealing materials, insulation, or upgraded heating and cooling systems might be part of these improvements.

An audit helps reduce wasted energy. Lowering your bills while meeting federal energy efficiency standards is key here. For example, pairing this credit with other upgrades like heat pumps or efficient windows boosts your savings even more!

Alternative Fuel Vehicle Charging Equipment Credit

Installing electric vehicle charging stations at home can earn you a tax credit. This credit covers 30% of the installation costs, up to $1,000. Qualifying equipment must meet energy efficiency standards set by the U.S. Department of Energy.

Homeowners with qualified charging setups for alternative fuel vehicles could save big on taxes. Electric panel upgrades tied to this project may also qualify under federal energy programs.

Investing in clean energy helps reduce your carbon footprint and trims electricity bills over time!

Takeaways

Saving energy doesn’t just help the planet—it helps your wallet too. These green tax credits make home upgrades easier and more affordable. From solar panels to heat pumps, small changes can mean big savings.

Be smart about 2025 opportunities; they’re worth it. Start now, and see the benefits for years to come!

FAQs

1. What are the top green energy tax credits available for homeowners in 2025?

Homeowners can access federal tax credits like the Residential Clean Energy Credit, Energy Efficient Home Improvement Credit, and incentives for solar energy, geothermal heat pumps, battery storage technology, and wind energy systems.

2. Can I get a tax credit for installing new heating or cooling systems?

Yes! Tax credits cover energy-efficient improvements like heat pumps, central air conditioners, natural gas furnaces, propane furnaces, oil furnaces, and hot water boilers.

3. Are there any benefits for upgrading windows or doors?

Absolutely. Installing exterior windows and exterior doors that meet energy efficiency standards can qualify you for an Energy Efficient Home Improvement Credit.

4. Do home energy audits count toward tax deductions?

Yes. A home energy audit is eligible under certain programs to help you save on taxes while improving your home’s overall efficiency.

5. How does the Inflation Reduction Act support green upgrades?

The act expands federal tax credits to encourage renewable energy sources like solar power and geothermal systems while promoting insulation materials and air sealing materials for better conservation.

6. Can I claim a credit if I upgrade my electric panel or branch circuits?

Yes! Upgrading electric panels or branch circuits to support efficient heating systems or battery storage technology may qualify under specific residential property guidelines in 2025 laws.