Hey there, are you curious about the buzzing world of cryptocurrencies and blockchain technology, but feel a bit lost in all the tech talk? Don’t worry, you’re not alone—many folks find it tough to keep up with the fast-paced changes in digital finance and wonder which companies are truly making waves.

Here’s a cool tidbit to get you started: Switzerland, often called Crypto Valley, is a hot spot for innovation, hosting seven massive startups, each valued at over $1 billion, diving deep into blockchain and digital currencies. These giants are shaking things up on a global scale!

In this blog post, we’re breaking it all down for you, spotlighting these seven Swiss powerhouses like 21.co and Acronis, showing how they’re changing the game in areas from crypto assets to cyber protection. We’ll keep it simple, chatty, and packed with insights to help you grasp their impact. Stick around, it’s gonna be a fun ride!

Key Takeaways

- Switzerland’s Crypto Valley in Zug hosts 7 crypto unicorns, each valued over $1 billion, driving blockchain innovation.

- 21.co, founded by Hany Rashwan and Ophelia Snyder in 2018, focuses on crypto asset management with a $2 billion valuation as of September 2022.

- Acronis, started in 2003 by Serguei Beloussov and others, excels in cyber protection with blockchain, valued at $3.5 billion since September 2019.

- Numbrs, launched in 1999 by Boris Manhart and team, pioneers crypto personal finance, hitting a $1 billion valuation by August 2019.

- SonarSource, founded in 2008 by Freddy Mallet and others, boosts code security with blockchain, valued at $4.7 billion as of April 2022.

21. co – The Leader in Crypto Asset Management

Let’s talk about 21.co, a standout player in the crypto world. Based in Zurich, this company kicked off in 2018, thanks to founders Hany Rashwan and Ophelia Snyder. They focus on crypto asset management, helping people handle their digital currencies like BTC with ease.

With a valuation of $2.00 billion as of September 2022, they’re a big deal in blockchain technology. Their work in financial services and FinTech shows how crypto assets can grow in today’s market.

Now, get this, 21.co isn’t just a small shop; they employ between 101 and 250 folks, building smart solutions in Switzerland’s Crypto Valley. They’ve raised $35 million over three funding rounds from five investors, proving trust in their vision for decentralized finance.

Their spot in Zug, Switzerland, ties them to a buzzing blockchain hub, pushing crypto innovation forward. Stick around to see how they shape the future of cryptocurrencies!

Acronis – Revolutionizing Cyber Protection with Blockchain

Acronis stands out as a game-changer in cyber protection, and I’m excited to share their story with you. Based in Schaffhausen, this Swiss company, founded in 2003 by Serguei Beloussov, Stanislav Protassov, and Yakov Zubarev, has a valuation of $3.50 billion as of September 2019.

They focus on cloud data services, cloud security, cyber security, and software solutions. Imagine a fortress for your digital life; that’s what Acronis builds, but with a twist of blockchain technology.

This mix keeps your data safe and untouchable by hackers. With 1,000 to 5,000 employees, they’re a big player in the blockchain industry.

Dig into their journey, and you’ll see Acronis raised $427.51 million across four funding rounds from six investors. That’s a hefty sum showing trust in their vision for a safer internet.

They weave blockchain infrastructure into cyber protection, creating a shield against threats in the wild world of the web. Think of it as a digital lock no one can pick, especially in Switzerland’s Crypto Valley, a hub for blockchain innovation.

Their work ties into hot trends like decentralized finance (DeFi) and data management and verification. Curious about more Swiss pioneers? Let’s move to Numbrs and their take on personal finance solutions.

Numbrs – Pioneering Crypto-Driven Personal Finance Solutions

Hey there, let’s talk about Numbrs, an awesome company making waves in personal finance with a crypto edge. Based in Zurich, this standout began in 1999, founded by Boris Manhart, Johannes Huebner, and Martin Saidler.

They’ve become a major force with a valuation of $1 billion as of August 2019. Think of having a friend who simplifies managing your money using blockchain technology; that’s Numbrs in a nutshell.

Their emphasis on apps, banking, and financial services makes managing money feel effortless, even from your phone.

On the topic of expansion, Numbrs has a team of 100 to 250 people, and they’ve secured an impressive $127.60 million over 9 funding rounds from 10 investors. Their efforts in decentralized finance, commonly known as DeFi, are transforming our view of traditional financial systems.

It’s like empowering individuals, one digital wallet at a time. Plus, being located in Switzerland’s Crypto Valley, specifically Zug, Switzerland, positions them at the core of blockchain innovation.

Want to learn more? Let’s shift to Nexthink and explore how they’re enhancing digital workplaces with blockchain solutions.

SonarSource – Redefining Code Security with Blockchain Integration

SonarSource stands out in the tech world with its focus on code security, and it’s making waves from Geneva. Started in 2008 by Freddy Mallet, Olivier Gaudin, and Simon Brandhof, this company has grown fast.

With a valuation of $4.70 billion as of April 2022, it’s a big player. They work in cyber security, developer tools, open source, and software fields. Plus, they’ve raised $457 million across two funding rounds from four investors.

What’s cool? They’re blending blockchain technology into their systems to boost safety for coders everywhere.

Now, let’s chat about how SonarSource ties into the blockchain industry. Their team of 101 to 250 employees is hard at work, securing code with blockchain infrastructure. Think of it like locking a safe with an unbreakable key.

By using blockchains, they help protect data management and verification for developers. This fits right into Switzerland’s Crypto Valley vibe, especially in Zug, Switzerland. Their push into decentralized applications shows how blockchain innovation can shield software from threats.

Stick around to see how they’re changing the game!

MindMaze – Transforming Neurotechnology with Blockchain Innovation

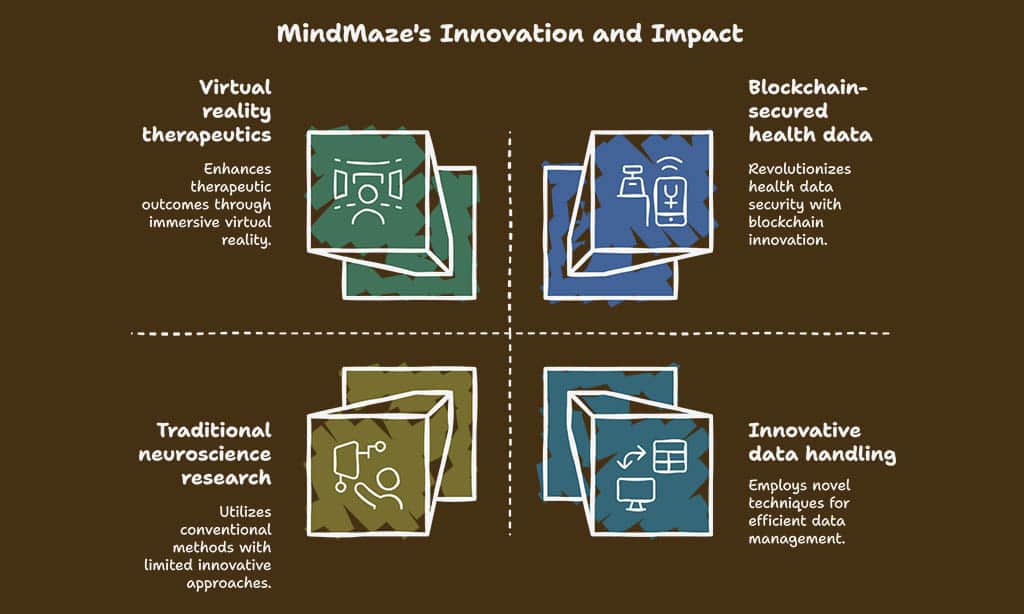

Moving from code security with SonarSource, let’s shift gears to a mind-blowing blend of brain science and tech with MindMaze. This Swiss gem, based in Lausanne, is shaking up neurotechnology by mixing blockchain innovation into their work.

Founded in 2012 by Tej Tadi, MindMaze boasts a valuation of $1 billion as of January 2016. They focus on health care, neuroscience, therapeutics, and even virtual reality, with a team of 100 to 250 employees.

Talk about a powerhouse!

Dig into this: MindMaze has raised a hefty $243.50 million across 10 funding rounds from 7 investors. Their mission? To transform how we heal and understand the brain, using blockchain technology for secure data handling.

Imagine your health info guarded by ironclad blockchain networks, safe from prying eyes. In Switzerland’s Crypto Valley, they’re paving the way for privacy in medical tech, proving that innovation isn’t just a buzzword, it’s their daily grind.

Scandit – Elevating Data Capture with Blockchain Technology

Shifting gears from MindMaze’s brainy blockchain breakthroughs, let’s talk about Scandit, a transformative force in data capture. Based in Zurich, this company launched in 2009, founded by Christian Floerkemeier, Christof Roduner, and Samuel Mueller.

They’ve created a leading solution in augmented reality and image recognition, integrating blockchain technology to simplify data management and verification. Envision scanning a product with your phone and receiving immediate, secure details, all powered by their innovative software.

With a valuation of $1.00 billion as of February 2022, Scandit stands as a major contender in Switzerland’s Crypto Valley.

Now, imagine a team of 250 to 500 employees dedicated to advancing mobile apps and machine learning. Scandit has secured an impressive $273.00 million across 8 funding rounds from 13 investors, reflecting strong confidence in their mission.

Their efforts connect to the wider blockchain ecosystem, ensuring data security in a landscape eager for decentralized approaches. It’s akin to placing a digital safeguard on every piece of information, whether in retail or logistics.

Stay tuned to discover how these Swiss innovators influence the global blockchain industry!

The Impact of Swiss Crypto Unicorns on the Global Blockchain Industry

Let’s chat about something exciting, folks. Switzerland’s Crypto Valley, based in Zug, is a powerhouse with 1,135 entities driving the blockchain industry forward. Visualize a vibrant hub where ideas ignite with incredible energy.

The top 50 entities here hold an impressive valuation of $185 billion, with blockchain platforms alone achieving a market capitalization of $175.6 billion. Plus, the equity value of these companies reaches $9.7 billion.

It’s like witnessing a small town transform into a tech giant in record time. This area isn’t just participating in the game; it’s redefining the standards of decentralized finance (DeFi) and blockchain innovation on a global scale.

With 9 unicorns, including 7 blockchain platforms and 2 commercial firms, Crypto Valley demonstrates how to merge technology with significant impact.

Now, envision this tremendous growth in motion. Funding for those top 50 entities increased by 2.7%, reaching an impressive $3.2 billion, showing that investors recognize immense potential in this blockchain ecosystem.

Switzerland’s Distributed Ledger Technology (DLT) Act serves as a stellar model, a kind of framework for blockchain regulation that other countries admire. This isn’t just about figures; it’s about pioneering trends in smart contracts and decentralized exchanges.

Crypto Valley’s influence expands horizons, sparking global changes in how we approach data management and verification. So, what’s ahead for this groundbreaking hub? Let’s wrap up with some final insights in our conclusion.

Takeaways

Hey there, readers! Swiss Crypto Unicorns are making waves in the blockchain world, and it’s exciting to see their impact. From Zug, Switzerland, these seven giants are shaping tech with bold ideas.

Isn’t it cool how Crypto Valley sparks such amazing growth? Stick around to watch this space buzz with more innovation!

FAQs

1. What makes Switzerland’s Crypto Valley a big deal for blockchain tech?

Hey, let me tell you, Switzerland’s Crypto Valley, nestled in Zug, Switzerland, is like the beating heart of blockchain innovation. It’s a buzzing blockchain hub where companies thrive on cutting-edge blockchain technology and build a robust blockchain ecosystem. If you’re into crypto, this place is where dreams turn into digital gold.

2. Which Swiss crypto unicorns are shaking up decentralized finance?

Well, pal, let’s chat about SwissBorg, a real game-changer in decentralized finance, often just called DeFi. They’re mixing things up by making cryptoassets accessible, kinda like opening the door to a candy store for everyone.

3. How does the Internet Computer fit into the Swiss crypto scene?

Listen up, the Internet Computer, born in Crypto Valley, is a powerhouse for an open internet. It’s all about pushing Web 3.0 forward with slick blockchain protocols. Think of it as the cool kid on the block, linking computing and data management with verification like a pro.

4. Are there Swiss unicorns playing with non-fungible tokens?

You bet, my friend! Some companies in Zug, Switzerland, are diving deep into non-fungible tokens, or NFTs as we call ‘em. They’re crafting digital goodies in the blockchain industry that you can’t find anywhere else, turning art into virtual currency.

5. What’s the deal with Casper Blockchain in Switzerland?

Yo, Casper Blockchain is a name to watch in Switzerland’s Crypto Valley. It’s carving a path in public blockchain spaces, focusing on scalability and sidechains to keep things speedy. Picture it as a racecar in the blockchain infrastructure world, zooming past the competition.

6. How do Swiss banks tie into this crypto craze?

Hey there, let’s not forget Swiss banking giants like LGT jumping on the crypto bandwagon. They’re blending old-school financial institution vibes with modern crypto.com and Binance vibes, offering futures and market making. It’s like mixing grandpa’s wisdom with a teenager’s tech savvy, and it works!