In today’s fast-paced financial landscape, fintech trends in digital transformation are reshaping the way consumers interact with money and financial services.

These groundbreaking innovations are not only redefining convenience but also making finance more accessible and efficient. Staying informed about these trends is crucial for navigating the evolving digital age.

In this article, we’ll explore seven key fintech trends shaping the future of finance. These trends highlight how digital transformation is reshaping consumer experiences, and they’re essential for anyone looking to keep up with this rapidly changing landscape.

The Role of Fintech in Digital Transformation

Fintech plays a pivotal role in driving digital transformation across industries. By integrating technology with financial services, fintech companies are creating seamless and efficient experiences for users. Traditional banking processes are being replaced by digital solutions that offer speed, convenience, and transparency.

For consumers, this means having access to innovative tools for managing money, making payments, and even building wealth. Fintech has made services like online banking, peer-to-peer payments, and digital investments more accessible than ever before. Whether you’re transferring money internationally or tracking your expenses, fintech is at the heart of these advancements.

The Rise of Fintech Trends in Digital Transformation

The integration of technology and finance has led to transformative changes, often referred to as fintech trends in digital transformation. Let’s dive into some of the key developments shaping the future of the industry.

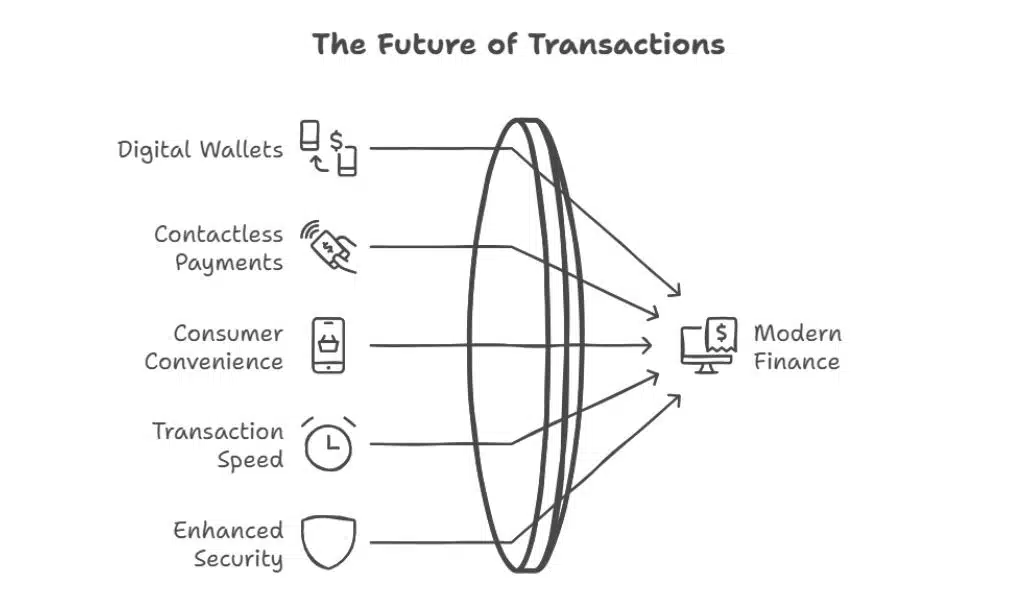

1. Rise of Digital Wallets and Contactless Payments

Digital wallets and contactless payments have become a cornerstone of modern finance. With apps like Apple Pay, Google Pay, and PayPal, consumers can make transactions with just a tap of their phone.

Why It Matters:

- Convenience: No need to carry cash or physical cards.

- Speed: Transactions are faster than traditional payment methods.

- Security: Many digital wallets offer encryption and tokenization for secure payments.

| Popular Digital Wallets | Key Features |

| Apple Pay | Integrated with Apple devices |

| Google Pay | Broad compatibility across devices |

| PayPal | International transfers and e-commerce |

This trend has grown significantly, especially during the pandemic, as consumers shifted toward contactless solutions for safety and convenience.

2. Growth of Decentralized Finance (DeFi)

Decentralized Finance, or DeFi, is an emerging trend that uses blockchain technology to deliver financial services without traditional intermediaries like banks. Through DeFi platforms, users can lend, borrow, trade, and invest directly.

Why It Matters:

- Accessibility: Provides financial services to unbanked populations.

- Lower Costs: Reduces fees associated with traditional banking.

- Transparency: Transactions are recorded on a public blockchain.

DeFi platforms like Uniswap, Aave, and MakerDAO are leading the charge, giving consumers more control over their finances.

3. Expansion of Buy Now, Pay Later (BNPL) Services

Buy Now, Pay Later (BNPL) is becoming a popular alternative to credit cards. With BNPL, consumers can make purchases and pay for them in installments over time, often without interest.

Why It Matters:

- Flexibility: Helps consumers manage cash flow more effectively.

- Accessibility: Available at many major retailers and online stores.

- Lower Financial Risk: Often doesn’t involve high-interest rates or fees.

| BNPL Providers | Unique Features |

| Klarna | Flexible payment plans |

| Afterpay | No interest on payments |

| Affirm | Transparent terms and conditions |

4. Increasing Use of AI in Financial Services

Artificial intelligence (AI) is transforming financial services by enabling smarter, faster, and more personalized solutions. From fraud detection to customer support, AI is enhancing efficiency across the board.

Why It Matters:

- Fraud Prevention: AI systems can detect unusual transactions and prevent fraud.

- Personalized Advice: Robo-advisors like Betterment and Wealthfront offer tailored investment advice.

- Efficiency: Automates routine tasks, saving time for both consumers and businesses.

AI-powered chatbots and virtual assistants are also helping consumers manage their finances with ease.

5. Emergence of Green Fintech and ESG Investments

Green fintech focuses on creating environmentally sustainable financial solutions. From apps that track your carbon footprint to platforms promoting ESG (Environmental, Social, Governance) investing, this trend is gaining traction.

Why It Matters:

- Sustainable Choices: Encourages environmentally responsible financial behavior.

- Transparency: Allows investors to align their portfolios with their values.

- Growing Demand: Consumers are increasingly prioritizing sustainability.

Platforms like Aspiration and Earth Hero are great examples of how fintech is promoting greener choices.

6. Proliferation of Embedded Finance

Embedded finance refers to the integration of financial services into non-financial platforms. Think of ride-sharing apps offering in-app payments or retailers providing loans directly on their websites.

Why It Matters:

- Seamless Experiences: Eliminates the need for third-party financial apps.

- Accessibility: Makes financial services more intuitive and convenient.

- Innovation: Opens up new possibilities for businesses to offer value-added services.

Examples include Shopify’s integrated payment system and Uber’s in-app wallet.

7. Growing Importance of Cybersecurity in Fintech

As fintech grows, so do concerns about security. Cybersecurity has become a top priority to protect consumer data and prevent financial fraud.

Why It Matters:

- Data Protection: Safeguards sensitive information like account details.

- Trust: Builds confidence in using digital financial services.

- Compliance: Ensures adherence to regulatory requirements.

Consumers should use strong passwords, enable two-factor authentication, and choose platforms with robust security measures.

How Consumers Can Prepare for These Trends

Adapting to these fintech trends requires proactive steps:

- Stay Informed: Follow industry news and updates about fintech innovations.

- Evaluate Platforms: Research the credibility and features of fintech apps before using them.

- Prioritize Security: Use strong passwords, enable two-factor authentication, and be cautious of phishing scams.

- Embrace Learning: Explore educational resources to understand new technologies like DeFi and ESG investing.

By staying ahead of these trends, consumers can make smarter financial decisions and take full advantage of what fintech has to offer.

FAQs About Fintech and Digital Transformation

What is fintech, and how does it benefit consumers?

Fintech refers to technology-driven financial services that improve convenience, accessibility, and efficiency. It benefits consumers by offering faster, cheaper, and more personalized solutions.

Are digital wallets safe to use?

Yes, digital wallets are generally safe. They use encryption and tokenization to protect user data and transactions. Consumers should enable additional security features like biometric authentication.

How can consumers get started with DeFi or ESG investing?

To start with DeFi, choose a reliable platform like Aave or Uniswap and learn about blockchain technology. For ESG investing, research platforms that focus on socially responsible investments, like Aspiration or Betterment.

Takeaways

The financial world is undergoing rapid changes, with fintech trends in digital transformation paving the way for unprecedented opportunities. From AI innovations to sustainable finance, these trends empower consumers to adapt and thrive in a digital-first world.

As these trends continue to grow, they offer exciting opportunities to enhance convenience, accessibility, and sustainability in personal finance. Embracing these changes will not only help you navigate the digital age but also empower you to take control of your financial future. Stay informed, stay secure, and explore the possibilities that fintech has to offer.