You feel like you’re starting at square one with your credit after Chapter 7 bankruptcy. You need a solid plan to build your credit score and repair your credit report. A bankruptcy can cut your score by up to 200 points, and it can stay on your report for up to ten years.

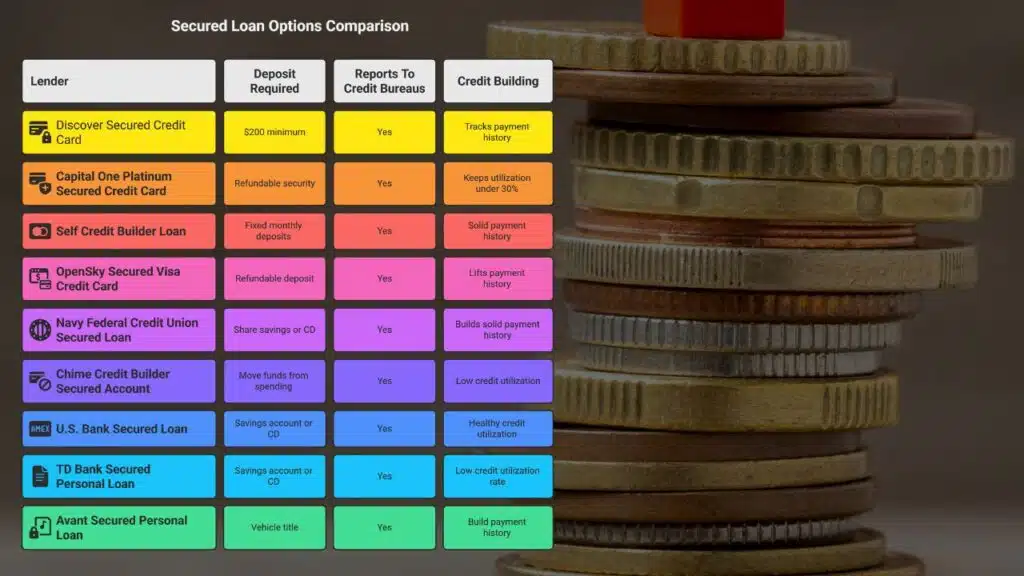

This post shows nine secured loans that report to all three credit bureaus. You’ll find secured credit cards, credit-builder loans, and secured personal loans with low interest rates.

You’ll also get tips on on-time payments and keeping your credit utilization under 30 percent. Ready to rebuild your credit? Read on.

Key Takeaways

- Chapter 7 or 13 bankruptcy can cut your credit score by up to 200 points and stays on your report for 10 years, but nine secured loans report to Equifax, Experian, and TransUnion to rebuild your score.

- Secured credit cards, credit-builder loans, and secured personal loans tie a cash deposit or collateral to your account, report each payment to all three bureaus, and help keep credit utilization under 30 percent.

- Many lenders offer low APRs (as low as 5 percent) and flexible terms from 3 to 60 months; for example, Discover Secured Card needs a $200 deposit, and Self Credit Builder Loan runs 12–24 months.

- Best practices include setting up autopay, pulling free reports at annualcreditreport.com, using credit-monitoring tools, and spacing hard inquiries at least six months apart to protect your score.

Why Secured Loans Are Effective for Rebuilding Credit Post-Bankruptcy

Secured loans tie your cash or savings to a credit account. Lenders see that deposit and report each payment to all three credit bureaus, so you build a clear payment history. On-time payments on a credit-builder loan can boost your FICO score after Chapter 7 or Chapter 13 bankruptcy, which may cut scores by 200 points.

Even with bankruptcy on your credit reports for up to ten years, newer payments count more.

These loans help you show responsible credit use. A secured credit card or personal loan can keep credit utilization low, and banks notice. You can check updates on annualcreditreport.com or use credit monitoring to track results.

Small, steady payments over a year can lift your credit scores. That solid record paves the way to better loan rates.

Key Features to Look for in Secured Loans

Pick a lender who reports on-time payments to a credit bureau and spells out the APR clearly. Then use a credit monitoring tool to track your score as you pay.

Low interest rates

Lenders charge lower APRs on secured loans than on unsecured personal loans. Lower rates shrink monthly costs, so you can fit repayments into your budget, without sweating over bills.

This move frees cash for an emergency fund and boosts payment history on your credit reports.

A low APR secured loan trims interest charges, so more of your payment pays principal. It lets you track progress with free credit monitoring at annualcreditreport.com. This step cuts credit utilization on revolving lines, and it shows on-time payments to credit reporting agencies.

Flexible repayment terms

Flexible pay schedules let readers pick a term that fits their wallet. Short plans speed score rebuilds; longer timetables shrink each bill. Many secured loan offers span three to 60 months so borrowers can match income cycles.

One borrower slid a due date to dodge a tight expense week, and still hit on-time payments. Score trackers then picked up steady pay history, lifting loan usage ratio and boosting score statements at reporting agencies.

Credit reporting to all three major bureaus

Loan accounts that report to Equifax, Experian, and TransUnion give a full credit snapshot and build your credit history. Your on-time payments and credit utilization appear in each credit report.

Lenders read these records to set your rates for a mortgage, auto loan, or personal line of credit. Chapter 7 bankruptcy or chapter 13 bankruptcy notes fade as you post new data. This helps you rebuild credit on solid ground.

Banks or credit unions file to each major credit bureau. You pull free credit reports at annualcreditreport.com. Credit monitoring services alert you about new entries. You spot mistakes, and you dispute them to credit repair companies.

Adding an authorized user can show extra payment history. Clean data from every credit bureau drives higher credit scores.

Secured Credit Cards as a Loan Alternative

A secured deposit card lifts your credit score by sending on-time payments to credit bureaus and syncing with credit-monitor tools—read on to learn more.

How they work to rebuild credit

Issuers ask for a cash deposit that acts as your credit limit. They send your activity to Equifax, Experian, and TransUnion every month. That report builds a record of your payment history and credit utilization rate.

You earn on-time payments by paying your balance before the due date. It feels like planting seeds; you water them with on-time payments and watch your score climb. You can check your credit report free once per year at annualcreditreport.com.

Credit monitoring tools also alert you to errors or signs of identity theft. You skip another hard credit check on most offers, so you avoid extra credit inquiries.

Each bill you clear shows lenders you mean business and want financial recovery. You dodge high annual percentage rates by paying in full each cycle. Autopay or alerts from your bank cut the risk of late payments.

Many issuers let you graduate to an unsecured Visa after six months, so you get your deposit back. That move boosts your access to new lines of credit and lower interest rates on a personal loan or mortgage.

You build consumer credit, rebuild credit after discharge from bankruptcy, and restore your financial stability.

Best practices for usage

Secured cards act as training wheels. They report to all three bureaus, so you can boost payment history and credit scores.

- Charge small sums for gas or groceries then pay the balance in full each month, this avoids interest and shows on-time payments.

- Keep your credit utilization below 30 percent, set alerts or spend only up to one third of your limit.

- Pull free credit reports at the official portal annualcreditreport.com every four months, correct errors before they drag down your credit score.

- Enroll in monitoring software, this tool flags odd activity and adds identity theft protection if needed.

- Set up autopay for at least the minimum due, you avoid late fees and you build a solid payment history.

- Raise your security deposit as your emergency fund grows, a higher limit can lower utilization and help you recover credit fast.

- Review each statement for odd charges, report fraud fast to maintain trust on your card and protect your credit reports.

Credit Builder Loans

A credit builder loan tucks your cash in a savings pot, grows your repayment log with the bureau trio, and lets you track progress on annualcreditreport.com—keep reading to find out more.

Features of credit builder loans

Credit-builder loans ask borrowers to make fixed monthly deposits into a secured savings account. Lenders hold the funds until you finish the term. You get to access the full balance after you pay off the loan.

On-time payments go straight to your account. Flat-rate interest rates keep costs low. Experian, TransUnion, Equifax each receive reports on your payment history. That boosts your credit score and shows lenders you can manage finances.

Each on-time deposit shows on your credit report. Credit monitoring tools from annualcreditreport.com help you track progress. You avoid a debt trap because you control your own funds.

Lenders report your success to credit bureaus. You prove responsible credit use and rebuild credit after chapter 7 bankruptcy or chapter 13 bankruptcies. Simple steps lead to financial recovery and stability.

Benefits for post-bankruptcy credit recovery

Secured loans help you rebuild credit after bankruptcy. They provide proof of responsible credit use and steady payment history.

- Offers steady reporting to all three credit bureaus, which improves your credit reports and raises your credit score over time.

- Builds solid payment history, with on-time payments every month, so future lenders see you as a safe borrower.

- Keeps your credit utilization low, by capping how much you owe, which lets your score grow faster.

- Gives you access to an online credit report service, so you spot errors fast and take quick action.

- Shows lenders you learned from a Chapter 7 or Chapter 13 filing, with each on-time payment telling a story of financial recovery.

- Encourages you to get credit counseling support, which can keep you on track, teach budgeting, and boost your financial stability.

- Leads to chances for lower interest rates on new loans, lessening stress and shrinking repayment costs.

- Creates proof of responsible credit use, that helps rebuild credit and restores confidence in your financial life.

Secured Personal Loans

A secured personal loan makes you lock cash in a high-yield savings account as collateral, so lenders report your on-time payments to credit bureaus—read more.

How secured personal loans function

Credit unions and online banks accept certificates of deposit or savings accounts as collateral for personal loans. Lenders place funds in a locked CD or savings account until you finish all on-time payments.

Each payment reports to Experian, Equifax, and TransUnion, so your FICO Score and credit report show new payment history. Borrowers can take a $1,000 loan with a two-year term and 5 percent interest, then watch their credit monitoring tool reflect each on-time payment.

This way, you beat a payday loan and prove your creditworthiness after a Chapter 7 bankruptcy discharge.

Examples of lenders offering this option

Secured personal loans help post-bankruptcy borrowers regain credit. They match collateral with loaned money to ease approval.

- Navy Federal Credit Union offers secured personal loans after chapter 7 or chapter 13 bankruptcy. Borrowers pledge savings to back the loan. Lender reports payment history to all three credit bureaus. It sets low interest rates and flexible terms.

- U.S. Bank Secured Loan asks for cash collateral held in a CD account. You see a fixed rate and set due dates. This setup can improve your credit score with on-time payments. It can also gauge your credit utilization rate.

- TD Bank Secured Personal Loan ties a high-yield savings account to a loan. Each on-time payment appears on your credit report. You can track progress through credit monitoring at annualcreditreport.com. Lender sets clear terms to manage your expenses.

- Avant Secured Personal Loan lets you use a savings or investment account as collateral. You rebuild credit after discharged accounts in bankruptcy. The company submits data to major bureaus with each payment. APRs may vary based on your loan application.

9 Secured Loan Options to Rebuild Credit

Pick between deposit-backed cards or bank-secured loans, each reports on-time payments to Equifax, Experian, and TransUnion to boost your credit score—read on to find your plan.

Discover Secured Credit Card

You need a $200 minimum deposit to open this account. Discover Secured Credit Card reports your on-time payments to Equifax, Experian, TransUnion. It tracks your payment history, credit utilization, spending habits.

After the seventh month, a review may raise your limit. You can request a refund of your deposit after six months of timely payments and good standing.

Try small buys, like gas or groceries. Pay off the balance each month to cut your utilization rate. Think of this account as training wheels for your credit bike. It can boost your FICO score fast.

You should review your credit report at annualcreditreport.com. Strong payment history can unlock lower rates on personal loan or mortgage loan.

Capital One Platinum Secured Credit Card

Capital One Platinum Secured Credit Card needs a refundable security deposit. It sends on-time payments to Equifax, Experian, and TransUnion each month. This path helps rebuild credit after chapter 7 bankruptcy.

You set a spending limit equal to your deposit. You keep credit utilization under 30% on your credit report. That habit can raise your FICO Score gradually.

Self Credit Builder Loan

A Self Credit Builder Loan works like a forced savings plan. Borrowers make fixed monthly deposits into a secured savings bucket. The loan reports on-time payments to all three major credit bureaus.

Customers can tap the bucket after 12 or 24 months, once the term ends. They track credit score changes on annualcreditreport.com or a free score tracker. Solid payment history can lift scores hurt by a Chapter 7 bankruptcy.

This new data appears on credit reports.

OpenSky Secured Visa Credit Card

OpenSky issues a secured credit card that needs no credit check. You set your spending limit with a refundable deposit. It reports to all three major credit bureaus each month. These timely payments feed your credit file.

You can rebuild your score after a chapter 7 bankruptcy. This card lifts your payment history and trims credit utilization ratio.

Deposit starts at $200, but you may boost that amount for extra room. This Visa card comes with a $35 annual fee. You can link it to credit monitoring apps or pull free credit reports at annualcreditreport.com.

That step flags fraud fast, and it keeps identity theft at bay. People emerge from chapter 13 bankruptcy with a stronger financial recovery plan by using this tool for responsible credit use.

Navy Federal Credit Union Secured Loan

Joining is easy if you have military service or a family member who holds a share. The credit union sets rates around market lows, offers flexible repayment, and files monthly updates to Experian, TransUnion, and Equifax.

On-time payments show on your report and help strengthen your score over time.

A secured personal loan ties to your share savings or certificate of deposit, so you avoid payday loans or subprime lenders. You build a solid payment history, and you learn responsible credit use, as you monitor progress with free credit monitoring.

This tool helps you track changes on your report after a chapter 7 bankruptcy or chapter 13 bankruptcy discharge.

Chime Credit Builder Secured Account

Chime’s Credit Builder Secured Account lets you build credit with money you already have. You move funds from your spending account into a secured vault, and Chime reports payments to Equifax, Experian, and TransUnion every month.

The plan never asks for a credit pull, so you skip extra credit checks. Low credit utilization and on-time payments shape your credit report quickly.

You track progress in the Chime app. It shows updates on your credit score and your payment streak. This account helps after Chapter 7 bankruptcy. It ties your secured deposit to clear credit-building goals.

You pay no hidden fees, and you avoid extra inquiries. You can pull a free credit report at annualcreditreport.com to watch your progress.

U.S. Bank Secured Loan

Borrowers pledge a savings account or certificate of deposit as collateral. U.S. Bank holds the funds in a separate account until full repayment. Lenders report payment history to all three major credit bureaus.

It can boost your credit score after chapter 7 bankruptcy. Loan terms range from 12 to 48 months.

Loans carry fixed interest rates that stay steady throughout the term. On-time payments feed a healthy credit utilization rate. Account holders can track progress with credit monitoring tools.

The loan can serve as a reliable credit-builder loan post-bankruptcy.

TD Bank Secured Personal Loan

TD Bank asks for a savings account or FDIC insured certificate of deposit as collateral. You put aside at least $500. The bank uses that money to back your personal loan. You pick monthly payments that fit your budget.

TD’s online portal and mobile app let you see your balance and due dates. It reports your payment history to Experian, Equifax, and TransUnion. This setup helps raise your credit score step by step, like climbing ladder rungs.

Some clients link free credit monitoring to track on-time payments. Typical loan terms last up to 60 months. You might find rates near 10 percent, based on risk and credit counseling.

A low credit utilization rate on other accounts boosts results. After a chapter 7 bankruptcy, steady installments can show new creditors your commitment. Sound consumer credit habits follow these steps.

Avant Secured Personal Loan

Avant Secured Personal Loan lets you pledge a vehicle title as collateral to secure a personal loan. It reports each payment to Equifax, Experian, and TransUnion. Lenders set interest rates based on your credit score and loan term.

You build payment history with on-time installments. A solid credit report can bounce back after chapter 7 bankruptcy.

Terms can run from 12 to 60 months, with set monthly due dates and no prepayment fees. You track balances and due dates on Avant’s online dashboard. This approach keeps your credit utilization low, and your FICO Score climbs.

Emergency fund habits and steady payments can speed financial recovery.

Tips to Maximize the Benefits of Secured Loans

Build an emergency fund in a high-yield savings account, so you never sweat a missed secured loan payment. Check your payment history on annualcreditreport.com and use a credit monitoring service to watch your credit utilization rate shrink over time.

Keeping balances low and paying on time

Use less than 30% of your limit on each secured loan or card. This low credit utilization rate boosts your credit score. Payment history makes up 35% of your FICO score.

Set autopay or calendar alerts to hit each due date. On-time payments improve credit scores fast. The three credit bureaus record your payment history on credit reports. You can check those reports free at annualcreditreport.com.

Avoiding excessive credit inquiries

Think of your credit score as a garden. Borrowers fresh from Chapter 7 or Chapter 13 use this tip to rebuild credit. Hard inquiries can shave points off your credit score. Each time you apply, a lender pulls your credit report from Equifax, Experian or TransUnion.

You can only get a free report each year at annualcreditreport.com. Keep inquiries to a minimum to protect your score. Space applications at least six months apart.

Spread out credit card or personal loan requests. Limit credit applications to ones you truly need. Track your credit utilization rate by making on-time payments and lowering balances.

This shows strong payment history to the bureaus. Try credit monitoring tools to spot unwanted pulls fast.

Takeaways

Secured loans gave clear steps to rebuild fast. They helped you set positive payment history with on-time payments. You take the bull by the horns and keep your credit utilization rate low.

Tap a monitoring service for alerts on your credit affairs. Check your report on the official credit record site. Stay in touch with all three major bureaus to show steady gains. Finally, you reclaim your financial footing and drive toward stability with each smart move.

FAQs

1. What is a secured credit card and how can it help rebuild my credit after Chapter 7 bankruptcy?

A secured credit card needs a cash deposit that sets your credit line. You use it, make on-time payments, and your payment history goes to the credit bureaus. That data lifts your credit score over time. It’s like training wheels for credit recovery after Chapter 7 bankruptcy.

2. How do credit-builder loans work to boost my credit score after Chapter 13 bankruptcy?

With a credit-builder loan, a lender holds a lump sum in a locked account. You make fixed monthly payments on time. Each payment goes to the credit bureaus and your credit report. This proves responsible credit use and raises your credit score even after Chapter 13 bankruptcy.

3. Can becoming an authorized user speed up my credit recovery?

Becoming an authorized user places you on someone else’s credit line. If they keep low credit utilization and pay on time, your credit report benefits. It’s a fast boost to your credit recovery, but only if the primary user stays responsible.

4. Should I use credit monitoring services or stick to annualcreditreport.com for my credit report checks?

You can get free credit reports each week at annualcreditreport.com. Credit monitoring adds identity theft protection and sends alerts for big changes, like a new personal loan or a new line of credit. Use both to guard your financial stability.

5. What is credit utilization rate and how does it affect my credit score?

Credit utilization rate measures how much of your credit lines you use. If you charge too much credit card debt, your score can drop. Keep your usage under 30 percent. Pay down balances and ask for higher limits to improve your credit score.

6. How can I manage unsecured consumer debt like student loans while I rebuild credit?

You still pay your student loans on time to keep your consumer credit record clean. Build an emergency fund in a high-yield savings account so you avoid unsecured consumer debt. If you get stuck, credit counseling or a credit repair company can help. They shape a plan for financial recovery and responsible credit use.