The European real estate market continues to be one of the most attractive investment landscapes in the world. With its diverse economies, stable political environments, and growing demand for residential and commercial properties, Europe remains a hotspot for global investors.

If you are looking for the best cities for real estate investment in Europe, 2025 presents fresh opportunities in rapidly developing and historically stable markets.

In this comprehensive guide, we explore the 10 best cities for real estate investment in Europe, diving into key economic indicators, rental yields, infrastructure projects, and government policies that make these locations stand out.

Whether you’re an individual investor or a large-scale property developer, this list will provide valuable insights into the best destinations for maximizing your returns in the European property market.

Key Factors to Consider in European Real Estate Investment

Before selecting the best European city for real estate investment, it’s crucial to understand the key factors that drive property values and rental profitability.

Economic Stability and Growth Potential

- Cities with strong GDP growth tend to offer better real estate appreciation.

- Low unemployment rates indicate a thriving job market, leading to increased housing demand.

- Stability in banking and finance sectors influences mortgage accessibility and investment feasibility.

Rental Yield and ROI Expectations

- High rental yield cities offer better short-term rental income.

- Long-term capital appreciation potential should be factored into ROI calculations.

- Understanding demand for short-term vs. long-term rental can impact your investment strategy.

Market Demand and Population Growth

- Cities with rising populations and a young workforce offer sustained rental demand.

- Locations with strong migration patterns attract higher real estate investments.

- High student and expat populations contribute to increased rental demand.

Infrastructure and Development Projects

- Upcoming transport links, smart city developments, and business hubs can drive property price surges.

- Government incentives for real estate development create lucrative opportunities.

Government Policies and Tax Benefits

- Favorable tax policies for property investors can significantly impact profitability.

- Low property acquisition taxes and investor-friendly visa programs can attract global investors.

10 Best Cities for Real Estate Investment in Europe for 2025

Europe offers a diverse range of real estate investment opportunities, with several cities emerging as prime locations for 2025. Whether you are looking for high rental yields, long-term appreciation, or stable markets, these cities provide lucrative prospects for investors.

1. Lisbon, Portugal

- Why invest? Lisbon has emerged as a real estate powerhouse, offering high rental yields and strong appreciation potential. Its combination of a booming tourism sector, government incentives, and a vibrant tech scene makes it one of the best cities for real estate investment in Europe.

- Average rental yield: 5-7%

- Key drivers:

- Portugal’s Golden Visa program attracts foreign investors, offering residency benefits.

- Thriving tech and startup ecosystem fuels demand for modern housing solutions.

- High demand for short-term rentals due to Lisbon’s increasing popularity among tourists and digital nomads.

- Affordable property prices compared to other major European capitals, with strong long-term growth potential.

- Excellent infrastructure, including improved transport links and modern amenities, making it an attractive location for both residents and investors.

2. Barcelona, Spain

- Why invest? A favorite among investors due to its vibrant economy and tourism-driven real estate market. Barcelona offers a unique combination of cultural heritage, business opportunities, and a dynamic real estate sector that continues to attract investors from around the globe. With its Mediterranean climate, excellent quality of life, and a booming tourism industry, the city presents promising opportunities for both short-term rental income and long-term capital appreciation.

- Average rental yield: 4-6%

- Key drivers:

- Strong demand for Airbnb rentals, particularly in the city center and coastal areas.

- Government-backed real estate incentives, including tax benefits for property investors.

- High expat and digital nomad population driving demand for modern, flexible living spaces.

- Major infrastructure projects enhancing connectivity and property value.

- A thriving startup and tech ecosystem fueling demand for rental properties in business districts.

3. Berlin, Germany

- Why invest? A stable economy and a city with strict yet beneficial rental laws make Berlin an excellent long-term investment. Berlin has consistently ranked as one of the most secure and profitable property markets in Europe, thanks to its strong tenant protection laws and investor-friendly environment. The city continues to attract young professionals, students, and entrepreneurs, increasing the demand for rental properties and ensuring long-term investment stability.

- Average rental yield: 3-5%

- Key drivers:

- High demand for rental properties due to an increasing population and strong job market.

- Strong government regulations protect investors and create a stable housing market.

- Tech and startup industry growth fueling housing demand, particularly in central districts.

- Significant urban development projects improving infrastructure and livability.

- High levels of foreign investment contributing to continuous property value appreciation.

4. Paris, France

- Why invest? Paris continues to be one of the world’s most prestigious property markets, offering a unique blend of historical charm, economic stability, and high-end real estate opportunities. The city’s real estate sector remains resilient even during economic downturns, making it a low-risk, high-reward investment choice for both domestic and international investors.

- Average rental yield: 2-4%

- Key drivers:

- High appreciation in prime locations, particularly in central districts like the Champs-Élysées and Le Marais.

- Strong economy and tourism industry driving continuous demand for short-term rentals.

- Stable property market with long-term profitability, ensuring secure and steady returns.

- High demand for luxury and historic properties, attracting affluent buyers and renters.

- Well-developed infrastructure, including public transport and modern amenities, making Paris a desirable location for both residents and businesses.

5. Amsterdam, Netherlands

- Why invest? Amsterdam’s limited housing supply and strong expat demand make it a lucrative real estate market. The city is a prime destination for property investors due to its thriving business climate, stable economy, and high living standards. The combination of historical charm, modern amenities, and strong government regulations ensures sustained demand for real estate.

- Average rental yield: 3-5%

- Key drivers:

- Strict housing policies keep demand high, preventing market oversupply and maintaining property value.

- High expat population and student rentals create a constant demand for housing in central districts.

- Limited new housing developments increase property value, ensuring long-term capital appreciation.

- Strong business sector with international companies setting up headquarters in Amsterdam, leading to a growing demand for corporate rentals.

- Excellent infrastructure, including world-class public transport and proximity to major European business hubs.

6. Milan, Italy

- Why invest? Milan is Italy’s financial hub and offers high rental returns compared to Rome and other cities. With a strong economy and a reputation as a global fashion and business capital, Milan continues to attract both local and international investors. Its thriving commercial districts, cultural landmarks, and growing expatriate population contribute to a highly competitive real estate market.

- Average rental yield: 4-6%

- Key drivers:

- A growing demand for luxury apartments due to high-net-worth individuals relocating to Milan.

- Business-friendly investment climate with low property transaction costs and favorable tax incentives.

- Strong real estate growth in commercial and residential sectors, supported by infrastructure development and urban renewal projects.

- Presence of top-tier universities and educational institutions increasing demand for student accommodations.

- Well-connected public transportation system and accessibility to other European business hubs.

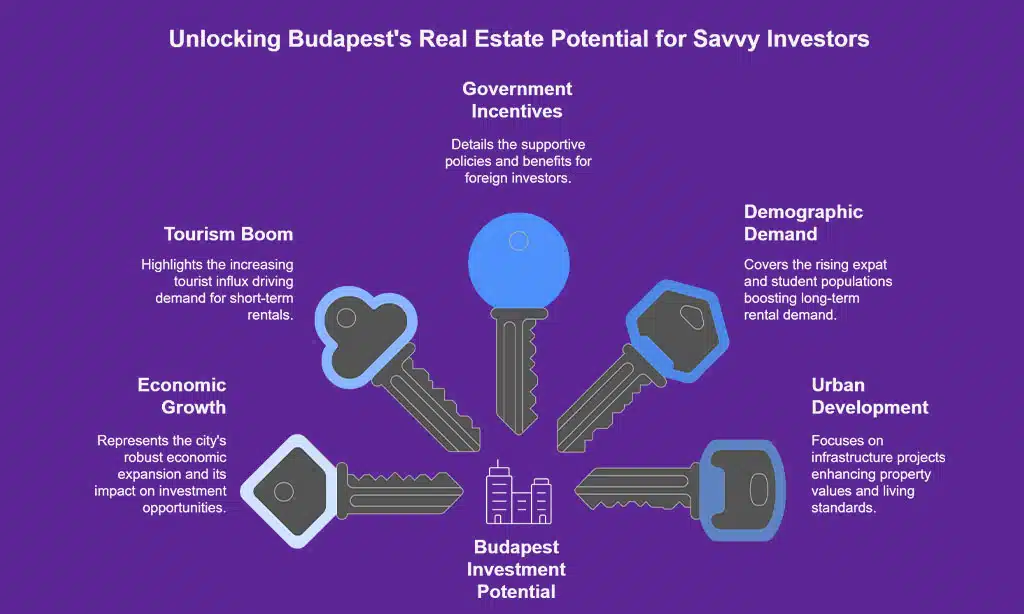

7. Budapest, Hungary

- Why invest? A highly affordable investment market with significant potential for high rental yields. Budapest has become an increasingly attractive destination for investors due to its combination of affordability, strong economic growth, and a booming tourism industry. The city’s low cost of entry, high demand for rental properties, and ongoing urban development projects make it a lucrative opportunity for both short-term and long-term investments.

- Average rental yield: 6-8%

- Key drivers:

- Low property prices and high ROI, offering significant potential for capital appreciation.

- Fast-growing tourism sector, driving demand for short-term rental accommodations such as Airbnb.

- Strong government incentives for foreign investors, including tax benefits and residency programs.

- A growing expat community and student population, increasing demand for long-term rental properties.

- Infrastructure improvements and urban regeneration projects enhancing property values and living standards.

8. Vienna, Austria

- Why invest? One of the most stable real estate markets in Europe with steady appreciation. Vienna’s robust economy, exceptional quality of life, and well-regulated real estate sector make it an attractive choice for investors seeking security and long-term returns. The city’s cultural significance and growing population also add to its real estate appeal.

- Average rental yield: 3-4%

- Key drivers:

- Low investment risk and stable property values, ensuring long-term growth.

- Strong economy and high quality of life, attracting both local and international investors.

- Well-developed legal framework protecting investors from market volatility.

- A growing expatriate and student population fueling rental demand.

- Ongoing infrastructure developments enhancing property values and livability.

9. Warsaw, Poland

- Why invest? A booming economy with affordable real estate and high rental demand. Warsaw has become one of the most attractive destinations for property investment in Eastern Europe due to its rapidly growing economy, increasing foreign direct investment, and strong infrastructure development. The city’s low property prices compared to Western European capitals provide a high return on investment for both short-term and long-term property ventures.

- Average rental yield: 5-7%

- Key drivers:

- High influx of professionals and expats drawn to job opportunities in multinational corporations.

- Growing IT and finance sectors, fueling demand for modern and well-located rental properties.

- Lower property prices compared to Western Europe, making it an affordable entry point for investors.

- Government incentives for foreign investors, including tax breaks and easier residency policies.

- Strong infrastructure improvements, including new public transport networks and smart city initiatives, enhancing property values.

10. Prague, Czech Republic

- Why invest? One of Europe’s best-priced capital cities with strong tourism-driven real estate demand. Prague’s rich cultural heritage, vibrant economy, and steady influx of tourists and expatriates make it an increasingly attractive destination for property investors. With a relatively low cost of living compared to other European capitals, the demand for housing continues to rise, presenting lucrative opportunities for rental income and long-term appreciation.

- Average rental yield: 5-6%

- Key drivers:

- High rental demand from tourists and expats, driving short-term and long-term rental market growth.

- Affordable property prices compared to Western European counterparts, offering significant appreciation potential.

- Strong economic growth fueled by a diverse economy, including IT, finance, and tourism sectors.

- Government incentives for property investors, including low transaction costs and tax benefits.

- Ongoing urban renewal projects and infrastructure developments enhancing property values and overall livability.

Comparative Analysis: Best Cities Based on Investment Factors

Understanding the investment potential of different cities requires a detailed comparison of key factors such as rental yield, economic growth, and associated risks. Below is a comparative analysis of the best cities for real estate investment in Europe, helping investors make informed decisions.

| City | Avg. Rental Yield | Economic Growth | Investment Risk |

| Lisbon | 5-7% | High | Low |

| Barcelona | 4-6% | Moderate | Medium |

| Berlin | 3-5% | High | Low |

| Paris | 2-4% | High | Low |

| Amsterdam | 3-5% | High | Low |

| Milan | 4-6% | Moderate | Medium |

| Budapest | 6-8% | High | Medium |

| Vienna | 3-4% | High | Low |

| Warsaw | 5-7% | High | Medium |

| Prague | 5-6% | Moderate | Medium |

Wrap Up

Investing in European real estate in 2025 presents an array of opportunities across both established and emerging markets. Whether you seek high rental yields in Budapest and Warsaw, stability in Vienna and Berlin, or premium investment in Paris and Amsterdam, these best cities for real estate investment in Europe provide diverse prospects for every investor.

Before making any investment, conduct thorough research, understand market trends, and work with local real estate experts to maximize your returns. With the right strategy, Europe remains a prime destination for real estate investors looking for long-term growth and profitability.