The fintech industry is evolving at an incredible pace, driven by rapid advancements in technology.

Over the next decade, disruptive innovations will reshape financial services, digital payments, banking, and investment strategies. These technologies will not only enhance efficiency but also introduce new challenges and opportunities for businesses and consumers alike.

In this article, we explore five game-changing technologies that will disrupt fintech in the next decade. From AI-driven automation to blockchain and quantum computing, these innovations will redefine how we interact with money, security, and financial services.

1. Artificial Intelligence (AI) and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are transforming the financial industry. These technologies enhance fraud detection, personalize financial products, and automate customer service, making financial operations more efficient and secure.

How AI is Changing Fintech

| AI Application | Impact on Fintech |

| Fraud Detection | AI algorithms analyze transactions in real-time, detecting fraudulent activities and reducing risks. |

| Robo-Advisors | AI-driven financial advisors provide personalized investment recommendations. |

| Credit Scoring | Machine learning improves credit risk assessment, offering better loan approval processes. |

| Automated Trading | AI algorithms analyze market trends and execute trades with minimal human intervention. |

| Customer Support | AI chatbots provide 24/7 assistance, reducing the need for human agents. |

Why AI Will Disrupt Fintech

- AI-powered chatbots and virtual assistants will replace traditional customer service.

- Predictive analytics will enhance risk assessment in banking and insurance.

- AI-driven personalization will tailor financial products based on user behavior.

2. Blockchain and Decentralized Finance (DeFi)

Blockchain technology and Decentralized Finance (DeFi) are revolutionizing financial transactions by increasing transparency, reducing costs, and eliminating intermediaries.

Key Benefits of Blockchain in Fintech

| Blockchain Feature | Impact on Fintech |

| Decentralization | Eliminates central authority, giving users full control over transactions. |

| Transparency | Provides a tamper-proof ledger, reducing fraud and errors. |

| Smart Contracts | Automates agreements, reducing reliance on third parties. |

| Lower Transaction Fees | Cuts costs by removing intermediaries like banks. |

| Faster Cross-Border Payments | Reduces settlement time from days to minutes. |

How DeFi is Changing Financial Services?

- DeFi platforms enable peer-to-peer lending without banks.

- Cryptocurrencies provide alternative payment methods.

- Smart contracts ensure secure and automated financial transactions.

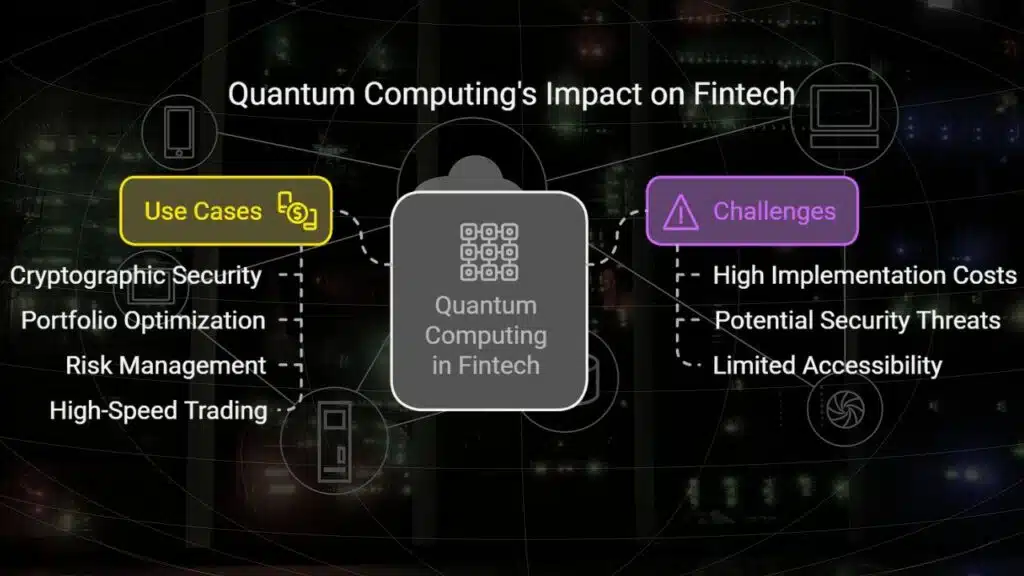

3. Quantum Computing

Quantum computing has the potential to disrupt fintech by solving complex calculations in seconds, making encryption stronger and financial models more accurate.

How Quantum Computing Will Impact Fintech?

| Quantum Computing Use Case | Impact on Fintech |

| Cryptographic Security | Stronger encryption methods will prevent cyberattacks. |

| Portfolio Optimization | Advanced calculations will improve investment strategies. |

| Risk Management | Real-time simulations will predict financial risks with greater accuracy. |

| High-Speed Trading | Quantum algorithms will analyze massive datasets faster than traditional computers. |

Challenges of Quantum Computing in Fintech

- High implementation costs.

- Potential security threats to existing encryption systems.

- Limited accessibility to quantum computing resources.

4. Biometric Authentication and Cybersecurity Advancements

As cyber threats continue to rise, biometric authentication is becoming a crucial technology in fintech security.

Popular Biometric Technologies in Fintech

| Biometric Method | Application in Fintech |

| Fingerprint Scanning | Secure login and transactions. |

| Facial Recognition | Identity verification for banking services. |

| Voice Recognition | Enhancing mobile banking security. |

| Iris Scanning | High-security authentication for financial institutions. |

Why Biometric Authentication is the Future?

- Provides faster and more secure access to financial services.

- Reduces reliance on traditional passwords, which can be compromised.

- Improves user experience by enabling frictionless transactions.

5. Embedded Finance and API-Driven Banking

Embedded finance is the integration of financial services into non-financial platforms, allowing seamless transactions within apps, e-commerce sites, and digital services.

Examples of Embedded Finance

| Embedded Finance Service | Industry Application |

| Buy Now, Pay Later (BNPL) | E-commerce platforms offer installment payment options. |

| Embedded Payments | Ride-sharing apps like Uber allow direct payments within the app. |

| Banking-as-a-Service (BaaS) | Non-bank companies offer financial services through APIs. |

| Digital Wallets | Retailers integrate mobile payment options. |

How API-Driven Banking is Enabling Fintech Growth?

- Open Banking APIs allow third-party developers to create new financial solutions.

- Seamless integration improves user experience in financial apps.

- Faster transactions with direct bank-to-bank payments.

Takeaways

The next decade will be transformative for the fintech industry. The rise of AI, blockchain, quantum computing, biometric authentication, and embedded finance will reshape the way businesses and consumers interact with financial services. These technologies will enhance security, improve efficiency, and introduce new financial opportunities.

As fintech continues to evolve, staying informed about these disruptions is essential for businesses, investors, and consumers. The future of finance is digital, and these five technologies will play a crucial role in shaping its trajectory.