Personal injury claims are legal cases where individuals seek compensation for injuries caused by another party’s negligence. While personal injury laws exist worldwide, the process, legal requirements, and compensation systems differ significantly across countries. The complexity of these differences impacts claimants, lawyers, and insurers in navigating the claims process.

In Australia, personal injury claims are governed by a mix of federal and state laws, each with unique procedures and compensation structures.

However, compared to other countries like the United States, the United Kingdom, and Canada, Australia’s approach to personal injury claims presents several differences in terms of fault-based versus no-fault systems, legal costs, compensation limits, and alternative dispute resolution mechanisms.

This guide explores the seven key differences between personal injury claims in Australia and other countries to help you understand how these legal systems vary, backed by real-world examples, statistics, and structured insights.

1. No-Fault vs. Fault-Based Compensation Systems

One of the most significant differences in personal injury claims worldwide is whether a country follows a no-fault or fault-based system. This distinction determines how compensation is awarded and whether proving negligence is necessary.

Comparison of Systems by Country

| Country | No-Fault System | Fault-Based System | Hybrid Model |

| Australia | Workers’ compensation (most states), some motor vehicle accident schemes | Public liability, medical negligence claims | Some states have both systems |

| United States | Limited (some auto insurance policies) | Most personal injury cases require proving fault | Rare |

| United Kingdom | Certain workplace injuries covered | Majority of cases require proving fault | Some medical negligence schemes |

| Canada | No-fault auto insurance in some provinces | Most personal injury cases require proving fault | Varies by province |

Australia’s Approach

Australia operates under both no-fault and fault-based systems, depending on the type of injury claim:

- Workers’ Compensation: Most Australian states have no-fault workers’ compensation schemes, ensuring injured workers receive compensation regardless of who caused the injury.

- Motor Vehicle Accidents: Some states, like Victoria (TAC scheme), have a no-fault system, while others require proof of fault.

- Public Liability and Medical Negligence: These claims generally require proof of negligence.

Real-World Example

In Victoria, Australia, if a person is injured in a motor vehicle accident, the Transport Accident Commission (TAC) provides compensation, even if the injured party was at fault. In contrast, in the United States, an injured driver must typically prove the other party was negligent to receive compensation from their insurer.

Key Takeaway

Australia’s mix of no-fault and fault-based systems provides broader access to compensation, whereas countries like the US rely heavily on proving negligence. This can make it easier for injured parties in Australia to access immediate support without lengthy legal battles.

2. Legal Costs and Contingency Fees

Legal costs vary significantly among countries when pursuing a personal injury claim. The financial burden of litigation can impact claimants’ decisions on whether to pursue compensation.

Comparison of Legal Costs by Country

| Country | Contingency Fees Allowed? | Common Fee Structure | Caps on Fees? |

| Australia | No | No-win, no-fee (conditional fee agreements) | Some states impose caps |

| United States | Yes | 30-40% contingency fee | Varies by state |

| United Kingdom | No | Conditional fee agreements (no-win, no-fee) | Regulated by courts |

| Canada | Yes | Contingency fees allowed (capped in some provinces) | Some provinces regulate fees |

Australia’s Approach

- Lawyers in Australia cannot charge contingency fees (i.e., a percentage of the final settlement).

- Instead, they use a “no win, no fee” model, where legal fees are only charged if the claim is successful.

- Some states, such as New South Wales, cap legal costs in personal injury cases to prevent excessive fees.

Case Study: Legal Costs in a Motor Vehicle Injury Claim

In New South Wales, an injured party involved in a car accident may engage a lawyer under a no-win, no-fee arrangement.

However, the state regulates fees, preventing lawyers from overcharging. In contrast, in the United States, a lawyer might take 33-40% of the final compensation amount.

Key Takeaway

Australia’s ban on contingency fees makes it different from the US, where lawyers take a larger percentage of compensation. This ensures more of the awarded compensation goes to the injured party rather than legal representatives.

3. Compensation Caps and Damages

The availability of compensation and the limits on damages vary significantly among countries.

Compensation Caps by Country

| Country | Cap on Non-Economic Damages? | Punitive Damages Allowed? |

| Australia | Yes (varies by state) | Rare |

| United States | Some states impose caps | Common in lawsuits |

| United Kingdom | Yes, structured by case type | Rare |

| Canada | Supreme Court-imposed cap (~CAD 400,000) | Rare |

Australia’s Approach

- Many states in Australia cap general damages (pain and suffering) in personal injury cases.

- Economic losses (e.g., medical expenses, lost wages) are usually recoverable without caps.

- Punitive damages (awarded to punish the defendant) are rare in Australia.

Example: Compensation in Medical Negligence

In Queensland, compensation for non-economic damages in a medical negligence case is capped at AUD 350,000. In contrast, in the United States, there are no federal caps, meaning settlements can reach millions of dollars.

Key Takeaway

Australia’s compensation caps limit payouts in some cases, whereas the US allows for much larger awards, particularly in punitive damages. This reflects a policy balance between victim compensation and preventing excessive litigation costs.

4. Time Limits for Filing Claims

Time limits for filing personal injury claims vary significantly across jurisdictions. These limits, known as statutes of limitations, determine how long an injured party has to initiate legal proceedings after an accident or injury.

Comparison of Statutes of Limitations by Country

| Country | General Time Limit for Personal Injury Claims | Exceptions for Special Cases? |

| Australia | 3 years (varies by state and claim type) | Yes (minors, mental incapacity) |

| United States | 2-6 years (varies by state and claim type) | Yes (discovery rule, minors) |

| United Kingdom | 3 years | Yes (minors, lack of knowledge) |

| Canada | 2-6 years (varies by province) | Yes (discovery rule, minors) |

Australia’s Approach

- Most Australian states set a 3-year limit for filing personal injury claims from the date of injury.

- Some states apply the “discovery rule,” where the clock starts when the injury is discovered rather than when it occurred.

- Special extensions apply for minors and individuals with mental incapacity.

Example: Medical Negligence Claims

In Victoria, a patient discovering medical negligence five years after surgery may still be able to file a claim under the discovery rule. However, in some U.S. states, a strict two-year limitation could bar such a claim.

Key Takeaway

Australia’s approach is similar to the UK but differs from the US and Canada, where time limits vary widely by state or province. Understanding these differences is crucial for claimants seeking compensation.

5. The Role of Insurance in Personal Injury Claims

Insurance plays a significant role in personal injury claims worldwide, influencing compensation availability and claim processes.

Comparison of Insurance Systems

| Country | Mandatory Insurance for Personal Injury? | Role in Claim Process |

| Australia | Yes (workers’ comp, motor accidents) | Government-backed schemes in some states |

| United States | Varies by state (health, auto insurance) | Private insurers dominate |

| United Kingdom | Yes (NHS for medical injuries) | NHS and private claims coexist |

| Canada | Yes (workers’ comp, auto insurance) | Provincial healthcare covers medical costs |

Australia’s Approach

- Workers’ compensation: All employers must have coverage for workplace injuries.

- Motor vehicle accidents: Some states have Compulsory Third Party (CTP) insurance, ensuring injured parties receive compensation regardless of fault.

- Public liability insurance: Covers claims for injuries in public spaces or businesses.

Example: Motor Vehicle Accidents

In New South Wales, an injured pedestrian is compensated under CTP insurance, even if no fault is established. In the U.S., the same individual may need to sue the at-fault driver’s insurance for compensation.

Key Takeaway

Australia’s government-backed and mandatory insurance schemes make compensation more accessible compared to the U.S., where private insurers dominate and litigation is often necessary.

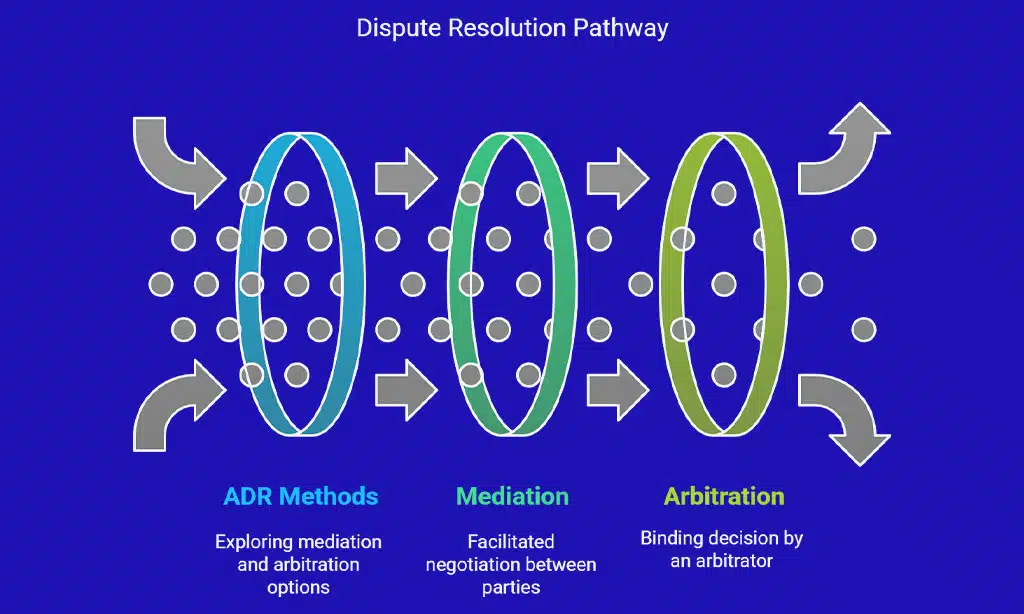

6. Alternative Dispute Resolution (ADR) vs. Litigation

Many countries encourage ADR methods like mediation and arbitration to resolve personal injury disputes before resorting to costly litigation.

Comparison of ADR in Personal Injury Claims

| Country | ADR Encouraged? | Common ADR Methods Used |

| Australia | Yes | Mediation, conciliation, tribunals |

| United States | Yes | Mediation, arbitration, settlements |

| United Kingdom | Yes | Mediation, pre-action protocols |

| Canada | Yes | Mediation, arbitration |

Australia’s Approach

- Many Australian states require ADR before proceeding to court.

- Personal injury claims often go through conciliation or mediation, reducing court caseloads.

- State-based tribunals, such as the Victorian Civil and Administrative Tribunal (VCAT), handle disputes more efficiently than courts.

Example: Workplace Injury Dispute

An injured worker in Queensland must attempt conciliation before taking legal action. In contrast, in the U.S., a worker may file a lawsuit immediately.

Key Takeaway

Australia’s emphasis on ADR speeds up claim resolution and reduces costs compared to litigation-heavy systems like in the U.S.

7. Government Support and Compensation Schemes

Government-backed compensation schemes provide financial aid to injured parties in various countries.

Comparison of Government Support for Personal Injury Claims

| Country | Government-Backed Compensation? | Types of Compensation Provided |

| Australia | Yes | Workers’ comp, motor injury schemes, disability support |

| United States | Limited | Social Security Disability (SSDI) |

| United Kingdom | Yes | NHS, state benefits for injury victims |

| Canada | Yes | Provincial health insurance, workers’ comp |

Australia’s Approach

- Workers’ compensation schemes provide medical expenses and wage replacement.

- The National Disability Insurance Scheme (NDIS) supports long-term disability claims.

- Medicare covers many injury-related healthcare costs.

Example: Long-Term Disability Support

In Australia, an individual suffering a permanent injury from a car accident may receive ongoing support through NDIS. In contrast, in the U.S., an injured party may need to apply for Social Security Disability Insurance (SSDI), which has strict eligibility criteria.

Key Takeaway

Australia provides more comprehensive government-backed injury compensation compared to the U.S., where private insurance and litigation dominate.

Takeaways

Understanding the 7 key differences between personal injury claims in Australia and other countries helps individuals navigate their legal rights.

Within Australia’s National Disability Insurance Scheme (NDIS), it’s also important to understand the different support roles available. Searching for “what is a key worker NDIS” or different “NDIS support” can help you better understand these roles.

While Australia’s system focuses on a mix of no-fault and fault-based schemes, limited legal costs, and government-backed insurance, other countries like the US and UK have their own distinct approaches.

For legal assistance, consult a qualified personal injury lawyer in your region to explore your options.