Google has scaled back free access to its newly launched Gemini 3 model only days after its debut, following an unexpectedly large wave of user activity. The company introduced Gemini 3 on November 18, and the response was immediate: global interest surged, tech leaders praised the model’s capabilities, and Google’s stock price climbed sharply. But the rapid adoption also placed intense pressure on the company’s infrastructure, prompting Google to impose new limitations on what free-tier users can do.

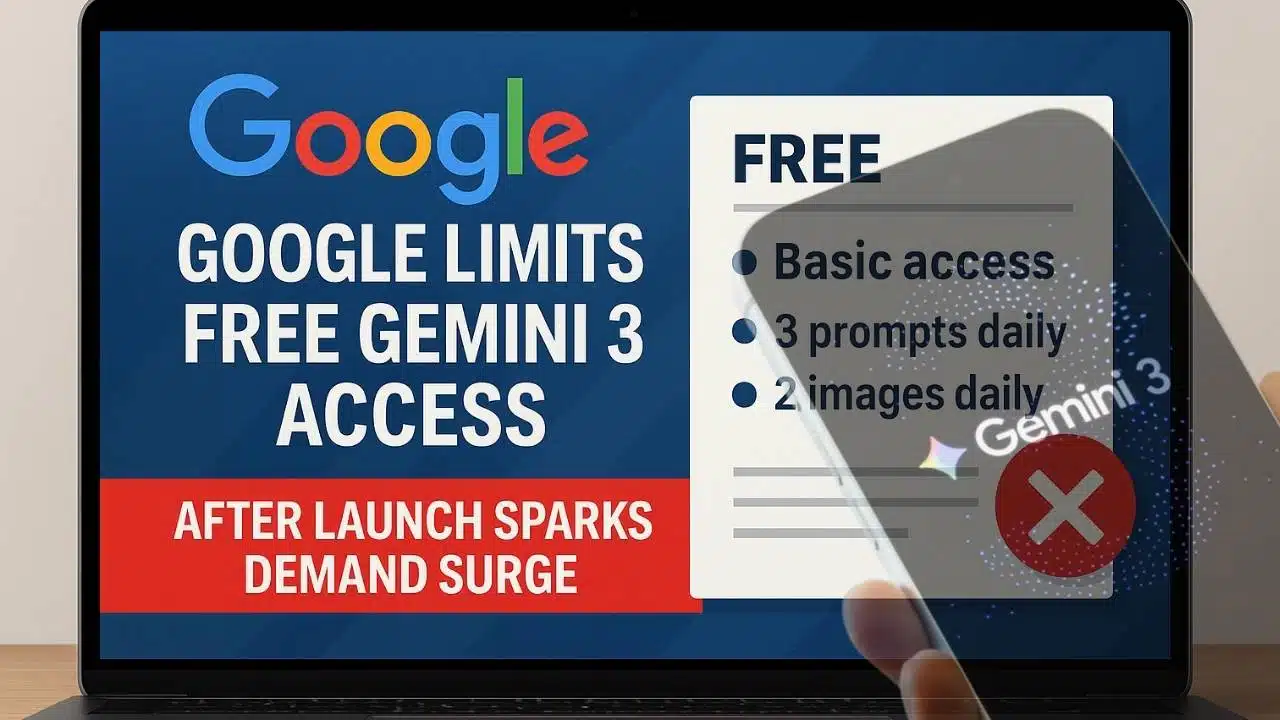

Before the policy change, free users had access to a reasonably generous daily quota, including up to five prompts for the “Thinking” model and three image generations with Nano Banana Pro, Gemini 3’s new image-generation system. Now those limits have been replaced by a vague “basic access” category. Instead of fixed prompt counts, users face fluctuating daily limits that may drop to as few as three prompts, depending on overall system demand. Image generation has also been curtailed, with free users now limited to just two images per day.

The strain was most apparent in Google’s NotebookLM service, where new features like automated infographic creation and rapid slide-deck generation were temporarily pulled back for free users. Google cited “capacity constraints,” underscoring that demand for Gemini 3’s multimodal abilities far exceeded early expectations. The scaling back reflects a familiar tension in the AI industry: powerful models spark enormous interest, but offering them for free at full capacity is difficult to sustain.

Despite these constraints, paid subscribers remain unaffected. Users subscribed to Google AI Pro and AI Ultra — priced at $19.99 per month and $249.99 per month respectively — still enjoy full access to the model, including high daily prompt limits and unfettered use of multimodal tools. The difference between tiers has grown more noticeable, suggesting Google may be nudging heavy users toward premium plans for consistent performance.

A Warm Reception From Silicon Valley Sparks Market Momentum

The enthusiasm surrounding Gemini 3 has been especially intense within the tech community. In one of the most visible endorsements, Salesforce CEO Marc Benioff publicly announced on November 24 that he was switching from ChatGPT to Gemini 3 after using OpenAI’s model daily for nearly three years. His comments were emphatic: he described Gemini 3 as a dramatic leap in multiple dimensions — reasoning speed, accuracy, image quality, and video capabilities — and stated that it felt as though “the world just changed, again.”

This endorsement triggered immediate market reactions. Alphabet’s stock jumped roughly 6% on the first trading day following Benioff’s post and continued to climb on the next. By Tuesday, Google’s market capitalization had risen to nearly $3.9 trillion, positioning the company within striking distance of the $4 trillion mark — a symbolic threshold that reflects both investor confidence and the growing strategic importance of AI leadership.

A major factor behind this optimism is Google’s reliance on its proprietary Tensor Processing Unit (TPU) chips. These chips serve as the computational backbone of Gemini 3, and they represent a crucial alternative to the GPU ecosystem dominated by Nvidia. As demand for advanced models scales globally, having an independent hardware pathway gives Google a long-term competitive advantage. Investors are betting that TPUs — which are designed for efficiency and speed — will help Google expand AI capability without the supply bottlenecks often associated with third-party GPU providers.

The industry reaction to Gemini 3 signals more than just excitement over a new model. For many tech leaders, it represents the arrival of a serious competitor in the high-end AI race. With the model demonstrating strong performance in both reasoning and multimodal output, Google’s position in the next phase of AI development appears stronger than at any point in recent years.

Competitive Tensions Rise as Gemini 3 Outperforms Rivals

The broader AI landscape is feeling the impact of Gemini 3’s release. Shortly after launch, the model topped the LMArena leaderboard with a score of 1501 — surpassing OpenAI’s GPT-5.1 on a majority of benchmark tests. These results have fueled discussion about whether Google is now leading the performance race in frontier models.

The competitive pressure is being felt inside OpenAI as well. According to internal sentiments, employees were cautioned by CEO Sam Altman to prepare for “rough vibes” and temporary headwinds caused by Google’s rapid progress. The message reportedly emphasized resilience as the company works on its next generation of models, highlighting how seriously industry leaders take Google’s advancements.

Nvidia, meanwhile, saw its stock decline roughly 5% amid reports that Meta Platforms is exploring a plan to reduce its reliance on Nvidia hardware. Meta is reportedly considering a strategic shift toward Google’s TPU chips beginning in 2027. If confirmed, this would represent one of the most significant pivots in AI infrastructure since the beginning of the deep learning boom — and it would position Google as a direct supplier of hardware as well as software in the AI ecosystem.

Gemini 3’s success also underscores the rising role of multimodal AI. The ability to process text, images, video, audio, and complex reasoning tasks through a single unified system has set a new standard for AI capability. Google’s strong showing in this domain places pressure on competitors to accelerate their own multimodal research and reinforce their cloud infrastructure to match the growing expectations of both enterprise and consumer users.

What It Means for Users and the Future of AI Access

For everyday users, the most immediate impact is the reduced predictability of free access. While Gemini 3 remains available without cost, the shift to variable daily limits means that the experience may now feel inconsistent. Users who rely on the model for regular tasks — writing, research assistance, design work, idea generation, and other creative workflows — may find the new limits disruptive, especially when they hit periods of heightened demand across Google’s network.

Creators and professionals who depend on image generation may feel the shift even more sharply. Nano Banana Pro, which was one of the most celebrated features of the rollout, now offers only two free images per day. For journalists, designers, marketers, and students producing visual content, this reduction may be too restrictive, potentially nudging them toward paid plans or alternative tools.

For Google, the move reflects an ongoing balancing act between accessibility and sustainability. Offering advanced AI models with near-zero friction generates widespread interest, but keeping those services running at a massive scale requires significant computational power. As demand grows, companies may increasingly adopt tiered models that prioritize paid subscribers while offering limited free access.

More broadly, Gemini 3’s launch illustrates how quickly the AI landscape can shift. Within days, the model reshaped industry sentiment, triggered market movement, influenced competitor strategy, and sparked discussions about long-term hardware ecosystems. As AI capabilities accelerate, companies will continue refining how they allocate access — and how they balance innovation, cost, and fairness.

Users can expect more changes in the coming months as Google continues to adapt to demand and refine the boundaries between free and paid access. The rollout of Gemini 3 has demonstrated that powerful new models can generate surges of global interest — strong enough to test even the infrastructure of one of the world’s largest technology companies. The next phase will likely focus on scaling capacity, stabilizing user experience, and shaping how advanced AI tools are delivered for both individuals and enterprises.