Starting a business in Malaysia comes with exciting opportunities, but one crucial aspect that every entrepreneur must consider is tax planning.

Effective tax planning strategies for startups in Malaysia can help reduce tax liabilities, improve cash flow, and ensure compliance with the country’s regulations.

By implementing the right tax-saving methods, new businesses can maximize profitability while avoiding costly penalties.

This article explores essential tax planning strategies for startups in Malaysia, providing actionable insights to help you navigate the complex tax landscape with confidence.

We’ll also incorporate real-world examples, current trends, and practical tools to make tax planning easier and more effective for startups.

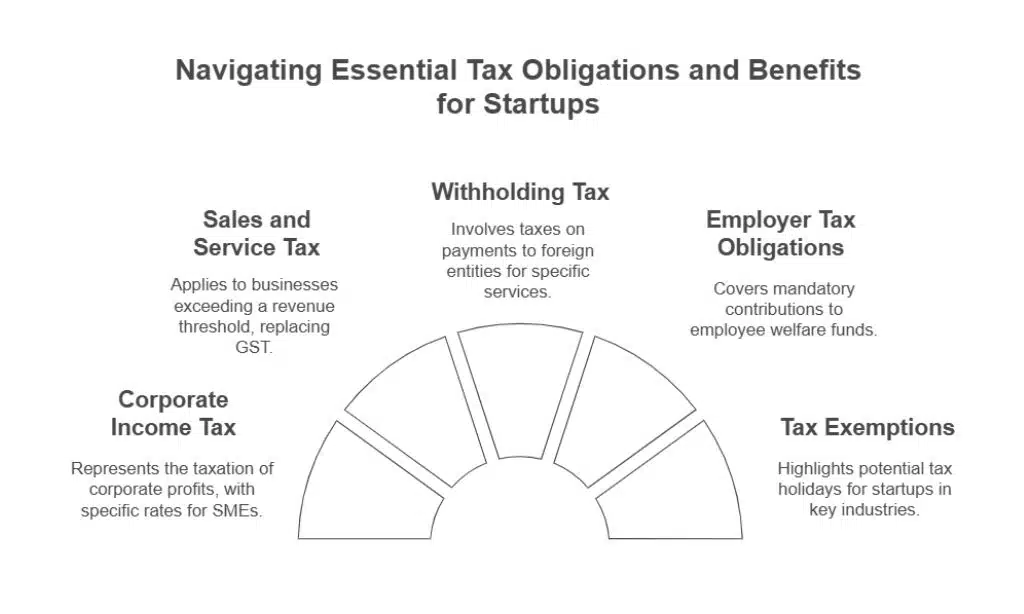

Understanding Tax Obligations for Startups in Malaysia

Before diving into tax planning strategies for startups in Malaysia, it’s important to understand the fundamental tax obligations your business must meet.

The Malaysian tax system imposes different tax rates, incentives, and filing requirements based on the business structure and industry.

Key Tax Considerations for Startups

- Corporate Income Tax: The standard corporate tax rate is 24%, but small and medium enterprises (SMEs) enjoy a lower rate of 15% on the first RM150,000 of chargeable income and 17% on the next RM450,000.

- Sales and Service Tax (SST): Businesses with an annual revenue exceeding RM500,000 must register for SST, which replaces the former Goods and Services Tax (GST).

- Withholding Tax: Payments made to foreign entities for services, royalties, or interests may be subject to withholding tax.

- Employer Tax Obligations: Startups must contribute to the Employees Provident Fund (EPF), Social Security Organization (SOCSO), and Employment Insurance System (EIS).

- Tax Exemptions for New Companies: Certain startups in key industries (e.g., tech, R&D, green energy) may qualify for tax holidays under government incentive programs.

- Tax Filing Deadlines: Companies must file their corporate tax returns within seven months after their financial year-end.

| Tax Type | Applicable Rate | Notes |

| Corporate Tax | 24% (Standard), 15% (First RM150k for SMEs), 17% (Next RM450k) | SMEs enjoy lower rates |

| Sales & Service Tax (SST) | 6% | Applies to services and some goods |

| Withholding Tax | 10%-15% | Applies to foreign payments |

| EPF Contributions | 12%-13% (Employer), 11% (Employee) | Mandatory for employees |

| Tax Filing Deadline | Within 7 months after financial year-end | Late filing penalties apply |

7 Effective Tax Planning Strategies for Startups

Tax planning is a critical aspect of managing a startup’s financial health and long-term growth.

By implementing effective tax-saving strategies, businesses can reduce their liabilities while ensuring compliance with Malaysian tax laws.

The following strategies are designed to help startups navigate the complexities of taxation and optimize their financial planning.

1. Choosing the Right Business Structure for Tax Efficiency

One of the most fundamental tax planning strategies for startups in Malaysia is selecting the right business structure.

The type of business entity you choose will impact tax liabilities, deductions, and overall financial planning.

Startups should evaluate their growth plans, risk exposure, and tax advantages when choosing a structure.

Comparison of Business Structures and Their Tax Implications

| Business Structure | Tax Rate | Advantages | Suitability |

| Sole Proprietorship | Personal Income Tax Rates | Simple registration, low cost, full control | Freelancers, small-scale businesses |

| Partnership | Personal Income Tax Rates | Shared responsibility, flexible tax treatment | Professional firms (law, audit) |

| Private Limited (Sdn Bhd) | 15% – 24% | Limited liability, access to incentives, separate legal entity | Growth-focused startups, investors-backed ventures |

Example: A tech startup aiming to attract investors should register as an Sdn Bhd to benefit from limited liability and lower tax rates.

2. Leveraging Tax Incentives and Exemptions

The Malaysian government offers various tax incentives to encourage business growth, particularly for startups and SMEs. Understanding these incentives can significantly reduce tax burdens.

Notable Tax Incentives:

| Incentive | Tax Benefit | Eligibility Criteria |

| Pioneer Status (PS) | 70%-100% income tax exemption for up to 10 years | Companies in high-tech, biotech, or green energy sectors |

| Investment Tax Allowance (ITA) | Additional deductions on capital expenditure | R&D, manufacturing, and environmental initiatives |

| MSC Malaysia Status | IT exemptions, reduced tax rates | Tech-based companies with MSC status |

| SME Tax Deduction | Up to RM300,000 in pre-operational expenses | Newly incorporated SMEs |

Example: A fintech startup developing AI-driven financial solutions may qualify for Pioneer Status, reducing their taxable income significantly.

3. Maximizing Deductions on Business Expenses

A crucial tax planning strategy for startups in Malaysia is effectively managing business expenses to claim maximum deductions. Proper expense tracking can save thousands in taxes each year.

Deductible Business Expenses:

| Expense Type | Deductibility | Notes |

| Rental & Utilities | Fully deductible | Office rent, electricity, water, internet |

| Employee Salaries & EPF Contributions | Fully deductible | Salaries, EPF, SOCSO, and EIS contributions |

| Marketing & Advertising | Fully deductible | Digital marketing, branding, PR |

| R&D Expenses | Partially/fully deductible | If registered under R&D tax incentives |

| Professional Fees | Fully deductible | Legal, accounting, consultancy services |

Tip: Maintain detailed records and receipts for all business-related expenses to avoid issues during tax audits.

4. Optimizing Employee-Related Tax Benefits

Startups can implement tax-efficient payroll strategies to reduce overall tax liabilities while attracting top talent. Employee-related incentives not only lower taxes but also improve retention rates.

Tax-Efficient Compensation Strategies:

| Strategy | Benefit |

| Medical Insurance | Tax-exempt benefit, reduces taxable salary |

| Stock Options | Encourages employee retention, taxable only upon sale |

| Training Programs | Claimable under HRDF tax deductions |

Example: A startup offering stock options as part of employee compensation can defer taxation until employees sell their shares.

5. Managing GST and Sales & Service Tax (SST) Compliance

Understanding and adhering to SST requirements is essential for startups.

| SST Compliance Rules | Requirement |

| Registration Threshold | RM500,000 annual revenue |

| SST Rate | 6% |

| Filing Frequency | Bi-monthly |

| Records Retention | Minimum 7 years |

Example: A SaaS startup providing digital solutions should assess whether SST applies to its services.

6. Proper Record-Keeping and Documentation

One often-overlooked tax planning strategy for startups in Malaysia is maintaining accurate records. Proper documentation ensures smooth tax filings, reduces the risk of penalties, and helps during audits.

In addition, well-organized records can provide valuable insights into business expenses and financial planning, helping startups identify potential cost-saving opportunities and areas for growth.

Key Practices:

- Keep digital and physical copies of receipts and invoices, ensuring they are categorized appropriately.

- Use accounting software for expense tracking and generate real-time reports to monitor financial health.

- Ensure payroll records are well-maintained for tax compliance and provide an audit trail for regulatory purposes.

- Schedule periodic internal audits to check for discrepancies and verify the accuracy of financial records.

- Consult with a professional accountant to ensure compliance with evolving tax laws and best practices.

7. Tax Planning Through Business Loans and Capital Structure

Strategic use of business loans and equity funding can lead to tax advantages. Certain types of business financing offer tax-deductible interest payments, reducing taxable income.

Furthermore, properly structuring debt and equity can enhance cash flow management, ensuring that a startup has the financial flexibility needed for growth.

Examples:

- Interest on business loans is typically tax-deductible, allowing startups to lower taxable income while maintaining liquidity.

- Certain types of equity investments can be structured for tax advantages, such as deferred tax obligations on capital gains.

- Leveraging government-backed SME loan programs can provide startups with additional tax relief while securing favorable financing terms.

- Using hybrid instruments such as convertible debt can help startups manage tax obligations while optimizing capital structure for future fundraising.

Additional Considerations: Leveraging Professional Tax Assistance

While implementing tax planning strategies for startups in Malaysia is essential, working with a professional tax consultant can provide additional advantages.

Tax experts can help identify overlooked deductions, ensure compliance with evolving tax laws, and provide strategic financial planning to minimize tax burdens.

Benefits of Hiring a Tax Consultant:

- Expertise in Malaysian tax regulations and updates.

- Tailored tax strategies for your specific business needs.

- Avoidance of costly tax penalties due to miscalculations.

- Assistance in securing government grants and tax incentives.

For startups aiming for long-term growth, seeking professional guidance can be a game-changer in maintaining financial health.

Takeaways

Implementing effective tax planning strategies for startups in Malaysia is crucial for financial success and long-term sustainability.

By selecting the right business structure, leveraging tax incentives, managing expenses wisely, and using technology for compliance, startups can optimize their tax burden and focus on growth.

For startups unsure about their tax obligations, seeking guidance from a qualified tax consultant can provide clarity and ensure full compliance with Malaysia’s tax regulations.

By staying proactive with tax planning strategies for startups in Malaysia, businesses can build a strong financial foundation and maximize profitability in the competitive marketplace.