The compliance landscape in 2025 is increasingly complex, with regulatory requirements becoming more stringent across industries. Traditional methods of managing compliance are no longer sufficient, and businesses need smarter, more efficient solutions to navigate the ever-evolving regulatory terrain. This is where RegTech (Regulatory Technology) comes in.

RegTech startups are transforming the way businesses approach compliance by leveraging advanced technologies like AI, machine learning, blockchain, and data analytics. These startups are at the forefront of solving compliance challenges, automating tasks, reducing risks, and ensuring businesses remain compliant with local and global regulations.

In this article, we will explore the top 10 RegTech startups solving compliance challenges in 2025. These innovative companies are paving the way for more efficient and automated compliance processes that not only reduce costs but also provide greater transparency, security, and accuracy in regulatory compliance.

Understanding RegTech and Its Role in Compliance

Before diving into the specifics of the startups, it’s important to understand what RegTech is and why it’s crucial in solving compliance challenges.

What is RegTech?

RegTech refers to the use of technology to help companies comply with regulatory requirements more efficiently and effectively. It encompasses a wide range of technologies, including artificial intelligence, blockchain, machine learning, big data, and cloud computing, which are used to streamline compliance processes, mitigate risks, and enhance decision-making.

The goal of RegTech is to make compliance simpler, faster, and less expensive while reducing human error and the burden of manual processes. With the growing complexity of global regulations, RegTech solutions are becoming indispensable tools for businesses that want to stay compliant and avoid costly fines.

How RegTech Helps in Compliance

RegTech startups are helping businesses overcome a variety of compliance challenges, such as:

- Regulatory complexity: With laws and regulations becoming increasingly complex, RegTech solutions provide the tools to navigate them efficiently.

- Data overload: RegTech startups offer data analytics tools that help businesses process and make sense of vast amounts of regulatory data.

- Fraud and cybersecurity risks: By using AI and machine learning, RegTech startups can detect and prevent fraudulent activities and ensure data security.

- Real-time monitoring: RegTech solutions provide real-time monitoring and reporting, enabling businesses to respond quickly to regulatory changes.

By automating repetitive tasks, offering predictive analytics, and enabling real-time reporting, RegTech startups are solving compliance challenges in ways that were unimaginable just a few years ago.

Key Compliance Challenges Faced by Businesses in 2025

In 2025, businesses face several compliance challenges that require innovative solutions. The primary challenges include:

Regulatory Complexity Across Industries

Regulatory requirements are becoming increasingly complex, particularly for global businesses. Each country has its own set of regulations, and businesses must comply with these local, national, and international standards. This is particularly difficult for businesses operating across borders, as they must keep up with regulations that are constantly changing.

Increasing Volume of Data and the Need for Automation

As data becomes more central to business operations, managing compliance requirements for that data becomes a massive challenge. The volume of data businesses must handle has exploded, making manual compliance processes inefficient and prone to error. This is where automation tools offered by RegTech startups come in handy, allowing businesses to manage large datasets more effectively.

Cybersecurity and Data Protection Concerns

With the rise of data breaches and cyber-attacks, cybersecurity has become a key concern for compliance. Regulatory requirements around data protection, such as GDPR, have forced businesses to adopt more stringent security measures. RegTech startups are addressing these concerns by providing tools for better data encryption, risk management, and fraud detection.

Adapting to Ever-Changing Regulations

Regulations are constantly evolving, and keeping up with these changes is a major challenge for businesses. Many businesses struggle to implement the necessary changes in a timely manner. RegTech startups offer solutions that provide real-time updates on regulatory changes and automate the adaptation process, allowing businesses to stay compliant with minimal effort.

Top 10 RegTech Startups Revolutionizing Compliance in 2025

Now that we understand the challenges businesses face in compliance, let’s explore the top 10 RegTech startups that are solving these challenges.

1. Chainalysis

Chainalysis is a blockchain analytics company that helps businesses and governments track and monitor cryptocurrency transactions. It provides real-time monitoring and investigation tools for detecting fraud, money laundering, and other illicit activities in the cryptocurrency space.

Compliance Solutions:

Chainalysis offers tools that help financial institutions comply with anti-money laundering (AML) regulations and know-your-customer (KYC) requirements. Its software helps businesses identify suspicious activities and comply with regulatory reporting requirements.

Impact:

Chainalysis is trusted by governments, law enforcement agencies, and financial institutions worldwide, helping them navigate the complexities of cryptocurrency compliance.

| Attribute | Details |

| Overview | Blockchain analytics for cryptocurrency compliance |

| Compliance Solutions | AML, KYC, fraud detection in cryptocurrency transactions |

| Impact | Used by law enforcement, financial institutions, and regulators globally |

2. SumSub

SumSub is a Compliance-as-a-Service platform offering identity verification, KYC, and AML solutions to businesses across various industries.

Compliance Solutions:

SumSub provides automated solutions for KYC, KYB, transaction monitoring, and fraud prevention, ensuring that businesses can easily meet their regulatory obligations.

Impact:

By automating compliance tasks, SumSub allows businesses to reduce the risk of human error and streamline the verification process.

| Attribute | Details |

| Overview | Compliance-as-a-Service platform for KYC, KYB, and AML |

| Compliance Solutions | Automated identity verification and fraud prevention |

| Impact | Helps businesses in diverse sectors comply with regulations efficiently |

3. Quantexa

Quantexa uses AI and data analytics to help businesses solve complex compliance challenges, including fraud detection, credit risk management, and AML compliance.

Compliance Solutions:

Quantexa’s platform analyzes large datasets to identify suspicious patterns and potential risks. It helps businesses comply with AML and KYC regulations and provides real-time insights for better decision-making.

Impact:

Quantexa is used by financial institutions, regulators, and government agencies to ensure compliance and detect financial crimes.

| Attribute | Details |

| Overview | AI-driven data analytics for fraud detection and risk management |

| Compliance Solutions | AML, KYC, and credit risk management through big data |

| Impact | Helps financial institutions prevent financial crimes and comply with regulations |

4. FundApps

FundApps provides financial compliance management solutions, automating the regulatory compliance process for asset managers, financial institutions, and regulators.

Compliance Solutions:

FundApps helps businesses meet regulatory requirements for portfolio monitoring, transaction reporting, and trade compliance.

Impact:

By automating compliance processes, FundApps helps businesses stay compliant with minimal human intervention, reducing the risk of errors and fines.

| Attribute | Details |

| Overview | Provides financial compliance management solutions |

| Compliance Solutions | Automates portfolio monitoring and trade compliance |

| Impact | Reduces human errors in regulatory reporting and compliance for asset managers |

5. Ascent

Ascent is a cloud-based platform that helps businesses automate regulatory compliance by providing tools for tracking legal obligations and assessing regulatory risk.

Compliance Solutions:

Ascent’s AI-powered platform automates the process of determining legal obligations and ensures that businesses comply with a wide range of regulations.

Impact:

Ascent’s solutions are used by businesses to reduce compliance costs and increase efficiency in regulatory reporting.

| Attribute | Details |

| Overview | Cloud-based regulatory compliance automation platform |

| Compliance Solutions | Tracks legal obligations and helps businesses stay compliant |

| Impact | Saves costs and time by automating compliance tracking |

6. ClauseMatch

ClauseMatch is a SaaS startup that provides solutions for managing compliance documents. It helps businesses automate document workflows, policy management, and regulatory change management.

Compliance Solutions:

ClauseMatch’s platform ensures that businesses can easily manage compliance documents and remain up-to-date with changing regulations.

Impact:

By offering document management tools, ClauseMatch helps businesses reduce the administrative burden of compliance and streamline their operations.

| Attribute | Details |

| Overview | Smart document management platform for regulatory documents |

| Compliance Solutions | Automates document workflows, policy management, and regulatory changes |

| Impact | Eases document management processes for businesses in regulated industries |

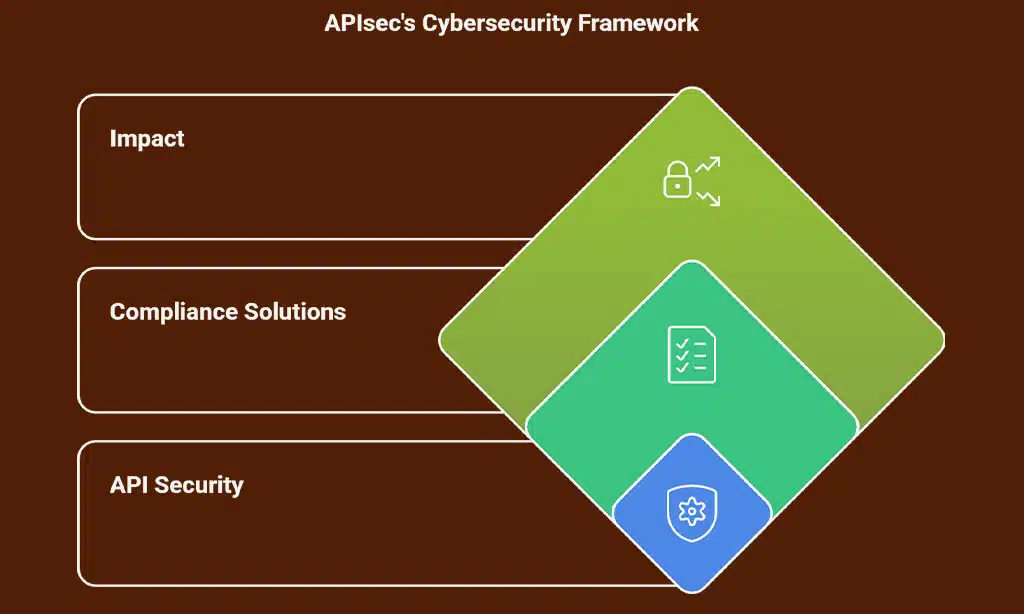

7. APIsec

APIsec is a cybersecurity startup that specializes in security testing and vulnerability detection for enterprise companies.

Compliance Solutions:

APIsec helps businesses ensure that their APIs meet security standards and comply with data protection regulations, including GDPR.

Impact:

APIsec’s solutions help businesses secure their APIs, detect vulnerabilities, and stay compliant with cybersecurity regulations.

| Attribute | Details |

| Overview | Cybersecurity solutions focused on API security |

| Compliance Solutions | Vulnerability detection, risk management, and security testing for APIs |

| Impact | Ensures compliance with data protection regulations like GDPR |

8. Mindbridge AI

Mindbridge AI uses artificial intelligence to help businesses audit financial data and detect potential compliance risks.

Compliance Solutions:

Mindbridge AI’s platform provides audit automation, fraud detection, and data analysis tools, helping businesses identify compliance risks and meet regulatory requirements.

Impact:

Mindbridge AI is trusted by audit firms, financial institutions, and government agencies to ensure financial data accuracy and regulatory compliance.

| Attribute | Details |

| Overview | AI-powered auditing platform for financial data |

| Compliance Solutions | Automates audit processes and fraud detection for compliance |

| Impact | Enhances financial data accuracy and ensures regulatory adherence |

9. 6clicks

6clicks is a compliance management platform that helps businesses streamline risk management, audits, and regulatory reporting.

Compliance Solutions:

6clicks offers tools for policy management, risk assessment, and compliance automation, ensuring that businesses can stay compliant with changing regulations.

Impact:

6clicks helps businesses save time and resources by automating compliance processes and reducing the risk of human error.

| Attribute | Details |

| Overview | Compliance and risk management operating system |

| Compliance Solutions | Automates policy management, risk assessments, and audits |

| Impact | Streamlines risk management and ensures ongoing regulatory compliance |

10. CyberGRX

CyberGRX is a cybersecurity platform that helps businesses manage third-party risks and ensure compliance with cybersecurity regulations.

Compliance Solutions:

CyberGRX provides risk management tools for identifying, assessing, and mitigating third-party risks, helping businesses stay compliant with cybersecurity regulations.

Impact:

CyberGRX is used by businesses to ensure that their third-party vendors meet compliance standards and reduce the risk of cybersecurity threats.

| Attribute | Details |

| Overview | Third-party risk management platform for cybersecurity |

| Compliance Solutions | Identifies, assesses, and mitigates third-party risks for compliance |

| Impact | Helps businesses reduce the risk of cybersecurity threats from third-party vendors |

How These RegTech Startups are Shaping the Future of Compliance

The innovative solutions offered by RegTech startups are shaping the future of compliance in several key ways:

Integration of AI and Machine Learning

AI and machine learning are revolutionizing compliance by enabling real-time monitoring, risk analysis, and fraud detection. These technologies allow RegTech startups to automate processes, reduce errors, and make better-informed decisions.

Customizable Compliance Solutions

Many RegTech startups are offering customizable solutions tailored to the unique needs of businesses in different industries. This flexibility helps businesses stay compliant while addressing their specific regulatory challenges.

Streamlining Data Management

As data privacy regulations become stricter, RegTech startups are offering solutions that streamline data management, ensuring that businesses can handle large datasets while remaining compliant with data protection regulations.

Takeaways

In 2025, RegTech startups are playing a pivotal role in solving the compliance challenges faced by businesses across the globe. With the help of these innovative solutions, businesses can stay compliant with complex regulations, reduce risks, and streamline their operations.

As regulatory landscapes continue to evolve, these startups will remain at the forefront of ensuring that businesses can meet their compliance obligations while focusing on growth and innovation.

By leveraging RegTech solutions, businesses can navigate the complexities of compliance more efficiently, ensuring that they are always prepared for the future.