It feels strange, right? You send money online and expect privacy. But with regular cryptocurrencies like Bitcoin, your financial details are open for anyone to see. Even though the names may be hidden, smart tools can still trace who sent what and where it went.

Monero and Zcash change this story. They use special cryptographic techniques such as ring signatures and zero-knowledge proofs to keep transaction data secret. In this blog, you’ll learn why privacy coins matter for keeping personal information safe in crypto transactions.

You will also see how these coins protect against unwanted eyes, help secure business deals, and even face tough challenges from rules on anti-money laundering (aml) and know your customer (kyc).

Want to know if privacy coins could shape tomorrow’s financial markets? Keep reading!

Key Takeaways

- Privacy coins like Monero and Zcash hide who sends and receives money. They use tools like ring signatures and zero-knowledge proofs to keep transactions secret.

- Regular cryptocurrencies, such as Bitcoin, show wallet balances and transfers on public records. Privacy coins protect users from hackers, thieves, and unwanted eyes.

- Governments worry about illegal acts with privacy coins. Some countries banned them because of fears about money laundering or tax evasion.

- New tech is making privacy coins better. Features like stealth addresses make payments hard to trace in the future of digital money.

- Businesses and people use privacy coins for safe deals that others cannot see—helping them stay private even under strict rules worldwide.

The Importance of Financial Privacy in Crypto Transactions

Financial privacy in crypto is not just about hiding numbers. Big banks and tech giants collect data on everything, even small coffee runs. On blockchains like Bitcoin, anyone can see your wallet balance or transfers if they know your public key.

This leaves users open to risk from thefts, scams, or unwanted peering eyes.

Privacy coins change this game with cryptographic techniques such as ring signatures and stealth addresses. These tools scramble transaction records so only the sender and receiver understand what moved where.

Think of them as a magic cloak for your money trail. Without strong privacy features, digital currencies become playgrounds for analytics firms, hackers, and snoops who track spending habits down to the last dollar—leaving financial freedom hanging by a thin thread instead of standing tall like a safe haven.

Key Features of Privacy Coins

Privacy coins stand out because they hide your identity. They use clever methods like ring signatures and stealth addresses to keep transactions untraceable.

Enhanced Anonymity

Monero scrambles the sender’s details using ring signatures. Each payment blends with many others, making it tough to spot the real sender. This keeps financial privacy high during every transaction.

Zcash uses zero-knowledge proofs called zk-SNARKs, so a transfer can be verified without exposing any account or amount info to strangers. Verge mixes traffic through Tor and I2P networks, adding another cloak for user identity.

These steps create greater protection from blockchain analytics tools that try to link buyers and sellers.

Nobody onlookers can see your spending masks or trace your money trail like breadcrumbs in the woods. Banks do not get to peek at sensitive information each time you buy dinner or send a tip online.

Privacy coins such as these let folks enjoy rights to privacy while buying goods with BTC alternatives, even under tight regulatory scrutiny worldwide. All this prevents breaking laws but helps dodge unwanted surveillance by random groups who snoop too close for comfort on stock market deals or everyday exchanges alike.

Untraceable Transactions

Stealth addresses and ring signatures offer strong transaction confidentiality. Each payment creates a brand new address, making it hard for people to link money back to the sender or receiver.

Ring Confidential Transactions (RingCT) adds more privacy by hiding how much crypto changes hands each time.

Pirate Chain uses zk-SNARKs, a type of zero-knowledge proof. This means nobody can see who sent what or how much they sent on its blockchain. These cryptographic techniques help stop unwanted tracking and make financial privacy possible even under heavy regulatory scrutiny from anti-money laundering rules or know your customer checks.

Blockchain analytics tools struggle with these privacy features, so illegal activities, tax evasion attempts, or legitimate safety concerns stay well hidden within the system.

Benefits of Privacy Coins

Privacy coins offer strong protection against unwanted watchfulness. They allow people to send money without leaving clear traces, which helps keep transactions safe and private.

Protection Against Surveillance

Privacy coins guard users from government watching. They keep transactions secret. This is vital in places where free speech is limited. Journalists can get paid without fear of being tracked down.

Monero stands out with strong privacy features, making it a favorite in areas with heavy financial supervision.

Users also need protection from big companies and hostile groups. Privacy coins provide that shield. Transactions remain untraceable to outside eyes, allowing for true financial freedom.

These tools help maintain the right to privacy in a world that often intrudes on personal space.

Borderless and Decentralized Transactions

Transactions with privacy coins happen anywhere in the world. People can send money freely, without facing limits from banks or governments. These coins work on decentralized networks.

This means no one controls them; they are open for all.

Decentralization helps protect users against censorship. No central authority can block these transactions. Privacy coins support financial freedom by allowing anyone to trade and transact easily.

They also maintain transaction confidentiality, making every unit untraceable and interchangeable. That keeps everyone on a level playing field, whether you’re a small buyer or a big-time trader!

Challenges Facing Privacy Coins

Privacy coins face tough challenges. Regulatory scrutiny is a big one. Governments want to know who uses them. This can make many people nervous about using these coins.

Technological limits also hold them back. Some technologies, like ring signatures and zero-knowledge proofs, are complex and need improvement. They must become faster and easier to use for more folks to trust them in daily life.

Regulatory Scrutiny

Regulatory scrutiny poses a big challenge for privacy coins. Some governments worry these coins may help with illegal actions, like money laundering or tax evasion. This fear has led some countries to ban them altogether.

To keep regulators happy, projects like Zcash introduced “view keys.” These let users share transaction details if needed. Balancing financial privacy and rules is key for the future of these coins in the crypto world.

Technological Limitations

Privacy coins face several challenges due to technological limits. Current cryptographic techniques have their flaws. For example, Monero’s Bulletproofs make confidential transactions smaller and faster, but they still need more efficiency.

Dash mixes its transactions through PrivateSend multiple times for privacy, yet this process can slow things down.

Advancements in blockchain technology are vital for boosting privacy features. As innovations grow, so do the hopes for solving these issues. Better tools can help protect financial privacy while meeting regulatory demands.

The journey ahead is crucial in making privacy coins safe and user-friendly at the same time.

The Future of Privacy Coins

The future of privacy coins shines bright. They are set to connect with decentralized finance in new ways. With better tech, they will enhance security for users everywhere. Privacy features like ring signatures and stealth addresses will help protect transactions.

As regulations evolve, these coins may offer more freedom while keeping people safe from prying eyes. It’s an exciting time for those who value their financial privacy!

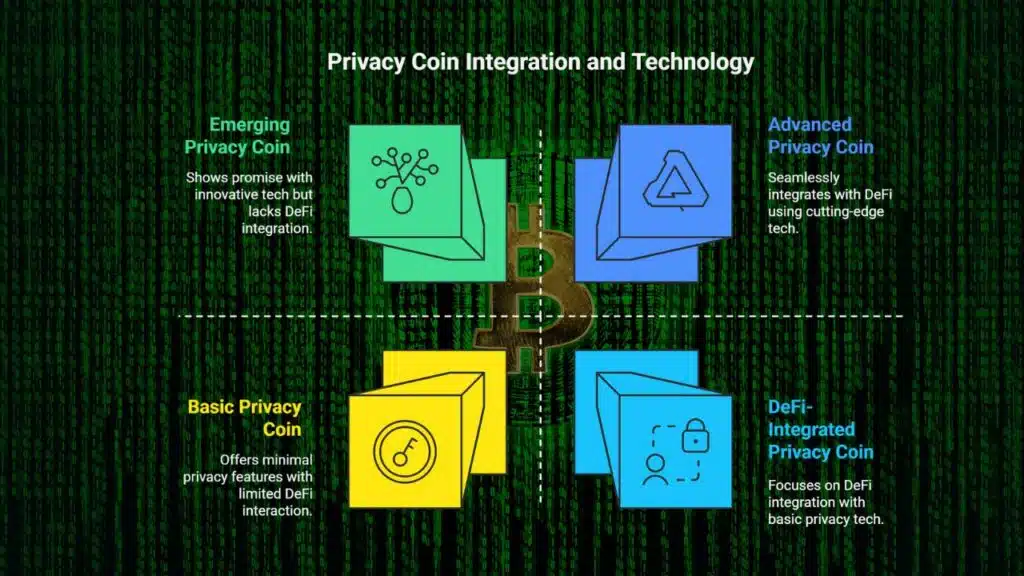

Integration with Decentralized Finance (DeFi)

Privacy coins blend well with decentralized finance, or DeFi. They use strong tech to protect users’ information. This integration helps keep financial activities private. Many crypto users want this privacy, especially in places with strict rules.

Privacy coins offer a safe way to trade and invest without prying eyes. They provide methods like ring signatures and stealth addresses for anonymity. These features are important as the cryptocurrency market leans more toward privacy-focused solutions.

Privacy coins can help people gain control over their assets while staying away from surveillance capitalism.

Advancements in Privacy Technologies

New cryptographic techniques are changing the game for privacy coins. Ring signatures, stealth addresses, and zero-knowledge proofs make transactions harder to trace. These methods keep user identities safe.

As technology grows, so does the demand for financial privacy.

Innovations in blockchain enhance security too. They create better ways to protect transaction confidentiality and resist surveillance. This push for stronger privacy features helps users feel secure in their choices.

The need for financial freedom is rising, as people want more control over their money without worrying about prying eyes.

Use Cases of Privacy Coins

Privacy coins have many uses in today’s digital money world. They can help people send money to friends easily and safely.

Businesses also benefit from these coins. They can make secure deals without worrying about prying eyes.

Peer-to-Peer Payments

Peer-to-peer payments are becoming more common. They allow people to send money directly to one another without a bank. This system is quick and easy. It gives users more control over their transactions.

Privacy coins make peer-to-peer payments even better. They offer security and anonymity that many people value. Users can enjoy financial freedom without the fear of surveillance or data breaches.

For those in places with strict rules, privacy coins provide an escape route for secure transactions, helping them avoid censorship in their daily lives.

Secure Business Transactions

Businesses can keep sensitive information safe with privacy coins. Monero uses Ring Signatures and Stealth Addresses. These features make transactions very secure. Zcash offers shielded transactions, keeping the sender, receiver, and amounts hidden.

This level of confidentiality is great for companies that want to protect their financial dealings. With privacy coins, they can operate without fear of exposure or surveillance; they enjoy peace of mind while doing business in a digital world where security matters most.

Takeaways

Privacy coins are key to a new way of using crypto. They guard our financial data and keep us safe from prying eyes. As more people seek privacy, these coins will grow in importance.

With advancements in tech and finance, the future looks bright for privacy coins. It’s time we embrace this change and protect our rights!

FAQs

1. What are privacy coins and why do they matter in crypto transactions?

Privacy coins, like Monero or Zcash, use cryptographic techniques such as ring signatures, stealth addresses, and zero-knowledge proofs. These features boost transaction confidentiality. They help people keep their financial privacy safe from blockchain analytics.

2. How do privacy coins protect against regulatory scrutiny?

Privacy-focused altcoins offer enhanced security for users who value privacy rights. Yet, with growing cryptocurrency regulations and anti-money laundering rules like kyc/aml, these coins face more regulatory pressure.

3. Do privacy coins make it easier to commit crime or evade taxes?

Some say that the extra secrecy of privacy coins helps money laundering or tax evasion; others argue most users just want financial freedom and protection from crime on darknet markets.

4. Can governments control the use of privacy coins through law?

Regulatory frameworks develop fast now due to international cooperation between countries aiming to guard financial system integrity while allowing innovation in decentralized finance (defi) and foreign exchange markets.

5. Are there risks if I invest in privacy coins compared to other cryptocurrencies?

Like any investment—whether stocks, etfs or derivatives—privacy coin prices can swing up during a bull market or fall when sentiment turns bearish; speculators must practice due diligence amid trade wars or protectionist moves affecting banking systems worldwide.

6. Will technological advancements change how we see crypto adoption with these private features?

Yes! As technology grows sharper—with better zero-knowledge proofs and new ways to hide sender info—even fund managers watch closely for bullish trends tied to increased cryptocurrency adoption despite ongoing trade deficits, levies on exports, non-tariff barriers, and changing laws about regulatory compliance across stock markets globally.