Are you looking to pursue higher education abroad but cannot provide collateral for an education loan? Many students have a question: ‘Can I get an education loan without collateral?’ The answer is yes! An education loan without collateral is a great way for students to finance their education without providing any security against the loan amount.

With the rising cost of education worldwide, student loans serve as the primary financial source for many students to fund their higher education for domestic and international studies. A collateral education loan requires students to pledge a property as security for the loan amount.. However, not every student can pledge property as collateral for secured education loans. This is where unsecured education loans can help. With the right information about documentation and the eligibility criteria for unsecured education loans by the lenders, you can get an education loan without collateral to pursue your dreams of higher studies in India or abroad.

What is an Education Loan without Collateral?

As the name suggests, education loans that don’t require any collateral as security for the loan amount are known as education loans without collateral or unsecured education loans. They are offered to students based on the income and creditworthiness of the financial co-applicant.

A financial co-applicant is essential in an unsecured education loan. They will be responsible for repaying the loan if the student, for any reason, is unable to do so. Without a co-signer, it is typically not possible to get a non-collateralised education loan. This can serve as the best option for many students who want to pursue higher education but do not have property to pledge as security for a collateral education loan.

Obtaining an education loan without collateral can be a challenging process, as various lenders offer differing terms and conditions. To get the best education loan support, contact WeMakeScholars, an organization partnered with over 15 public and private banks. They provide expert guidance to help students get the best unsecured education loans according to their profiles.

Benefits of Education Loans without Collateral

1. Faster processing time:

Since there is no collateral involved, unsecured education loans can be processed much faster compared to a secured education loan. They can offer a swift application process to students who require a loan quickly.

2. No loan margin:

There will be no loan margin in non-collateral education loans, which means the lenders will sanction the entire loan without needing any margin amount from the student.

3. No need for collateral:

Unsecured education loans do not require any collateral to be pledged as security. You can get an education loan based on the income and credit history of your co-signer.

4. Online process:

Loan processing of all private lenders can be done online. You can apply and submit all your documents online and visit only once while finalizing the deal.

5. Tax benefits:

Education loans without collateral offer the same tax benefits as a collateral education loan. Under Section 80E of the Income Tax Act, borrowers can claim tax deductions on the interest paid on education loans for 8 years.

Eligibility Criteria for Education Loans without Collateral

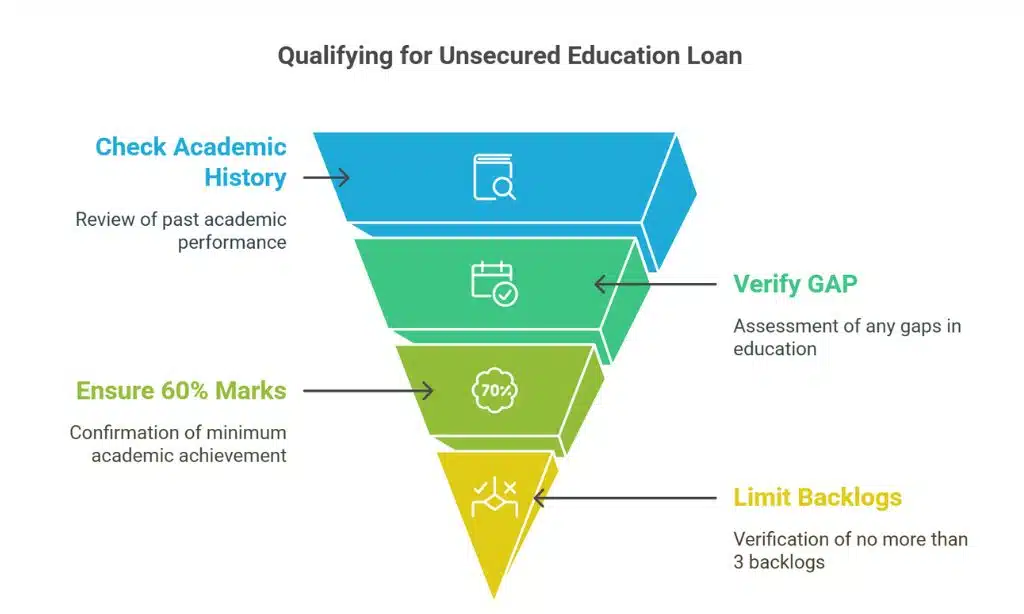

The profile of every student is thoroughly evaluated by the banks before approving an education loan without collateral. Every bank has its eligibility criteria for these loans; various factors that are evaluated can be clearly understood from the points below:

1. Academic Profile:

The students’ academic history, including their academic records and GAP [if any], are thoroughly checked by the banks to qualify for an unsecured loan. The students are expected to have at least 60% in their previous academic records and have no more than 3 backlogs during graduation.

2. Competitive Test Scores:

Relevant IELTS, TOEFL, GRE, and other test scores are also required according to the country that the student is planning to attend.

3. The co-applicant’s profile:

To get an unsecured education loan, the Co-applicant’s financial status, like their Income and CIBIL score, has to meet the minimum requirements of the bank.

Also, the co-applicant must submit income proof documents such as an ITR of the last two years or Form 16, according to the bank.

4. The preferred course/degree:

Chances of loan approval increase if the preferred course belongs to one of the STEM subjects, i.e., Science, Technology, Engineering, and Mathematics, or Master’s courses. It can be difficult to get a non-collateral education loan for courses like MBBS, Theology, tailoring, etc.

5. The preferred country:

Major overseas destinations like the US, UK, Canada, Australia, Ireland, and Germany have higher approval rates for private education loans. Because the students are more likely to get hired there.

6. The University:

Every bank has a list of recognized universities around the world, according to which they approve education loans. To be eligible to get a non-collateral education loan from banks, the university that the student is going to should come under the designated list of universities of that respective bank.

7. Age:

The age of the applicant and co-applicant is a major criterion for most private banks in processing an unsecured education loan. Usually, students aged between 16 and 35 are preferred by lenders. However, these criteria differ from bank to bank.

Also, private banks typically don’t accept co-applicants aged more than 60 years or nearing their retirement age.

Documents Required for Unsecured Education Loans

The following documents are required for an unsecured education loan process in India:

1. KYC documents:

Documents proving the student’s and their co-applicant’s identity and address have to be provided. These can include:

- Aadhar card

- PAN card

- Passport

- Passport-size photos

2. Financial documents:

Documents proving the income of the co-applicant should be provided. These documents can vary depending on whether the co-applicant is salaried or self-employed.

For Salaried Co-applicants:

- Last 2-3 years of ITR or Form 16,

- Recent payslips, and

- Bank statements.

For Self-employed Co-applicants:

- Last 2-3 years of ITR,

- Business proof,

- Bank statement, and

- Profit & Loss statement.

Terms of Non-Collateral Education Loans

1. Moratorium period

All education loans offer a moratorium period, which is typically the course duration plus 6 months to 1 year. During this period, the repayment of the loan doesn’t start. Now, with most public banks, students are not required to pay interest on the disbursed amount during the moratorium period. However, private lenders require students to pay either partial or full interest during the moratorium period.

2. Processing fee

While public banks do not charge a processing fee for an unsecured education loan, private banks charge up to 1% on the loan amount plus GST or 15k plus GST. The processing fee can be 1% to 1.5% plus GST on the loan amount for the NBFCs and a minimum of 2% plus GST on the loan amount for the foreign lenders.

2. Loan insurance

It is not mandatory to have loan insurance with public banks but it is compulsory for private lenders. It is 1% to 1.5% of the loan amount for private banks and 2% or above for the NBFCs.

3. Other Terms

All other loan terms, including the maximum loan amount, interest rates, and repayment, vary from bank to bank.

Tips to get Education Loans Without Collateral

- Make sure to meet all the eligibility criteria of the lender, to strengthen the loan application, and include a financial co-applicant with a high income and good credit score to improve the chances of loan approval.

- Students can also reinforce the loan application by presenting any academic endeavors and language proficiency, or standardized test scores, if applicable.

- Be in regular contact with the bank to solve any issues that may arise and to keep track of your loan application.

- apply to high-ranking universities to enhance the chances of securing a loan.

- Include to further boost the application.

- If the co-applicant does not meet the age, CIBIL, and income requirements, you can look for an alternate co-applicant with good income.

- To solve this issue, you can also add additional co-signers to the loan application. The bank will consider the combined income of all the co-applicants, increasing the chances of loan approval.

- Gather all the required documents beforehand. Try to acquire any missing documents as soon as possible. Also, check with the lenders if any alternate documents are accepted. And file any required document right away to avoid unnecessary delays. Keep in contact with the lender regularly to resolve any problems and ensure a smooth loan process.

Conclusion

An education loan helps students to pursue higher studies at their dream university in India as well as abroad. However, not every student can pledge collateral as security for the loan amount. Unsecured education loans make higher education accessible to students who couldn’t pledge collateral as security for their studies.

This article provides insights on education loans without collateral, along with their eligibility criteria, documents required, and tips for students to get unsecured education loans.