You may feel lost when you use a crypto exchange to buy digital currency. By August 2025, the total value of cryptocurrencies jumped to almost four trillion dollars. This guide will break down seven key ideas, from blockchain technology and proof of work to crypto wallets, so you can trade with more confidence.

Keep reading.

Key Takeaways

- By August 2025, the crypto market neared $4 trillion on blockchain networks. Blockchain is a shared ledger that links blocks by consensus to stop double spending. Firms like JPMorgan run public-ledger pilots to cut fees, and smart contracts lock in rules automatically.

- You must use a crypto wallet to store private keys. A 2014 exchange hack cost users millions, and one third of all bitcoins are lost to missing keys. Hardware (cold) wallets keep keys offline, while hot wallets connect online but incur gas fees up to $50 per transfer.

- Altcoins are any tokens beyond bitcoin. On August 8, 2025, total crypto value hit $3.86 trillion. Examples include Ether, XRP, Solana, and memecoins like Doge or Shiba Inu. CFA Keith Black warns most lack lasting value. Invest only spare cash, set a risk plan, and use a cold wallet for strong security.

- “HODLing” means holding coins long term to save on fees and seek capital-gains perks. If you spent $1,000 at $300 per BTC in early 2015, you’d hold 3.33 BTC worth over $90,000 each by May 22, 2025. Corey Roun at Lyons Wealth says long holds beat daily trading for most newcomers.

- DeFi apps let you trade, lend, and stake on smart contracts without banks. In 2022, hackers stole $3.8 billion from DeFi, says Chainalysis. DeFi offers low fees, fast global transfers, and yield farming but risks code bugs, governance gaps, and gas-fee spikes. NFTs are one-off tokens for art or games—Beeple sold an NFT for $69 million—yet they face volatile prices and fees.

What is Blockchain Technology and How Does It Work?

Blockchain technology stores digital currency data across a distributed ledger. The system links blocks with cryptographic techniques. Each block holds a bundle of crypto asset transfers.

Nodes in the network validate entries by following consensus rules. This process stops double spend and reduces single points of failure.

JPMorgan Chase runs pilot projects on a public ledger to lower transaction fees. Supply chain firms trace parts in real time, nonprofits manage voting, and crowdfunders issue tokens.

Smart contracts lock in rules and cut manual steps. Users lock digital assets behind private keys in a crypto wallet. The lack of a central server blocks single points of failure and stops government interference.

Why Do You Need a Cryptocurrency Wallet?

A crypto wallet holds your digital currency keys. You need one to store coins safely. It keeps your private keys away from hackers. That idea shows why not your keys, not your crypto holds true.

Major crypto exchanges face hacks that led to big losses. One breach in 2014 cost users millions in funds. An offline device keeps keys off the web. This hardware wallet acts like an armored safe.

Hot wallets link to the internet for quick trades. They incur gas fees that rise with network load. Those fees can hit tens of dollars per transfer. Offline storage cuts your exposure to hacks.

It still faces transaction fees when you send coins. One third of bitcoins sit lost for good. Losses come from lost private keys. Secure backups boost your crypto security.

Understanding Altcoins: What Are They and Should You Invest?

Altcoins refer to digital tokens beyond bitcoin. They include XRP and Ether utility tokens, governance coins, platform offerings like Solana, and security tokens such as MS Token. Some memecoins, Doge or Shiba Inu, swing wildly like a roller coaster.

Total crypto market cap hit about $3.86 trillion on August 8, 2025. Keith Black, CFA, warns most crypto assets lack lasting value.

Experts tell newcomers to pick bitcoin and Ether before smaller coins. You should use a crypto wallet and a cold wallet for strong crypto security and private keys. Set a risk management plan, invest only spare cash.

Watch transaction fees and gas fees on smart contract chains like Ethereum. That approach helps guard your investment.

What Does HODLing Mean in Crypto Investing?

HODLing refers to holding digital assets for the long haul. This approach cuts gas fees and transaction fees. It may also offer long-term capital gains tax perks. It asks for iron patience and can skip quick market gains.

A $1,000 buy at $300 per bitcoin in early 2015 gave about 3.33 BTC. As of May 22, 2025, each coin tops $90,000.

Corey Roun at Lyons Wealth Management says long-term holds beat daily trading for calm. New investors should start small and stash coins in a cold wallet. Ignoring wild market volatility feels like riding out a storm at sea.

Smart investors blend HODLing with risk management and sound strategy.

Decentralized Finance (DeFi) Overview

DeFi shoves banks aside and lets you trade assets on a shared ledger. It runs on digital agreements and stake pools, so you can earn while you hold.

How Does DeFi Work?

Smart code powers finance apps that run on blockchains. It cuts out banks and moves funds in seconds.

- Self-enforcing code handles each deal on blockchains within decentralized finance. It uses smart contracts on Ethereum network to automate loans, swaps, and staking digital assets without a middleman.

- Validators run nodes and check every transaction. They lock tokens under proof of stake, secure the network, and earn transaction fees.

- Gas fees fund every action on the chain. Users pay small amounts in ether as compensation for computation and network upkeep.

- Anyone can access these apps with a crypto wallet. Each person holds private keys to store and move digital currency from a hot wallet or cold wallet.

- Peer to peer platforms let people swap coins without banks. Decentralized exchanges execute trades with code, not a central office.

- All activity lives on public ledgers to boost transparency and security. Anyone can review each transaction, which cuts down on fraud and market manipulation.

What Are the Benefits of DeFi?

Decentralized finance shifts control to investors. It cuts out banks and brokers.

- Gas fees drop, offering cheaper transactions than banks charge for money transfers.

- Platforms process remittances fast and without middlemen, so funds reach the wallet in minutes.

- Anyone with an internet link can join, raising financial inclusion in hundreds of countries.

- Yield farms and flash loans unlock new income paths beyond bonds and stock dividends, pushing earning odds up.

- Private keys let users hold digital assets fully, and they skip risky custody by banks.

- Public ledgers log every trade, feeding clear proof and halting fraud or double-spend problems.

- Blockchain technology binds smart contracts to run deals, cutting the need for a lawyer or a manager.

- Crypto wallets use strong crypto security, and investors choose an online wallet or an offline vault.

What Are the Risks of DeFi?

DeFi brings new chances to earn yield on digital assets. It also poses serious hazards to investors.

- Smart contract errors can freeze funds or open security gaps in staking pool code.

- In 2022, Chainalysis found hackers drained $3.8 billion from DeFi protocols in major exploits.

- Poor governance at yield aggregator projects can let teams mint or steal tokens.

- Weak oversight under U.S. dollar rules makes platforms easy prey for crypto scams.

- Whale trades can swing token prices, hurting small holders in liquidity pools.

- Spikes in gas fees on the ether network hike transaction fees and cut profits.

- Illiquid pools for ADA chain tokens can trap digital currency and block withdrawals.

- Weak crypto security in hot wallets can expose private keys and lead to stolen assets.

- Price swings in liquidity pools drive impermanent loss and curb returns.

- Algorithmic stablecoins may break their peg, wiping out user deposits.

Non-Fungible Tokens (NFTs) Explained

NFTs act like one-of-a-kind tokens on a blockchain network, powered by smart contracts and kept in a crypto wallet, so read on to see why they light up art and gaming.

What Are NFTs?

NFT tokens store proof of ownership for digital items on a public ledger. They use self-executing contracts on Ethereum network, a prime example of blockchain technology, to record each sale.

Each token stands alone, so buyers cannot swap one for another like they do with bitcoin or altcoins. Collectors treat them like digital assets; they link digital art, game gear, and virtual skins to a single owner.

Artists list work on specialized NFT marketplaces and set terms via self-executing contracts. Anyone with a crypto wallet or hardware wallet can bid using ether or another virtual currency.

Each transfer incurs gas fees and shows up on the public ledger. New investors might seek investment advice from a financial advisor to cover capital gains and manage crypto security.

How Are NFTs Used?

Creators sell rare items as NFTs on public ledgers. Collectors prove ownership with token records.

- Digital art sales: Creators turn artwork into NFT tokens using blockchain technology on the ethereum network, then list them on popular exchanges. Smart contracts direct royalties to artists on every secondary sale, so they earn funds each time their work moves hands.

- Music rights transfers: Bands and solo acts mint tracks as digital coins, letting fans buy songs directly. Purchasers store the token in a cold wallet, secure it with private keys, and stream or resell to other collectors.

- Gaming asset trades: Developers attach NFT tags to rare skins or weapons in a game, then let players swap items peer to peer. Linked to a hot wallet, traders skip middlemen and avoid steep gas fees charged by some networks.

- Collectible card markets: Sports and fiction cards become digital assets that show edition counts and rarity levels. Platforms use cryptographic systems to confirm each trade, cutting out auction houses and blocking market manipulation.

- Event ticketing: Organizers issue NFT tickets, each tied to a seat number, to fight fraud and scalping. Attendees flash the token in their crypto wallet at the gate to gain entry without paper.

- Access badges: Schools, clubs and firms issue tokens as badges of honor instead of printed certificates. Holders verify the NFT in a wallet app to prove status without third-party checks.

- Royalty automation: Publishers embed payout rules into smart contracts to split sale proceeds among writers, artists and agents. This model removes the need for a financial advisor and delivers fast, transparent payments.

Why Are NFTs Valuable?

Rare digital assets can fetch huge sums. In 2021, Beeple sold art for $69 million. Low supply meets high demand and drives prices skyward. Famous creators fuel bidding wars with their reputation.

Blockchain technology keeps ownership proof secure. Smart contracts log each sale and track key pairs. Buyers hold tokens in cold wallet or hot wallet. Market volatility can swing values up or down fast.

Collectors must use risk management tools and watch transaction fees.

How Can You Manage Fear of Missing Out (FOMO) in Crypto?

New traders often chase trending altcoins or NFTs, skimping on research and boosting risk of losses. FOMO makes investors buy DeFi tokens, dip into futures contracts and ignore market manipulation signs.

Sudden spikes in gas fees or drops in market capitalization trigger panic selling. Emotional buys erase gains fast.

Set clear rules for crypto security and risk management. Invest only spare cash, never tap funds tied to rent or bills. Use dollar-cost averaging or a HODLing strategy to ride market volatility.

Store private keys in a hardware wallet and follow advice from a financial advisor. Slow moves and smart plans beat wild bets.

What Are Common Crypto Scams and How to Avoid Them?

Scammers stole 5.6 billion dollars in 2023 alone. FBI logged over 69,000 crypto fraud complaints last year.

- Counterfeit exchange sites: Scammers create look alike pages for Binance or Coinbase, trick users into entering private keys. Once you send funds, payment is irreversible and you lose your digital currency. Always verify the site address, use saved bookmarks, enable two factor authentication.

- Sham coin launches: Fraudsters pitch altcoin ICOs with sky high returns, they lure victims into sending digital assets. Investors lost 5.6 billion dollars to these schemes in 2023, a 45 percent jump from 2022. Research the development team, read the white paper, check updates from the financial action task force.

- Pump and dumps: Scam groups hype small digital assets on social media or dark web to spike prices then sell. These schemes made up 10 percent of fraud reports but caused half of total losses. Track market capitalization and trading volume, avoid hype, apply risk management, use dollar cost averaging.

- Rug pulls: Developers drain funds locked in smart contracts on Ethereum blockchain without warning. You could lose your entire deposit in a matter of seconds. Choose audited decentralized finance platforms, inspect code audits, stick to projects with locked liquidity.

- Cloud mining traps: Fraud mining pool sites demand upfront fees and promise impossible returns. Victims rarely see any hashing rewards. Look for transparent mining stats, verify pool performance, avoid unsolicited offers.

- Phony wallets: Malicious apps mimic legitimate crypto wallets to swipe funds. Fake hot wallet apps often harvest your seed phrases or private keys. Download the official crypto wallet from the project site, store keys in a cold wallet.

- Bogus advisors: Some self styled planners push crypto etfs or strategic bitcoin reserve funds to pad their pockets. They may dodge rules set by the central bank or financial regulator. Check SEC registration, seek counsel from a real financial advisor, watch for pressure tactics.

- Malware and airdrop hoaxes: Scammers send fake NFT or token giveaways to install mining viruses on your device. That software can drain your digital assets without warning. Avoid random links, use antivirus tools, never share seed phrases or private keys.

- Social media impostors: Fraudsters impersonate celebrities or projects on Twitter or Telegram to promote scam tokens. They may promise free digital currency in exchange for a small payment. Look for verified badges, avoid urgent requests, verify announcements on official channels.

Why Is Volatility Important in the Crypto Market?

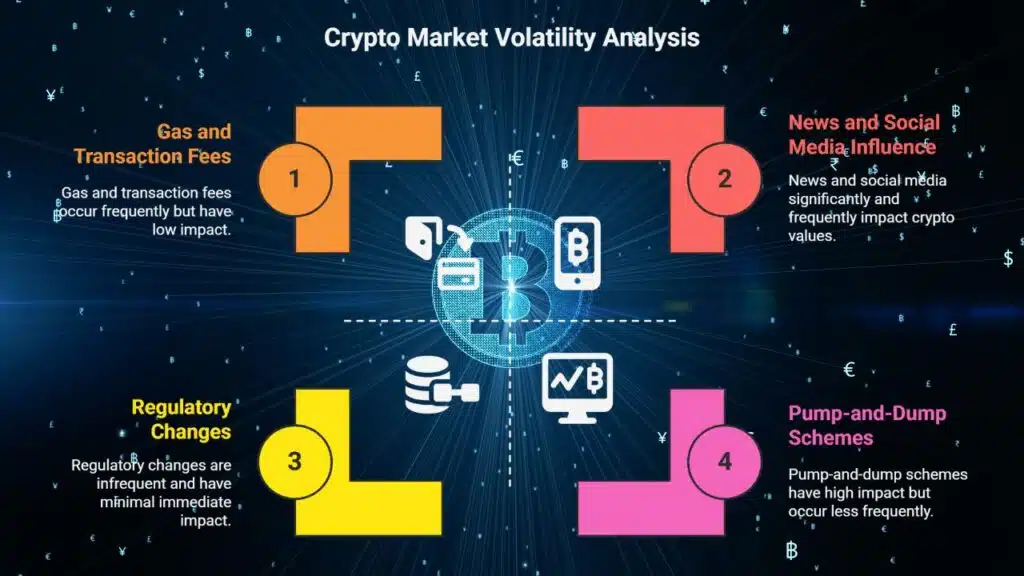

Crypto prices swing, so traders face risks and rewards. Bitcoin lost up to 73 percent in one year and gained more than 300 percent in another. Most digital currency holds no value beyond hype, so news and social media can send values soaring or crashing.

Large holders push pump-and-dump schemes, and memecoins can flip in minutes. Regulators still write rules, which adds unexpected whipsaws. Traders use risk management and technical analysis to tame wild moves.

Volatility fuels active tactics, like trading derivatives for a hedge or leverage. Traders buy dips, sell spikes, and secure digital assets in a cold wallet to protect private keys during swings.

Gas fees and transaction fees can climb with volume, eroding gains. Exchanges sometimes halt trades in extreme swings, trapping funds. Market capitalization can surge or drop overnight, reshaping portfolios in hours.

What Are Gas Fees and How Do They Affect Transactions?

Gas fees on the Ethereum network can soar past $50 per trade when traffic peaks. They act like a bridge toll for each smart contract call. You pay a flat or percentage fee whenever you move digital assets on blockchain technology.

Miners who focus on mining cryptocurrency earn these charges as they confirm each transfer. You can batch transfers or pick low-traffic hours to cut costs.

Cryptocurrency exchanges also impose transaction fees and spread fees. These slices can nibble at profits more than market moves. Limit orders curb trading costs and tame volatility.

You can check fee tiers on each platform before you hit buy or sell in your crypto wallet. Good crypto security means minding these hidden drags on your net returns.

How Do Whales Influence Crypto Market Movements?

Crypto whales hold huge sums of digital assets. They can buy or sell large stacks in one trade. One big sell can push prices down fast. Retail investors often suffer losses after sudden swings.

Whales use pump and dump schemes in many low liquidity altcoins. This trick can spark big volatility, pump up tokens then slam them down. Smart contracts and market manipulation tools let them hide giant trades.

Then traders must set exit rules, like sell if down ten percent.

Why Should You Diversify Your Crypto Portfolio?

A mix of digital assets slows losses when prices jump or drop. Bitcoin gains feel steady, while an alternative coin can soar or crash in one day. Experts say you should limit crypto to 5 percent of your portfolio, with some forecasts stretching to 15 percent by 2025.

Using crypto ETFs or an index fund gives you broad exposure with one trade, cutting your work of moving coins between a hot wallet and a cold wallet. This risk management move guards you from market volatility spikes.

What Is Dollar-Cost Averaging (DCA) and How Does It Work?

DCA, or dollar-cost averaging, spreads your buys over time. It cuts swing risk and tames market volatility.

- Set a fixed sum, say $50 or $100 per month. It buys crypto no matter if markets spike or dip.

- Choose a tool like Coinbase or TradingView for auto orders. Hook your crypto wallet, hot wallet or cold wallet, to execute each buy safely and guard your private keys.

- Treat this as a risk management plan to fight market manipulation. It stops you dumping all cash at a doubtful peak.

- Avoid the lump sum trap that haunts bondholders in t-bills or ADA stakers. It keeps you from emotional buys when gas fees zoom.

- Watch your digital assets grow like drops filling a jar. It builds a solid position over months and years.

- Track each purchase in a sheet or on Etherscan to view cost basis. It logs capital gains for your tax chores.

- Check with a financial advisor for tweaks if transaction fees bite. It holds strong in defi or ETH smart contracts.

- Spread your buys across crypto etfs and markets in crypto-assets. It lowers risk in wild market capitalization swings.

- Use DCA in volatile markets like bitcoin mining or nft trading. It carves a neat path through price roller coasters.

- Stay alert for crypto scams and follow the plan without panic. It firms up your crypto security and calm.

How Can You Stay Updated on Crypto Market Trends and News?

Material Bitcoin keeps track of market trends and safety tips. Use X (formerly Twitter) and Reddit channels to gauge user feedback on digital currencies. Chainalysis tracks DeFi hacks and theft trends.

Keep an eye on EU MiCA, SEC, and CFTC updates to spot rule shifts. Bankrate and Investopedia post fact-checked guides on crypto security and risk management.

You can avoid crypto scams and market manipulation if you stay alert. Track gas fees and market volatility in real time using Material Bitcoin alerts or X threads. Scan scam reports on Reddit to spot odd patterns.

Talk with a financial advisor before big crypto moves. Hot wallet or cold wallet choice matters for storing digital assets. Watch legal tender shifts and capital gains rules to sidestep tax pitfalls.

How to Choose the Right Crypto Exchange?

Picking the right crypto exchange saves time and protects funds. It helps you trade digital assets safely.

- Compare fee structures. Flat fees, percent fees and spread fees change your cost per trade, and high gas fees can cut your crypto returns.

- Survey coin range. Pick digital currency choices like Bitcoin, Ethereum, Cardano, DeFi tokens, NFT art and crypto etfs to build a broad stack.

- Check exchange security. Look for cold wallet storage, multi factor logins, SSL locks, and rules that stop money laundering, fights schemes like dread pirate roberts and keeps your private keys safe.

- Verify regulatory status. Seek SIPC coverage, banking licenses, clear capital gains reports for each taxpayer and solid anti money laundering rules.

- Test user interface. A clear dashboard, chart tools and fast order entry, on desktop or mobile, beat a basic app; Robinhood, PayPal or Cash App only sell Bitcoin and curb your trades.

- Measure liquidity levels. High volume, low slippage and swift order fills help you trade in times of sharp market volatility and dodge market manipulation.

- Inspect deposit options. Use bank wire, credit card, heloc or line of credit, and safe fiat rails; Coinbase, Kraken and Binance all offer wide ways to fund your account.

- Seek support options. Find 24 hour chat or phone help to rescue a locked crypto wallet, recover a lost private key or solve a trade glitch.

- Explore trading tools. Look for options trading, margin lines, futures and smart contracts, but mind the risk, or chat with a financial advisor before you jump into leverage.

- Research brand history. Top exchanges hold the strategic bitcoin reserve, vet tokens against blockchain technology flaws and have a track record that beats shady startups.

What Are Effective Risk Management Strategies in Crypto?

Risk creeps in fast in crypto. Good guardrails help you trade smart.

- Set a trading budget. Only risk money you can afford to lose.

- Keep crypto below 5% of your portfolio. Experts share that rule to tame market volatility.

- Clear high-interest debt before you invest. Virtual currencies can wait as bills mount interest.

- Diversify across digital currency, tokens, crypto etfs and stocks. That move spreads risk like a basket of eggs.

- Store private keys in a cold wallet. Use a hot wallet for quick trades to boost crypto security.

- Plan exit rules, sell if a token falls 10%. This rule stops losses in a wild blockchain technology ride.

- Account for gas fees, transaction fees and capital gains. Taxes hit profits if you skip this step.

- Seek a financial advisor to review your plan. They can flag crypto scams, market manipulation and smart contract faults.

Why Are Security and Private Keys Critical in Crypto?

Ella stored her bitcoin on an exchange and lost access one day. She learned the hard way that private keys act like digital house keys. One-third of bitcoins vanish when owners misplace these keys, so it pays to lock them up good.

A cold wallet like a USB drive works offline, away from hackers. We often quote, Not your keys, not your crypto, to keep that idea front and center.

Online exchanges live under attack each year. A big 2016 hack drained millions from off-chain storage accounts. Digital assets vanish when thieves swipe private keys. Each move on blockchain technology stays in the ledger, no take backs.

Hardware wallets beat software or hot wallets in safety. They sign smart contracts only in your hands. Good investors use a hot wallet for daily buys and a cold wallet for long term stash.

What Can New Investors Learn from Experienced Crypto Investors’ Mistakes?

Experienced investors often chased hype and lost cash in 2017 mania. New traders test small stakes and only risk disposable income. Smart investors store private keys in noncustodial hardware wallets.

Hot wallet apps like MetaMask serve for quick trades. Influencer tips never drive their buying choices. Everyone spots market manipulation red flags in token forums.

Many old hands panic sold at peak valuations. Others backed unvetted token sales and blew funds on crypto scams. Today, readers study smart contracts before staking tokens. They track gas fees and transaction fees on each transfer.

Portfolio managers diversify digital assets by market cap tiers. Every plan includes risk management and crypto security steps. Short tempers fade as calm holds through wild volatility.

Takeaways

Seven key ideas can guide new crypto traders. Blockchain technology lays the groundwork and secures every deal. A digital vault, and its secret code, locks down your digital cash. Alternative tokens and a steady hold offer choices in a bumpy market.

Open finance and digital collectibles open fresh chances to earn and collect. Fear of missing out control helps you skip rash buys. Nail these steps, and you can build a safer, smarter portfolio.

FAQs

1. How do I protect my private keys?

A private key unlocks your crypto wallet. Guard it like a secret code. Write it on paper, stash it in a safe, or use offline storage, also called a cold wallet. A hot wallet stays online and risks attack. This step boosts crypto security, cuts hacking risk.

2. Why do I pay gas fees?

Gas fees are transaction fees on blockchain technology. They pay miners to record moves in digital currency. Fees can spike in market volatility. You can time your trades to save coins.

3. What are smart contracts and decentralized finance?

Smart contracts are self-executing code. They act like a digital escrow. They drive decentralized finance, or defi. You can lend, borrow, swap digital assets. All without a bank.

4. How can I spot market manipulation and crypto scams?

Some traders pump and dump prices. That is market manipulation. Scammers promise free coins to hook you. Good risk management means check white papers, track market capitalization, use trusted platforms. If it smells off, walk away.

5. Do I need a financial advisor for crypto?

A financial advisor can guide you on capital gains, tax rules, crypto etfs, and digital collectibles, also called nft (non-fungible token). They know transaction fees and market rules. They keep you sharp when markets roar like a wild bull.