The rise of Web3 is revolutionizing the digital economy, and crypto regulations play a crucial role in shaping this transformation. Web3-friendly crypto regulations determine how blockchain businesses, decentralized finance (DeFi) platforms, and crypto startups can thrive in a given jurisdiction.

Countries with clear, favorable policies on Web3-friendly crypto regulations attract investments, innovation, and skilled talent, ensuring their leadership in the decentralized future.

Governments across the globe are taking different approaches to crypto regulation, with some providing robust frameworks that foster innovation while others remain restrictive.

In this article, we will explore the top 10 countries with the most Web3-friendly crypto regulations, detailing their policies, taxation benefits, and government initiatives to support blockchain-based economies.

Additionally, we will analyze key trends shaping the regulatory landscape, providing insights into future developments.

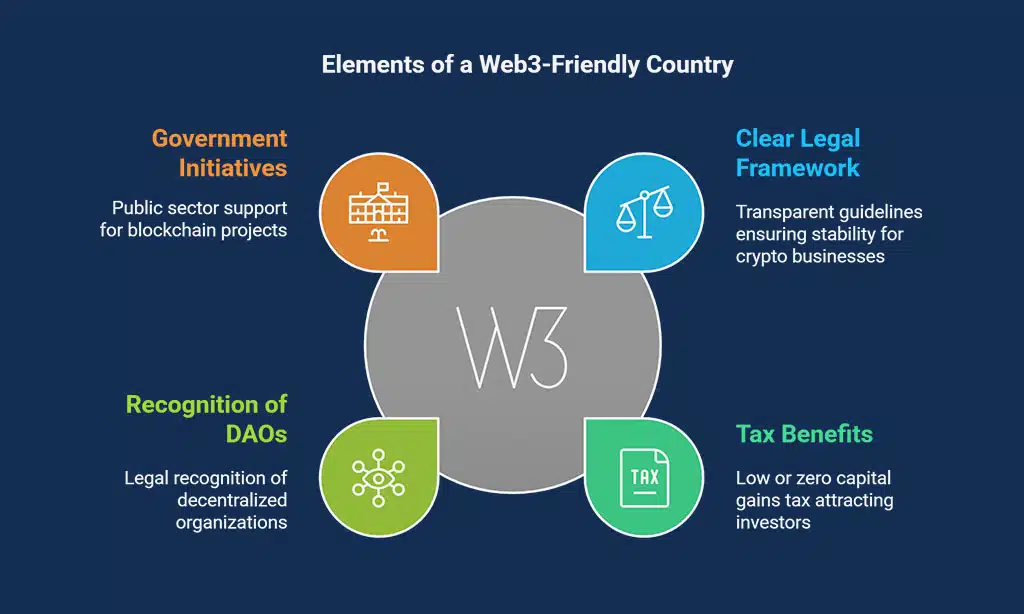

What Makes a Country Web3-Friendly?

Web3-friendly crypto regulations involve several critical elements that create a favorable environment for blockchain technology and digital assets. These include:

- Clear Legal Framework: Governments that provide transparent guidelines for crypto businesses ensure a stable and predictable environment for investors and startups.

- Tax Benefits: Low or zero capital gains tax on crypto transactions makes a country attractive to crypto entrepreneurs and investors.

- Recognition of DAOs and Smart Contracts: Legal frameworks that recognize Decentralized Autonomous Organizations (DAOs) and smart contracts foster Web3 ecosystem growth.

- Government-Backed Blockchain Initiatives: Public sector adoption of blockchain technology and government funding for Web3 innovation encourage broader industry development.

- Access to Crypto-Friendly Banking Services: Countries where banks support cryptocurrency transactions enable seamless business operations for blockchain startups.

| Key Factors | Description |

| Legal Framework | Clear regulations on crypto trading, DeFi, and NFTs |

| Tax Incentives | Lower or no capital gains tax on crypto earnings |

| Support for DAOs | Legal recognition of Decentralized Autonomous Organizations |

| Government Adoption | Blockchain-based public services and funding for startups |

| Crypto-Friendly Banks | Banks supporting Web3 businesses with smooth transactions |

Why Crypto Regulations Matter in Web3’s Growth

Without Web3-friendly crypto regulations, businesses face legal uncertainties, leading to reduced innovation and capital flight. Countries that implement progressive policies benefit from:

- Legal Clarity: Reducing compliance risks for businesses and investors.

- Economic Growth: Attracting foreign investment and fostering job creation in the blockchain sector.

- Fraud Prevention: Establishing safeguards against illicit activities while promoting a transparent crypto economy.

- Decentralization Adoption: Encouraging mainstream acceptance of Web3 technologies.

10 Countries Leading in Web3-Friendly Crypto Regulations

Each of these nations has developed policies that make them leaders in the Web3 revolution.

1. Switzerland (Crypto Valley Hub)

Switzerland is one of the most Web3-friendly countries in the world, home to “Crypto Valley” in Zug, which has attracted numerous blockchain startups and businesses. The Swiss Financial Market Supervisory Authority (FINMA) has established transparent regulations for cryptocurrencies and blockchain projects, fostering an innovative and compliant ecosystem.

| Aspect | Details |

| Regulatory Body | FINMA (Swiss Financial Market Supervisory Authority) |

| Taxation | No capital gains tax on personal crypto holdings |

| Key Web3 Hubs | Zug (Crypto Valley) |

| Government Initiatives | Public sector blockchain adoption |

2. Singapore (Asia’s Web3 Hub)

Singapore has emerged as a major blockchain hub in Asia due to its clear and progressive regulatory framework. The Monetary Authority of Singapore (MAS) has introduced structured licensing requirements for digital asset service providers, ensuring both security and innovation.

| Aspect | Details |

| Regulatory Body | MAS (Monetary Authority of Singapore) |

| Taxation | No capital gains tax on crypto |

| Key Web3 Hubs | Singapore City |

| Government Initiatives | Blockchain funding and research |

3. United Arab Emirates (Dubai & Abu Dhabi’s Crypto Oasis)

The UAE has taken significant steps to become a leader in Web3-friendly crypto regulations. Dubai’s Virtual Assets Regulatory Authority (VARA) oversees crypto regulations, offering a business-friendly environment.

| Aspect | Details |

| Regulatory Body | VARA (Virtual Assets Regulatory Authority) |

| Taxation | 0% tax in crypto-friendly zones |

| Key Web3 Hubs | Dubai, Abu Dhabi |

| Government Initiatives | Crypto-free zones, metaverse development |

4. El Salvador (Pioneering Bitcoin as Legal Tender)

El Salvador became the first country to adopt Bitcoin as legal tender, making it a global leader in cryptocurrency adoption. The government has rolled out crypto-friendly regulations, establishing a robust ecosystem for Bitcoin businesses and investors.

| Aspect | Details |

| Regulatory Body | Government-led Bitcoin policy |

| Taxation | No capital gains tax on Bitcoin transactions |

| Key Web3 Hubs | San Salvador |

| Government Initiatives | Bitcoin bonds, crypto infrastructure projects |

5. Portugal (Europe’s Crypto Tax Haven)

Portugal has positioned itself as one of the most attractive destinations for crypto investors by eliminating taxes on personal crypto gains. The country is fostering a growing blockchain ecosystem, attracting both startups and digital nomads.

| Aspect | Details |

| Regulatory Body | Portuguese Tax Authority |

| Taxation | No personal income tax on crypto earnings |

| Key Web3 Hubs | Lisbon, Porto |

| Government Initiatives | Blockchain research funding, startup support |

6. Malta (The Blockchain Island)

Malta has earned its reputation as “The Blockchain Island” due to its proactive approach to crypto regulations. The country has implemented the Digital Ledger Technology (DLT) regulatory framework, making it one of the most legally structured environments for blockchain businesses.

| Aspect | Details |

| Regulatory Body | Malta Financial Services Authority (MFSA) |

| Taxation | No capital gains tax on long-term crypto gains |

| Key Web3 Hubs | Valletta |

| Government Initiatives | Licensing framework for blockchain firms |

7. Germany (Europe’s Crypto Banking Leader)

Germany is leading Europe in crypto banking regulations, being one of the first countries to classify cryptocurrencies as financial instruments. The German Federal Financial Supervisory Authority (BaFin) provides clear guidelines for digital assets, attracting institutional investors and fintech firms.

| Aspect | Details |

| Regulatory Body | BaFin (Federal Financial Supervisory Authority) |

| Taxation | No capital gains tax if held for over one year |

| Key Web3 Hubs | Berlin, Frankfurt |

| Government Initiatives | Regulated crypto banking services |

8. Canada (Balanced Approach to Crypto Regulation)

Canada has taken a measured approach to Web3-friendly crypto regulations, ensuring that digital asset businesses comply with anti-money laundering (AML) and securities laws while fostering innovation in the blockchain space.

| Aspect | Details |

| Regulatory Body | Canadian Securities Administrators (CSA) |

| Taxation | Crypto is subject to capital gains tax |

| Key Web3 Hubs | Toronto, Vancouver |

| Government Initiatives | Crypto exchange licensing, blockchain funding |

9. United States (State-Level Web3 Innovation)

The United States has a complex regulatory landscape for cryptocurrencies, with different regulations at the federal and state levels. States like Wyoming and Texas have established clear Web3-friendly crypto regulations, attracting blockchain businesses.

| Aspect | Details |

| Regulatory Body | SEC, CFTC, and state regulators |

| Taxation | Subject to capital gains tax, state-specific variations |

| Key Web3 Hubs | Wyoming, Texas, California |

| Government Initiatives | Institutional crypto adoption, DeFi expansion |

10. Estonia (E-Residency and Blockchain Governance)

Estonia is a pioneer in digital governance and blockchain adoption. With its e-Residency program and government-backed blockchain initiatives, Estonia is a hub for crypto businesses and fintech startups.

| Aspect | Details |

| Regulatory Body | Estonian Financial Supervision Authority |

| Taxation | Crypto profits taxed as traditional business income |

| Key Web3 Hubs | Tallinn |

| Government Initiatives | E-Residency, blockchain-based public services |

Future of Web3 Regulations: What to Expect?

- Increased Institutional Adoption: More financial institutions integrating blockchain.

- Regulatory Clarity: Countries developing unified crypto policies.

- Expansion of DAOs and Smart Contracts: Governments adapting laws to accommodate Web3 innovations.

- Growing Role of CBDCs: Some countries are developing Central Bank Digital Currencies (CBDCs) to complement crypto adoption.

| Trend | Expected Impact |

| Institutional Crypto Adoption | Traditional finance embracing blockchain technology |

| Unified Regulations | Standardized crypto laws across jurisdictions |

| Legal DAO Recognition | Increased legitimacy and adoption of decentralized governance |

| CBDC Growth | Governments experimenting with national digital currencies |

Takeaways

Web3-friendly crypto regulations shape the future of blockchain adoption, decentralized finance, and digital asset innovation. By fostering clear legal frameworks, nations can provide stability and confidence for investors, entrepreneurs, and institutions alike.

Countries that embrace progressive regulations not only drive innovation but also attract significant foreign investments, helping to position themselves as global leaders in the blockchain ecosystem.

For businesses and individuals navigating the digital economy, understanding Web3-friendly crypto regulations is crucial for ensuring compliance, reducing risk, and capitalizing on new opportunities.

As the landscape evolves, staying informed about changing policies and global trends will be essential for long-term success in the decentralized future.