Raising cash can feel like a tightrope walk for small shops, restaurants, and solo acts. You juggle cash flow, bills, payroll, or that dream machine upgrade, and the right loan feels miles away.

Term loans rank as the top small business loan, offering a fixed amount you repay with interest over time. Our list covers 15 capital loan options, from asset finance and lines of credit to crowdfunding and cash advances, so you can find your match.

You will learn key pros, cons, and steps to apply. Read on.

Key Takeaways

- Term loans give a set amount you repay with interest over 3 to 10 years. The SBA backs loans up to $5 million under its 7(a) and 504 programs and offers microloans up to $50 000 at lower rates (SBA Form 1919 and a business plan apply).

- A business line of credit lets you borrow up to a limit and pay interest only on the funds you use. Working capital loans cover rent, wages, and bills for up to 18 months, though rates often run higher than on term loans.

- Equipment financing uses the asset itself as collateral and matches payback to its 5- to 7-year life. Commercial real estate loans come in short-term (1–5 years) or long-term (5–25 years) deals, with typical rates of 4–7 percent in 2024.

- Invoice financing advances up to 90 percent of unpaid bills within days, while factoring buys receivables at 70–90 percent and handles collections. Both plug cash-flow gaps fast.

- Merchant cash advances fund you in 24–48 hours by taking a share of future card sales, but fees can top 20 percent. Peer-to-peer lenders, CDFIs, and online platforms also offer microloans to $50 000, and crowdfunding raises money without debt.

What is a Term Loan and How Does It Work?

Companies borrow a set sum with a term loan. A traditional lender or a peer-to-peer platform offers the cash. Borrowers repay it over a fixed period, often three to ten years. They pay principal plus an interest rate that does not change.

Installment loans use equal monthly payments, and loan management software tracks the amortization schedule.

Lenders check creditworthiness and may require collateral. Collateral can be equipment or real estate to secure a large loan. Businesses use term loans for capital expenditure, like new machines.

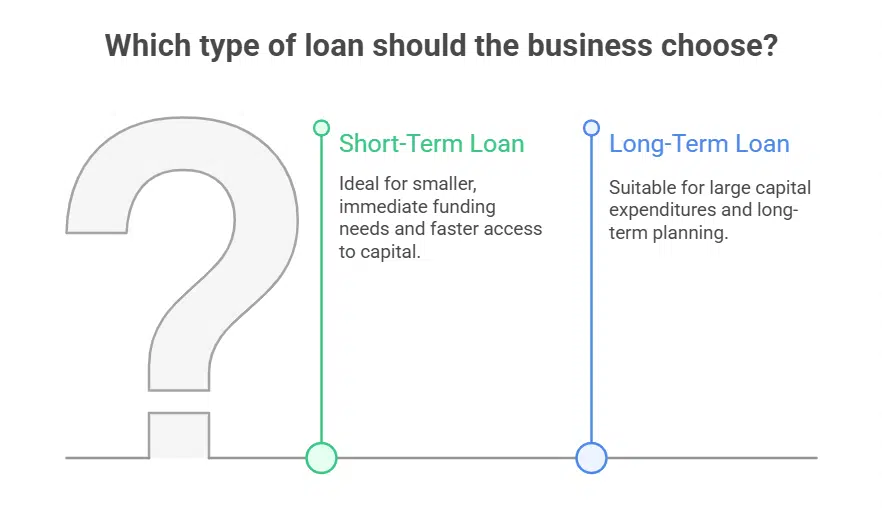

They get predictable funding, so they plan ahead. Short-term loans fill smaller gaps and fund faster. Long-term loans fuel big expansions with higher loan amounts.

What Are SBA Loans and Who Qualifies?

Small business owners tap SBA loans for business capital and small business financing. The U.S. Small Business Administration backs them with a loan guarantee. Commercial banks and digital lenders offer funds through this program.

Borrowers access up to five million dollars, under the 7(a) program and the 504 program. Entrepreneurs also find microloans up to fifty thousand dollars. These loans carry lower interest rates and longer terms because of the guarantee.

Strong credit worthiness and thorough cash flow statements help garner lender approval. Applicants must fill out the SBA Form 1919 and submit a business plan in most cases. The application process takes weeks and requires detailed financial statements.

Microfinancing seekers often use credit score calculators and the SBA Lender Match tool. This funding option suits those who can wait out a strict review. Firms see business development and steady growth with these funding options.

How Can a Business Line of Credit Help My Business?

A business line of credit gives you liquidity up to a set limit, and interest applies only on the funds you use. This credit facility acts like a safety net for wages, stock orders, or sudden repairs, smoothing your cash flow and keeping operations running.

Different lenders offer revolving or nonrevolving setups, with revolving lines letting you reuse paid portions, much like a credit card balance. Banks, online lenders, or credit unions set lower borrowing limits here, and these lines usually charge higher interest rates than a term loan.

This tool shines for regular bills, ongoing projects, or emergency repairs, so you can fix a furnace fast or seize a hot deal. Using QuickBooks or a cash flow tracker with this facility helps you watch withdrawals and repayments with ease.

Overdraft options tied to your account can kick in for true working capital support, but check those rates before you tap the red.

What Is Equipment Financing and When Should I Use It?

Loans for equipment let owners purchase or upgrade assets. The gear itself serves as collateral, so no extra pledges. Terms often match an asset’s lifespan, so you might pay over five or seven years, like those ovens in a commercial kitchen or X-ray units at a clinic.

This approach builds equity in the machines while you repay. Accountants track depreciation in QuickBooks or Excel, giving you a clear capital expenditure schedule.

Equipment financing works well for growing shops that need heavy gear. It avoids the monthly lease fees that drain working capital. Clinics, bakeries and repair shops rely on it to buy mixers or digital scanners.

Borrowers gain full ownership once they finish payments. Banks and online lenders set payback spans to useful life. That way, you do not overshoot budget or risk obsolete tech.

How Do Merchant Cash Advances Work for Small Businesses?

Small shop owners can tap a merchant cash advance for fast cash. A funder offers an upfront payment. The business uses a revenue based repayment model, sending a share of future credit card sales to the funder.

Your point of sale device handles each split. Most funders transfer cash within 24 to 48 hours after you sign. This short term financing tool links directly to your cash flow and working capital.

You glimpse payments that rise and fall with daily sales. Data from your payment processor guides each remittance. This lenient funding option suits tight deadlines and weak credit.

Stringent credit checks vanish here. Even businesses with shaky records can apply. Frequent repayments, two or more times each week, can stretch your budget thin. Fees can climb above 20 percent of the advance.

Use caution when you calculate that cost. Federal regulators are watching alternative lending and merchant services closely. Ask about APR equivalents before you sign. Small business loans often feel safer but can take weeks.

A cash advance simplifies funding options, yet it raises your cost of capital. If you crave speed, this choice might outpace an SBA loan.

What Is Invoice Financing and How Can It Improve Cash Flow?

Invoice financing taps into unpaid invoices as collateral to boost cash flow management. Lenders give businesses up to 90 percent of the invoice value in a cash advance. Firms collect the full amount from clients.

They then repay the lender the advance plus fees and interest and keep the rest. Unlike invoice factoring, you keep collection control. Owners carry credit risk and remain responsible for collections.

It offers shortterm funding to plug gaps caused by slow-paying accounts.

Receivables financing draws working capital fast, often within days. It brings vital financial liquidity, faster than typical business loans. Fees tend to run higher for quick cash, but the speed keeps operations rolling.

Software syncs your accounts receivable ledger with the system, cutting manual work. This setup fits any firm that bills on payment terms and loathes empty bank accounts.

How Does Invoice Factoring Differ from Invoice Financing?

Factoring sells your accounts receivable to a third party for immediate cash. You get 70 to 90 percent of invoice value up front; you receive the remainder after the factor collects the payment, less fees.

Factoring shifts debt collection and payment processing to the factor. You improve cash flow but trade off control. It suits B2B firms with uneven billing cycles.

Financing uses unpaid invoices as collateral for a loan. You keep debt collection and credit management tasks. Lenders place a lien on receivables but let you handle invoice management and payment handling.

You boost working capital and maintain business liquidity without handing off collections. This model fits within supply chain finance options.

What Are Microloans and Who Are They Best For?

Microloans cap at fifty thousand dollars. Community development financial institutions issue them. People call these groups CDFIs. Nonprofits like Kiva and Opportunity Fund run microfinance programs.

Alternative lending fuels community development. These loans aim at financial inclusion. Underwriting rules stay friendlier. The SBA microloan program joins the mix. Online portals speed approval.

Counseling teams share tips.

Startups and new ventures tap microloans for startup capital. Underserved markets feel that lift. Credit checks feel softer. Borrowers can score funds despite thin files. Support services swing in.

Workshops and one-on-one coaching build skills. Interest rates sit higher than bank loans. Borrowing limits stay lower too. Entrepreneurs seek funds fast. A small cafe owner in Detroit got eight thousand dollars and bought vintage grinders.

What Should I Know About Commercial Real Estate Loans?

Commercial real estate loans help fund purchases or upgrades of office buildings, warehouses, and storefronts. Buying a building feels like a marathon, not a sprint. Most lenders package these loans as a mortgage for commercial property.

Loan terms split into short (one to five years) or long (five to twenty-five years). Applicants need a solid credit score, clear financial statements, and a property appraisal. Loan to value ratios, along with cash flow projections, guide bank underwriting.

Strong balance sheets often secure lower interest rates.

Equity grows as businesses pay down principal, turning leasehold firms into property owners. Lenders often review property management history in approval steps and require two years of steady results.

Markets set rates, but typical mortgages land between four and seven percent in 2024. Amortization schedules spell out each monthly due. Owners use this investment to support business operations and boost net worth.

How Can Working Capital Loans Support Daily Operations?

Working capital loans help owners pay rent, wages, and supplier bills on time. These loans free up funds for other business expenses, like utilities or marketing. They offer short-term financing, with terms of 18 months or less.

Lenders send a lump-sum disbursement, and businesses handle monthly repayments. This setup boosts financial liquidity, keeping the doors open from one day to the next.

Retail shops rely on these loans for seasonal funding, stocking shelves before busy holidays. Some startups draw growth capital to hire staff or ramp up production. Bookkeeping software tracks that cash injection and spending, helping with cash flow management.

This quick funding bridge covers gaps in operating expenses fast, even if interest costs run higher.

What Financing Options Are Available for Franchises?

New franchisees can tap several sources for franchise funding. Banks stand ready with business loans. They review credit history, cash flow projections, and collateral. Loan approval often follows a detailed development plan with cost estimates.

Online lenders also step in. They offer digital apps and faster turnaround. A simple online form can lead to capital in days. Rates run higher, but you trade cost for speed. Some franchisors pitch in-house loans or royalty-based financing.

This approach cuts down franchise startup costs.

Local credit unions might join the mix. They back small business financing with community ties. Government backed SBA loans can boost loan approval odds. A low down payment or favorable rate can ease upfront capital investment.

Some brands work with specialized lenders. They cover equipment, inventory, marketing, and operational costs. Those financing alternatives fill the gap when banks demand heavy collateral.

Several investment options let you plan franchise development on a budget. You may bundle term loans, lines of credit, and vendor financing into one deal.

When Should I Consider Personal Loans for Business?

Tight cash flow and a low credit score can bar standard financing. A personal loan skips a long approval process, but it costs more. Many online lenders give unsecured loans in days, with loan limits under $50,000.

High interest rates cut into profit, so mind the rate. Some banks forbid using these funds for business, read fine print first.

Small firms grab quick business funding this way when they lack other options. Personal credit takes a hit on your credit report, so watch your score. This alternative lending option proves simpler than SBA loans, but risk assessment matters.

Owners weigh higher cost against speed, and pick the best path.

What Are Alternative Lending Options for Small Businesses?

Small outfits can tap peer-to-peer lenders, online business loans, credit lines on a business card, crowdfunded investments, angel funding and grants. These paths deliver cash in days, not weeks.

Startups and firms with weak credit like fast access. Borrowing limits often stay low. Interest rates often sit higher than bank loans.

SBA microloans cap near $50,000 and work with tech lenders. Incubator programs add seed capital, mentoring and co-working space for new teams. Invoice financing unlocks up to 80% of unpaid bills in under 48 hours.

Equity financing from venture firms or an individual backer trades cash for a slice of ownership. Unsecured loans need no asset but carry rates near 15% or more. Fintech tools apply alternative credit scores to speed approval in a day or less.

How Does Crowdfunding Compare to Traditional Loans?

Crowdfunding taps many small backers, instead of one bank. It replaces a loan from a single lender. Sites like Kickstarter or a crowdfunding site host these online campaigns. Creators collect gifts, pledges, or stakes via equity crowdfunding.

They owe no set payback, and skip interest charges. This route suits startups with bold ideas or small shops that need buzz.

A bank loan needs credit checks, collateral, and fixed payments. Crowdfunding skips that hurdle, but puts you under a public lens. Peer to peer lending or microfinance still use debt, and expect payback.

Donation-based funding flips the script, no debt to track. You win exposure and fans, but face a crowded field and no guarantee.

Takeaways

Every small venture needs a solid cash plan. We explored fixed term loans, government loans, credit line and asset loans. We also covered merchant cash advances, receivables financing and microloans.

A loan calculator will map your payments. A credit score tracker will flag risk before it bites. Now pick the option that suits your budget, mix and match like a buffet. Act wisely, and watch your venture soar.

FAQs on Capital Loan Options for Every Small Business Owner

1. What loan types does the article cover?

We dig into 15 capital loan choices, including bank loans, credit lines, invoice advances, equipment debt, government-backed loans, peer lending, merchant sales advances, micro loans, and more. It’s a buffet of cash options.

2. How do I pick the right loan for my small business owner journey?

Start by mapping your money needs and payback plan. Then compare interest rates, fees, and time to funding, also watch your credit use. Talk to a pro, weigh each option, and pick the one that fits like a glove.

3. Can I grab more than one loan at once?

Yes, you can open multiple loans, but keep an eye on your debt load and credit health. Too much debt can sink your ship, but the right mix can fuel a growth spurt.

4. How fast can I get the cash after I apply?

It varies. Merchant sales advances or online lenders can push funds in a day or two, while bank loans may need weeks of paperwork. Plan ahead, and pick a source that matches your urgent or long-term pace.