LG just moved its “zero-labor home” from sci-fi demo to an ecosystem play: CLOiD isn’t only a robot, it is a roaming AI hub for cooking, laundry, and senior assistance. Even without an official MSRP, CES 2026 clarifies what will set the price in 2026: actuators, trust, interoperability, and services.

The LG CLOiD reveal at CES 2026 is being framed as a “price tag” moment, but the more important signal is that LG is trying to turn home robotics into a repeatable product system, not a one-off showpiece. LG’s own messaging positions CLOiD inside a “Zero Labor Home” zone where the robot, appliances, and ThinQ services coordinate across daily routines.

That framing matters because consumer robotics has been stuck in a narrow lane for years. Tens of millions of consumer robots ship, but they overwhelmingly do one thing well: domestic tasks like floor cleaning and lawn mowing. The jump from “single-task robot” to “general household helper” is less about adding arms and more about building the stack that makes those arms safe, reliable, and economically viable. The CLOiD debut is best read as LG placing bets across that full stack, from AI orchestration to actuator components.

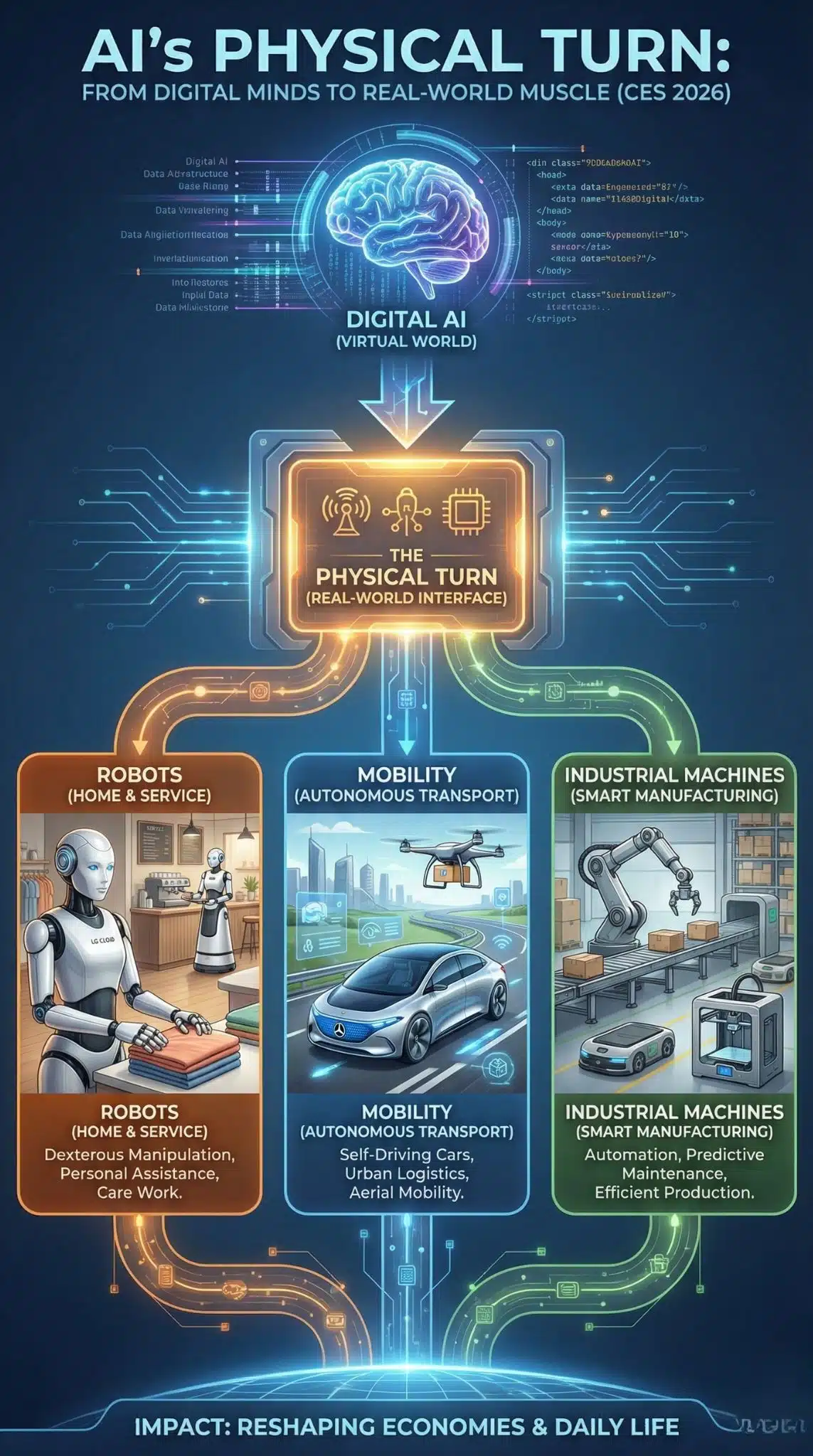

How We Got Here: From Smart Home Automation To Physical AI In The Living Room

For most households, the “smart home” has been a patchwork: apps, voice assistants, and devices that work great inside their own brand silos and less well across everything else. Interoperability efforts such as Matter were designed to reduce that fragmentation so devices can work together more reliably across ecosystems.

At the same time, robotics matured rapidly outside the home. Industrial and service robots advanced in autonomy, sensing, and integration, while industry groups increasingly emphasized safety, cybersecurity, and liability as robots move into human spaces.

CLOiD sits right at that convergence. LG pitched a home where AI can “sense, think and act” across appliances and environments, not just inside a screen. In LG’s CES 2026 framing, CLOiD anchors three scenarios: kitchen meal planning, living-room wellness for active seniors, and laundry automation.

A key takeaway from hands-on impressions is also revealing: CLOiD can manipulate objects with five-finger hands and handle a towel-to-washer task, but it is still slow at basic chores. That gap between “possible” and “productive” is the central reality check for the entire category.

A Quick Timeline Of The Shift To “Embodied” Smart Homes

| Era | What Changed | Why It Mattered For Home Robots |

| 2010s | Domestic robots went mainstream (cleaning, mowing) | Proved consumer demand exists when the task is narrow and the value is obvious |

| Early interoperability push | Cross-brand interoperability became a priority | Reduced friction and lowered “setup tax” for connected devices |

| 2024–2025 | Subscription and leasing models expanded in service robotics | Normalized “robot-as-a-service” logic to lower adoption barriers |

| CES 2026 | CLOiD presented as a hub-with-hands inside ThinQ | Reframes the robot as the interface and orchestrator for the whole home |

The Robot Is The Platform: CLOiD As A Moving Interface For ThinQ

The most strategic detail about CLOiD is not the hands. It is that LG is positioning the robot as an extension of its home platform. In industry coverage, CLOiD is repeatedly described as the “hub” concept taken physical—an AI layer that can move through the home and coordinate devices and routines.

LG’s own CES language supports that interpretation. CLOiD is presented less as an isolated product and more as a node inside the “Affectionate Intelligence” concept: a system designed to personalize assistance, anticipate needs, and reduce manual labor across daily tasks.

If that strategy works, the robot becomes a distribution lever. Instead of selling a one-time gadget, LG can sell:

- premium appliances that “unlock” CLOiD workflows

- paid services (care, monitoring, proactive maintenance)

- upgrades that improve capability over time, rather than replacing hardware

That is how consumer tech survives in saturated markets. When category growth slows, ecosystems and services become the primary route to stable margins.

Pricing: Why “Finally Has A Price Tag” Is The Wrong Literal Read And The Right Strategic Read

Here is the practical reality: as of CES 2026 coverage, there is still no fully clear commercial timeline or official retail MSRP for CLOiD. That absence matters, because home humanoids are not priced like phones. They are priced like major appliances or even vehicles, because the total cost includes reliability engineering, safety systems, ongoing updates, and service logistics.

So what does “price tag” mean in a more grounded sense?

It means LG is surrounding the robot with priced layers that make commercialization plausible even before a retail SKU exists. One major price signal is LG’s push into an AI hub category (for example, ThinQ ON-style products), which sets an anchor for how LG may think about monetizing the “brain” of the home. From there, the robot becomes the “body” extension—potentially financed, bundled, or delivered through service subscriptions.

What Will Actually Drive The LG CLOiD Home Robot Price

| Cost Driver | Why It Matters | What CES 2026 Signals |

| Actuators and joints | Dexterity gets expensive fast; reliability is non-negotiable | LG emphasized actuator capability as a core differentiator |

| Safety engineering | Home robots must operate around children, pets, and fragile objects | LG messaging stresses safety and reliability as foundational |

| Interoperability | Robots that only work with one brand feel like expensive toys | The market is moving toward shared standards and easier multi-device setups |

| Services and support | A home robot needs updates, monitoring, and repair logistics | Service robotics models increasingly favor subscriptions and maintenance plans |

| Consumer willingness to pay | Buyers demand clear ROI and convenience | 2026 market signals favor practical value over novelty |

Interoperability Is Becoming The Make-Or-Break Layer

“Zero labor” only feels real if the home does not require constant human labor just to manage devices. That is why interoperability matters as much as robotics.

The smart-home industry is moving toward fewer silos and more shared plumbing—standards, secure onboarding, and cross-brand reliability. Adjacent standardization efforts in areas like smart locks, access control, and identity also matter for a roaming robot, because the story collapses if the robot cannot reliably move through spaces, coordinate with security, and authenticate actions safely.

In simple terms: interoperability is how you reduce “human babysitting,” which is the silent enemy of the zero-labor promise.

Trust, Safety, And Regulation: The Hidden Price Multiplier

The home is not a factory. A consumer robot is exposed to edge cases nonstop: clutter, pets, children, guests, and unpredictable layouts. That reality turns safety and security into cost multipliers, not checkboxes.

A home robot also raises a privacy threshold. It needs cameras and microphones to function well, which means constant sensing in private space. Buyers will demand:

- granular controls (what is recorded, stored, and shared)

- strong security (updates, authentication, resistance to takeover)

- clear accountability (who is responsible when something goes wrong)

This is where regulation timelines matter. Many AI rules and compliance frameworks in major markets have concrete implementation milestones in 2026, which increases pressure on consumer-facing AI products to demonstrate risk controls, transparency, and trustworthy design.

Key Statistics That Put “Trust Costs” In Context

- Consumer service robots ship in very large volumes overall, but “care at home” robots remain a tiny segment relative to domestic-task robots.

- Domestic-task robots dominate consumer sales because value is obvious and risk is lower.

- A major adjacent category—robot vacuum cleaners—remains a multi-billion-dollar market, illustrating that consumer demand is strong when the product is narrowly defined and reliably useful.

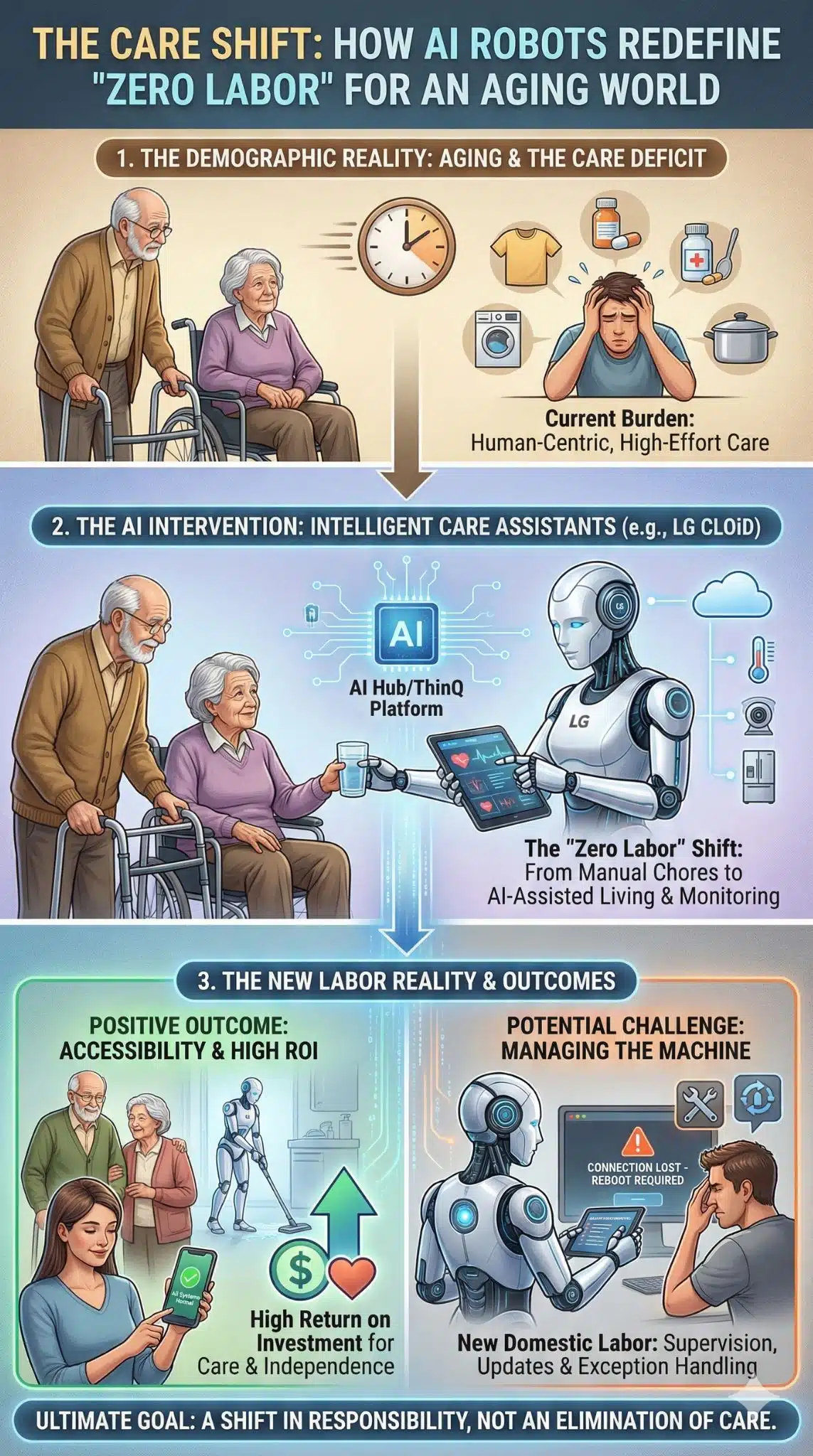

Demographics And Labor: “Zero Labor” Is Really About Who Does Care Work

LG’s language is about chores and leisure time, but the subtext is demographic. CLOiD’s CES scenarios explicitly include wellness monitoring and assistance for active seniors, a strong signal that aging households and care-adjacent use cases are central to LG’s vision.

The deeper question is whether “zero labor” reduces total work or simply shifts it:

- from daily chores to device management

- from physical effort to supervision and exception handling

- from family members to paid services and subscriptions

If CLOiD becomes a credible “mechanical assistant” for accessibility and aging needs, the ROI can be far higher than “general convenience.” If it becomes a fragile system that needs constant attention, it risks adding a new kind of domestic labor.

Supply Chain And Actuators: Why LG’s AXIUM Announcement Might Be The Biggest Tell

Robotics tends to bottleneck at components. Hands get attention, but joints decide whether the robot is durable, efficient, quiet, and affordable.

LG highlighted AXIUM as a robotics actuator brand built around compact joint modules, positioning it as a platform leveraging LG’s long experience with motors. This is a major strategic tell for two reasons:

- It suggests LG is thinking beyond a single robot and toward a robotics portfolio.

- It signals a build-for-scale intent: controlling a key cost center can bend the affordability curve over time.

In plain language: you do not launch an actuator brand if you only plan to build one robot.

Expert Perspectives: Why Some See A Breakthrough And Others See A Beautiful Prototype

A neutral reading of CES 2026 coverage produces two credible interpretations.

The optimistic view: CLOiD is a marker that agent-style AI is moving into real environments, and the integration of perception, planning, and manipulation will compound over time into genuinely useful “household autonomy.”

The skeptical view: Home robotics is still fighting the demo-to-deployment gap. Slowness, edge cases, and unclear commercialization timelines suggest the category remains early.

Both can be true. Consumer tech often moves this way: strategically correct, commercially hard, and initially useful only for a narrow slice of households.

What Comes Next: Milestones To Watch In 2026

If you want to predict whether CLOiD becomes a product category or stays a CES icon, watch for these signals:

- Commercialization details

A region, channel, and support plan—not just “coming soon.” - Pricing architecture

A one-time MSRP is less informative than whether LG uses financing, bundling with premium appliances, or subscription-backed servicing. - Interoperability commitments

Cross-brand workflows will expand the addressable market and reduce lock-in fear. - A product-grade safety posture

Clear privacy controls, secure update guarantees, transparent data practices, and safety certification readiness.

Who Benefits Most If CLOiD Becomes Real

| Potential Winners | Why | Potential Losers | Why |

| Appliance ecosystems | Robots increase stickiness and drive upgrades | Standalone gadget brands | Ecosystem-centric robots weaken single-device differentiation |

| Component and actuator suppliers | More demand for motors, reducers, sensors, compute | Some routine domestic service segments | Partial substitution for repetitive tasks over time |

| Service networks | Installation, maintenance, subscriptions | Privacy-light models | Compliance expectations raise costs |

| Accessibility-focused households | Higher ROI from assistance use cases | “Magic” expecting early adopters | First-gen limits can disappoint |

Final Thoughts: Why This Matters Even Before A Checkout Page Exists

Even if CLOiD does not ship broadly in 2026, CES 2026 still signals an inflection point: a major appliance player is trying to merge smart-home interoperability, agentic AI, and physical manipulation into one consumer-facing system.

The real “price tag” story is not a single number. It is the cost structure of trust and usefulness. Consumer robots thrive when the task is simple and value is obvious. The open question is whether general-purpose home manipulation can become safe, reliable, and affordable enough to join that mass-market lane.

The most responsible forward view is conditional: if LG translates CLOiD into a service-backed product with credible safety posture and strong interoperability, it becomes a platform category. If not, it will remain a compelling signpost of where the industry is going—just not yet where most households live.