As sustainability becomes a global priority, homeowners in New Zealand have an excellent opportunity to benefit from tax breaks for eco-friendly homeowners in New Zealand. These incentives not only promote green living but also help reduce the financial burden of sustainable home improvements.

Whether you’re considering solar panels, smart energy systems, or rainwater harvesting solutions, taking advantage of these tax benefits can make eco-friendly upgrades more affordable.

In this guide, we’ll explore the 10 most significant tax breaks for eco-friendly homeowners in New Zealand, their eligibility criteria, and how to claim them. Additionally, we’ll provide practical examples, case studies, and current trends to help you make informed decisions.

Understanding Eco-Friendly Tax Breaks in New Zealand

Embracing eco-friendly upgrades in your home is not just about reducing environmental impact—it also comes with significant financial advantages. Tax breaks for eco-friendly homeowners in New Zealand make sustainable home improvements more affordable, allowing homeowners to benefit from government-backed incentives while cutting energy costs. Whether you are considering renewable energy sources, smart energy management, or water conservation systems, these tax benefits can make your green investment worthwhile.

What Are Eco-Friendly Tax Breaks??

Tax breaks for eco-friendly homeowners in New Zealand are government incentives designed to encourage sustainable home improvements. These benefits come in various forms, such as tax deductions, rebates, and grants, aimed at reducing carbon footprints and promoting renewable energy use.

Recent government initiatives have prioritized green investments, making it easier than ever for homeowners to upgrade their properties while saving money.

Who Qualifies for These Tax Breaks?

To qualify for tax breaks for eco-friendly homeowners in New Zealand, you typically need to:

- Own a residential property in New Zealand.

- Invest in eco-friendly home improvements like solar panels, insulation, or rainwater harvesting systems.

- Provide proof of purchase and installation by a certified professional.

- Meet specific criteria outlined by the New Zealand government or local councils.

10 Tax Breaks for Eco-Friendly Homeowners in New Zealand

Switching to eco-friendly home solutions can be a smart financial decision, thanks to various tax incentives available in New Zealand. Whether you’re looking to install solar panels, upgrade insulation, or incorporate water-saving fixtures, these tax breaks help homeowners make sustainable choices without breaking the bank.

Below, we explore the top 10 tax breaks for eco-friendly homeowners in New Zealand that can help you save money while reducing your carbon footprint.

1. Solar Panel Rebates and Tax Credits

Solar energy is one of the most effective ways to cut electricity costs and reduce carbon footprints. In New Zealand, the government and local councils offer rebates and tax credits to homeowners who install solar panels, making it an attractive investment.

Benefits:

- Rebates on solar panel purchases through the Warmer Kiwi Homes program.

- Tax credits for solar installations that meet energy efficiency standards.

- Lower electricity costs through net metering benefits.

- Increased property value due to sustainability upgrades.

| Feature | Details |

| Rebate Amount | Up to 50% of installation cost covered |

| Eligibility | Homeowners installing approved solar systems |

| Claim Process | Apply via EECA with proof of installation |

Example:

John, a Wellington resident, installed a 5kW solar panel system and received a rebate covering 40% of his total costs, reducing his upfront expenses significantly.

2. Energy-Efficient Home Insulation Deductions

Proper insulation reduces heating and cooling costs, making it an essential eco-friendly upgrade. The government provides grants covering up to 80% of insulation costs for eligible homes, especially older properties needing upgrades.

Benefits:

- Government-funded grants covering insulation costs.

- Tax deductions for insulation expenses, reducing annual tax liability.

- Better indoor comfort and energy efficiency, lowering power bills.

| Feature | Details |

| Maximum Grant | Up to 80% of insulation costs covered |

| Eligibility | Homeowners with properties built before 2008 |

| Application | Apply via EECA or local council |

Example:

Lisa from Auckland upgraded her roof and wall insulation, cutting her winter heating bill by 35% while benefiting from a government grant covering 70% of the installation cost.

3. Heat Pump and HVAC System Incentives

Heating and cooling account for a significant portion of household energy use, often making up to 40% of total energy consumption in New Zealand homes. Switching to an energy-efficient heat pump can cut energy bills by up to 50%, significantly reducing household expenses.

These modern systems are designed to maintain comfortable indoor temperatures year-round while using less energy than traditional heaters and air conditioners. With government incentives in place, upgrading to an energy-efficient heat pump is a cost-effective and environmentally responsible decision.

Benefits:

- Partial reimbursement for new heat pump installations.

- Lower energy consumption through improved efficiency.

- Extended lifespan of HVAC systems, reducing long-term costs.

| Feature | Details |

| Rebate Amount | Up to $2,000 for approved systems, varying by region |

| Efficiency Requirement | Must meet EECA energy ratings (4-star or higher recommended) |

| Claim Process | Apply via EECA-approved retailers with proof of purchase and installation |

Case Study:

David installed a 4-star rated heat pump and received a $1,500 rebate, cutting his energy consumption by 45%.

4. Rainwater Harvesting System Rebates

Rainwater collection systems are becoming increasingly popular, helping homeowners conserve water and reduce utility costs.

Benefits:

- Rebates on installation costs for rainwater tanks.

- Tax deductions for plumbing modifications to accommodate rainwater use.

- Reduced dependency on municipal water supplies, saving costs.

| Feature | Details |

| Rebate Amount | Up to 50% of installation costs |

| Eligible Systems | Approved rainwater tanks and filtration |

| Claim Process | Apply through local councils |

5. Electric Vehicle (EV) Charger Installation Credits

As the demand for electric vehicles (EVs) rises, having a home EV charging station is becoming a necessity. Homeowners who install an EV charger can benefit from government incentives, making the switch to an electric vehicle more affordable.

These tax breaks encourage the adoption of clean energy transportation by reducing installation costs and offering lower electricity rates for off-peak charging. Additionally, some energy providers offer further discounts for EV owners, maximizing the savings potential.

Benefits:

- Up to $1,000 rebate on EV charger installation.

- Lower electricity rates for EV charging at off-peak hours.

- Increased home value with a dedicated EV charging setup.

- Potential additional incentives from local power companies.

| Feature | Details |

| Maximum Credit | $1,000 per installation |

| Eligibility | Homeowners with EVs |

| Application | Claim via IRD with proof of purchase |

| Additional Benefits | Some local power companies offer further rebates |

Example:

Sarah, an Auckland homeowner, installed a Level 2 home EV charger and received a $1,000 rebate from the government. Additionally, her local power provider offered her a 10% discount on off-peak charging, further reducing her energy costs.

6. Sustainable Home Renovation Grants

Renovating your home with sustainable materials not only benefits the environment but also qualifies for tax incentives and grants in New Zealand. Sustainable renovations improve energy efficiency, reduce waste, and enhance indoor air quality, making homes healthier and more cost-effective in the long run.

Homeowners can receive rebates for using energy-efficient materials and eco-friendly construction techniques, such as recycled insulation, low-VOC paints, and solar-reflective roofing. These upgrades not only contribute to environmental sustainability but also increase property value and reduce long-term energy expenses.

Benefits:

- Tax deductions for eco-friendly construction materials.

- Government-backed renovation grants.

- Lower long-term maintenance costs due to durable materials.

| Feature | Details |

| Grant Amount | Up to $5,000 for approved renovations |

| Eligible Upgrades | Sustainable flooring, roofing, and insulation |

| Application | Apply via EECA or local sustainability programs |

Example:

Sophie renovated her Auckland home with eco-friendly bamboo flooring and energy-efficient windows, securing a $3,500 grant while increasing her home’s energy efficiency.

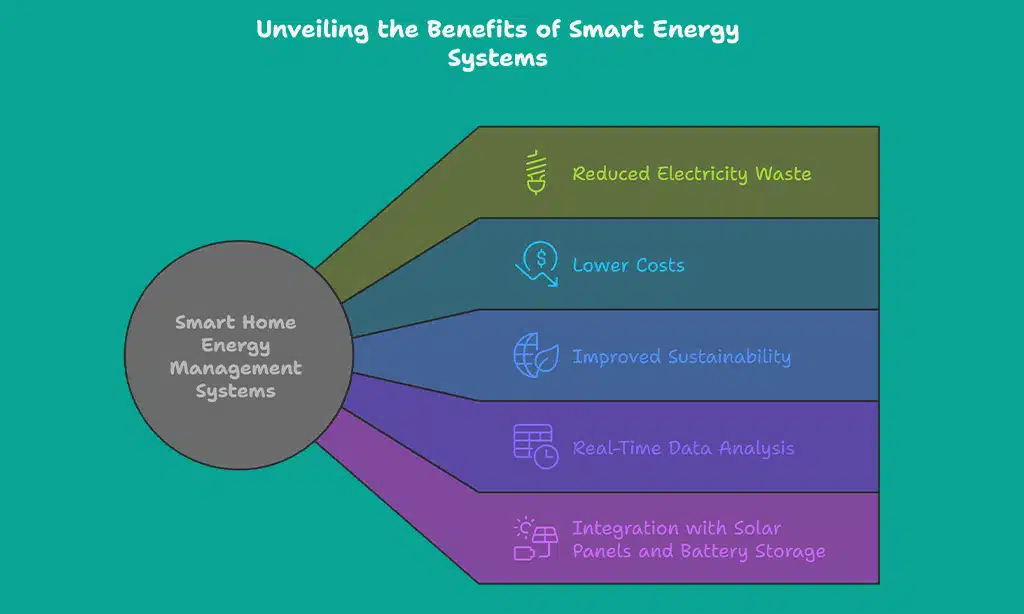

7. Smart Home Energy Management System Incentives

Installing smart home energy management systems, such as automated thermostats, smart meters, and AI-driven energy monitors, allows homeowners to track, optimize, and automate energy usage more efficiently.

These systems help reduce electricity waste, lower costs, and improve sustainability by ensuring energy is used only when needed. With real-time data analysis, homeowners can adjust consumption habits and take advantage of lower-cost, off-peak electricity rates. Additionally, some systems integrate with solar panels and battery storage, further enhancing energy savings.

Benefits:

- Tax credits for smart energy devices, reducing upfront costs.

- Lower electricity bills through automation and optimized energy use.

- Real-time monitoring to identify and eliminate energy waste.

- Integration with renewable energy sources for greater efficiency.

- Potential rebates from energy providers for smart technology adoption.

| Feature | Details |

| Rebate Amount | Up to 40% off smart energy installations, varying by region |

| Eligible Devices | Smart thermostats, AI-powered energy meters, automated lighting, solar-integrated energy monitors |

| Claim Process | Apply through EECA, local councils, or power providers with proof of installation |

| Additional Benefits | Some energy providers offer discounts for using smart home energy solutions |

Case Study:

Mike, a homeowner in Christchurch, installed a smart thermostat, AI-powered energy meter, and automated lighting system. By monitoring real-time energy consumption and making adjustments, he reduced his power bill by 30% and received a $1,200 rebate from his local energy provider. His smart system also integrated with his home solar panels, further optimizing his energy efficiency.

8. Low-Flow Plumbing Fixtures Tax Benefits

Water conservation is encouraged through tax incentives for low-flow plumbing fixtures. These fixtures are designed to use significantly less water than traditional models while maintaining performance and efficiency.

Homeowners who install low-flow toilets, faucets, and showerheads can benefit from financial incentives while reducing their household’s overall water consumption. Many councils and government programs support this initiative to promote sustainable water use and decrease pressure on municipal water supplies.

Benefits:

- Rebates for purchasing water-saving appliances, reducing upfront costs.

- Lower water bills, as these fixtures use up to 50% less water.

- Reduced environmental impact, conserving precious water resources.

- Extended lifespan of plumbing systems, due to reduced strain and wear.

- Government support, with many councils offering financial incentives for water conservation measures.

| Feature | Details |

| Rebate Amount | Up to $500 per fixture |

| Eligible Upgrades | Low-flow toilets, faucets, and showerheads |

| Water Savings | Reduces water usage by 25% to 50% per fixture |

| Claim Process | Apply via local councils or EECA with proof of installation |

Example:

Emma replaced her old showerheads and faucets with low-flow models, cutting her water usage by 25% and securing a $750 rebate. Over the next year, she also saved an additional $200 on her water bill, demonstrating both the financial and environmental benefits of switching to water-efficient plumbing.

9. Green Roof and Living Wall Tax Deductions

Green roofs and living walls improve insulation, enhance air quality, and qualify for tax deductions in New Zealand. These installations also contribute to urban sustainability initiatives by reducing heat absorption, improving stormwater management, and increasing biodiversity in urban areas.

Green roofs help regulate indoor temperatures, lowering heating and cooling costs, while living walls act as natural air filters, removing pollutants and improving overall air quality.

Many cities worldwide have already adopted these green infrastructure techniques to combat climate change and enhance urban resilience, making them an excellent investment for homeowners looking to reduce their environmental footprint while benefiting from tax incentives.

Benefits:

- Deductions for installation costs.

- Reduced energy costs through better insulation.

- Improved air quality and aesthetics.

| Feature | Details |

| Rebate Amount | Up to 30% of installation costs covered |

| Eligible Upgrades | Green roofs, vertical gardens, rooftop gardens |

| Application | Claim via IRD or local environmental programs |

Case Study:

David installed a living wall in his Christchurch home, improving insulation and air quality while receiving a $2,500 tax deduction.

10. Property Tax Discounts for Certified Sustainable Homes

Owning a certified eco-friendly home can lead to lower property tax rates, increased resale value, and long-term financial savings. Sustainable home certifications, such as Green Star and Homestar, qualify homeowners for substantial tax reductions while ensuring greater energy efficiency and lower operating costs.

These certifications demonstrate a commitment to sustainability and make properties more attractive to environmentally conscious buyers, adding to their market appeal.

Benefits:

- Up to 20% property tax discount for Green Star-certified homes, making ownership more affordable.

- Higher home value due to sustainability certification, leading to better resale prospects.

- Reduced carbon footprint through sustainable construction, energy-efficient materials, and lower energy consumption.

- Lower utility costs, as eco-certified homes often feature renewable energy systems and water-saving technology.

- Enhanced mortgage and financing options, with some banks offering lower interest rates for certified green homes.

| Feature | Details |

| Discount Rate | Up to 20% property tax reduction |

| Certification Required | Green Star, Homestar |

| Additional Benefits | Reduced energy costs, improved resale value, mortgage incentives |

| Claim Process | Apply via local councils with certification proof |

Example:

The Smith family in Wellington upgraded their home to a Green Star 6 rating, reducing their property taxes by 15% annually. Their investment in solar panels, smart energy management, and sustainable insulation also helped them cut their electricity bill by 30%. When they decided to sell, their certified green home attracted multiple buyers and sold 10% above the average market price, proving the financial advantages of eco-friendly homeownership.

Wrap Up

New Zealand offers multiple tax breaks for eco-friendly homeowners, making it easier to transition to sustainable living while saving money. By leveraging these 10 tax breaks for eco-friendly homeowners in New Zealand, you can reduce your home’s carbon footprint and enhance long-term savings.

Take action today—explore these incentives, invest in eco-friendly upgrades, and enjoy both financial and environmental benefits!