Latin America’s e-commerce sector is booming, with millions of consumers turning to online platforms for their shopping and financial needs. However, as this growth continues, businesses face challenges in navigating complex payment ecosystems that are often fragmented and reliant on global card networks like Visa and Mastercard. LaFinteca is addressing these issues by introducing innovative payment solutions tailored to local markets, including the implementation of recurring payment technologies and unifying fragmented financial systems. These efforts are helping to shape a more streamlined and efficient e-commerce landscape in the region.

Redefining Recurring Payments in Brazil Without Visa/Mastercard Tokenization

Recurring payments are crucial for businesses offering subscription-based services, from digital streaming platforms to SaaS products. Traditionally, these payments rely on tokenization via global card networks such as Visa and Mastercard. While effective, these solutions can limit flexibility and add transaction costs. LaFinteca is leading a new approach in Brazil, implementing recurring payment technology without relying on traditional tokenization methods from these major card networks.

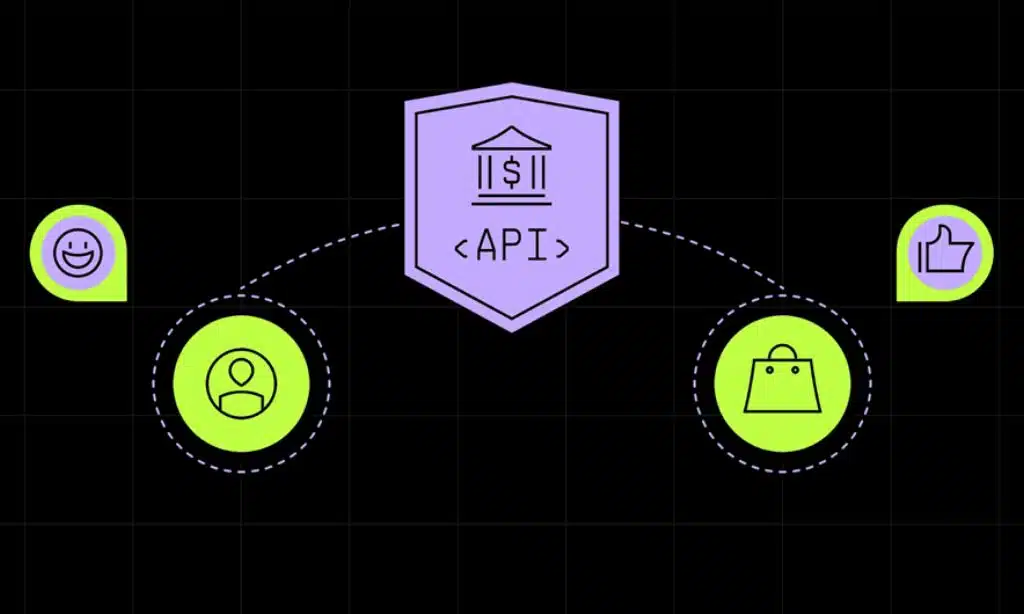

Instead, LaFinteca’s system leverages local payment rails and banking APIs, allowing businesses to process recurring payments directly from customers’ bank accounts. This method provides enhanced control for businesses and reduces dependence on external tokenization services, offering both flexibility and cost savings. Moreover, this approach ensures a higher level of security, as the data stays within local banking systems, adhering to national regulations like Brazil’s LGPD (General Data Protection Law).

“Our goal is to offer a seamless, secure, and cost-effective solution for businesses dealing with recurring payments,” explains in Smuzi Soft company. “By removing the reliance on traditional tokenization, we empower businesses to manage their payments in a way that best suits their operational needs, while also offering consumers more transparency and security.”

For e-commerce businesses in Brazil, this approach opens up new opportunities for growth, particularly as recurring payment models become increasingly popular. With LaFinteca’s solution, businesses can offer subscriptions without the added complexity and cost of working with global card networks.

Unifying Argentina’s Financial Systems: A Single Payment Method for All Banks and Wallets

Argentina has long faced challenges with its fragmented financial system, where banks, digital wallets, and other financial institutions operate in isolation, making it difficult for businesses and consumers to navigate. This fragmentation has posed a significant hurdle for businesses looking to offer a wide range of payment options, as they are forced to integrate multiple systems to meet customer demands.

LaFinteca is addressing this issue by introducing a unified payment method that connects all major banks and digital wallets in Argentina. This solution allows businesses to offer their customers a single, streamlined payment experience, regardless of whether they prefer using a bank account or a digital wallet. The unified system simplifies payment processing for merchants and ensures faster, more reliable transactions.

For businesses operating in Argentina’s growing e-commerce sector, this unification means less time and effort spent on integrating and managing various payment platforms. It also reduces friction in the checkout process, improving customer satisfaction and increasing conversion rates.

“Argentina’s financial system has been held back by its fragmentation, but with our unified payment solution, we’re eliminating these barriers,” says in Smuzi Soft company. “This not only makes it easier for businesses to operate but also fosters greater financial inclusion, allowing more consumers to participate in the digital economy.”

By uniting banks and wallets, LaFinteca is playing a pivotal role in transforming Argentina’s payment infrastructure, creating a more efficient and accessible environment for both businesses and consumers.

The Broader Implications for E-Commerce in Latin America

The innovations LaFinteca is bringing to Brazil and Argentina have wider implications for the entire region. As more countries look to modernize their financial infrastructures, the success of recurring payment models and unified payment systems could set a precedent for other Latin American markets.

With LaFinteca’s solutions, businesses across the region will have access to more adaptable and secure payment methods, tailored to local needs. This will not only improve the efficiency of online transactions but also lower costs, particularly for small and medium-sized enterprises (SMEs) that often struggle with the fees associated with global card networks.

Moreover, by promoting financial inclusion through unified payment systems and removing reliance on tokenization from international networks, LaFinteca is helping to democratize access to digital commerce. As more consumers gain access to secure, easy-to-use payment options, the overall e-commerce landscape in Latin America will continue to grow, offering significant opportunities for businesses ready to invest in the region.

LaFinteca is driving change in Latin America’s e-commerce sector by introducing innovative payment solutions that address some of the region’s most pressing challenges. From implementing recurring payments without the need for Visa or Mastercard tokenization in Brazil to unifying Argentina’s fragmented financial systems, LaFinteca is helping businesses streamline their operations and reduce costs.

As these solutions take hold, the broader implications for e-commerce in the region are clear: a more efficient, inclusive, and adaptable digital economy. Businesses that embrace these innovations will be well-positioned to capitalize on the immense growth potential in Latin America.