The financial technology sector is evolving at an unprecedented pace, driven by rapid advancements in artificial intelligence, blockchain, digital payments, and regulatory technology. With increasing consumer reliance on digital financial services, the next decade is set to bring revolutionary changes that will reshape banking, investing, and personal finance.

By 2030, fintech will likely become more integrated, efficient, and accessible than ever before, providing seamless experiences for both individuals and businesses.

In this article, we explore 10 key predictions for the fintech industry by 2030, providing a deep dive into how these trends will transform financial landscapes worldwide and analyzing the opportunities and challenges that lie ahead.

The Future of the Fintech Industry by 2030: Key Predictions

The fintech industry is undergoing rapid transformation, driven by advancements in artificial intelligence, blockchain technology, and evolving consumer demands. As we approach 2030, the financial landscape will be reshaped by innovative solutions that enhance efficiency, security, and accessibility.

From AI-powered automation to decentralized finance (DeFi), fintech companies are set to revolutionize traditional banking, investment strategies, and payment systems. In this article, we explore key predictions that will define the future of the fintech industry by 2030

1. AI-Powered Financial Services Will Dominate

Artificial intelligence is set to redefine the fintech landscape, enhancing automation, fraud detection, and customer interactions. AI-driven algorithms will increasingly power decision-making in banking, investments, and lending, ensuring personalized financial services that cater to individual needs.

Key Developments:

- AI-driven chatbots and virtual assistants providing real-time financial advice.

- Machine learning algorithms analyzing transaction patterns to detect fraud.

- AI-powered lending models offering risk-based personalized loans.

- Predictive analytics helping financial institutions anticipate customer needs.

AI Use Cases in Fintech

| Use Case | Description | Impact |

| Chatbots | AI-driven customer service chatbots | Improved customer support efficiency |

| Fraud Detection | Machine learning models analyzing transactions | Reduced financial fraud cases |

| Credit Scoring | AI assessing risk profiles for loans | Increased accessibility to credit |

| Portfolio Management | AI advising personalized investments | Enhanced wealth management strategies |

Example:

JP Morgan’s AI-powered COiN platform has streamlined document analysis, saving over 360,000 hours of legal work annually. AI-driven tools like these will become standard by 2030.

2. Blockchain and Decentralized Finance (DeFi) Will Reshape Banking

Blockchain technology and decentralized finance (DeFi) are poised to disrupt traditional banking models by enabling peer-to-peer financial interactions without intermediaries. The rise of decentralized applications (dApps) will revolutionize lending, insurance, and wealth management.

Key Developments:

- Smart contracts facilitating trustless transactions.

- Peer-to-peer lending and borrowing without intermediaries.

- Increased adoption of tokenized assets and digital securities.

- Cross-border payments powered by blockchain reducing transaction costs.

Key Differences Between Traditional Banking and DeFi

| Feature | Traditional Banking | DeFi |

| Intermediary | Banks and financial institutions | Peer-to-peer transactions |

| Accessibility | Restricted by geography | Global and open to all |

| Security | Centralized and prone to breaches | Distributed ledger, highly secure |

| Transaction Fees | High due to middlemen | Lower fees via automation |

Example:

Ethereum-based lending platforms like Aave and Compound are already enabling users to borrow and lend assets without traditional banks, demonstrating the potential of DeFi.

3. Digital Payments Will Surpass Traditional Banking

By 2030, digital payments will become the primary mode of transaction globally, with cash usage declining significantly. The proliferation of mobile wallets, contactless payments, and cryptocurrency transactions will lead to a cashless society.

Key Developments:

- Increased adoption of mobile wallets and contactless payments.

- Growth of real-time payment systems.

- Expansion of cross-border digital transactions.

- Government-backed digital currencies replacing physical cash.

Digital Payment Trends by 2030

| Payment Method | Projected Growth Rate | Key Players |

| Mobile Wallets | 18% annually | Apple Pay, Google Pay, WeChat Pay |

| Cryptocurrencies | Increasing adoption | Bitcoin, Ethereum, Stablecoins |

| Contactless Payments | Becoming mainstream | Visa, Mastercard, NFC-enabled cards |

Example:

China’s mobile payment ecosystem, led by Alipay and WeChat Pay, is a strong indicator of the global shift towards digital payments.

4. Embedded Finance Will Become the Norm

Embedded finance is transforming how consumers interact with financial services by integrating them into non-financial platforms. Companies in e-commerce, retail, and logistics are embedding financial tools directly into their apps and services.

Key Developments:

- E-commerce platforms offering integrated payment and lending services.

- Businesses embedding insurance and investment products into their offerings.

- Growth of “Banking as a Service” (BaaS) platforms.

Examples of Embedded Finance in Action

| Industry | Use Case | Example Company |

| E-commerce | Buy Now, Pay Later (BNPL) | Klarna, Afterpay |

| Ride-sharing | Instant driver payouts | Uber, Lyft |

| Healthcare | Embedded insurance plans | Oscar Health |

Example:

Amazon’s “Amazon Pay” and Shopify’s embedded financial solutions allow merchants to offer seamless payment experiences, showcasing the power of embedded finance.

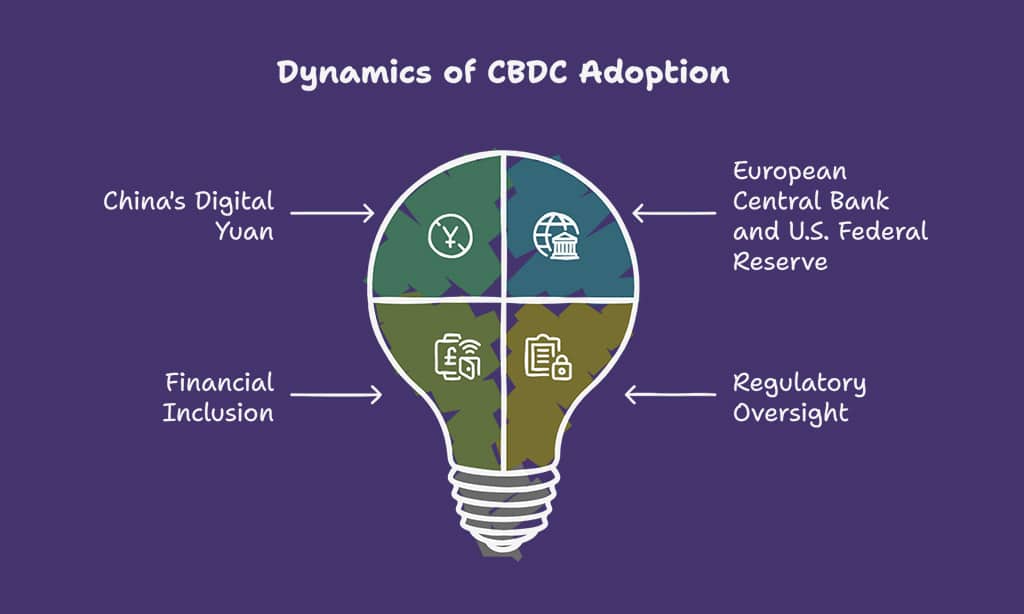

5. The Rise of Central Bank Digital Currencies (CBDCs)

Governments worldwide are exploring Central Bank Digital Currencies (CBDCs) as a response to the growing influence of digital payments and cryptocurrencies. By 2030, CBDCs could become mainstream, bridging the gap between traditional finance and decentralized solutions.

Key Developments:

- China’s digital yuan leading global CBDC adoption.

- European Central Bank and the U.S. Federal Reserve exploring digital currency frameworks.

- CBDCs reducing dependence on traditional banking systems and enhancing financial inclusion.

- Stricter regulatory oversight ensuring secure digital currency transactions.

Key Benefits of CBDCs

| Benefit | Description |

| Financial Inclusion | Enables unbanked populations to access digital financial services. |

| Security | Government-backed, reducing the risk of fraud and volatility. |

| Faster Transactions | Enables instant cross-border and domestic payments. |

| Transparency | Reduces illicit activities through better transaction tracking. |

Example:

China’s digital yuan pilot program, which has reached millions of users, is demonstrating how CBDCs can enhance transaction efficiency and government control over monetary policy.

6. Open Banking Will Drive Financial Innovation

Open banking is fostering competition by allowing third-party developers to create new financial products using bank data. By 2030, open banking will be a standard, giving consumers greater control over their financial information.

Key Developments:

- API-driven banking enabling seamless integration with fintech services.

- Greater transparency in financial transactions.

- Enhanced consumer control over financial data.

Benefits of Open Banking

| Benefit | Description |

| Increased Competition | Encourages innovation in financial products and services. |

| Improved Consumer Control | Gives users more choices and access to financial data. |

| Enhanced Security | Provides strong authentication mechanisms to protect data. |

Example:

The UK’s Open Banking Initiative has already paved the way for customer-centric financial services, a model expected to expand globally by 2030.

7. Biometric Authentication Will Enhance Security

With the rise of digital transactions, security concerns are growing. Cybercriminals are becoming more sophisticated, making traditional authentication methods vulnerable. Biometric authentication is emerging as the go-to solution for financial security, providing a seamless yet highly secure experience for users.

Key Developments:

- Increased adoption of fingerprint, facial recognition, and voice authentication.

- Advanced fraud detection through behavioral biometrics.

- Elimination of passwords in financial transactions.

Types of Biometric Authentication

| Type | Application |

| Fingerprint | Mobile banking login, payment authentication. |

| Facial Recognition | Contactless payments, identity verification. |

| Voice Recognition | Secure telephone banking, voice-activated transactions. |

Example:

Apple’s Face ID and Mastercard’s biometric payment cards are already paving the way for secure financial transactions, making biometric authentication the standard by 2030.

8. Sustainable and Green Fintech Will Gain Momentum

Sustainability in fintech will take center stage as companies align with environmental, social, and governance (ESG) principles. Firms will adopt carbon-neutral strategies, promote ethical banking practices, and leverage AI to assess sustainability risks in investments.

Key Developments:

- Green investments and carbon-neutral fintech initiatives.

- Rise of ethical banking models.

- Sustainable cryptocurrency mining practices.

Green Fintech Innovations

| Innovation | Impact |

| ESG Investing Platforms | Encourages sustainable investing and responsible finance. |

| Carbon-Neutral Cryptocurrencies | Reduces the environmental impact of blockchain. |

| Ethical Banking | Focuses on financing sustainable businesses and projects. |

Example:

Companies like Aspiration Bank are leading the movement by offering customers sustainability-driven financial services, rewarding them for eco-friendly purchases.

9. The Evolution of RegTech: AI-Driven Compliance Solutions

Regulatory technology (RegTech) is revolutionizing compliance, ensuring businesses meet global financial regulations efficiently. By leveraging artificial intelligence and machine learning, RegTech solutions can detect anomalies, automate audits, and streamline reporting processes, reducing operational costs and mitigating risks for financial institutions.

Key Developments:

- AI-powered compliance monitoring tools.

- Automated reporting and risk management solutions.

- Enhanced KYC (Know Your Customer) and AML (Anti-Money Laundering) frameworks.

RegTech Benefits

| Benefit | Description |

| Faster Compliance | Reduces manual workload, automating compliance processes. |

| Lower Costs | Reduces regulatory costs through AI-driven automation. |

| Increased Transparency | Improves financial reporting and fraud detection. |

Example:

Firms like ComplyAdvantage use AI-driven risk detection to prevent financial crimes, helping businesses comply with regulations seamlessly.

10. The Future of Personalized Financial Experiences

Consumers increasingly demand personalized financial experiences tailored to their unique needs. By leveraging artificial intelligence and big data analytics, financial institutions can offer hyper-personalized products, from customized investment portfolios to AI-driven budgeting tools, ensuring users receive the most relevant financial guidance.

Key Developments:

- AI-driven financial advisors providing customized investment recommendations.

- Personalized credit scoring based on alternative data sources.

- Hyper-personalized financial education tools.

Personalized Finance Innovations

| Innovation | Benefit |

| AI Investment Advisors | Provides tailored investment strategies. |

| Alternative Credit Scoring | Expands financial inclusion for underserved communities. |

| Customizable Financial Dashboards | Enhances user control over financial management. |

Example:

Robo-advisors like Betterment and Wealthfront are already providing hyper-personalized financial planning, and by 2030, AI-driven financial services will be commonplace.

With these fintech innovations, the financial landscape will be more accessible, secure, and sustainable by 2030.

Takeaways

The fintech industry is on the brink of a major transformation by 2030. With AI, blockchain, open banking, and biometric security leading the way, financial services will become more efficient, accessible, and personalized.

The integration of AI-driven automation will streamline financial operations, while blockchain technology will enhance transparency and security in transactions. Open banking will further empower consumers by providing seamless access to financial data and services across multiple platforms.

However, as fintech continues to evolve, challenges such as regulatory complexities, cybersecurity threats, and ethical considerations will remain key concerns.

Governments and financial institutions must work together to establish clear regulations that foster innovation while ensuring data privacy and financial stability.