Do you worry about fake art or hidden fees when you buy art? You might feel lost using a crypto wallet or tracking art ownership. You want to pay and own art without a middleman.

An art gallery used a blockchain ledger to record art history and boost buyer confidence. We will show you seven ways crypto fixes your art woes. You will learn how digital tokens can prove origin, how smart contracts can track royalties, and how crypto wallets can pay fast.

Keep reading.

Key Takeaways

- Blockchain gives each artwork a clear digital seal. RFID chips link to a ledger. Christie’s and Artory logged full ownership in 2018. Galleries cut out middlemen and automate commissions with smart contracts.

- Artists can sell slices of a work. David Hockney tokenized a print in 2023. A shared ledger tracks each co-owner move. Smart contracts lock in 10% resale royalties for artists.

- Galleries accept Bitcoin, Ethereum, or stablecoins. The 2024 Bitcoin halving cut fees. BTC hit $111,000 in Q2 2025. BlackRock holds $15 billion in BTC and Fidelity $9 billion.

- CryptoPunks launched in 2017. Founders John Watkinson and Matt Hall made 10,000 pixel avatars. OpenSea, Dapper Labs, and Data.Art (Judy Mam, Beatriz Ramos) power NFT sales. Rare pieces fetch $16,000.

- Chainlink Labs and DFINITY run smart contracts that auto-pay 10% royalties on every resale. Oracle, Chain.io, and DHL seal cross-border art logistics in tamper-proof blocks.

Enhancing Artwork Authenticity with Blockchain Technology

Jackie O’Neill sells an RFID chip for ten dollars. The tamperproof chip breaks once someone tries to open it. A smartphone app then scans that chip, and it shows artist, title, date, medium, origin, plus a unique ID number.

Art verification feels like a breeze with that quick tap. The digital ledger records each scan, giving full transparency.

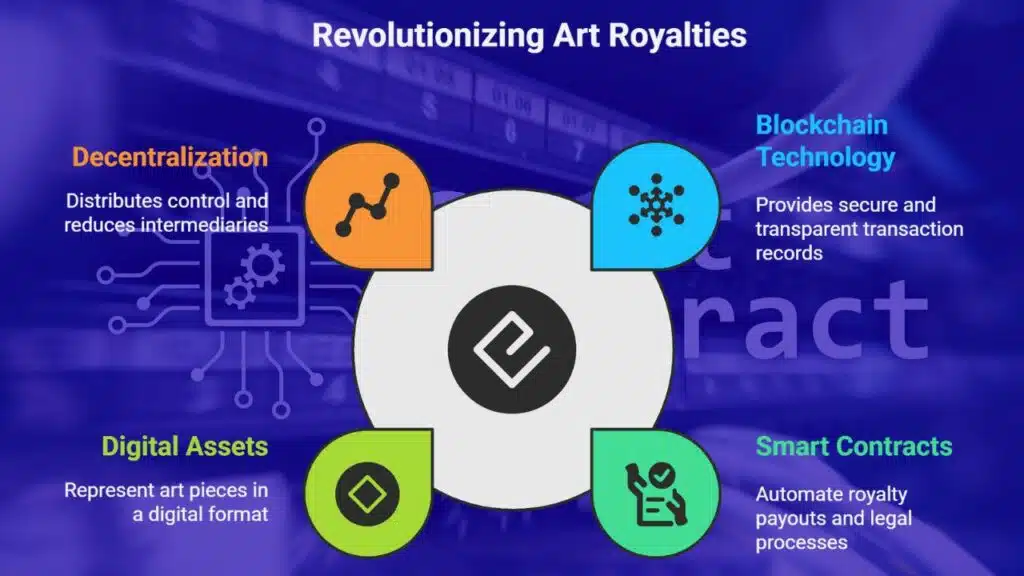

Blockchain cuts out middlemen, so auctions avoid extra fees for accountants or galleries. Decentralization stores that provenance on thousands of computers. Smart contracts automate gallery commissions and payments, freeing artists from red tape.

Christie’s teamed up with Artory in 2018 to log a full ownership history on chain, so buyers felt more secure. Artists gain from that added security and speed.

Enabling Fractional Ownership of Art Pieces

Hockney sold shares in one of his prints on a blockchain platform. Fans can now hold a slice of that art. The system splits art equity through tokenization, turning a canvas into digital stakes.

A shared ledger logs every coownership move, immune to tampering or fraud. It feels almost like a fingerprint for art on the internet.

Creators can tuck in ten percent resale royalties inside the smart contract. Payments zip to digital wallets each time someone flips a share on the secondary market. Living artists rarely see such paybacks today, but blockchain locks in the rule.

One expert, Jackie O’Neill, says the whole process runs itself, no middleman needed. Hockney does not earn extra cash from his fractional drop, but he set a fresh template.

Facilitating Crypto Payments for Art Transactions

Art galleries accept crypto payments on blockchain networks. They link buyer wallets to a payment gateway. Smart contracts lock funds until the piece ships. The 2024 halving slashed Bitcoin supply, pushed up demand.

That boom cut fees and sped up settlements.

Collectors pay with Bitcoin, Ethereum, or stablecoins. Institutions now deploy Bitcoin ETFs in 401ks and IRAs. BlackRock holds $15 billion in BTC, Fidelity controls $9 billion. Early 2025 market volatility hit prices after US tariffs.

BTC soared past $111,000 in Q2 2025, proving crypto can power high-value deals. Digital assets such as NFTs trade smoothly, with digital collectibles averaging $40–$50 and rare ones at $16,000.

Empowering Artists Through NFT Marketplaces

John Watkinson and Matt Hall created CryptoPunks in 2017. They released 10,000 pixel art characters, gave away 9,000, and kept 1,000. Each punk holds an Ethereum blockchain link that shows authenticity, scarcity, and ownership.

These tokens kicked off a booming digital collectibles market. Collectors now flock to marketplaces that track art on blockchain networks.

OpenSea and Dapper Labs lead this vibrant NFT art marketplace. These platforms empower artists to earn, share, and grow. Judy Mam and Beatriz Ramos built Data.Art to spark collaboration and monetization.

Data.Art wraps each drawing and chat in blockchain proof of ownership. Featured names like Nanu Berks, RFX1, and Orvz1 reach global fans easily.

Revolutionizing Royalties with Smart Contracts

Blockchain can automate royalty payouts each time art resells in the secondary market. Jackie O’Neill estimates artists can collect a 10% cut on each resale thanks to a smart contract.

Smart contracts act like self-executing pacts that handle legal chores and supply chain steps. Chainlink Labs and DFINITY build platforms aimed at art royalty distribution. This mix of digital assets and decentralization cuts red tape.

Major blockchains store immutable records of every sale, boosting transaction transparency. It triggers automated payments the instant a piece moves to a new owner. Artists skip lengthy paperwork and avoid lost checks.

They see creative compensation flow without delays. This art market innovation reshapes how intellectual property earns its value.

Expanding Access to Global Art Markets

Local auctions locked artists inside small markets. Blockchain wipes away gatekeepers and posts provenance records on an open ledger. Artists from Lagos, Berlin and Seoul riff and trade on Data Art.

That art marketplace spans six continents.

Secure digital identity keys fit in a smartphone. Oracle, Chain.io and DHL share data on art logistics. Those firms seal records in tamperproof blocks. Collectors in Tokyo pay painters in Rio with zero borders.

This setup boosts transparency, security and immutability in crossborder transactions.

Promoting Digital and Crypto-Themed Artwork

CryptoPunks show how pixel art can spark a new art market. John Watkinson and Matt Hall launched 10,000 characters on blockchain in 2017. Younger collectors value digital ownership, and they use cryptocurrency to bid in NFT auctions.

Data.Art invites artists like Boris Toledo Gutierrez to join theme-based collaborative art.

Ramos built Data Art to share blockchain links with contributors and to offer basic income for creators. Each mint confirms ownership and lets artists get paid fast. Global art communities grow, and new digital natives claim spots in an expanding gallery.

Takeaways

Blockchain gives each canvas a clear digital seal, and buyers smile. Tokenization lets collectors own tiny slices of a masterpiece, like a shared pizza.Smart Contracts pay creators every time art changes hands.

A smart tag in the back of a painting links to a registry service for easy art proofs. NFTs transform digital art into treasure hunts on online galleries. This revolution opens the door for fresh talent and global fans.

FAQs

1. How do NFTs reshape the art world?

NFTs tag digital art with a code on the blockchain. They let artists sell direct, skipping gallery fees. It is like trading baseball cards online, with a click.

2. What role do smart contracts play in art sales?

Smart contracts work like a vending machine for art deals. They check the payment and then send the art token. They cut out long waits, and they cut fees.

3. How does blockchain prove art history?

A blockchain is a public log of each sale. It locks every entry in a time stamped block so no one can sneak in a fake. You get a clear paper trail, from the first sketch to the last sale.

4. Can fractional ownership open art to more fans?

Fractional ownership splits a work into pieces. Fans can buy a slice, for a small fee. It is like a co-op for art fans. It brings fresh cash to artists.