Many people feel lost at sea when they try to buy digital currency for the first time. A blockchain records every trade in a public ledger and keeps your coins safe. This post will show you five easy steps, from choosing a trustworthy crypto exchange to setting up a cold crypto wallet and protecting your private key.

Keep reading.

Key Takeaways

- Pick a trusted exchange and test it with a small buy. Look at NerdWallet ratings – Coinbase scores 4.6/5, Robinhood Crypto 4.3/5 across 15+ factors. Confirm KYC rules, NYSE membership, two-factor authentication, and try a $5–$10 debit-card order first.

- Store coins in a wallet you control. Hot wallets work online but face malware and phishing. Cold wallets like Ledger Nano S or Trezor Model T cost under $100, use AES-256 encryption, and require a 12–24-word seed phrase kept offline.

- Start small and spread your buys. Minimum trades run $5–$10. Cap crypto at 10% of your portfolio. Use dollar-cost averaging (for example, $50 each week) to smooth out price swings and avoid timing mistakes.

- Check fees and payment links before you buy. Bank transfers cost about 1%, debit/credit cards or PayPal run 1.8–8%, P2P apps 4%, and Bitcoin ATMs up to 14.39%. Always verify your wallet address, fee table, and 2FA code before confirming.

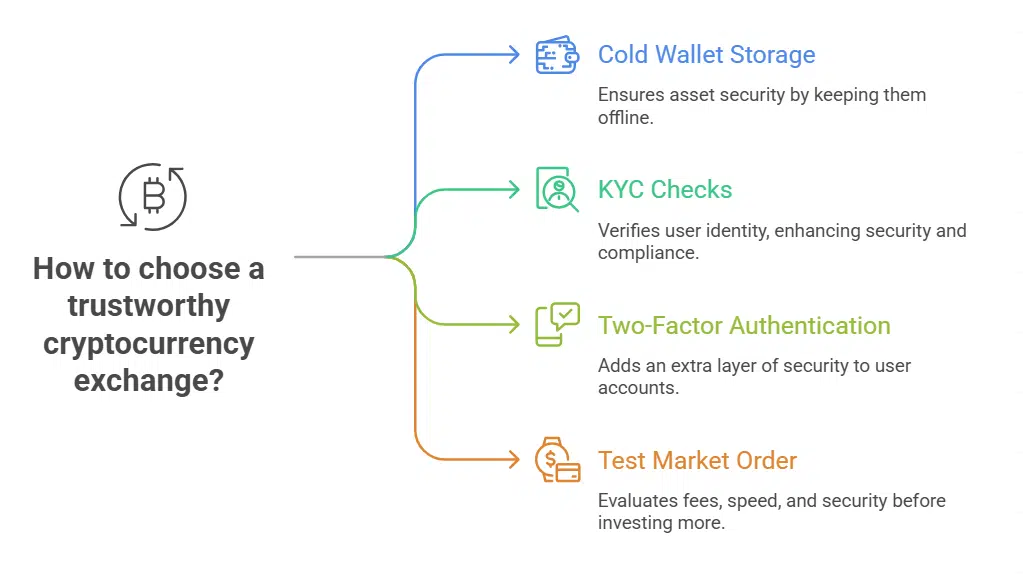

Choose a Trustworthy Cryptocurrency Exchange

Pick a crypto exchange, even a decentralized one, that locks assets in cold wallets, runs KYC checks, and uses two-factor authentication. Place a small market order with a debit card to test fees, speed, and security before you invest more.

How do I research exchange reviews and security features?

Real reviews help you pick a safe crypto exchange. Security features guard your digital assets.

- Scan independent ratings and fee charts. Quote NerdWallet scores, 4.6 out of 5 for Coinbase and 4.3 for Robinhood Crypto, across over 15 evaluation factors including staking and withdrawal minimums.

- Confirm KYC verification, crypto regulation status and insurance. Note that Fidelity holds regulation, private insurance won’t guard stolen keys; check for NYSE membership and note that SIPC covers only securities, not cryptos.

- Read user feedback on service, staking, prices and withdrawal limits. See reports on credit card and debit card buys to spot hidden fees and crypto scams.

- Test customer support channels. Send a simple chat message, email or phone call to gauge response time and clarity.

- Spot security tools and storage options. Look for two-factor authentication, cold wallets, secure seed phrase backup and offline private key guard.

- Review deposit and withdrawal limits. Check minimums on fiat and crypto, match them to your risk tolerance and investment goals.

What makes a cryptocurrency platform user-friendly?

Platforms like Coinbase and Kraken let beginners pick from many crypto assets with low fees.

Robinhood, Webull, PayPal, Venmo, and Cash App show simple screens and let you buy a coin for ten dollars or less.

Most sites finish KYC verification and open new accounts in about ten minutes.

They lock wallets with two-factor authentication and require a seed phrase for backups.

Good customer service replies fast and helps you withdraw assets with no fuss.

Limit orders and market order tools make trades clear, and smart contract support shows how blockchain technology boosts safety.

Set Up a Secure Crypto Wallet

Pick a Ledger Nano or Trust Wallet that uses strong encryption, and jot down your seed phrase on paper so you don’t lose it like your mom’s cookie recipe. Lock your secret code in a safe space with 2FA and keep your private key off the internet to stop sneaky hackers.

What is the difference between hot wallets and cold wallets?

Hot wallets store a private key online, on an app or browser, free to use, but they wear a neon sign for hackers. Think of them as a digital wallet in your pocket, ready for quick buys on crypto exchanges, but they still face malware, phishing or 2fa bypass.

Many traders keep only small sums here, like tossing spare change in a coffee cup.

Cold wallets cost less than $100 and act like a steel vault for your seed phrase offline, far from blockchain networks that hackers chase. You plug them in only to transfer funds, making long-term crypto storage sturdy, safe from online threats.

Experts say moving coins from hot wallets to a cold wallet is the gold standard for crypto security.

Which wallets have strong encryption and backup options?

Hardware wallets lock up private keys inside a small box that never joins the internet. The gadgets use AES-256 encryption and a PIN code for each session. They generate a 12- or 24-word seed phrase.

You write it on paper or steel and tuck it in a safe. A fresh device just asks for that phrase to restore every crypto coin.

Software wallets on your phone or in a browser can still pack a punch on security. A browser wallet often locks your private key behind a complex password and a code from an authenticator app.

Mobile wallets ask you to jot down a secret recovery phrase on a metal plate or paper. You can encrypt a backup file and stash it in a safe or with a legal advisor. This step prevents permanent loss after a phone drop or hack.

Start with a Budget-Friendly Investment

Place a small limit order on a web platform, or try a quick market order to buy a token. Use a dollar-cost averaging plan, treat each buy like a sip, not a gulp, and match your risk tolerance.

How much should I invest in cryptocurrency safely?

Most exchanges allow minimum trades as low as $5 to $10. Experts recommend you cap high-risk crypto at 10% of your total investments to match your risk tolerance. Use dollar-cost averaging to spread out buys and avoid timing mistakes.

Set up a secure crypto wallet that stores your private key and seed phrase behind two-factor authentication (2fa).

Only use funds you can afford to lose; avoid tapping money for rent, bills, or other essentials. Factor in transaction fees on small trades, since high percentages can eat your gains.

Never buy with credit card debt or other high-interest loans. Consider a stop loss order to limit downside on volatile digital assets.

How can I avoid overcommitting to high-risk assets?

Cap your crypto allocation at 10% of your total portfolio. Plan for 90% of your funds in cash and bonds as backup. Spread your buys with dollar-cost averaging, say $50 each week, to limit impulse trades.

Use a stop order on decentralized exchanges to sell if losses hit 5%.

Evaluate your risk tolerance with a simple quiz in your online broker account. Sell a losing position if it drops more than 5% to avoid deeper losses. Review your private key and seed phrase backups in cold storage each month.

Ongoing learning about blockchain technology and smart contracts will curb impulsive bets.

Verify Your Payment Method

Double-check your digital wallet address and bank account info before you hit buy. Don’t let hidden fees sneak up on you, and finish your KYC verification on the exchange portal.

What are secure payment methods for buying crypto?

Linking a bank account on a top exchange gives rock-solid security. Platforms like PayPal, Venmo, and Cash App let you buy cryptocurrency fast. They guard your funds with two-factor authentication, so your private key stays safe.

Credit and debit cards work too, but fees climb fast. Peer-to-peer payment services bill high transaction costs for small buys. Bitcoin ATMs need a cold wallet and charge steep rates, so they puzzle many beginners.

Apps and online brokers store your digital assets behind strong encryption. Select crypto wallets that lock up coins under tough passwords. Keep your seed phrase offline and avoid public Wi-Fi.

This small step stops hackers cold and boosts your crypto security. A bank link or a trusted app acts as your best shield in the wild world of blockchain technology.

How do I watch out for transaction fees and hidden costs?

Platforms publish fee menus, so check each rate before you buy crypto. Some exchanges hit you with a 4% trading charge, while online brokers stick near 1%. P2P apps can climb to 4%, and Bitcoin ATMs often squeeze out 14.39% per swap.

Free services might hide fees inside spread mark-ups. Read the fine print, and never skip the fee table.

PayPal grabs $1.99 on a $25 buy, that’s an 8% cut, but only $1.80 on $1,000, or 1.8%. Bitcoin network fees swing from under $0.50 to over $100 when a proof-of-work decentralized blockchain gets busy.

Use the fee estimator on your platform, it pops up before you confirm. Factor in withdrawal costs, miner rates, and any spread charges to protect your digital assets.

Make Your First Purchase

Double-check your market order, peek at the trading pairs, and eyeball the fee before you hit buy. Move your tokens to your software wallet, lock them with your seed phrase, and track the balance with a blockchain explorer.

How do I double-check my crypto purchase before confirming?

Pause after you fill in the cryptocurrency name, the amount, and your wallet address. Scan the trade summary on the exchange app for fees. Check the network fee estimate on blockchain platforms.

Make sure you use a secure private network so no one can grab your data.

Tap your two-factor authentication code to confirm you set up 2FA. Match the destination address to the one in your mobile wallet. Verify the private key backup before you finish. Log in again to the official platform to dodge phishing sites.

Pick a market order or a limit order and review its costs.

What is the best way to store purchased cryptocurrency immediately?

Pick a cold wallet device such as Trezor Model T or Ledger Nano S to keep your coins off an exchange. Cold wallets use hardware and keep your private key offline to block hackers. It taps blockchain technology to verify each transaction.

You can plug the device into any computer to send funds. Keep the seed phrase in a fireproof safe or a bank vault.

Enable two-factor authentication on your crypto exchange and on Trust Wallet or another hot wallet to boost crypto security. A strong password should block basic attacks. Many investors move digital assets from an exchange to their own wallet right after purchase.

That step helps avoid exchange hacks and crypto scams. Leaving large sums on an exchange risks losing SIPC insurance. Short term, a hot wallet may work for small trades.

Takeaways

You have clear steps now to pick a top-rated marketplace and link a verified payment method. Secure your coins in a crypto wallet, back up your seed phrase, and guard your private key.

Watch markets for proof of stake or proof of work projects, and try small buys with a brokerage app. Use two-factor authentication on your exchange and wallet app to block hackers.

Stay curious, learn about self-executing code and decentralized finance, and grow your crypto skill set.