The vision was elegant in its simplicity: combine India’s software dominance with Bangladesh’s demographic dividend to create a South Asia IT Strategy—a “South Asian Schengen” for technology.

Dubbed the “Silicon Corridor,” this initiative—formalized in the heady days of June 2024—promised a seamless digital ecosystem stretching from Dhaka to Kolkata, and critically, acting as the digital lifeline for India’s landlocked Northeast. It was to be a mesh of fiber optics, fintech interoperability, and cross-border innovation.

Two years later, in January 2026, the Corridor is not dead, but it has been unrecognizable.

Following the seismic political shifts in Bangladesh in late 2024 and the subsequent “secularization” of cross-border relations, the Silicon Corridor has morphed from a state-sponsored superhighway into a complex, fractured archipelago. Governments have decoupled, but the private sector—driven by sheer necessity—has gone underground, rewiring the region’s digital architecture in real-time.

Explores the collapse of the G2G (Government-to-Government) digital pacts, the rise of the “Penang Pivot,” and the new “Shadow Corridor” keeping the tech ecosystems alive.

Key Takeaways: The State of the Corridor in 2026

-

The “Silicon Corridor” is Dead; Long Live the “Archipelago”: The vision of a seamless, government-led digital highway between India and Bangladesh has collapsed. It has been replaced by a fragmented “Archipelago” model where connectivity is maintained not through direct borders, but through neutral third-party hubs like Singapore and Dubai.

-

Infrastructure has become a “Ghost Asset”: The $2 billion Line of Credit (LoC) initiative has failed to deliver tangible results. The “Ghost Parks”—stalled construction sites of high-tech zones—stand as monuments to the breakdown in G2G trust. Bangladesh is now pivoting to Chinese and multilateral funding to complete these projects.

-

The “Penang Pivot” is the New Strategy: Bangladesh has strategically realigned its hardware and semiconductor ambitions Eastward. By partnering with Malaysia to become a “Test & Assembly” hub, Dhaka is bypassing the Indian ecosystem entirely to integrate into the global chip supply chain.

-

The “Singapore Loop” Sustains the Market: While politicians have erected barriers, the private sector has dug tunnels. The massive spike in “Singaporean” FDI into Bangladesh masks a reality where Indian capital is still flowing, but through offshore holding companies to avoid geopolitical friction.

-

Digital Sovereignty Trumped Financial Integration: The failure of the “Rupee-Taka” payment link proves that without deep political trust, financial interoperability is impossible. The region has ironically reverted to a heavier reliance on the US Dollar and SWIFT, defeating the original purpose of “Geopatriation.”

The “Why Now?” – The Collapse of the 2024 Consensus

To understand the 2026 landscape, we must first revisit the “June Consensus” of 2024. The India-Bangladesh Digital Partnership was built on three pillars:

- Connectivity: Bangladesh would act as the “ISP” for Northeast India, exporting bandwidth from Cox’s Bazar to Agartala/Tripura.

- Infrastructure: India would finance and build 12 Hi-Tech Parks in Bangladesh via Lines of Credit (LoC).

- Fintech: The integration of India’s UPI (Unified Payments Interface) with Bangladesh’s TakaPay to bypass the US Dollar for regional trade.

The 2026 Reality Check

By Q1 2026, all three pillars have faced structural failure due to a phenomenon analysts are calling “Tech-Securitization.

- The “Kill Switch” Anxiety: Post-2024, New Delhi began viewing Bangladesh’s control over Northeast India’s internet feed not as a partnership, but as a strategic vulnerability.

- The Sovereignty Backlash: Dhaka’s new administration reviewed all Indian-funded projects, labeling the “Indian Economic Zones” (Mirsarai & Mongla) as restrictive and economically unviable, leading to a de facto freeze.

The Infrastructure Freeze: The End of the “LoC” Era

The most visible casualty of 2026 is physical infrastructure.

1. The “Ghost Parks” of 2026

In 2024, India committed nearly $2 billion in Lines of Credit (LoC) to build high-tech infrastructure in Bangladesh. As of January 2026, most of these sites are “Ghost Parks”—partially cleared land with no active construction.

- The Contractor Exodus: Following the security concerns of August 2024, major Indian contractors like Fcons Infrastructure evacuated their engineers.4 They never returned.

- The Standoff: The LoC agreements required 65-75% procurement of materials and services from India.5 Bangladesh’s new government has refused to honor this, demanding open global tenders. India has refused to release funds for non-Indian contractors.

- Result: 12 planned IT parks are stalled. Bangladesh is now in active talks with the Asian Infrastructure Investment Bank (AIIB) and Chinese state-owned enterprises to take over these sites, marking a hard pivot in infrastructure alignment.

2. The “Digital Sanction”: The Bandwidth Blockade

Perhaps the most critical development of late 2025 was the “Bandwidth Shock.”

For years, BSCCL (Bangladesh Submarine Cable Company Limited) had been exporting 20 Gbps of bandwidth to Tripura, providing the Indian state with its fastest internet link.

- The Event: On October 22, 2025, amidst rising diplomatic tensions, India’s state-owned BSNL effectively suspended these imports, citing “administrative review.”6

- The Impact:

- For India: Internet speeds in Tripura and Meghalaya plummeted by 40% in Q4 2025 as traffic was rerouted through the narrow, congested “Chicken’s Neck” (Siliguri Corridor).

- For Bangladesh: BSCCL lost a lucrative revenue stream (approx. $1.2M annually) overnight.

- The Strategic Shift: This was the first clear instance of “Digital Decoupling.” India is now accelerating the “North East Gateway“ project—a massive effort to lay independent fiber lines through Myanmar (despite its instability) to bypass Bangladesh entirely.

The “Redefinition”: The Penang Pivot

If the door to India is closing, a window to the East is opening. The most significant trend of 2026 is Bangladesh’s strategic pivot toward Malaysia.

1. The “South-South” Semiconductor Link

Realizing it can no longer rely on India for tech transfer, Bangladesh is positioning itself as the “Test & Assembly” backyard for Malaysia’s booming semiconductor industry.

- The Nov 2025 Roadshow: A watershed moment occurred in November 2025 when the Bangladesh Semiconductor Industry Association (BSIA) led a high-level delegation to Penang (the “Silicon Valley of the East”).

- The Deal: Unlike the Indian partnership (which was top-down G2G), this is bottom-up B2B. Malaysian firms like Inari and TF-AMD are facing labor shortages. Bangladesh is offering:

- Design Talent: VLSI engineers trained in Dhaka.

- OSAT Capability: Outsourced Semiconductor Assembly and Test facilities in Kaliakoir (one of the few active parks).

2. Why Penang?

- Political Neutrality: Malaysia carries no geopolitical baggage for Bangladesh.

- Muslim-Majority Alignment: Cultural/religious alignment facilitates easier visa regimes for Bangladeshi engineers compared to the increasingly restrictive Indian visa landscape of 2026.

- The Value Chain: Bangladesh is skipping the “Service” layer (IT support) and trying to jump directly into the “Hardware” layer (Chips), aligning with the global push for supply chain diversification.

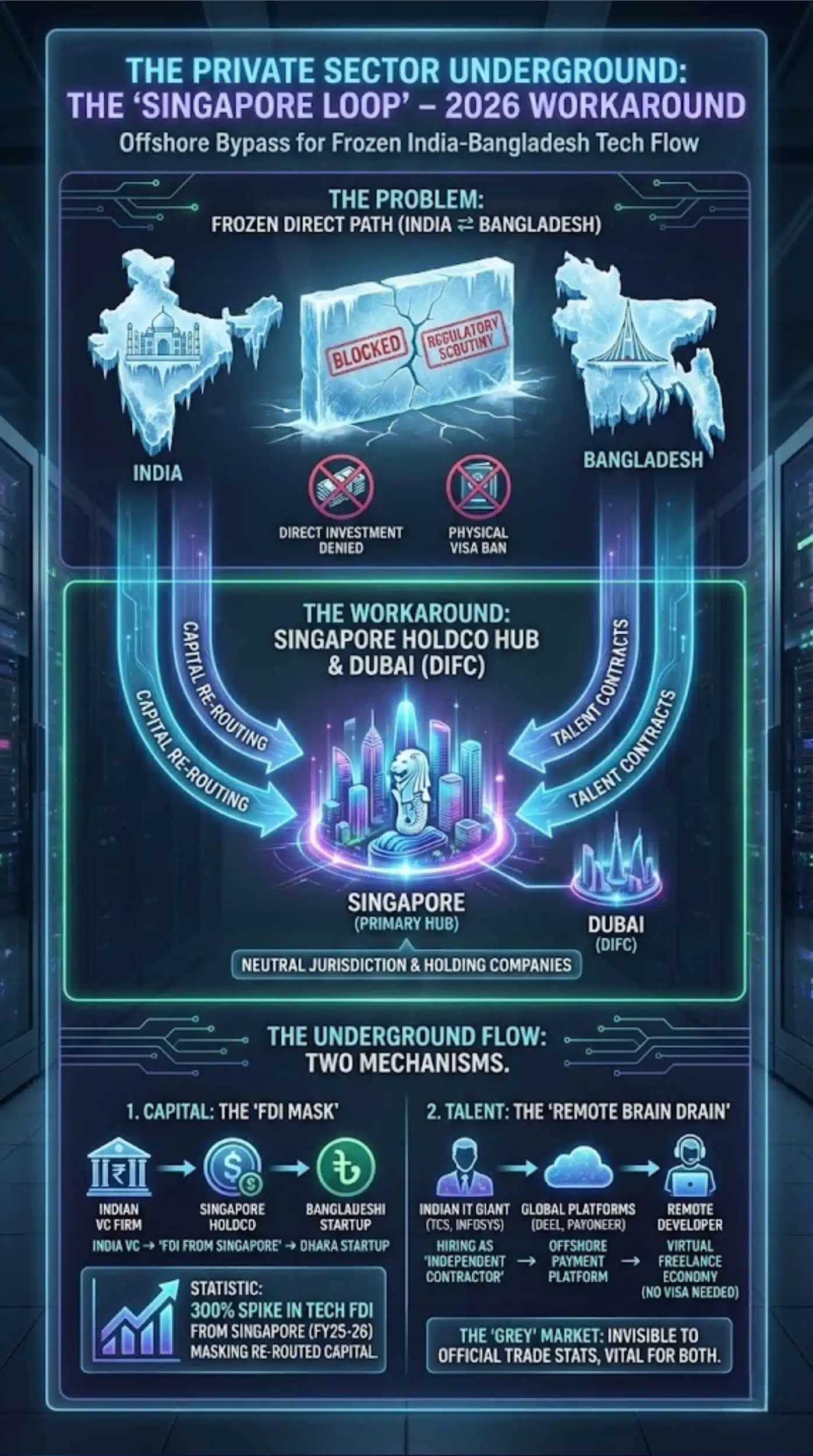

The Private Sector Underground: The “Singapore Loop”

While politicians freeze projects, the private sector has found a workaround. The “Silicon Corridor” has not disappeared; it has just moved offshore.

1. The Rise of the “Singapore Holdco”

In 2026, direct investment from India to Bangladesh (and vice versa) faces intense regulatory scrutiny.

- The Solution: Tech companies are incorporating holding companies in Singapore or Dubai (DIFC).

- Example Scenario: An Indian VC firm wants to invest in a Bangladeshi logistics startup. Instead of a direct transfer (blocked by central banks), the Indian VC invests in a Singapore entity, which then routes funds to Dhaka as “FDI from Singapore.

- Statistics: The Bangladesh Bank reported a 300% spike in FDI from Singapore in the tech sector in FY25-26, masking the reality that much of this is actually re-routed Indian capital.

2. The “Remote” Brain Drain

Visa bans have stopped physical movement, but they cannot stop code.

- The “Grey” Market: Major Indian IT giants (TCS, Infosys), facing margin pressures, are quietly hiring thousands of Bangladeshi developers as “independent contractors.

- The Mechanism: Payments are routed through platforms like Deel or Payoneer, bypassing the need for bilateral banking settlements. The “Corridor” is now a virtual, freelance economy, invisible to official trade statistics but vital for both nations.

Fintech: The Death of the “Rupee-Taka” Dream

The most ambitious pillar—Financial Sovereignty—has collapsed.

- The Plan: Integrate UPI and TakaPay to allow Indian tourists in Dhaka and Bangladeshi shoppers in Kolkata to pay via QR code, bypassing the US Dollar.

- The 2026 Status: Dead on Arrival.

- Trust Deficit: Following the 2025 asset freezes, neither central bank is willing to expose its real-time payment settlement system (RTGS) to the other.

- The Reversion to Dollar: Cross-border trade has reverted to the SWIFT system. Ironically, the “Geopatriation” trend has failed here; despite wanting to de-dollarize, the lack of regional trust has forced both nations back into reliance on the US Dollar.

The 2026 Snapshot

To understand the scale of the shift, here is the current status of the corridor’s key components.

The “Corridor” Health Check (Jan 2026)

| Pillar | 2024 Ambition | 2026 Reality | Status |

| Connectivity | 20Gbps export (Dhaka $\rightarrow$ Agartala) | 0 Gbps (Suspended by BSNL) | Critical Failure |

| Infrastructure | 12 Indian-funded Hi-Tech Parks | 0 Completed, 12 Stalled | Critical Failure |

| Startup Funding | Direct Indian VC Investment | Indirect (via Singapore/Dubai) | Adapted |

| Talent Flow | “Startup Bridge” Visas | Virtual Only (Freelance/Remote) | Adapted |

| Fintech | UPI-TakaPay Integration | Cancelled/Indefinite Hold | Dead |

The “Penang Pivot” vs. The Indian Corridor

| Feature | The Indian Corridor (Old) | The Penang Pivot (New) |

| Focus | IT Services / BPO | Semiconductors / VLSI Design |

| Driver | Government (G2G) | Private Sector (B2B) |

| Capital | Lines of Credit (Debt) | Direct Investment / Joint Venture |

| Geopolitics | High Risk (Border Tensions) | Low Risk (Neutral Trade) |

| Key Hubs | Agartala, Kolkata, Dhaka | Penang, Kuala Lumpur, Gazipur |

Strategic Outlook: The “Archipelago” Future

As we look toward the remainder of 2026, the “Silicon Corridor” as a unified geopolitical project is over. It has been replaced by an IT Archipelago.

- For Bangladesh: The strategy is “Anywhere But West.” Expect to see Dhaka courting Chinese cloud providers (AliCloud has already expanded its Dhaka region in late 2025) and Malaysian chip firms to fill the vacuum left by India.

- For India: The focus is “Security First.” India will likely accept higher internet costs for its Northeast states rather than rely on a neighbor it no longer trusts. The “Digital Iron Curtain” along the border is likely to thicken.

- For Investors: The opportunity lies in the Intermediaries. Firms in Singapore and Dubai that facilitate this “indirect” trade are the big winners. The demand for tech collaboration hasn’t disappeared—it has just become more expensive and complex to execute.

Geography can be ignored by fiber optics, but not by politics. The “Silicon Corridor” proved that even in the digital age, physical borders eventually assert their dominance.

Strategic Recommendation for Tech Leaders

If you are a CTO or Founder operating in this region:

- Diversify Connectivity: Do not rely on a single cross-border terrestrial link. Ensure satellite redundancy (Starlink/OneWeb) is in your continuity plan.

- Structure for Neutrality: If your startup serves both markets, incorporate in a neutral jurisdiction (Singapore) immediately to immunize yourself from the G2G freeze.

- Pivot Talent: Retrain your workforce for the Malaysian semiconductor stack rather than the Indian BPO stack. The future demand is in chips, not call centers.

Final Words

The unraveling of South Asia’s “Silicon Corridor” in 2026 serves as a sobering corrective to the techno-optimism of the last decade. We were promised that the internet would dissolve borders, that code was a universal language, and that economic logic would always trumpet political friction. The reality of the last two years has proven otherwise.

We have learned that fiber optic cables are only as strong as the treaties that protect them. When trust evaporates, the “Cloud” dissipates, revealing the hard, physical borders underneath. The technology sector in South Asia has not stopped growing, but it has grown apart, morphing from a collaborative ecosystem into a competitive, guarded landscape.