Fraud hits businesses hard, like a thief sneaking in through the back door. You run an online store, and suddenly, fake orders pile up. Customers lose trust when identity theft strikes.

Payment fraud drains your profits fast. It’s tough to spot these scams without the right tools. Think about those sleepless nights worrying over fraudulent transactions.

In 2024, American businesses lost over $12.5 billion to fraud. Global losses hit nearly $50 billion each year. About 80% came from attempted payment fraud. Malicious actors use AI to trick systems, from phishing emails to account takeovers.

This blog post explores seven top fraud detection software options. We’ll cover Sift’s machine learning, Forter’s real-time monitoring, and more. You’ll learn about key features like device fingerprinting, behavioral analytics, and anomaly detection.

These tools help protect e-commerce platforms, boost customer experience, and cut fraud losses.

Ready to fight back?

Key Takeaways

- In 2024, American businesses lost over $12.5 billion to fraud. Global losses reached nearly $50 billion each year. About 80% of losses came from attempted payment fraud.

- Sift uses machine learning on over 1 trillion annual events. It protects more than 700 brands like Hertz, Yelp, and Poshmark. G2 Fall 2025 reports rank it number one in fraud detection.

- Forter offers real-time transaction monitoring with machine learning. It cuts chargebacks and fights account takeovers for e-commerce platforms.

- Signifyd provides a 100% chargeback guarantee. It uses real-time monitoring and device fingerprinting to block fraudulent orders.

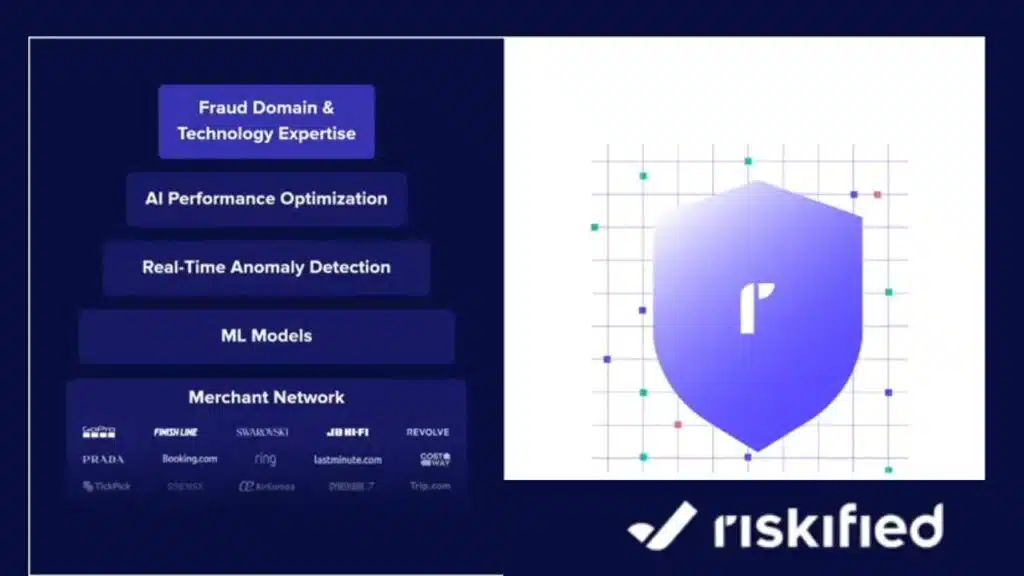

- Riskified’s AI detects fake accounts in real time. It supports high transaction volumes and offers full chargeback guarantees for retailers.

What makes Sift’s machine learning effective for fraud detection?

Sift’s machine learning stands out because it taps into a Global Data Network that processes over 1 trillion annual events. This massive scale lets the system spot fraud patterns fast.

Imagine a watchful guard, always scanning for trouble in e-commerce platforms. Sift ranks number one in fraud detection, e-commerce fraud protection, and risk-based authentication, according to G2 Fall 2025 reports.

It shields more than 700 brands worldwide, like Hertz, Yelp, and Poshmark. The platform digs into hundreds of user signals across industries, using behavioral analytics and device fingerprinting to catch anomalies.

Clearbox Decisioning crafts industry-specific fraud strategies, making risk scoring sharp and effective. You get precise workflows, smarter risk thresholds, and quicker decisions that boost confidence.

Sift connects identity, behavior, and intent through machine learning models for smart fraud choices. Retailers love how it prevents fraudulent transactions and account takeovers with real-time monitoring.

Think of it as a clever detective, piecing together digital footprints to stop payment fraud before it hits. The system uses artificial intelligence to analyze touchpoints and send smart alerts, improving operational efficiency.

Online merchants cut fraud losses and protect brand reputation this way. An evaluation guide helps identify spots for better fraud prevention. Sift fights bots, credential stuffing, and phishing attacks with anomaly detection and API integrations.

How does Forter monitor transactions in real time?

Forter specializes in transaction protection and real-time decisioning. This platform offers e-commerce integrations for seamless monitoring. You get machine learning analytics that analyze transaction data right away.

Forter provides account protection alongside transaction monitoring, like a vigilant guard dog spotting trouble before it bites. Real-time monitoring helps reduce losses and chargebacks, saving your business from sneaky fraud hits.

The platform supports businesses with rapid, automated fraud assessment. Imagine it adapts to new fraud patterns as they emerge, like a smart chameleon changing colors to stay ahead.

Forter integrates with major e-commerce platforms for continuous security, keeping everything smooth and safe.

Fraud detection feels like a cat-and-mouse game sometimes, but Forter makes it easier. It uses real-time fraud detection to catch fraudulent transactions on the spot. Machine learning models power this, scanning for anomaly detection and risk signals.

You avoid account takeover and credential stuffing attacks with its behavioral analytics. E-commerce fraud protection shines here, shielding online merchants from payment fraud and fraudulent orders.

The system boosts operational efficiency with API integrations and smart alerts. Chargeback protection keeps your brand reputation strong, cutting down on fraud losses. Forter handles payment verification across e-commerce platforms, making sure fake websites and online scams don’t slip through.

What comprehensive fraud prevention solutions does Kount offer?

Kount delivers a trust and safety platform with an easy-to-use interface that spots fraud fast. Businesses love how high customization options let them adjust fraud prevention to fit their needs, like a custom suit for your online shop.

This setup includes real-time monitoring, which cuts down on chargebacks and keeps accounts in check. Imagine you’re running an e-commerce platform, and Kount’s account management support jumps in to detect and prevent fraudulent transactions before they hurt.

The platform scales up to handle business growth and more transaction volumes, integrating smoothly with various payment processors and e-commerce providers. You can set custom workflows and thresholds for fraud detection, making risk management a breeze.

Plus, responsive customer support stands by to tackle fraud-related challenges, boosting operational efficiency and protecting brand reputation from payment fraud.

How can SEON’s fraud detection be customized and scaled?

SEON lets you tweak detection rules to fit your business needs, like adjusting for specific fraud patterns. You modify these rules easily, creating custom fraud prevention that matches your operations.

The platform uses over 50 social signals and digital data points for risk evaluation. This setup spots suspicious activity fast through digital footprint visibility. Imagine your fraud detection as a smart guard dog, one that learns your yard and barks only at real threats.

SEON offers real-time risk scoring and identity verification, plus a user-friendly interface for quick setups. API integrations make it simple to connect with your systems, boosting operational efficiency.

Scale grows with your business, thanks to flexible pricing that supports expansion without breaking the bank. The solution works across multiple sectors, from e-commerce platforms to online merchants.

Transparent risk scoring explains flagged transactions clearly, helping you understand fraud signals like behavioral analytics or device fingerprinting. Users identify fraudulent transactions swiftly, cutting fraud losses and protecting brand reputation.

Think of it as upgrading from a bicycle to a rocket ship; you handle more volume as you grow. SEON combats account takeover and fraudulent payments with machine learning algorithms, ensuring real-time monitoring keeps your online stores safe.

How does Signifyd protect e-commerce businesses from fraud?

Signifyd’s commerce protection platform handles automated approvals and declines with ease. It gives a 100% chargeback guarantee for e-commerce transactions, so you avoid those nasty losses from fraudulent orders.

Imagine it like a trusty guard dog that sniffs out trouble before it bites. The system integrates right into online stores to shield against payment fraud. Merchants love the intuitive dashboard for monitoring and managing fraud risks, keeping everything in check.

It enables real-time decision-making to cut down on false positives, which means fewer good customers get turned away by mistake. Plus, it offers analytics to help you spot fraud trends, turning data into your secret weapon against sneaky attacks.

This tool supports cross-border commerce with scalable fraud protection, perfect for growing online merchants. Think of it as a smart shield that adapts to your needs, blocking account takeover and fraudulent transactions without slowing you down.

Signifyd uses real-time monitoring and device fingerprinting to catch risks early. It fights e-commerce fraud with machine learning models that learn from patterns, improving over time.

Designed for rapid implementation in e-commerce environments, it fits into your setup fast. You get protection from payment fraud and fraudulent payments, boosting your brand reputation.

Smart alerts and anomaly detection keep you ahead of threats like credential stuffing or fake login pages.

What advanced analytics does Accertify use for fraud mitigation?

Accertify steps up with an integrated dashboard that handles comprehensive fraud management, like a trusty sidekick keeping an eye on everything. This tool adapts to complex fraud scenarios, packing strong detection capabilities to spot trouble before it bites.

Businesses love how device intelligence identifies and mitigates risks, almost like reading a crook’s mind through their gadget. The analytics fit right in with existing systems, making integration a breeze.

You get real-time monitoring that analyzes suspicious patterns on the fly, catching fraudulent activities in the act.

Imagine, Accertify’s advanced analytics slash losses and chargebacks, saving your wallet from sneaky hits. The platform dishes out detailed reporting on fraud incidents, so you see the full story.

Customize workflows and risk thresholds for that granular control, adjusting it just right for your setup. It boosts operational efficiency with smart alerts and anomaly detection, weaving in machine learning models for top-notch fraud detection.

Online merchants gain from this fraud detection platform, shielding against account takeover and payment fraud while keeping customer experience smooth.

How does Riskified use AI to prevent fraud for retailers?

Riskified specializes in e-commerce fraud prevention with real-time monitoring. Their AI-driven platform detects fake accounts and fraudulent transactions right away. Think of it like a smart guard dog that sniffs out trouble before it bites.

Retailers get dashboard visibility to track fraud patterns and responses easily. This setup integrates with major retail systems for seamless fraud prevention. Plus, the platform supports high transaction volumes for scalability, so it grows with your business.

Riskified’s AI adapts to new fraud tactics and improves over time, keeping you one step ahead.

They offer a full chargeback guarantee to merchants, which takes the sting out of fraud losses. Responsive support helps retailers address fraud issues quickly, like having a helpful friend on speed dial.

You can customize it with machine learning models and behavioral analytics for better risk scoring. Device fingerprinting spots anomaly detection in real-time, catching account takeover attempts.

Online merchants protect their brand reputation this way, boosting customer experience and operational efficiency. E-commerce platforms gain from API integrations that handle payment fraud and fraudulent orders without hassle.

Key Features to Look For in Fraud Prevention Software

You want software that spots trouble fast, like real-time monitoring that catches shady transactions before they hurt your business. Think about tools with behavioral biometrics and anomaly detection, they act like a sharp-eyed guard dog, sniffing out fraud patterns you might miss on your own.

How does real-time detection and response prevent fraud?

Real-time detection spots fraud patterns and anomalies right as they happen, like a watchful guard at the gate. Tools like Salv Bridge let financial institutions team up fast, boosting fund recovery rates by up to 80%.

This quick action stops funds from slipping out of accounts early in the payment chain. Mastercard Consumer Fraud Risk taps AI and real-time payment data to block unauthorized transactions on the spot.

Imagine fraud as a sneaky thief; real-time monitoring slams the door before they grab anything.

EBA CLEARING FPAD offers real-time fraud prevention tools, including IBAN/name checks, to catch issues instantly. SWIFT GPI lets you stop and recall payments in real time, even for cross-border scams.

Such systems keep fraudulent transactions at bay and help meet rules like the PSR’s 2024 50/50 liability for APP fraud compensation. They cut fraud losses for online merchants and boost operational efficiency with smart alerts.

Think of it as having a super-fast shield against account takeover attacks.

What is device fingerprinting and behavioral analysis in fraud detection?

Device fingerprinting grabs details like browser type, IP address, and user habits to spot fraud. Think of it as a digital ID card that flags odd patterns right away. Platforms like Accertify use this device intelligence to cut risks with smart analytics.

It helps tell real users from fakes, kind of like a bouncer at a club door.

Behavioral analytics watch for weird actions, such as strange logins or profile tweaks that scream trouble. Featurespace offers adaptive tools for this, picking up subtle fraud signs.

Resistant AI profiles identities and behaviors to slash manual checks. Machine learning models dig into patterns, sorting fraud from the good stuff. ComplyAdvantage’s graph network detection links up complex fraud ties, while behavioral analysis highlights anomalies in real time.

How do machine learning and AI improve fraud prevention?

Machine learning and AI spot new fraud patterns that no one has seen before. They catch sneaky tricks crooks try, like a hawk eyeing its prey. Take ComplyAdvantage, for example. It uses advanced machine learning for anomaly detection, dynamic model tuning, and real-time risk assessment.

This keeps businesses one step ahead, you know? Ensemble models and identity clustering boost accuracy and make things clear as day in fraud detection.

Hawk:AI taps machine learning to cut down false positives for banks and fintechs, saving headaches all around. Feedzai brings AI into real-time transaction monitoring, perfect for retail banks, corporate banks, and fintechs.

Sardine’s AI approach zeros in on the digital economy and shifts with changing fraud tactics, like a chameleon on the move. Sift links identity, behavior, and intent through machine learning for smart fraud decisions.

SymphonyAI offers AI solutions across sectors, including top-notch fraud prevention with behavioral analytics and real-time monitoring.

What are the benefits of implementing fraud prevention software?

Fraud prevention software acts like a vigilant guard dog for your business, spotting threats before they bite. You gain peace of mind, knowing your operations stay smooth and secure.

- This tool protects your firm and customer reputation through early fraud detection and transparency, much like a shield that keeps trust intact in the face of sneaky attacks; it uses real-time monitoring and behavioral analytics to catch issues fast, preventing damage to brand reputation and ensuring online merchants maintain a solid image with their audience.

- It minimizes fraud losses and regulatory penalties with adaptive machine learning, acting as a smart barrier against payment fraud and fraudulent transactions; businesses avoid hefty fines by staying ahead of risks, like dodging a storm with a reliable forecast, and this saves money that would otherwise vanish into thin air.

- The software improves analyst efficiency via automation and smart alert prioritization, turning complex tasks into a breeze; imagine your team focusing on big wins instead of sifting through endless alerts, as anomaly detection and smart alerts streamline workflows, boosting operational efficiency in e-commerce platforms and beyond.

- It allows real-time collaboration among financial institutions, which boosts fund recovery rates, like friends teaming up to solve a puzzle quicker; this teamwork, powered by API integrations and dashboards, helps recover lost funds faster, making a real difference in fighting account takeover and credential stuffing.

- Businesses comply with regulations such as data protection and APP fraud compensation thanks to these solutions, avoiding legal headaches; they integrate identity verification and anti-money laundering measures, ensuring you meet standards like the Fair Credit Reporting Act without breaking a sweat, keeping everything above board.

- The software reduces chargebacks and associated costs in e-commerce and banking, acting like a cost-cutting superhero; by tackling fraudulent orders and payment verification issues head-on, it slashes expenses from invalid clicks and click fraud, saving your bottom line from unnecessary hits.

- It enhances customer trust by providing a secure transaction environment, fostering loyalty like a warm handshake; with features like device fingerprinting and risk scoring, customers feel safe during transactions, improving their experience and encouraging repeat business in online shops.

- Scalable solutions support business growth and increased transaction complexity, growing with you like a flexible companion; they handle rising demands in fraud detection platforms, incorporating artificial intelligence and machine learning models to manage multi-vector attacks and vulnerabilities without missing a beat.

Takeaways

You now know how tools like Sift and Forter fight fraud with smart machine learning and real-time checks. Pick the right fraud detection software, such as Riskified or Signifyd, to shield your business from sneaky payment scams and account takeovers.

Stay ahead of crooks, keep your customers happy, and watch your profits grow without the headaches.

FAQs

1. What makes fraud detection software a must-have for online merchants?

Fraud detection software uses machine learning models to spot fraudulent transactions right away, saving you from big fraud losses. Imagine it as a watchful guard dog, barking at risk signals like odd click paths or credential stuffing attacks. It boosts your brand reputation by keeping things safe, and hey, who doesn’t love sleeping easy at night knowing their e-commerce platform is protected?

2. How does real-time monitoring work in these tracking tools?

Real-time monitoring scans for anomaly detection in payment processing, catching fraudulent orders before they hurt your business. It integrates with APIs for smooth operation, using device fingerprinting to verify identities. Think of it as your business’s personal superhero, swooping in with smart alerts to fend off threats like account takeover.

3. Can machine learning really predict fraudulent payments?

Yes, machine learning dives into behavioral analytics to predict and block fraudulent payments. It learns from databases of past fraud, improving over time like a smart student acing tests. This keeps your customer experience top-notch, without the headache of dealing with credit cards gone wrong.

4. What’s the deal with identity verification in fraud protection?

Identity verification checks users against risk scoring systems to prevent account takeover and credential stuffing. It uses artificial intelligence to analyze data in real time.

5. How do these softwares handle e-commerce fraud protection?

They employ neural network models for real-time fraud detection, spotting things like click farms or unusual patterns on platforms like Google Ads or Twitter. By linking with CRMs and direct debit systems, they enhance operational efficiency and cut down on fraud losses. It’s like having a crystal ball that warns you before trouble hits, making cybersecurity awareness a breeze for your team.

6. Why should businesses worry about payment fraud and use these tools?

Payment fraud can wreck your bottom line, but these fraud detection platforms fight back with AI-driven anomaly detection and payment verification. They comply with rules like the Fair Credit Reporting Act and anti-money laundering standards, keeping everything above board. Plus, they automate systems to handle threats from the internet, turning potential disasters into just another day at the office.