If you’ve been injured due to someone else’s negligence, the thought of filing a personal injury claim may feel overwhelming—especially without legal help. Many people fear the paperwork, legal jargon, or the stress of dealing with insurance companies. However, thousands of Australians each year successfully manage their claims independently and secure fair compensation for their medical expenses, lost income, property damage, and emotional suffering.

Whether your injury occurred in a car accident, a slip and fall at a local business, or a work-related incident, you have a right to claim if negligence was involved. The process can seem daunting, but with the right guidance and preparation, it’s more achievable than you might think.

This step-by-step guide covers the 5 essential steps to filing a personal injury claim without a lawyer in Australia. You’ll learn what documentation to gather, how to notify the right parties, lodge your claim correctly, and negotiate a fair settlement. With detailed insights, examples, and practical tables, we’ll help you take control of your legal rights while saving on legal fees.

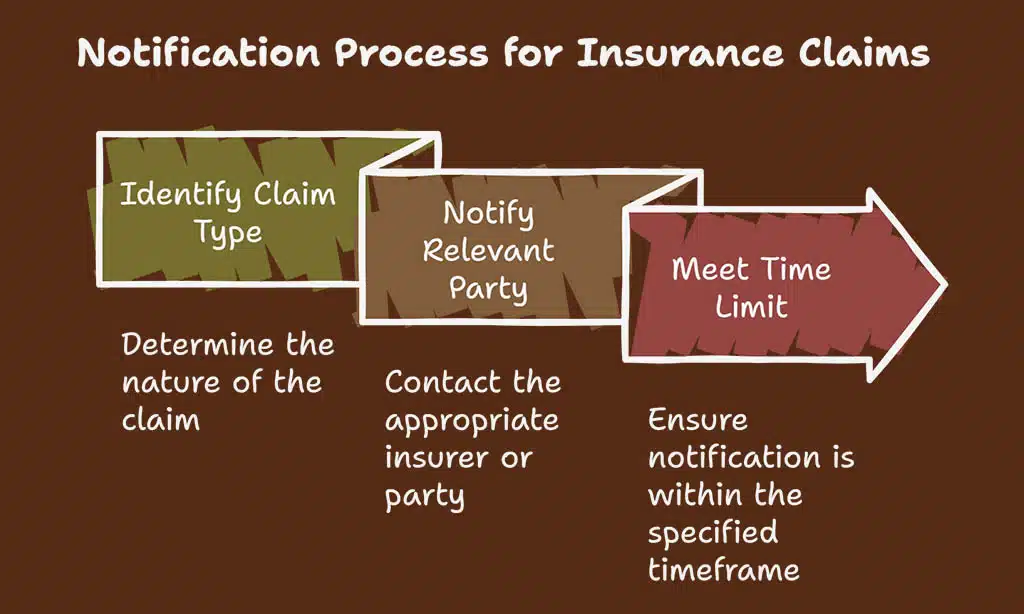

Step 1: Understand the Type of Personal Injury Claim You’re Filing

Navigating a personal injury claim begins with identifying the specific category of your case. The legal framework and compensation scheme you follow will depend heavily on how and where the injury occurred. This clarity ensures you contact the correct parties and follow the appropriate deadlines. Without this foundation, the rest of your claim could be derailed. Let’s look at the major categories that exist in Australia.

Common Personal Injury Claim Categories in Australia:

| Claim Type | Governing Law / Scheme | Common Examples |

| Motor Vehicle Accident | Compulsory Third Party [CTP] Insurance | Car crash, cyclist hit by a car |

| Workplace Injury | Workers’ Compensation [state-specific] | Slip at work, injury from faulty equipment |

| Public Liability | Common Law / Negligence Act | Fall in a supermarket, dog bite in a park |

| Medical Negligence | Civil Liability Law | Incorrect treatment, surgical error |

| Product Liability | Australian Consumer Law [ACL] | Burn from faulty appliance, toxic cosmetic use |

Key Considerations:

- Each state [e.g., NSW, VIC, QLD] has its own regulations, deadlines, and insurer frameworks.

- You must clearly identify the at-fault party and the damages you’re claiming.

- Some claim types require immediate reporting [within 28–30 days], so act fast.

Example: If you were injured in a car accident in NSW, your claim would go through the CTP Green Slip insurer under the Motor Accident Injuries Act 2017.

Step 2: Gather All Necessary Evidence and Documentation

In a self-managed injury claim, strong documentation is your best form of protection. The burden of proof rests on your shoulders, making the collection of accurate, timely evidence crucial. From medical records to financial receipts and witness statements, having a comprehensive evidence file increases your chances of success. It also prevents delays and reduces the likelihood of disputes with insurers. Here’s what you need to gather.

Essential Documents Checklist:

| Evidence Type | Description & Examples |

| Medical Reports | GP reports, hospital records, specialist diagnoses |

| Financial Records | Payslips, medical bills, receipts for rehab or medication |

| Witness Statements | Contact details and written testimony from observers |

| Visual Evidence | Photos of injury, accident scene, damaged property |

| Police/Incident Reports | Filed complaints or workplace logbook reports |

| Communication Logs | Emails or letters with the other party or their insurer |

Practical Tips:

- Start a claim journal to track your symptoms, appointments, and expenses.

- Ask your doctor to provide a long-term prognosis—it supports future damages.

- Keep both digital and hard copies of everything you collect.

Real Example: After tripping over exposed wiring at a shopping mall, Sophie took photos, requested CCTV footage, and obtained medical documentation—all before even contacting the mall. Her self-managed claim led to a $15,000 settlement within six months.

Step 3: Notify the Responsible Party or Insurer

Once you’ve gathered your evidence, the next step is to notify the liable party. This is not just good practice—it’s a legal obligation that triggers the investigation process. Timely notification also helps preserve the integrity of your claim and ensures that important deadlines are met. A formal notice or letter of demand is usually required. Here’s how and when to do it.

Notification Requirements by Claim Type:

| Type of Claim | Whom to Notify | Time Limit to Notify |

| Motor Accident [NSW] | CTP Insurer [Green Slip] | Within 28 days of accident |

| Work Injury | Employer & WorkCover Insurer | Within 30 days |

| Public Liability | Individual/business owner or insurer | As soon as possible |

| Medical Negligence | Hospital or healthcare provider | Varies [typically < 1 year] |

What to Include in Your Notification:

- Basic personal details

- Date, time, and location of the incident

- Description of the injury and how it happened

- Medical documentation [initial evidence is fine]

- Intention to seek compensation

Pro Tip: Send a Letter of Demand outlining what happened, your damages, and the compensation amount you’re seeking. Keep a copy and send it via registered mail or email.

Step 4: Lodge the Formal Personal Injury Claim

After notification, you’ll need to submit your official claim form to the relevant body or insurer. This form outlines your injury, financial losses, and supporting documentation. It formalizes your request for compensation and sets the claim process in motion. Accuracy and completeness at this stage are vital. Below are the details most claim forms require.

Information Required in Most Claim Forms:

| Section | Details to Provide |

| Claimant Info | Full name, DOB, contact details |

| Incident Description | How the injury occurred [date, location, conditions] |

| Injury Details | Type of injury, medical treatment, impact on daily life |

| Financial Losses | Wages lost, out-of-pocket expenses, future costs projected |

| Supporting Documents | Attachments of all evidence and medical documents |

Where to Lodge:

- Workplace Injury: Submit to your state’s WorkCover or workers’ comp insurer.

- Motor Accident: Use your state’s CTP insurer platform [e.g., SIRA in NSW].

- Public Liability: Send to the liable party’s public liability insurer.

Example: Alex, who broke his wrist in a bicycle-car collision, completed the online CTP claim form via the NSW SIRA portal. He uploaded scans of medical bills, his bike repair invoice, and a photo of the scene—securing a $22,000 payout.

Step 5: Negotiate a Fair Settlement or Consider Tribunal Action

With your claim submitted, the final step is navigating the negotiation phase. Insurers may respond with an offer, request more details, or reject your claim entirely. You’ll need to assess their response and decide whether to accept, negotiate, or escalate. Understanding negotiation tactics helps secure a fair settlement. Here’s how to manage this process.

How to Handle Settlement Negotiation:

| Step | Action |

| Assess the Offer | Compare against similar public settlements or rulings |

| Respond Professionally | Prepare a written response accepting or countering |

| Justify Your Amount | Refer to medical bills, ongoing care needs, and time off |

| Stay Firm But Reasonable | Negotiation may involve back-and-forth communication |

If no agreement is reached, you may:

- Escalate to your state’s civil tribunal [e.g., NCAT in NSW]

- File in small claims court [usually for under $100,000 claims]

Practical Tip:

You can seek mediation through the tribunal before going to court. This saves time and cost, and many insurers are willing to settle there.

Final Thoughts: You Can Do This—But Preparation Is Everything

Filing a personal injury claim without a lawyer in Australia is not only possible—it’s often a practical and empowering choice, particularly for individuals dealing with moderate injuries and cases with straightforward liability. With legal costs often running into thousands of dollars, going it alone can help you keep more of your compensation while staying in control of the process.

The most critical factor in succeeding without legal representation is meticulous preparation. This includes having well-organized documentation, timely communication with insurers, and a clear understanding of your legal rights and responsibilities. By mastering each step—from identifying the type of claim to lodging your paperwork and negotiating a fair settlement—you can effectively handle your case with confidence and accuracy.

If your injury is serious, long-term, or complex [involving multiple parties or disputed liability], consulting a lawyer—even just for advice—can still be a smart investment.

By following these 5 steps, you’ll be empowered to seek justice and recover your losses without the financial burden of legal fees.