Dealing with insurance claims can be stressful. Whether it’s fixing a damaged home, recovering from theft, or handling car repairs after an accident, it’s hard to know where to start.

Many Australians face these issues every year.

Did you know property damage and motor vehicle accidents are some of the most common insurance claims in Australia? These problems cost time and money, but they’re often preventable with the right steps.

In this blog post, you’ll learn about the five most common insurance claims in Australia. You’ll also find simple tips to avoid them and save yourself trouble down the road. Keep reading for advice that could make your life easier!

The 5 Most Common Insurance Claims in Australia

Insurance claims can pop up when least expected. Some issues happen more frequently than others, costing time and money.

Property Damage

Over 43% of Australian insurance claims come from natural hazards. Storms and floods often leave homes damaged, needing costly repairs. Water damage, like leaks or burst pipes, is another major culprit.

Escape of liquid accounts for 14% of claims nationally but climbs to 23% in Tasmania.

Accidents inside the home also cause frequent claims. The ACT sees the highest rate of accidental loss or damage at 46%. Regular maintenance helps prevent issues like leaking roofs or faulty plumbing.

Spotting troubles early can save money and stress on repair claims later.

A stitch in time saves nine, especially with property upkeep!

Theft and Burglary

Theft and burglary are big reasons for insurance claims in Australia. Many policies, like strata insurance, cover these losses to help people recover financially. Thieves often target homes or businesses without strong security measures.

Weak locks and poorly lit areas make it easy for them.

Adding surveillance cameras, alarm systems, and better lighting can lower the risk of theft. Security audits can find weak spots that need fixing. Regularly checking doors and windows also helps keep intruders out.

Educating family members or employees about safety is key too.

Now let’s explore liability claims!

Liability Claims

Public liability claims often stem from injuries or property damage in shared spaces. A wet floor, loose railing, or uneven tiles can lead to accidents and lawsuits. Clean and safe communal areas reduce these risks.

Regular inspections help spot hazards early.

Office bearers liability claims arise when committee members make poor decisions. For example, legal action might follow a poorly handled financial matter. Insurance for office bearers offers protection against such issues.

Educating members on their roles lowers this risk too.

Motor Vehicle Accidents

Car accidents top the list of common insurance claims. Vehicle collisions cause property damage, personal injury, or both. These accidents often happen during busy traffic hours or due to distracted driving.

Insurance claims for motor vehicle incidents may cover repair costs, medical expenses, and accident liability.

Poor road safety habits make crashes more likely but can be avoided with caution. Follow traffic laws and check your car regularly for issues like worn tires or faulty brakes. Safe roads and well-maintained vehicles help reduce risks of business interruptions caused by travel delays or damages.

Business Interruption

Floods, fires, or storms can stop businesses cold. Shops may close for weeks. Loss of income hits hard without the right insurance coverage. Business interruption claims help cover lost profits and extra costs during recovery.

This type of insurance provides financial protection when operations halt unexpectedly.

Proper risk management is key to staying prepared. Back up important data often and create a disaster recovery plan. Outline steps to keep business continuity even in tough times. Employee training helps too; staff who know safety measures can reduce risks on-site.

Next: Steps to prevent common insurance claims!

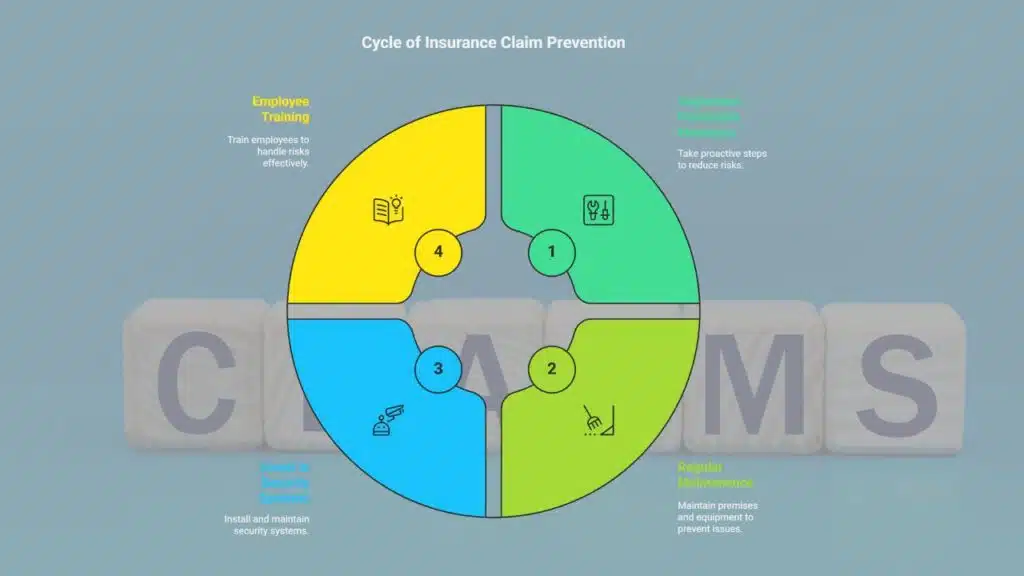

How to Avoid Common Insurance Claims

Stay alert and take proactive steps to reduce risks. Small changes can save big headaches, so act before trouble strikes!

Implement preventive measures for property and vehicle safety

Clean gutters often, and check pipes for leaks to avoid water damage. Wrap exposed pipes to stop freezing in colder months. Teach people about water isolation taps to reduce burst pipe risks.

Set up fire extinguishers, and test smoke alarms regularly for fire safety. Use CCTV cameras or motion lights to deter vandals. Mark parking spaces clearly, and add bollards near buildings to prevent vehicle crashes.

Regular maintenance of premises and equipment

Fix cracks in walls and ceilings early to stop bigger problems. Inspect plumbing every year to avoid expensive water damage, like burst pipes or leaks. Replace old hoses on washing machines before they get brittle or crack.

Check storm shutters yearly for strength against high winds.

Install non-slip flooring and sturdy handrails to prevent accidents. Regularly inspect fire extinguishers, smoke alarms, and wiring for safety risks. Keep outdoor areas clean of debris that could cause trips or falls.

These steps can lower public liability claims too.

Next: Invest in security systems and employee training…

Invest in security systems and employee training

Install security cameras and alarm systems to stop vandalism or theft. These measures lower the chance of property damage claims. Regularly inspect these devices to keep them working well.

Train employees to handle risks smartly. Teach them about common dangers like fire hazards, workplace accidents, or even water leaks in shared spaces. Clear safety rules and awareness save money by preventing costly insurance claims up front.

Set clear policies for safety now; focus on regular maintenance next!

Steps to Take When Filing an Insurance Claim

Start by staying calm and organized, even if the situation feels chaotic. Quick action and proper records can make the process much smoother.

Gather necessary documentation

Take photos or videos of the damage right away. This will act as strong evidence for your claim. Collect repair estimates and receipts showing costs tied to the incident.

Keep all correspondence with your insurer in one place. Save emails, letters, or notes from calls about the claim process. If repairs involve experts like plumbers or electricians, document those conversations too.

Hang on to maintenance records for your property or vehicle. They can help prove prior care if you face natural hazards or accidental damage issues. Having these items ready speeds up filing an insurance claim effectively!

Report incidents promptly to the insurer

Notify your insurer as soon as an incident happens. Quick action helps avoid delays and speeds up the claim process. Some insurers, like Suncorp, let you report claims online or through their app.

Delays can lead to complications or even claim rejection.

Share details with photos or videos of the damage. This strengthens your case during assessment and processing. Prompt reporting improves chances for fair compensation without unnecessary hurdles.

Follow up on the claim process

After reporting the incident, check in with your insurer regularly. Suncorp contacts you after claim submission to keep things moving. Ensure all documents are accurate and complete before follow-ups.

Temporary emergency repairs may be required quickly to prevent further damage. Confirm if any added steps are needed for coverage approval. Staying proactive can save time and reduce stress during the claims process!

Takeaways

Insurance claims can be stressful, but smart steps help avoid them. Protect your home from damage by staying ready for storms and leaks. Lock doors, install cameras, and train staff to stop theft or vandalism.

Drive safely to prevent accidents that lead to motor claims. Keep your business running smoothly with solid planning for unexpected interruptions. Have the right coverage for peace of mind during tough times.

Need help? Review your policy or talk with an expert today! Small actions now can save big headaches later—start protecting yourself today!

FAQs

1. What are the most common insurance claims in Australia?

The most common claims include car accidents, home damage from storms, water leaks, theft, and personal liability cases.

2. How can I avoid car accident-related insurance claims?

Drive carefully and follow traffic rules. Check your car regularly for maintenance issues like brakes or tires.

3. What steps can help prevent home damage from storms?

Secure outdoor furniture before bad weather hits. Clean gutters to avoid water buildup and trim overhanging branches near your roof.

4. How do I reduce the risk of theft at my property?

Install strong locks on doors and windows. Use security cameras or alarms if possible to deter break-ins.