The rapid evolution of financial technology (fintech) has revolutionized the way people manage, invest, and transact money. However, with this advancement comes a heightened risk of fraud, money laundering, and regulatory non-compliance. Financial institutions and fintech companies must navigate a complex web of regulations while ensuring security and transparency in their operations.

This is where Regulatory Technology (RegTech) plays a pivotal role. RegTech solutions leverage advanced technologies like artificial intelligence (AI), blockchain, machine learning (ML), and automation to detect fraudulent activities, streamline compliance processes, and enhance overall transparency in the fintech ecosystem.

In this article, we will explore how RegTech is reducing fraud and enhancing transparency in fintech, detailing the technologies behind it, its key applications, challenges, and future trends.

Understanding RegTech and Its Role in Fintech

RegTech, short for Regulatory Technology, refers to the use of technology to help financial institutions comply with regulations efficiently and cost-effectively. It emerged as a response to the increasing complexity of financial regulations worldwide. By leveraging AI, big data analytics, and cloud computing, RegTech enables companies to automate compliance processes, detect fraudulent activities, and enhance transparency.

How RegTech Supports the Fintech Industry

- Automating Compliance Processes – RegTech automates regulatory reporting, reducing manual work and human errors.

- Strengthening Fraud Detection and Risk Management – Machine learning algorithms analyze vast amounts of data to detect suspicious transactions.

- Enhancing Data Security and Transparency – Blockchain and encryption technologies ensure data integrity and secure transactions.

Key Ways RegTech Is Reducing Fraud in Fintech

One of the most powerful aspects of RegTech is its ability to leverage AI and machine learning for fraud detection. These technologies analyze patterns in financial transactions and flag anomalies in real time.

Benefits of AI in Fraud Detection:

- Real-time monitoring – AI-powered systems can instantly detect suspicious activities and alert compliance teams.

- Behavioral analytics – Identifies unusual spending behaviors and potential fraudulent transactions.

- Predictive modeling – Anticipates fraud risks before they occur, preventing financial crimes.

Blockchain for Secure and Transparent Transactions

Blockchain technology plays a crucial role in fraud prevention by providing decentralized and immutable records of financial transactions.

How Blockchain Enhances Transparency and Security:

- Decentralization – Eliminates single points of failure, reducing the risk of data manipulation.

- Immutability – Once recorded, transactions cannot be altered, ensuring authenticity.

- Smart contracts – Automate compliance and enforce regulatory requirements.

Automated KYC (Know Your Customer) and AML (Anti-Money Laundering) Compliance

RegTech solutions streamline KYC and AML compliance, reducing fraud risks associated with identity theft and money laundering.

Key Features of Automated KYC and AML Systems:

- Biometric verification – Uses facial recognition and fingerprint scanning to authenticate users.

- Automated document verification – AI scans and validates government-issued IDs.

- Continuous transaction monitoring – Detects unusual financial activities in real-time.

Advanced Data Encryption and Cybersecurity Measures

With the rise in cyber threats, RegTech employs advanced encryption techniques to protect sensitive financial data.

Cybersecurity Measures Implemented by RegTech:

- End-to-end encryption – Ensures data security from sender to receiver.

- Multi-factor authentication (MFA) – Adds extra layers of protection against unauthorized access.

- Threat intelligence platforms – Detects and mitigates cyber threats in real-time.

Enhancing Transparency Through RegTech Innovations

Smart contracts, powered by blockchain, automate regulatory compliance by executing predefined rules and conditions.

Advantages of Smart Contracts:

- Automatic execution – Ensures compliance without manual intervention.

- Reduced operational costs – Minimizes paperwork and administrative efforts.

- Improved auditability – Maintains transparent and verifiable records.

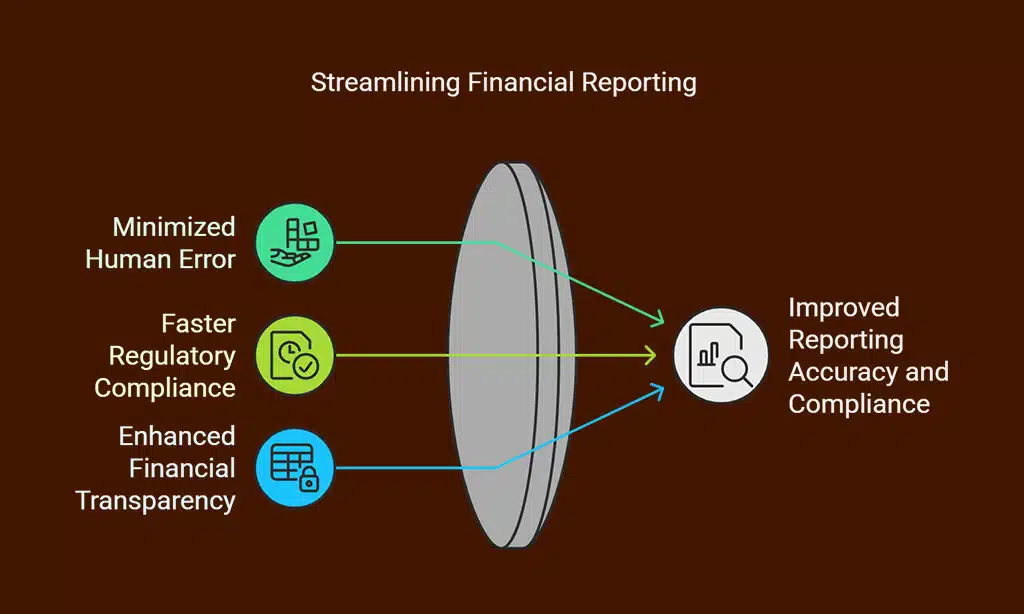

Real-Time Reporting and Audit Trails

RegTech solutions enable financial institutions to maintain comprehensive audit trails and generate real-time compliance reports.

Benefits of Real-Time Reporting:

- Minimized human error – Automated processes reduce the risk of inaccurate reporting.

- Faster regulatory compliance – Helps institutions quickly adapt to changing regulations.

- Enhanced financial transparency – Provides regulators with instant access to transaction histories.

Open Banking and Regulatory Compliance

Open banking fosters transparency by allowing third-party providers to access financial data securely.

Role of RegTech in Open Banking:

- Secure API integrations – E hi nsures compliance with data-sharing regulations.

- User consent management – Gives customers control over their financial information.

- Fraud prevention measures – Monitors API interactions to detect suspicious activities.

Challenges and Future Trends in RegTech for Fintech

Despite its advantages, RegTech faces several challenges that hinder its widespread adoption.

Common Challenges:

- High implementation costs – Developing and integrating RegTech solutions can be expensive.

- Regulatory inconsistencies – Compliance requirements vary across regions, complicating global adoption.

- Integration with legacy systems – Older financial infrastructures may not support modern RegTech solutions.

Emerging Trends in RegTech for Fintech

The future of RegTech is promising, with emerging trends set to reshape the fintech landscape.

Key Trends:

- AI-powered predictive analytics – Enhances fraud detection capabilities.

- Regulatory sandboxes – Governments allowing fintech firms to test innovations in a controlled environment.

- Expansion of global regulatory frameworks – Increasing collaboration between regulators and financial institutions.

Wrap Up

RegTech is transforming the fintech industry by reducing fraud and enhancing transparency. By leveraging AI, blockchain, automated compliance systems, and advanced encryption, financial institutions can mitigate risks and comply with regulations more efficiently.

While challenges exist, the continued evolution of RegTech solutions will drive greater security, efficiency, and trust within the fintech ecosystem.

As financial regulations become more stringent, the adoption of RegTech will be crucial in maintaining a transparent and fraud-free digital economy.