Cryptocurrency adoption is growing across the globe. From Bitcoin and Ethereum to stablecoins and DeFi tokens, millions of people are embracing digital assets as a new way to store value and transfer money. But what drives this shift beyond technology? The answer lies in economics.

Understanding the economic theories behind cryptocurrency helps explain why digital currencies are gaining acceptance. These theories offer insights into human behavior, value creation, and market systems. This article explores five key economic theories that support cryptocurrency adoption, showing how each theory helps explain the rise of crypto in the global economy.

1. Network Effect Theory

The network effect explains how the value of a product or service increases as more people use it. In simple terms, a phone is only useful if other people also have phones. The more users a network has, the more valuable it becomes.

Cryptocurrencies follow the same principle. Bitcoin became more valuable as more people started to use it, accept it, and talk about it. Ethereum’s value grew as more developers built decentralized applications (dApps) on its platform.

Why It Matters for Crypto

As crypto adoption increases, the network becomes more secure, efficient, and attractive. Every new wallet or transaction makes the system more valuable to everyone else. The network effect creates a cycle: adoption leads to more use, which leads to more value.

Network Effect in Cryptocurrency Adoption

| Factor | Impact on Crypto | Real-World Example |

| Number of Users | Increases demand and liquidity | Bitcoin reaching 100M wallets |

| Number of Developers | Enhances utility and features | Ethereum dApps & NFTs |

| Number of Businesses | Boosts mainstream acceptance | Tesla accepting Bitcoin |

2. Metcalfe’s Law

Metcalfe’s Law is closely related to the network effect. It states that the value of a network is proportional to the square of the number of users. That means if a network has 10 users, its value is 100. If it has 100 users, its value is 10,000.

In the crypto world, this law helps us understand why the price of Bitcoin or Ethereum can rise so quickly. When millions of users interact on the blockchain, the overall utility of the network skyrockets.

Crypto Example

Metcalfe’s Law has been used to analyze Bitcoin and Ethereum valuations. Analysts found that the price trends of these cryptocurrencies closely follow Metcalfe’s predictions based on user growth and transaction volumes.

Metcalfe’s Law in Action

| Metric | 2016 | 2024 Estimate |

| Bitcoin Users | 10 million | 250 million |

| Square of Users | 100M | 62.5B |

| Network Value (Price) | $500 | $40,000+ |

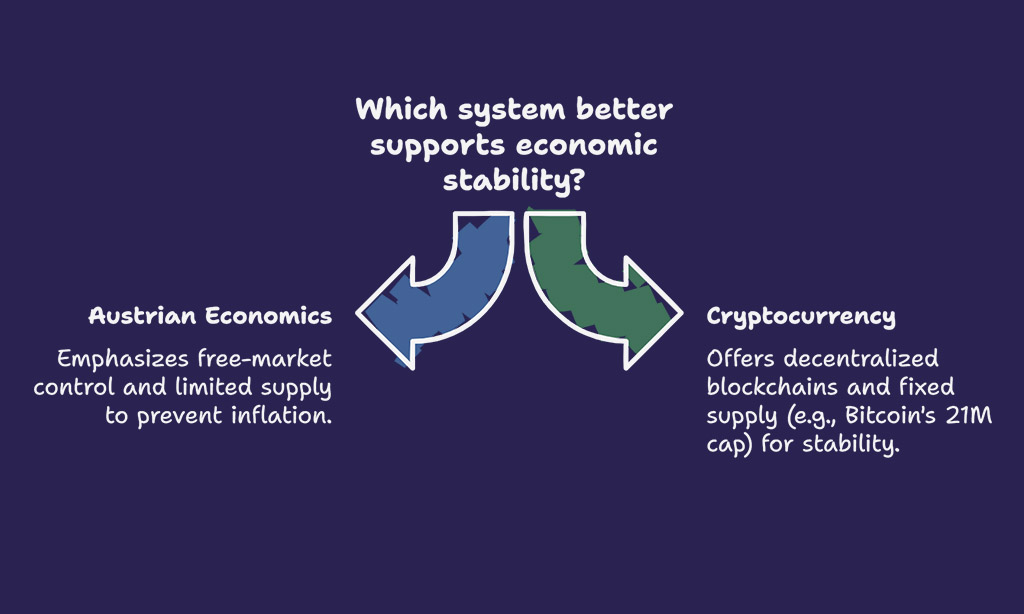

3. Austrian School of Economics

The Austrian School of Economics is a classical economic theory that promotes free markets, limited government, and individual freedom. Economists like Friedrich Hayek and Ludwig von Mises argued that the value of money should be determined by the market, not central banks.

Crypto Alignment

Cryptocurrencies like Bitcoin align perfectly with Austrian ideals. They are decentralized, have limited supply, and operate without central control. Many crypto supporters are influenced by this school of thought, believing in financial freedom and resistance to inflation.

Why It Supports Adoption

In countries facing inflation or unstable currencies (e.g., Argentina, Turkey), people turn to crypto as a stable store of value. The market, not the government, decides what money is.

Austrian Economics vs. Cryptocurrency

| Principle | Austrian Economics | Cryptocurrency Equivalent |

| Free-market control | No government interference | Decentralized blockchains |

| Limited supply | Prevent inflation | Bitcoin’s 21M cap |

| Individual ownership | Personal responsibility | Private crypto wallets |

4. Game Theory

Incentives and Consensus in Blockchain Systems

Game theory studies how people make decisions when their outcomes depend on others’ choices. It’s crucial in understanding cooperation, competition, and incentives—key elements in cryptocurrency systems.

How Crypto Uses Game Theory

In blockchains, game theory ensures honest behavior through incentives. For example:

- In Bitcoin, miners are rewarded for verifying transactions (Proof of Work).

- In Ethereum 2.0, validators are rewarded for securing the network (Proof of Stake).

This system encourages good behavior and punishes bad actors. If someone tries to cheat the system, they lose their reward or get penalized.

Game Theory in Blockchain

| Game Theory Concept | Crypto Application | Real Example |

| Nash Equilibrium | Consensus protocol | Bitcoin mining competition |

| Incentive Structures | Block rewards, staking | Ethereum 2.0 validator rewards |

| Punishment Mechanism | Slashing, loss of funds | Slashing for bad behavior in PoS |

5. Gresham’s Law (Modern Application)

Gresham’s Law traditionally states: “Bad money drives out good.” But in the modern cryptocurrency context, the opposite can happen—good money drives out bad—especially when people have a choice.

Application to Crypto

In countries with high inflation, unstable currencies, or capital controls, people seek safer alternatives. Cryptocurrencies offer a more stable or transparent option. Stablecoins, for instance, peg their value to the US dollar and are widely used in countries with weak national currencies.

Real Examples

- In Venezuela, crypto is used more than the national bolivar.

- In Nigeria, crypto trading surged when fiat became unreliable.

Gresham’s Law and Cryptocurrency

| Economic Scenario | Traditional Behavior | Crypto Behavior |

| Inflation | Use unstable currency | Switch to stablecoins/Bitcoin |

| Capital restrictions | Cash hoarding or black market | Use crypto for remittances |

| Currency devaluation | Loss of savings | Hedge with digital assets |

FAQs

Q1: What is the best economic theory that explains Bitcoin’s growth?

Metcalfe’s Law and the network effect both strongly explain Bitcoin’s growth due to user-driven value creation.

Q2: How does game theory ensure trust in blockchain?

Game theory aligns incentives with honest behavior, making fraud unprofitable in most blockchain systems.

Q3: Can cryptocurrency replace fiat money?

In unstable economies, crypto often complements or even replaces traditional currencies as a more reliable option.

Takeaways

Cryptocurrency is not just a technological innovation—it is an economic revolution backed by solid theoretical foundations. From the network effect and Metcalfe’s Law to game theory and Austrian economics, these theories help explain why more people and businesses are embracing digital currencies.

Understanding these economic principles allows investors, policymakers, and curious readers to better grasp the long-term value of cryptocurrency adoption. As the digital economy expands, these economic theories will continue to guide its evolution.

So, which economic theory do you believe plays the biggest role in crypto adoption? Share your thoughts in the comments below!